This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

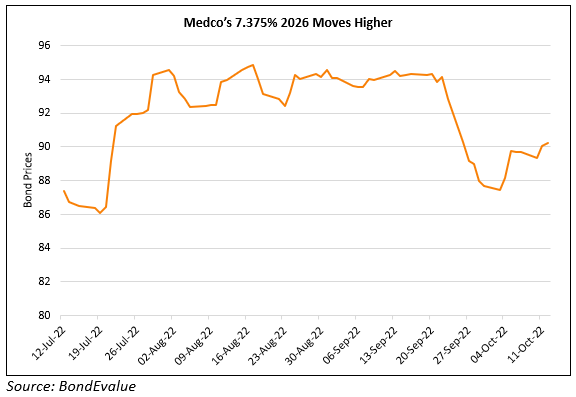

Medco Energi’s Dollar Bonds Rise

October 12, 2022

Indonesia’s Medco Energi Internasional saw its dollar bonds move over 4% higher with its 2026s among the nation’s top gainers after OPEC+ announced a large production. Last week, the OPEC+ decided to cut output by 2mn bpd, their biggest cut since 2020. As per research firm Ciptadana Sekuritas, 45% of Medco’s combined oil & gas volume is linked to spot oil prices and the remaining 55% is sold at fixed prices, thus seeing the company benefit from rising oil prices. They note that Medco’s 2022 oil and gas lifting is set to see a 64% YoY volume increase to 146mn bpd.

Go back to Latest bond Market News

Related Posts: