This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

July 29, 2022

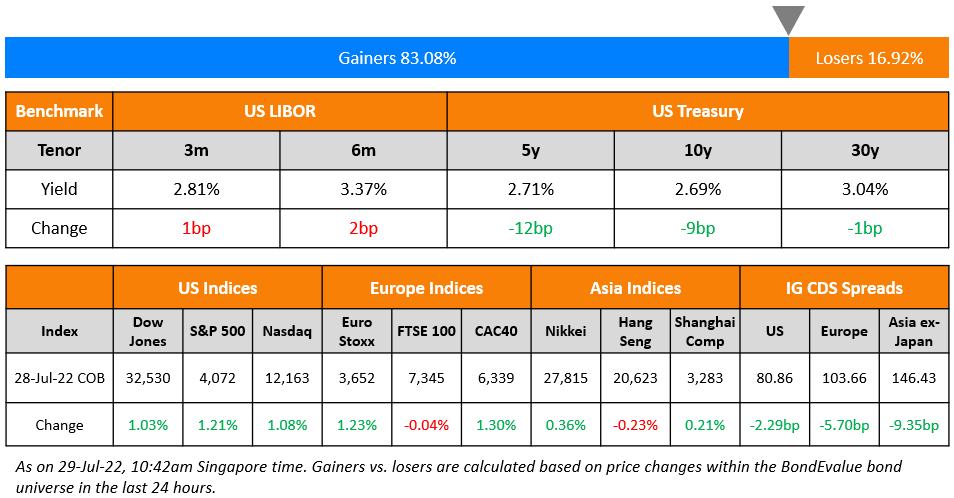

US equity markets continue its upward trend on Thursday with the S&P and Nasdaq up 1.2% and 1.1% respectively. Sectoral gains were led by Real Estate, higher by 3.7% followed by Utilities up 3.5%. US 10Y Treasury yields eased 9bp to 2.69%. European markets were mixed – DAX and CAC were up 0.9% and 1.3% respectively while FTSE ended flat. Brazil’s Bovespa gained 1.1%. In the Middle East, UAE’s ADX fell 0.1%, while Saudi TASI was up 0.9%. Asian markets have opened with a negative bias – STI, HSI and Shanghai were down 0.5%, 2.3% and 0.7% respectively while Nikkei was flat. US IG CDS spreads narrowed 2.3bp and US HY spreads were tighter by 13.3bp. EU Main CDS spreads were 5.7bp tighter and Crossover spreads were tightened by 25bp. Asia ex-Japan IG CDS spreads tightened 9.3bp.

The US GDP fell 0.9% in Q2 vs. expectations of a 0.5% growth. This follows a 1.5% contraction in Q1, putting the US in a recession based on the formal definition of two consecutive quarters of a GDP contraction. Meanwhile, China’s GDP growth slowed to 2.5% in the first half of 2022, indicating high pressure in H2 amid fears of a global recession, uncertainties arising from the Ukraine war and recurring lockdowns. Chinese state media said that China will try hard to achieve the best possible results for the economy this year, dropping mentions of its previous GDP target of 5.5% for 2022.

IBF-STS Course on Digital Assets | 11 Aug 2022 (In-person in Singapore) | 70/90% Funding

New Bond Issues

Posco raised $1bn via a dual-trancher:

- $700mn via a 3Y bond at a yield of 4.45%, 30bp inside the initial guidance of T+190bp area. The bonds received orders over $2.1bn, 3x issue size.

- $300mn via a 5Y bond at a yield of 4.592%, 25bp inside the initial guidance of T+210bp area. The bonds received orders over $1.5bn, 5x issue size.

The bonds have expected ratings of Baa1/A– (Moody’s/S&P), same as the issuer. Proceeds will be used for refinancing and general corporate purposes.

General Motors raised $2.25bn via a two-tranche green deal. It raised

- $1bn via a 7Y Green bond at a yield of 5.417%, 25bp inside the initial guidance of T+295bp area. The new bonds are priced at a new issue premium 18.7bp wider to its existing 4.3% 2029s that yield 5.23%.

- $1.25bn via a 10Y Green bond at a yield of 5.633%, 25bp inside the initial guidance of T+320bp area.

The senior unsecured green bonds have expected ratings of Baa3/BBB. Proceeds will be allocated exclusively to Clean Transportation Solutions: investments and expenditures for the design, development or manufacture of clean transportation technology and enabling solutions.

New Bonds Pipeline

- NH Investment hires for $ 3Y and/or 5Y Green bond

- Mianyang Investment hires for $ bond

- Busan Bank hires for $ Social bond

Rating Changes

- Fitch Upgrades Tereos to ‘BB’; Outlook Stable

- Moody’s downgrades Mauritius’s rating to Baa3, changes outlook to stable

- Pakistan Outlook Revised To Negative On Weakening External Position; ‘B-‘ Rating Affirmed

Term of the Day

Hawkish

Hawkish is a term used for a monetary policy stance where policymakers are concerned about inflation or overheating risks and therefore adopt a tightening stance. A hawkish stance could be either in the form of rate increases, asset purchases decreases or even indications on the same relative to market expectations. This is the opposite of a dovish stance which tries to ease financial conditions. In yesterday’s FOMC, the Fed hiked its benchmark rate by 75bp to bring the Fed funds target rate to 2.25-2.50% in order to combat rising inflation of 9.1%. Analysts expect the Feds to remain hawkish in the medium to long term until inflation levels are brought back to its target rate of about 2%.

Talking Heads

On China Banks Rushing to Raise Record Debt as Credit Losses Mount

Henry Hu, a senior director at S&P Global Ratings.

“We believe that asset quality is worsening due to Covid-related lockdowns, the property slump, the risks associated with small and micro loans, and the general economic slowdown in China… The capital injections from the government will help those small regional banks with large bad loan burdens to clean up their books and support the local economies.”

Peiqian Liu, chief China economist at NatWest Group

“Corporate sentiment and ability to increase capital expenditure are both very weak and so economic momentum is yet to pick up…As long as property woes and Covid linger, bad loans at banks will continue to rise.”

On Evergrande Rout Seeing More Sector Turmoil

John Lam, UBS group AG Analyst

“To restore homebuyers’ confidence, the government needs to improve the risk-reward for them. So allow some property price appreciation. That will send a strong signal to the market…The property sector will still survive, but some privately owned developers may cease to exist in the future.”

On the Idea That Two GDP Drops Spell a Downturn

Andrew Husby, Bloomberg US economist

“It’s extremely unlikely NBER could or would make a recession call anytime soon. As usual, they’ll be late, but that’s by design… Few of the relevant indicators have been consistently negative — but, many are choppy. Barring revisions, it still seems unlikely NBER would date the peak as early as June.”

Benjamin Friedman, a Harvard University economist

“A recession is a sustained and broad-based decline in economic activity, across many sectors of the economy. To point to the most obvious contradiction, the economy is still adding jobs at a very good rate. Many industries continue to see robust sales.”

On IMF Downgrading Asia Pacific Forecast as Shocks Keep Rolling

Krishna Srinivasan, director of the IMF Asia and Pacific Department

“Risks that we highlighted in our April forecast — including tightening financial conditions associated with rising central bank interest rates in the United States and commodity prices surging because of the war in Ukraine — are materializing…That in turn is compounding the regional growth spillovers from China’s slowdown…While growth is weakening, Asian inflation pressures are rising, driven by a global surge in food and fuel costs resulting from the war and related sanctions.”

Top Gainers & Losers – 29-July-22*

Other Stories

- Argentina’s Bonds Rise Amid Reports of a Cabinet Shakeup

- UOB Q2 net profit rises 11% to S$1.1b; declares interim dividend of S$0.60

- Apple Beats on Revenue and Profit, Expects Growth to Accelerate Despite ‘Pockets of Softness’

- Conglomerate Keppel’s Half-year Profit Soars as Businesses Rebound

- Amazon jumps on revenue beat and rosy guidance for third quarter

- SIA soars into the black in Q1 with second highest quarterly operating profit

Go back to Latest bond Market News

Related Posts:%20no%20logo-1.png)