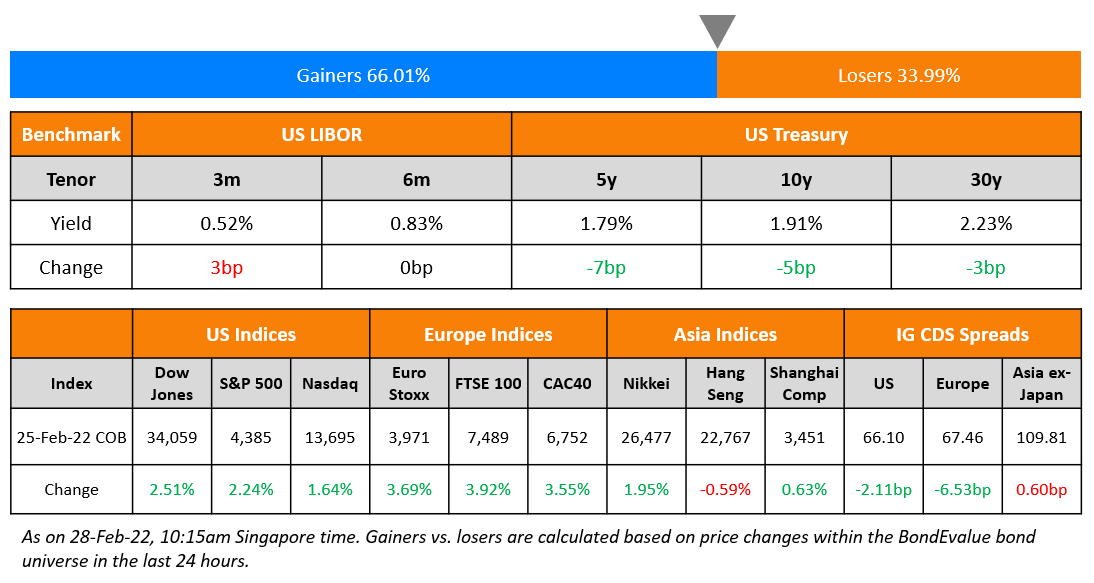

US equity markets registered another strong day of gains on Friday with the S&P and Nasdaq ending 2.2% and 1.6% higher. All sectors ended in the green, led by Materials and Financial, up 3.2-3.5%. US 10Y Treasury yields eased 5bp on Friday. European markets also rallied sharply – DAX, CAC and FTSE were up 3.6%, 3.7% and 3.9%. Brazil’s Bovespa closed 1.4% higher. In the Middle East, UAE’s ADX was up 0.6% and Saudi TASI was up 1%. Asian markets have opened with a negative bias – Shanghai, HSI, STI and Nikkei are down 0.3%, 1.5%, 2.2% and 0.3% respectively. US IG CDS spreads tightened 2.1bp and HY spreads were 9.9bp tighter. EU Main CDS spreads were 6.5bp tighter and Crossover CDS spreads were a sharp 38bp tighter. Asia ex-Japan CDS spreads were 0.6bp wider.

Learn About Bonds from Senior Bankers | Starting 28 March

In the current environment marred by geopolitical concerns, impending rate hikes and crisis in China real estate, it is imperative for investors and advisors to be able to analyze bonds effectively. This course will help you do just that via 8 interactive sessions conducted live via Zoom by senior bankers starting 28 March. Click on the banner below to know more and to sign up.

