This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

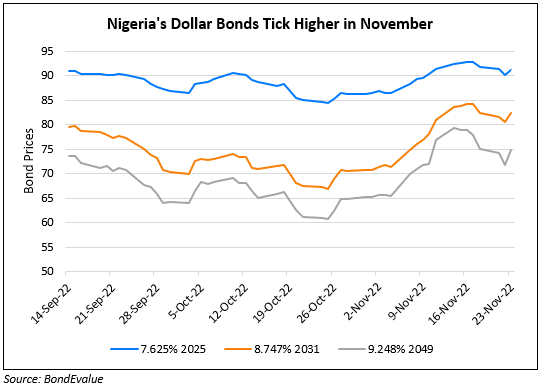

Nigeria’s Dollar Bonds Trend Higher in November

November 23, 2022

Dollar bonds of Nigeria have moved higher across the curve in November (see chart above). Its 2025s have moved over 5% higher since the beginning of the month whereas its 2031s and 2049s have rallied over 15% MTD. While there is no specific news on the sovereign, Morgan Stanley and JPMorgan have become bullish on EM hard-currency debt. JPMorgan upgraded its outlook for EM hard currency debt at “marketweight” from “underweight” and Morgan Stanley expects 14% next year if inflation falls.

Go back to Latest bond Market News

Related Posts:

Nigeria Explores Debt Restructuring

October 13, 2022

Pakistan and Nigeria Downgraded to CCC+ and B3

October 25, 2022

Nigeria Downgraded to B- by Fitch

November 14, 2022