This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Markets Now Pricing in 4 Fed Rate Hikes

March 2, 2023

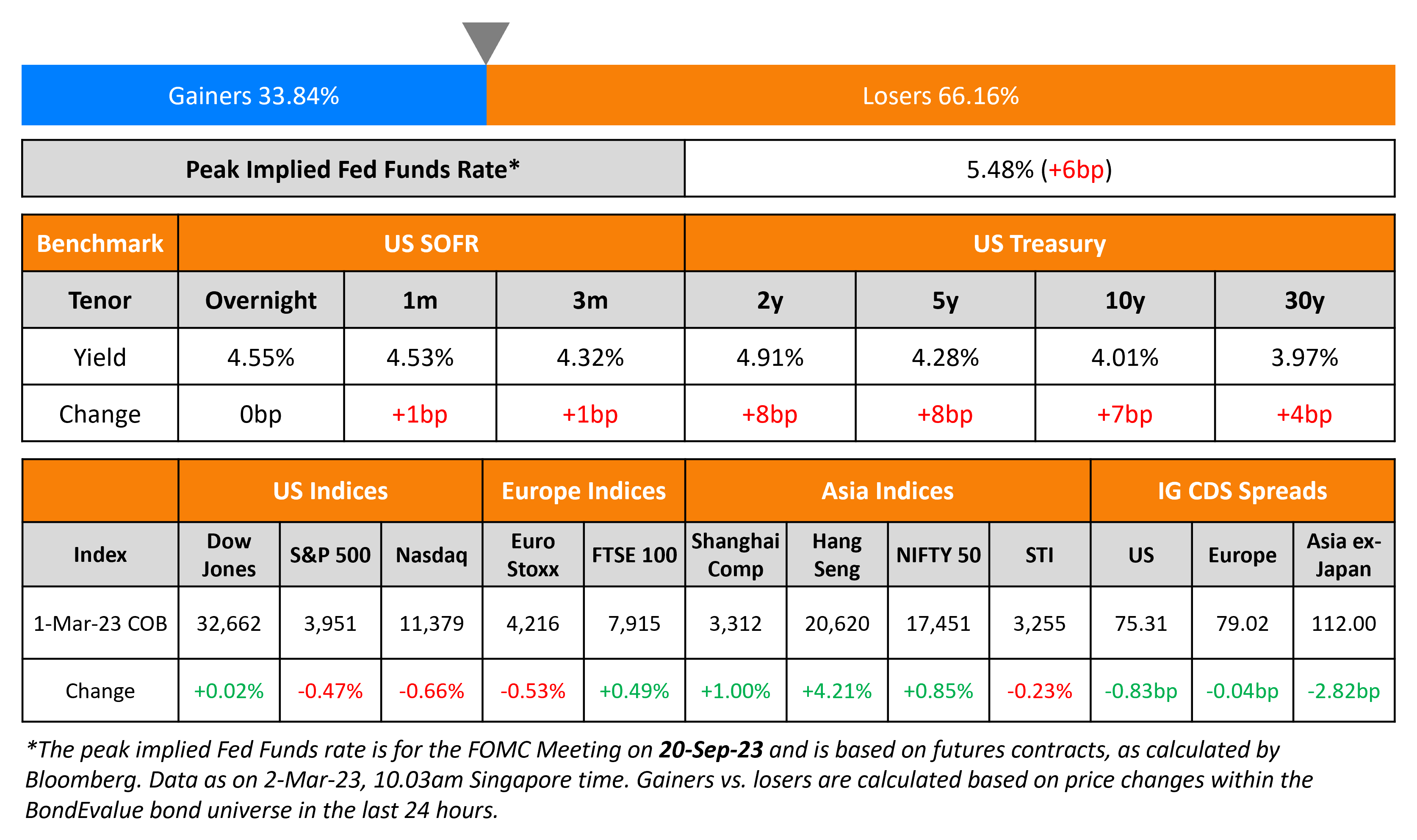

US Treasury yields jumped 7-8bp higher with the 10Y breaching the 4% mark for the first time since November. This was largely on the back of the US ISM Manufacturing Price Paid print coming in at 51.3, much higher than the 46.5 expected, thereby indicating sustained inflationary pressures. This was despite a contraction in the overall ISM Manufacturing Index that came at 47.7, lower than the expected 48. Fed officials Bostic and Kashkari also made hawkish comments related to rates (see Talking Heads), which pushed the peak Fed Funds rate 6bp higher to 5.48% for the September 2023 meeting. Markets are now pricing in four hikes of 25bp each at the next four FOMC meetings in March, May, June and July, based on the CME’s maximum probability calculations.

US IG and HY CDS spreads tightened by 0.8bp and 5.3bp respectively. As per Bloomberg, popular US credit ETFs HYG, LQD and JNK saw record monthly outflows of a combined $11.9bn in February. HYG and JNK are junk or high yield bond ETFs while LQD is an investment grade bond ETF. The outflows were led by a record $4.9bn withdrawal from the HYG ETF. HYG and JNK both dropped about 2.4% in February while LQD fell 4.5% in its worst monthly performance since September.

The S&P and Nasdaq ended lower on Wednesday, down by 0.5% and 0.7%. European equity markets also ended lower. European main CDS spread were flat while crossover CDS spread tightened 1.5bp. German inflation jumped by 9.3%, higher than the 9%with the German short-end Schatz yields rising by 7bp. Asian equity markets have opened with a negative bias today. Asia ex-Japan CDS spreads tightened by 2.8bp.

New Bond Issues

-

HSBC $ TLAC 6NC5/11NC10/21NC20 at T+210/245/245bp area

- Teva Pharmaceutical $500/500mn 6.5Y/8.5Y at 8.125/8.375% area

- Sumitomo $ 5Y at T+160bp area

- Hotel Properties S$ 5Y at 5.5% area

- Morocco $ 5Y/10.5Y at T+235/300bp area

Barclays raised S$400mn via a PerpNC5 AT1 bond at a yield of 7.3%, 35bp inside initial guidance of 7.65% area. The subordinated bonds have expected ratings of Ba2/BBB-. Proceeds will be used for general corporate purposes and to strengthen the capital base of the issuer. A capital adequacy trigger event will occur if the issuer’s CET1 ratio falls below 7%. If not called by the coupon reset date (15 September 2028), the current fixed coupon of 7.3% will be reset to 5Y SGD OIS Swap+392.9bp every 5 years. The new bonds are priced 33bp wider to its existing 8.3% Perps (callable in 2027) that were issued in June last year that currently yield 6.97%. The new bonds offer a juicy yield pick-up of 142bp over BNP Paribas’ recently issued SGD PerpNC5.5 AT1s priced last week that are rated BBB-/BBB and currently yielding 5.88%.

Teva Pharmaceutical raised €1.3bn via a two-tranche SLB deal. It raised:

- €800mn via a 6.5Y bond at a yield of 7.375%, 37.5bp inside initial guidance of 7.75% area. The new bonds are priced 11.5bp wider to its existing 4.375% 2030s that yield 7.26%.

- €500mn via a 8.5Y bond at a yield of 7.875%, 37.5bp inside initial guidance of 8.25% area.

The senior unsecured, SLBs have expected ratings of BB-. Proceeds will be used to fund the issuer’s tender offer announced earlier this week. Should the issuer fail to meet its KPIs, which include increasing new regulatory submissions, increasing access to medicine, and reducing greenhouse gases, the coupons will see a step-up of 10bp per KPI, up to a maximum of 30bp per tranche.

The Tender Offer announced by Teva Pharmaceutical is for the issuer’s notes due 2023-2026. More details in the table below:

The Offers will expire at 5pm ET on 27 March 2023, with the early tender cutoff being at 5pm ET on10 March 2023.

New Bonds Pipeline

- REC hires for $ Long 5Y Green bond

- Qatar plans for $ bond

Rating Changes

- Moody’s downgrades Pakistan Water and Power’s rating to Caa3, changes outlook to stable

- Moody’s downgrades CHS/Community Health’s CFR to Caa1 and Speculative Grade Liquidity Rating to SGL-3, outlook is stable

Term of the Day

TLAC

Total Loss Absorbing Capacity (TLAC) is an international standard designed for banks, particularly Global Systemically Important Banks (G-SIBs) by the Financial Stability Board (FSB) in 2015 to ensure that these banks have ample equity and bail-in debt in place to minimize tax payer and government bailout mechanisms. Securities eligible under TLAC include common equity, subordinated debt, some senior debt and unsecured liabilities with a maturity greater than one year. FSB requires that 33% of TLAC be filled with debt securities and a maximum of 67% with equity.

Talking Heads

On Fed officials debating higher vs. just longer after January inflation jump

Minneapolis Fed President Neel Kashkari

Inclined “to push up my policy path… at this point…I lean towards continuing to raise further”

Atlanta Fed President Raphael Bostic

A federal funds rate set in a range of from 5% to 5.25% would be adequate “until well into 2024″… This will allow tighter policy to filter through the economy and ultimately bring aggregate supply and aggregate demand into better balance”

On ‘No Question’ ECB Policy Tightening Must Continue – ECB’s Visco

“There’s no question that the tightening of the euro-area monetary stance must continue to ensure that a temporary increase in inflation caused by a supply shock doesn’t become a more persistent phenomenon sustained by demand factors”

On Fading Hopes of a Fed Cut Wipes Record $327bn From Bonds

Viktor Hjort, global head of credit strategy, BNP Paribas

“The risks are skewed to the downside: spreads should go wider. There’s been a nice growth narrative of late but I’m concerned that the market underestimates the fact that most policy tightening in the US and Europe has yet to hit the economy and corporate fundamentals.”

James Dichiaro, senior portfolio manager at Insight Investment

“While investors are happy to earn a higher degree of income within markets they are also scarred from the price action of 2022. The specter of yet higher rates from here is enough to cause investors to pull back, reassess, and await a better entry point, which we have witnessed in February”

Al Cattermole, a portfolio manager at Mirabaud Asset Management

“Investors need to have a longer-term horizon. If you don’t need the money in six weeks, this is a very attractive asset class.”

Top Gainers & Losers – 02-March-23*

Go back to Latest bond Market News

Related Posts:.png)