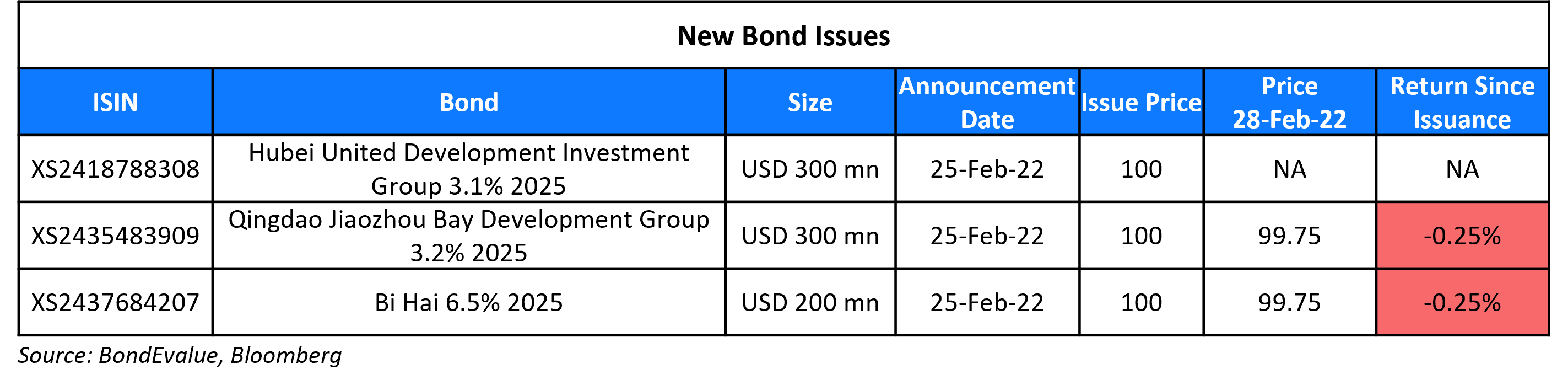

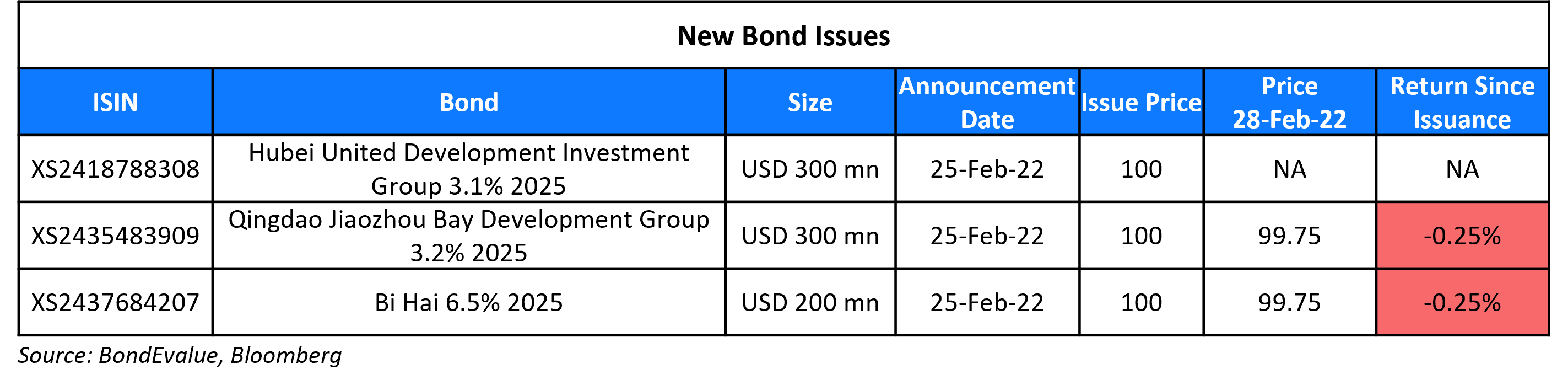

New Bond Issues

- Avic International $200mn 5Y at T+185bp area

- BOC Sydney $ 3Y at T+75bp area

Qingdao Jiaozhou Bay Development Group raised $300mn via a 3Y bond at a yield of 3.2%, 30bp inside initial guidance of 3.5% area. The bonds are unrated. Proceeds will be used as working capital for the eligible green projects.

Hubei United Development Investment Group raised $300mn via a 3Y green bond at a yield of 3.1%, 25bp inside initial guidance of 3.35% area. The bonds are rated Baa2, and received orders over $850mn, 2.8x issue size. Proceeds will be used to finance and replenish the working capital of green projects.

Yunnan Provincial Investment Holdings raised $200mn via a 3Y bond at a yield of 6.5%, 25bp inside initial guidance of 6.75% area. The bonds are unrated. Proceeds from the bond issue will be used for offshore debt refinancing.

New Bonds Pipeline

Rating Changes

Term of the Day

Fallen Angel

A fallen angel is a company or sovereign whose credit rating has been cut from investment grade to junk due to deteriorating financial conditions of the company. The downgrade to junk may have a negative impact on its bond prices as asset managers that are mandated to hold only investment grade debt may be forced to sell off their holdings in the fallen angels. Russia was downgraded to junk status of BB+ from BBB- by S&P.

Talking Heads

On SWIFT Ban on Russia Meaning that the Fed May Need to Ready Dollars

Credit Suisse Group strategist Zoltan Pozsar

“Exclusions from SWIFT will lead to missed payments and giant overdrafts similar to the missed payments and giant overdrafts that we saw in March 2020… Banks’ inability to make payments due to their exclusion from SWIFT is the same as Lehman’s inability to make payments due to its clearing bank’s unwillingness to send payments on its behalf”

On Stagflation Threat Rattling Bond Traders as Fog of War Descends

Tracy Chen, a portfolio manager at Brandywine Global Investment Management

“This Russia-Ukraine crisis has accelerated the stagflation trend. Higher commodity prices will cause growth to slow down and boost inflation. The Fed will be even further behind the curve”

On BlackRock, Vanguard Grappling With Sanctions on Russian Securities

BlackRock, the world’s biggest asset manager

“We are taking all necessary actions to ensure compliance with applicable sanctions laws and regulations”

ETF provider Direxion

“During this time, the fund may not meet its investment objective, may experience increased tracking error and may experience significant premium/discounts and bid-ask spreads”

Jay Baris, a law partner at Sidley Austin

“Portfolio managers face a balancing act between complying with sanctions and complying with their obligations to fund shareholders under other laws and objectives, which include trying to match an index”

Darshak Dholakia, a Washington-based partner at Dechert LLP

On ECB’s Wunsch Agreeing With Market View of Tightening

Agrees with the expectation that the ECB will halt bond purchases in the third quarter and raise interest rates at the end of this year or early in 2023… disagreed with the idea that tightening by the ECB would cripple the economic recovery, as monetary policy remains “extremely accommodating.”

On the extra time alleviating the need to rush to the market to sell

On U.S. Bond Issuance to Depend on Placid Tone

Barclays Plc’s credit strategists led by Bradley Rogoff and Dominique Toublan

“Given the lack of clarity on macro risks, we think risk assets will be under pressure in the near term”

John McClain, a high-yield portfolio manager at Brandywine Global Investment Management

“We continue to see almost every new issue struggle and until that changes investors are probably going to be hesitant particularly with the continuous onslaught of outflows from the asset class”

Top Gainers & Losers – 28-Feb-22*

.png)

Other Stories

.png)