This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Moody’s Extends Review for Downgrade on Huarong and its OFVs

July 30, 2021

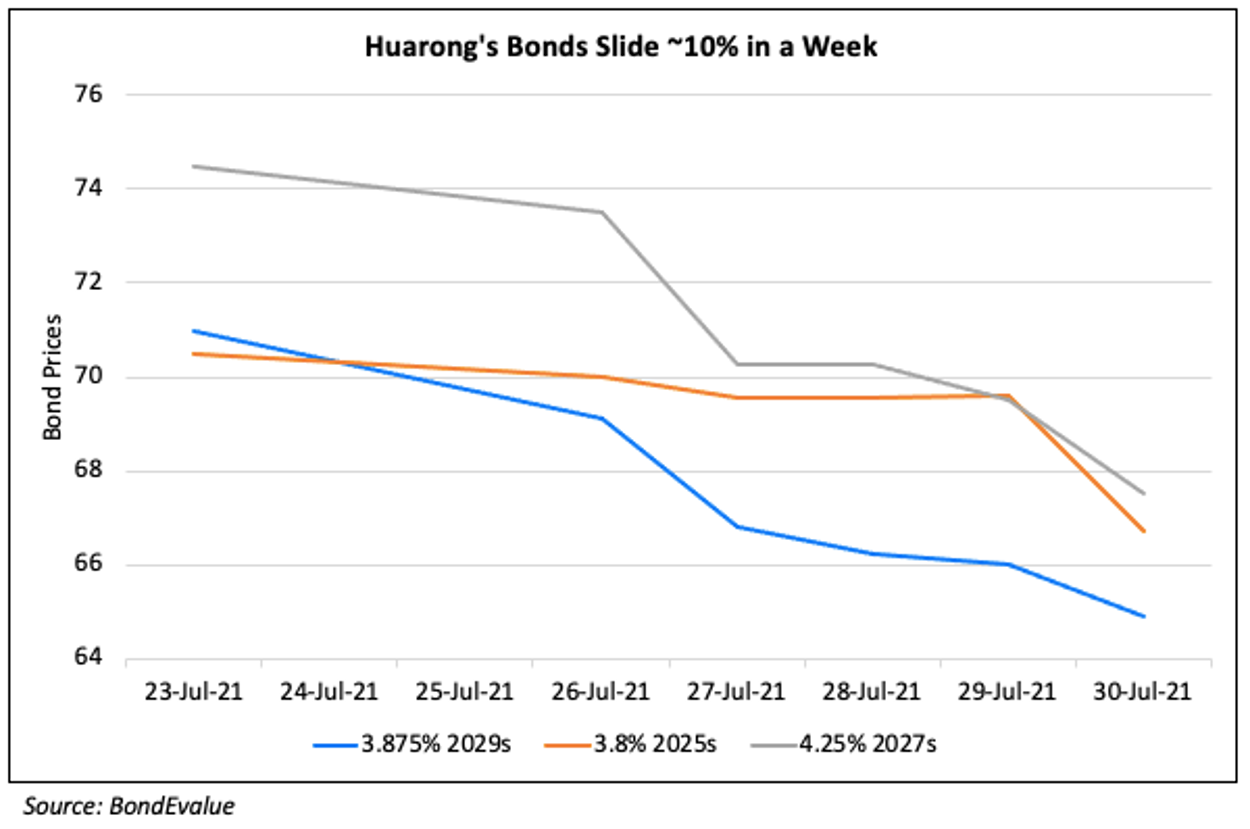

Moody’s has extended its review for downgrade on all the ratings of China Huarong Asset Management Co., Ltd. (Huarong) reflecting the uncertainty around Huarong’s 2020 unpublished annual results and the details of the relevant transaction mentioned in Huarong’a announcement on March 31, 2021. It has also extended the review for Huarong’s offshore financing vehicles (OFVs), including Huarong Finance 2017 Co. Ltd, Huarong Finance II Co. Ltd. and Huarong Finance 2019 Co. Ltd. It was downgraded to Baa1 by Moody’s on April 29 and placed under review for downgrade. Huarong has so far honoured all its debt repayments with its OFV, China Huarong International Holdings Limited repaying the principal and interest on its offshore bonds that matured between April and July. Huarong International has also announced on July 15 that it plans to redeem its $500mn 2.875% Perps due in September 2021, which led to a jump in all of its dollar bonds. However, the up move was short-lived – its shorter term 3.8% 2025s, 4.25% 2027s and 3.875% 2029s were down 2.89, 2.01 and 1.13 respectively to trade at 66.72, 67.49 and 67.49 respectively. Its longer dated 4.95% 2047s were also down 1.58 to trade at 61.42 cents on the dollar.

Go back to Latest bond Market News

Related Posts: