This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Manila Water, Mirae Asset, Fantasia Launch $ Bonds; Future Retail Misses First Coupon on $ Bond

July 23, 2020

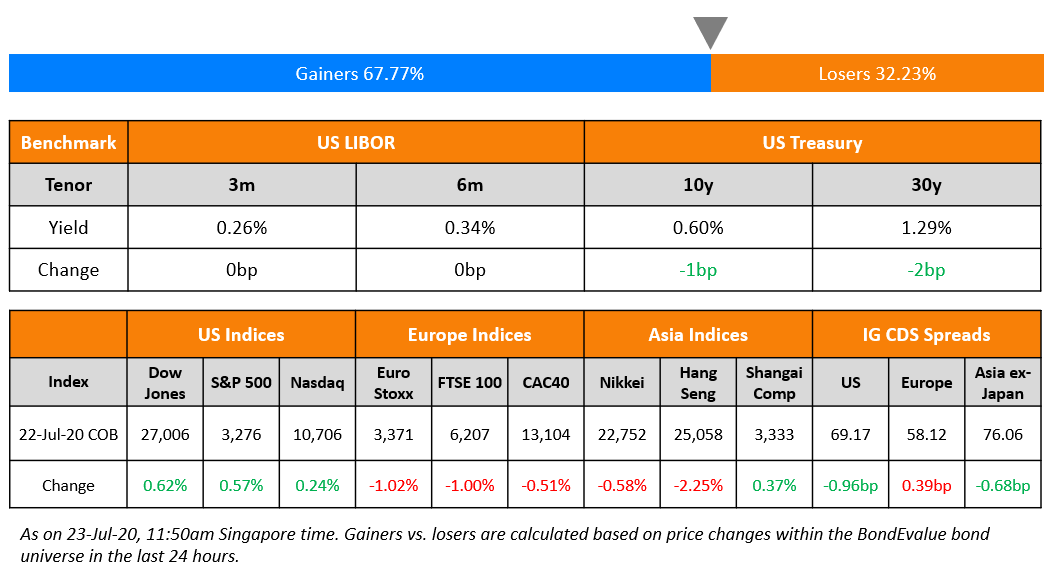

Tensions between US and China increase as the US demands closure of China’s consulate in Houston and dented risk sentiment in the markets. Wall Street saw a choppy session ending higher but European shares retreated after the rally from the recent Covid-19 relief package news ran its course. US treasuries traded in a narrow range. US and Asia ex-Japan IG CDS spreads were mostly unchanged but Europe’s IG and Crossover CDS spreads widened a tad. Primary issuance momentum slowed down this week globally. Asian markets are opening slightly lower this morning.

New Bond Issues

- Megaworld $ 7yr @ 4.625% area

- Manila Water $ 10NC5 Sustainable @ 4.75% area

- Huzhou City Investment Dev. $ 3yr @ 3.8% area

- Mirae Asset Daweoo $ 3/5yr @ T+250/290bp area

- Fantasia Holdings $ 3NC2 @ 10% area

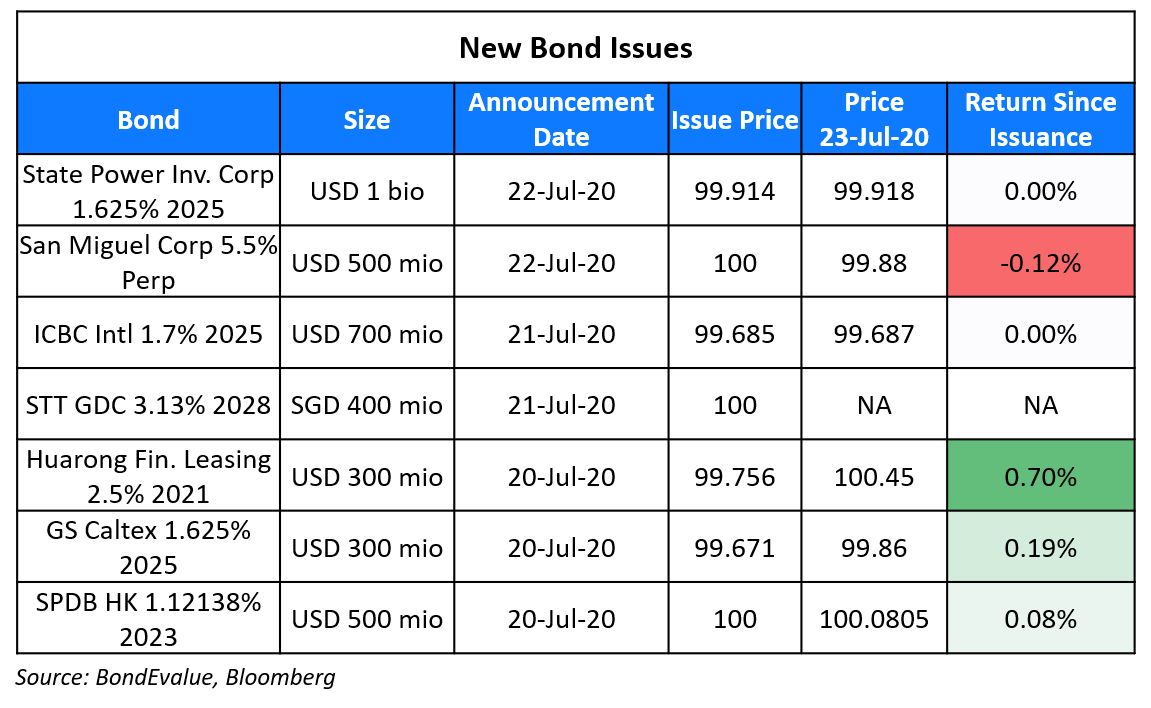

Philippine beer-maker San Miguel Corp raised $500mn via perpetual non-call 5Y (PerpNC5) bonds at a yield of 5.5%, 37.5bp inside initial guidance of 5.875% area. The unrated bonds received orders of over $2.2bn at the time of final guidance, 4.4x issue size. The bond’s coupon will reset at the initial spread of 523.7bp over 5Y Treasuries plus a 500bp step-up if not called on the first call date of July 29, 2025.

State Power Investment Corp, one of the five largest state-owned electricity producers in China, raised $1bn via 5Y bonds at a yield of 1.643%, 138bp above Treasuries and 52bp inside initial guidance of T+190bp area. The bonds, with expected ratings of A2/A, received final orders of over $4.6bn, 4.6x issue size. The bonds are expected to be issued by wholly owned subsidiary SPIC MTN, with state-owned parent company SPIC as guarantor.

Rating Changes

Ukrainian Steelmaker Metinvest Off CreditWatch Negative; ‘B’ Rating Affirmed

Noble Energy Inc. Ratings Placed On CreditWatch Positive On Acquisition By Chevron Corp.

Moody’s places CAR Inc.’s ratings on review for upgrade

Moody’s assigns Baa3 to USD notes guaranteed by Huzhou City Investment Development Group

Fitch Assigns Huarong Leasing Management HK’s USD Notes Final ‘A-‘

EU Set To Dominate The High Grade Bond Market With Its €750bn Recovery Fund

Now that the EU leaders have reached an agreement on the €750bn recovery fund to combat the effects of the pandemic on its member nations, the EU is set to dominate the high grade bond markets. Investors expect the barrage of bond issues from the EU to set new pricing benchmarks for the region and boost the Euro as a reserve currency. Philip Brown, head of public sector debt capital markets at Citi said, “I think this will transform capital markets in Europe. You’ll have a shared safe asset that’s large enough to find its way into government bond indices and government bond portfolios.” The €750bn recovery fund will disburse €390bn in grants and €360bn in cheap loans. In addition to this is the EU’s €100bn Support to mitigate Unemployment Risks in an Emergency (SURE) loan programme. According to IFR, the SURE programme will concentrate wholly on fixed-rate issues in euros, with maturities from three to 30 years. Paul O’Connor, head of the UK multi-asset team at Janus Henderson Investors, said, “The symbolism here is very important”, describing the move as the eurozone’s “first real attempt at mutualising debt and its biggest step yet towards fiscal integration”. However, as reported by the FT, the bonds come without so-called cross default clauses, which means that individual member states are not on the hook for repayment if Brussels were to default. That makes the EU’s triple A status vulnerable to any future political crisis, according to Moritz Kraemer, former head of sovereign ratings at Standard & Poor’s. He added, “A traumatic EU break-up looks unlikely today. But a lot can go wrong before 2058.”

