This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 5, 2022

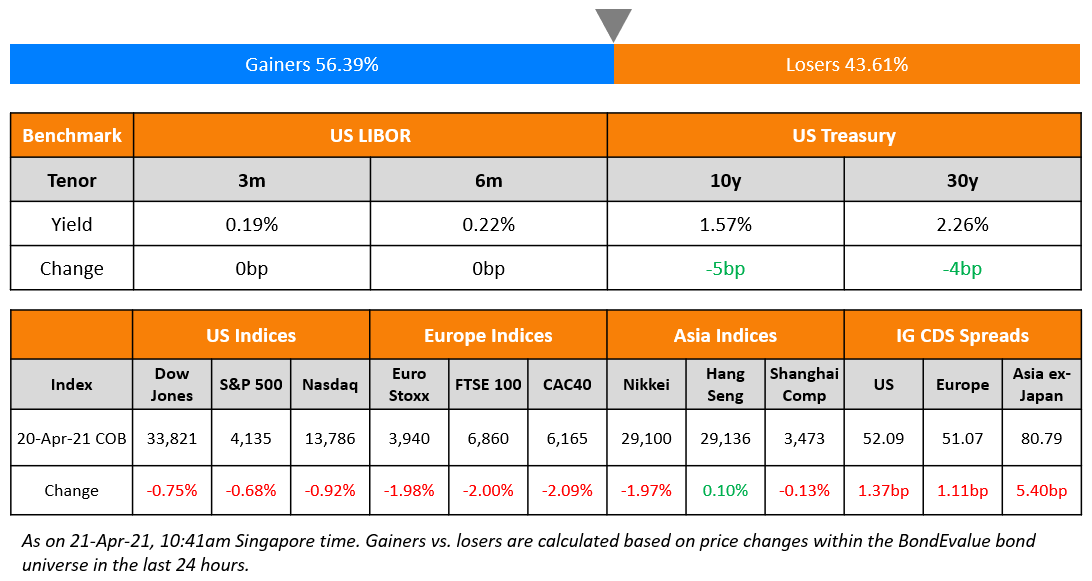

US equity markets ended mixed on Thursday with the S&P flat and Nasdaq up 0.4%. Sectoral losses were led by Energy down 3.6% and Consumer Staples down 0.8%; Consumer Discretionary was up 0.5%. US 10Y Treasury yields were 3bp down at 2.69%. European markets also ended mixed – DAX and CAC ended up 0.6% each while FTSE was flat. Brazil’s Bovespa gained 2%. In the Middle East, UAE’s ADX fell 0.3% and Saudi TASI ended flat. Asian markets have opened mixed – STI, Shanghai, and Nikkei were up 0.2%, 0.2%, and 0.7% respectively while HSI was flat. US IG CDS spreads tightened 0.7bp and US HY spreads were tighter by 5.8bp. EU Main CDS spreads were 1.3bp wider and Crossover spreads were widened by 10.5bp. Asia ex-Japan IG CDS spreads tighter by 1.3bp.

The Bank of England (BoE) raised its benchmark rate by 50bp, the most since 1995, to 1.75% in line with expectations. BoE has warned that the economy will slip into recession by the end of year, and will continue into 2023. The central bank expects inflation to peak at over 13% by October and to remain higher for most of 2023. From the next month, BoE will start selling £40bn ($49bn) worth of government bonds it purchased during its quantitative easing of 2012.

IBF-STS Course on Digital Assets | 11 Aug 2022 (In-person in Singapore) | 70/90% Funding

New Bond Issues

Standard Chartered raised $1.25bn via an AT1 PerpNC5.5 at a yield of 7.75%, 37.5bp inside the initial guidance of 8.125% area. The bonds have expected ratings of Ba1/BB-/BBB-. Proceeds will be used for general business purposes, including and without limitation to repurchase or refinance existing debt and to strengthen further its regulatory capital base. The first call date for the AT1s is on 15 February 2027 and the second call date is on 15 February 2028. If the bond is not called by the second call date, the coupon rate will reset then and every five years thereafter to the 5Y Treasury plus a margin of 497.6bp.

Aside from the call option, the bank also has the power to call back its AT1s in the event of tax changes or regulatory/capital disqualification. The bond’s coupon payments are fully discretionary, non-cumulative and “subject to sufficient Distributable Items” as per Bloomberg. Additionally, the bonds have a mechanical trigger which will activate when Standard Chartered’s CET1 ratio drops below 7%; the bonds will be automatically converted into ordinary shares if triggered. The new bonds are priced 147bp wider to its existing 6% Perps callable in 2025 that are currently yielding 6.28%.

Facebook parent Meta raised $10bn via a four-tranche debut bond issuance:

The senior unsecured bonds have expected ratings of A1/AA-. Proceeds will be used for general corporate purposes.

HSBC raised $4.75bn via a two-tranche deal. It raised

- $2.25bn via a 6NC5 fixed-to-float bond at a yield of 5.21%, 25bp inside the initial guidance of T+270bp area. The new bonds are priced at a new issue premium of 9bp vs. its existing 4.755% 2028s that yield 5.12%.

- $2.5bn via a 11NC10 fixed-to-float bond at a yield of 5.402%, 25bp inside the initial guidance of T+300bp area. The new bonds are priced at a new issue premium of 20.2bp vs. its existing 7.625% 2032s that yield 5.2%.

