This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 7, 2022

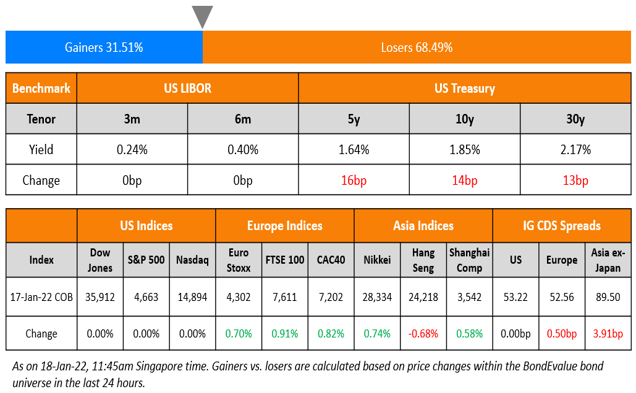

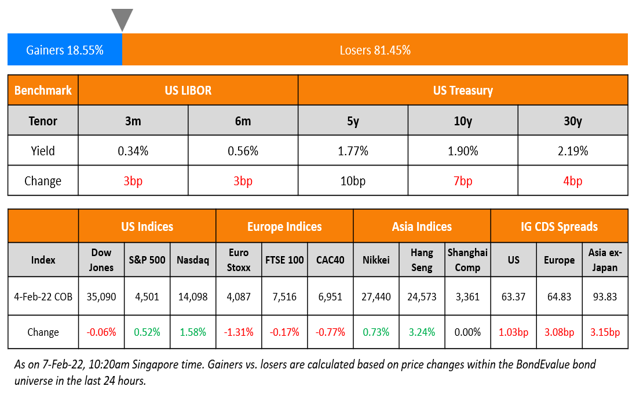

US equity markets rose with the S&P and Nasdaq ending 0.5% and 1.6% higher. Sectoral gains were led by Consumer Discretionary, up over 3%. US 10Y Treasury yields rose 7bp to 1.90%. European markets were lower with the DAX, CAC and FTSE down 1.8% 0.8% and 0.2%. Brazil’s Bovespa closed 0.5% higher. In the Middle East, UAE’s ADX was up 0.1% and Saudi TASI closed 0.5% higher. Asian markets have opened mixed with HSI and Nikkei down 0.31% and 0.73% while STI and Shanghai are up 0.32% and 1.91% respectively. US IG CDS spreads were 1bp wider and HY CDS spreads were 9.5bp wider. EU Main CDS spreads were 3.1bp wider and Crossover CDS spreads were 14.3bp wider. Asia ex-Japan CDS spreads were 3.2bp wider also.

US NFP came at 467k for January, much higher than the 125k print forecasted. The unemployment rate rose to 4% from 3.9%. FT notes that trading on credit default swaps (CDS) (Term of the Day, explained below) for protection from junk-rated companies defaulting has jumped to $197bn in January, up from $123bn in December, and is among the highest since the pandemic began in March 2020. Despite a positive economic backdrop, the credit cycle has turned due to the impetus for the Fed to tighten monetary policy according to Viktor Hjort, global head of credit strategy at BNP Paribas.

New Bonds Pipeline

- Kia Corp hires for $ green bond

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Dongtai Communication hires for $ 65mn 180-day bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

- Angola Upgraded To ‘B-/B’ On Improved Debt Metrics; Outlook Stable

- Moody’s downgrades Ghana’s rating to Caa1; outlook stable

- Credito Real Downgraded To ‘CCC-‘ From ‘B-‘ On Higher Refinancing Risk, Remains On CreditWatch Negative

- Fitch Downgrades Enel to ‘BBB+’ on Higher Expected Leverage; Endesa to ‘BBB+’

- Fitch Downgrades Credito Real’s Ratings to ‘CC’; RWN Maintained

- Fitch Revises Ukraine’s Outlook to Stable; Affirms at ‘B’

Term of the Day:

Credit Default Swap

A Credit Default Swap (CDS) is a financial contract between two counterparties that allows an investor to “swap” or offset the credit risk with another investor. CDS acts like an insurance policy wherein the buyer makes regular payments to the seller to protect itself from an issuer default. In the event of a default, the buyer receives a payout, typically the face value of the bond or loan, from the seller of the CDS as per the agreement. CDS spreads are a commonly used metric to track the market-priced creditworthiness of an issuer. A widening (increase) in CDS spreads indicates a deterioration in creditworthiness and vice-versa.

Talking Heads

On Rate Hikes Coming Too Slowly in Asia For Some Bond Funds

Paul Greer, a London-based money manager at Fidelity

“We expect EMEA and Latin American central banks to finish their monetary policy tightening cycles before Asia… So, we are generally avoiding Asian local bonds and see more value in other regions.”

Edwin Gutierrez, the head of emerging-market sovereign debt at abrdn

“The juice is to be had in LatAm and EMEA… Asia is just starting to experience a pickup in inflation, as countries move away from zero-Covid policies.”

Julio Callegari, lead portfolio manager at JPMorgan Asset Management

“In countries like Russia, Czech Republic, Brazil and Chile, the tightening will be over in the first half of this year,”

On Bond Bears Bracing for Challenges From Consumer Prices, Auctions

Alan Ruskin, chief international strategist at Deutsche Bank

“Unless you think inflation comes down rapidly due to other factors that are not related to tighter policy, then the Fed is miles behind the curve. It is remarkable how little additional tightening is being priced for next year.”

Christopher Brightman, chief executive officer at Research Affiliates LLC

“Our firm believes the neutral real rate is zero, and getting the funds rate back to 2% will not achieve that aim if inflation stays higher.”

Fed Could Hike at All Seven Remaining Meetings This Year – Larry Summers

“Markets have to be prepared for a rate hike in every meeting and they have to be prepared for the possibility that, as the inflation process continues, we might need to have meetings with more than a single 25 basis point rate hike… The data are very uncertain, and we’ve all got to recognize and be humble about that… The greater risk is that we under-tighten and that we end up with an economy with underlying inflation above 4%”.

On Central banks to embark on “largest quantitative tightening in history” – Morgan Stanley

Morgan Stanley’s analysts

“G4 central bank balance sheets will peak in May. We forecast the European Central Bank’s balance sheet to actually shrink faster than the Fed’s from May 2022 to May 2023, given less liquidity via TLTROs.”

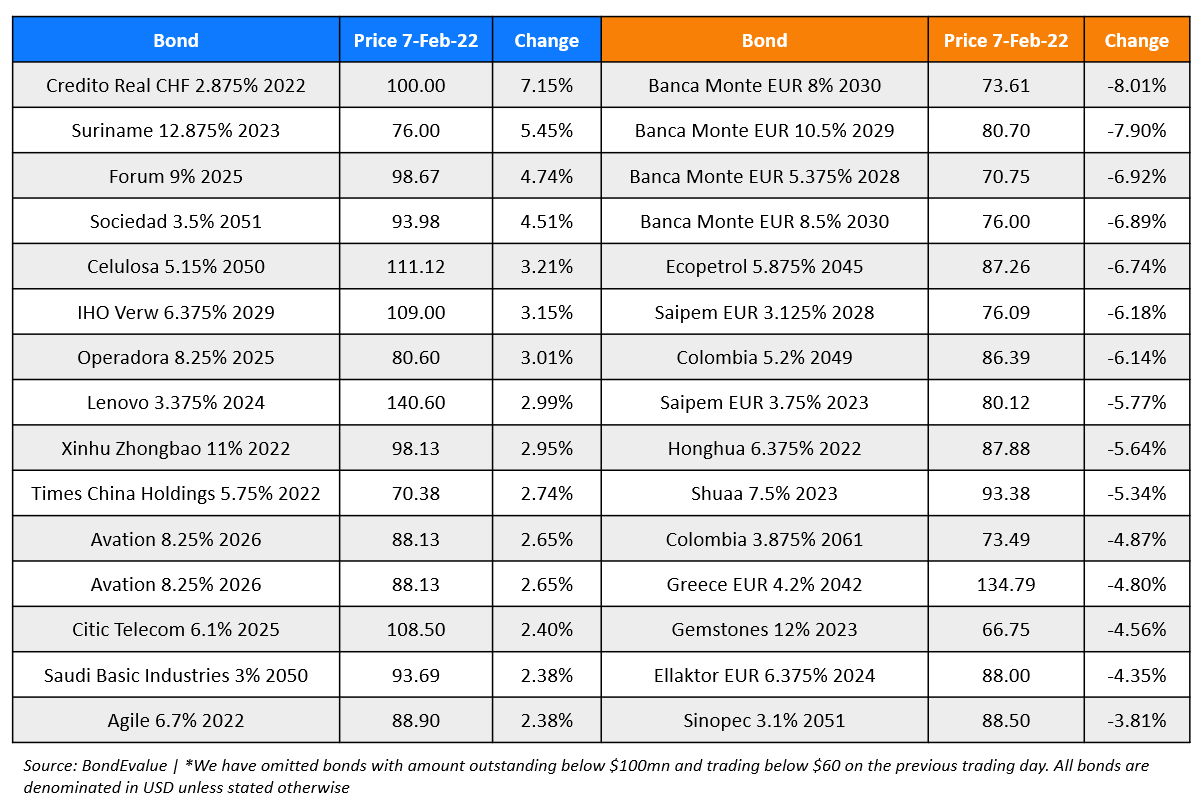

Top Gainers & Losers – 07 -Feb-22*

Other Stories

Credit Suisse faces money laundering charges in trial of Bulgarian cocaine traffickers

Go back to Latest bond Market News

Related Posts:.png)