For the full story, click here

ECB Considers Directing Banks to Hold Back Dividends in 2020

The European Central Bank is considering directing banks to hold back dividends this year against the expectations of the investors, who were hoping that the payout would start in the fourth quarter. Earlier in March, the ECB supervisors had advised banks to conserve capital to weather the pandemic by holding off dividends till at least October. The ECB supervisory board responsible for this decision includes the national regulators as well as ECB-appointed officials. According to the central bank, this was the trade-off for unprecedented regulatory relief to help maintain credit flow to the companies impacted by the pandemic. Although no decision has been taken yet, such a halt would allow the banks much needed cash flow amid the pandemic-driven slowdown, albeit at the cost of possibly lower equity valuations. Stopping the dividends would ensure additional capital of ~€30bn ($35 billion) in the euro-area banking system. As per Bloomberg, in extending the request for restraint, the supervisors would follow a call by the European Systemic Risk Board to halt payouts until at least January. The ESRB, which is led by ECB President Christine Lagarde, said last month that the toll of the crisis had only become clear in the last two months and even more restraint could be needed “if additional data indicate a slower release from containment policies and potentially a deeper economic slump.”

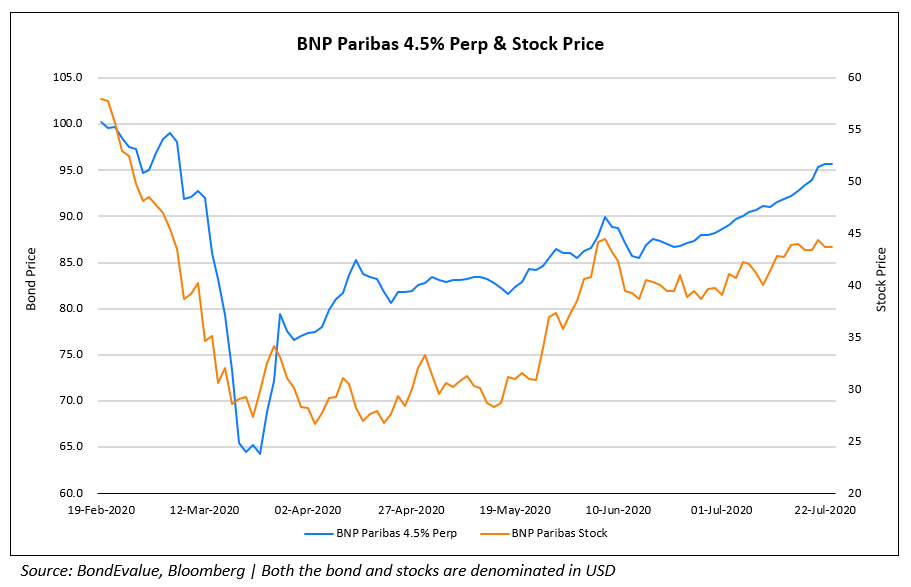

Halting the dividends, however, could be against the interests of the lenders. Bloomberg reported last month that lenders including BNP Paribas have been lobbying to resume dividend payments as this would help in boosting its slumped stock prices. BNP’s stock and bond prices took a beating during the March meltdown but have been slowly creeping back to normal levels. Halting dividends for an extended period will exert downward pressure on banks’ stock prices going forward.

For the full story, click here

For the full story, click here

Future Retail Misses First Coupon Payment on Debut Dollar Bond

India-based retailer, Future Retail informed investors via an exchange filing late on Wednesday night that it has missed a coupon payment of $13.4mn the first on its debut $500mn 5.6% bonds due 2025, issued on January 22 this year. The company said that nation-wide lockdowns imposed by the Indian government to contain the spread of the Covid-19 virus has negatively impacted its liquidity position, causing it to miss the coupon payment. However, the Biyani-family led company said that it plans to make the payment within the 30-day grace period. The bonds fell ~9 points this morning to trade at 55 cents on the dollar on the secondary markets.

For the full story, click here

Rallye’s Holding in Casino Drops After Share Pledge for Financing

A filing by France’s stock market regulator AMF revealed that Rallye’s stake in French retailer Casino dropped below 50% after a share pledge for Fimalac financing. Rallye’s stake dropped to 43.6% after it pledged 9.47m shares of Casino as guarantee to a trust, to meet its financing obligations. It is noteworthy that Rallye holds 56.5% of voting rights in Casino. Rallye is present in the retail food sector as well as in non-food e-commerce and sporting goods through its interests in Casino and Groupe Go Sport. Rallye’s bonds have been trading at distressed levels since over a year now with its 4% and 4.371% bonds due 2021 and 2023 trading at 18.2 and 18.9 cents on Euro respectively. While Casino’s short-tenor bonds (maturing in 2023 or earlier) are trading slightly lower at €95-101, its 3.992% perpetuals callable in 2024 are trading at €50.5 on the secondary markets.