The senior unsecured bonds have expected ratings of A3/A-. Proceeds will be used for general corporate purposes.

Lloyds raised $2.5bn via a two-tranche deal. It raised

-

$1.25bn via a 4NC3 bond at a yield of 4.716%, 20bp inside the initial guidance of T+195bp area. The new bonds are priced 2.4bp tighter to its existing 4.65% 2026s that yield 4.74%.

-

$1.25bn via a 11NC10 bond at a yield of 4.976%, 30bp inside the initial guidance of T+260bp area. The new bonds are priced at a new issue premium of 11.6bp vs. its existing 2.707% 2035s that yield 4.86%.

The senior unsecured bonds have expected ratings of A3/BBB+. Proceeds will be used for general corporate purposes.

The Monetary Authority of Singapore (MAS) raised S$2.4bn ($1.74bn) via a 50Y debut Green Singa bond at a yield of 3.04%, 11bp inside the initial guidance of 3.15% area. While the bonds are unrated, the issuer is rated Aaa/AAA/AAA. The proceeds will be used in accordance with the SINGA and the Singapore Green Bond Framework.

Johnson Electric Holdings has decided to postpone its USD denominated 5Y bond after launching at an IPG of T+270bp on Thursday. The deal was pulled before the final price guidance was announced due to “unfavorable conditions” .

New Bonds Pipeline

- Tianjin Binhai New Area Construction & Investment hires for $ bond

- NH Investment hires for $ 3Y and/or 5Y Green bond

- Busan Bank hires for $ Social bond

Rating Changes

- Moody’s upgrades Yes Bank’s rating to Ba3 from B2; changes outlook to stable

- Moody’s upgrades Citigroup Global Markets Holdings to A2 from A3 and affirms ratings of various other Citigroup subsidiaries

- Fitch Downgrades Credit Suisse Group to ‘BBB’; Outlook Negative

- Fitch Downgrades Laos’ Long-Term Foreign-Currency IDR to ‘CCC-‘

Term of the Day

Prepaid Forward Contracts

Prepaid Forward Contracts are predominantly used by investors who hold a large number of shares in a single firm. It allows these investors to pledge the sale of a certain amount of the shares that they hold, on a future date. Furthermore, instead of waiting for the future date to receive the proceeds of its sale, investors will receive prepayments on their stock sale upfront. These prepayments are akin to a tax-free deposit since the tax liabilities on the capital gains are not due until the transaction is settled on the future date. Additionally, these contracts give investors the possibility of holding on to more shares than the amount that they committed.

For example, Party A pledges $1mn of shares that are currently priced at $10 each. This amounts to 100,000 shares now. If the price drops below $10 in the future, Party A will still have to deliver 100,000 shares on the delivery date. However, if the price rises to $20 for example, Party A will only have to deliver 50,000 shares ($1mn divided by $20) on the future delivery date. Softbank has raised as much as $22bn in cash by selling more than half of its holdings in Alibaba Group through prepaid forward contracts.

Talking Heads

On the Policy Rate being above 4% mid-2023

Cleveland Fed President Loretta Mester

“I would pencil in going a bit above four as appropriate… It’s not unreasonable I think to maintain that as where we’re getting to and then we’ll see…It’s not unreasonable to think we might have to do a 75 (basis point move) but I can imagine it could be a 50. We’ll just have to look at the data as it comes in”

On the Pound Dropping Not Being a Crisis for Now

Bank of England Governor Andrew Bailey

“We don’t target the exchange rate… Recently it’s been a story of dollar strength. I don’t think sterling is in crisis at all…We’ve seen a shrinkage in the labor force… Firms feel they can raise prices quite easily at the moment. The worst thing that can happen is that inflation becomes embedded. That’s what worries me.”

On China ‘Living With Slightly Lower GDP Growth if Inflation Stays Below 3.5%

Chinese Premier, Li Keqiang

“If we can keep the unemployment rate below 5.5 per cent and the CPI rise stays under 3.5 per cent for the whole year, we can live with a growth rate that is slightly higher or lower than the target, not too low of course…Given the size of the economy, and a large number of people entering the labour force each year … should economic activity deviate from the proper range, it would entail enormous costs in bringing it back to track.”

On China Debt Market with Foreign Outflows for Sixth Consecutive Month

Institute of International Finance (IIF)

“For the coming months, several factors will influence flows dynamics, among these the timing of inflation peaking and the outlook for the Chinese economy will be in focus.”

On Chinese Companies Listed in US Probably Not Being Qualified for Hong Kong Listing

CMB Wing Lung Bank Equity Research Team

“It’s troublesome for [the 52 companies], because there’s lingering uncertainty and an unknown deadline as to when they might have to delist [in the US]… If they have to delist, they will have extra demand for capital to buy back the shares from smaller shareholders, causing problems to both their operations and financial situation.”

Victoria Lloyd, a partner in Baker McKenzie’s capital markets practice

“If the US-listed Chinese companies do not qualify for a Hong Kong listing, essentially, they can either remain listed in the US with the hope that China and the US will come to an agreement on the audit inspection issue, or they can go private… However, going private will not be easy as many of these companies are not trading very well and market valuation will be low. So most of them are caught in the crossfire, and their US-listing status leaves them in a sticky position.”

Top Gainers & Losers – 5-August-22*

Other Stories

Go back to Latest bond Market News

Related Posts:%20no%20logo-1.png)