Term of the Day

Dividend Stopper

Dividend stopper is a common covenant seen in perpetual bond structures that requires the bond issuer to not pay a dividend, if it decides to stop coupon payments on the perpetual bonds. Some contingent convertible (CoCo) perpetual bonds have a clause that allows the issuer to skip a coupon payment at their discretion, if the financial situation of the issuer is stressed. In such cases, a dividend stopper covenant is beneficial to the CoCo bondholders as it restricts the issuer from paying dividends on its equity in times when it has not paid coupon to its CoCo bondholders. This is why the presence (or absence) of a dividend stopper covenant is seen as the determining factor on whether the CoCo perpetual bonds are not (or are) subordinated to its equity.

Talking Heads

On the €750bn EU Pandemic Fund – Christine Lagarde, European Central Bank President

Lagarde said she would have preferred a greater proportion of grants over loans, in line with the Commission’s original proposal that was changed to convince fiscally frugal countries such as the Netherlands. “It could have been better but it’s a very ambitious project,” Lagarde told a live-streamed interview with the Washington Post.

“Even though it’s hard and it’s expensive, we are better to blunt the economic impact now in the short term, by spending more, than to allow it to get worse and deal with the consequences of it being worse,” Solomon said Wednesday in an online presentation hosted by the Economic Club of New York. Solomon warned that while more spending would be needed, it will translate into slower growth and a bigger economic burden in the future, with fallout that could include the risk of a weakening dollar. “There’s real consequence to this,” he said. “There’s no free lunch. And unfortunately, we’re going to live with the consequences for quite some time.”

On Growing Uncertainty for Debtholders Due to Delayed Payments

Darryl Flint, chief investment officer of hedge fund Double Haven Capital

“Exchange offers and debt extensions are very much en vogue at the moment,” said Darryl Flint. “The alternative is to go through a restructuring process,” which risks cross-defaults and critical damage to the underlying business, he said. “Exchange offers and extensions are likely to be most successful where terms offered are fair and where the bondholder group is suitably cohesive to negotiate terms and then support the deal,” said Flint.

Raymond Chia, head of credit research for Asia-excluding Japan at Schroder Investment Management

“Bond investors are often stuck between a rock and a hard place in these situations,” said Raymond Chia. “They may not like what the company is offering but they feel they will be worse off if the company defaults and goes into liquidation or a lengthy restructuring.”

On Household Savings and Its Impact on Rates

Anthony Crescenzi, a portfolio manager at Pacific Investment Management Co.

Anthony is among those saying that uncertainty about the economy will keep cash accounts bloated. “The high savings rate exists in part due to the caution that households are taking with respect to expenditures, a factor that is likely to persist for some time,” said Crescenzi. “The presence of a substantial amount of savings deposits on bank balance sheets is likely to impart downward pressure on market interest rates.” The effect won’t just be limited to money-market rates, according to Crescenzi.

Peter Yi, director of short-duration fixed income and head of credit research at Northern Trust Asset Management

The long-lasting psychological scars of this crisis mean that the savings rate should likely stabilize at about 15%, or double its historic average, according to Peter Yi. “Companies are really afraid of what this downturn can mean and are drawing down their bank credit lines and trying to strengthen their liquidity profile during this extremely uncertain operating environment,” said Yi. “People overall are still concerned, with some investors simply saying they need to get on the sidelines until the dust settles.

Michael Darda, market strategist at MKM Partners

It all adds up to a “savings shock” that means it will not just be the Fed’s monetary accommodation that continues to suppress interest rates, said Michael Darda. “We are probably going to see household savings rates that are going to be higher on average than we saw in the last cycle,” he said. “That means the equilibrium interest rates should be lower. And given the rate structure along the yield curve is all interconnected, that will keep all rates lower than otherwise.”

Top Gainers & Losers – 23-Jul-20*

Go back to Latest bond Market News

Related Posts: