This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 27, 2022

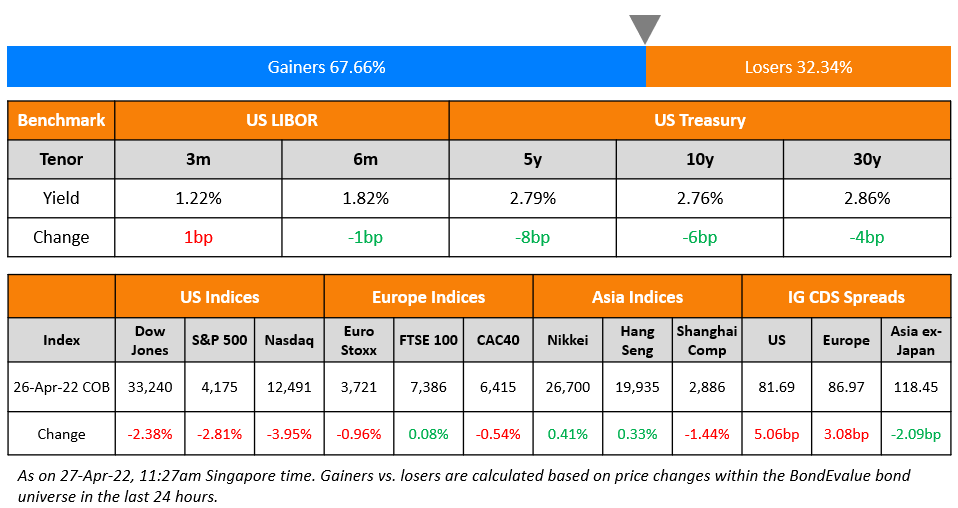

The S&P and Nasdaq saw a sharp drop yesterday, down 2.8% and ~4% respectively. Sectoral losses were led by Consumer Discretionary, down 5% and IT down 3.7%. The overall risk-off tone saw US 10Y Treasury yields ease 6bp to 2.76%. European markets were broadly weaker – DAX was down 1.2%, CAC was down 0.5% while FTSE was up 0.1%. Brazil’s Bovespa closed 2.2% lower. In the Middle East, UAE’s ADX was flat while Saudi TASI was down 0.3%. Asian markets have opened mixed – Shanghai and HSI were up 0.4% and 0.1% while STI and Nikkei were down 0.1% and 1.4%. US IG and HY CDS spreads widened 5.1bp and 23.5bp respectively. EU Main CDS spreads were 3.1bp wider and Crossover spreads were 11.5bp wider. Asia ex-Japan CDS spreads were 2.1bp tighter.

New Bond Issues

Keppel Infrastructure Trust raised S$250mn via a 5Y bond at a yield of 4.11%, 24bp inside initial guidance of 4.35% area. The bonds are unrated and are issued by Keppel Infrastructure Fund Management. The bonds received orders over S$300mn, 1.2x issue size. Funds, banks and corporates bought 65% of the deal and private banks took 35%. Singapore accounted for 99% and others 1%. Private banks will get a 15-cent concession. Proceeds are for debt refinancing, working capital as well as acquisitions and/or investments.

Keppel Infrastructure Trust raised S$250mn via a 5Y bond at a yield of 4.11%, 24bp inside initial guidance of 4.35% area. The bonds are unrated and are issued by Keppel Infrastructure Fund Management. The bonds received orders over S$300mn, 1.2x issue size. Funds, banks and corporates bought 65% of the deal and private banks took 35%. Singapore accounted for 99% and others 1%. Private banks will get a 15-cent concession. Proceeds are for debt refinancing, working capital as well as acquisitions and/or investments.

Singapore Technologies Engineering raised $1bn via a two-trancher. It raised $700mn via a 5Y bond at a yield of 3.468%, 30bp inside initial guidance of T+100bp area. It also raised $300mn via a 10Y bond at a yield of 3.809%, 30bp inside initial guidance of T+135bp area. The bonds are rated AAA and received orders over $2.3bn, 2.3x issue size. APAC took 53%, EMEA 37% and North America 10%. About 52% went to banks, 16% to asset and fund managers, 15% to governments and central banks, 14% to corporations and 3% to broker dealers and others. ST Engineering Urban Solutions USA is the issuer and ST Engineering the guarantor. Proceeds will be used for capital expenditure, debt refinancing and acquisitions.

Orient Securities raised €100mn via a 3Y bond at a yield of 1.76%, 27bp inside initial guidance of MS+95bp area.

New Bonds Pipeline

- Korea East-West Power hires for $ 5Y Green bond

- Busan Bank hires for $ Social bond

- Kookmin Card hires for $ Sustainability bond

- Continuum Energy Aura hires for $ Green Bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

Rating Changes

- Future Retail’s Senior Secured Notes Downgraded To ‘CC’ On Termination Of Asset Sale; Issuer Rating Remains ‘SD’

- Fitch Revises Outlook on GLP to Stable from Negative; Affirms at ‘BBB’

- Fitch Revises Guatemala’s Outlook to Positive; Affirms Ratings at ‘BB-‘

Term of the Day

Risk Weighted Assets (RWA)

Risk Weighted Assets (RWA) is a calculation used in banking that helps determine the minimum amount of capital (capital adequacy ratio) that a bank should keep as reserves against unexpected losses arising out of its assets turning sour or insolvency/bankruptcy. Riskier assets like unsecured loans, high yield securities etc. that carry a higher risk of default are given a higher risk weightage and safer assets like Treasuries are given a lower weightage since high risk assets require higher capital adequacy ratios (CAR).The minimum capital requirements as a percentage of RWAs are set by regulatory agencies with banks required to keep a minimum of 10.5% of RWA as Tier 1 and Tier 2 capital under Basel III.

Talking Heads

On Treasury Yields Extend Slide Amid Signs of Extreme Bearishness

John Brady, managing director at RJ O’Brien

“A lot of rate hikes are priced in and there is a big short base in the front end. There is a sense of fading Fed tightening expectations, and some accounts do see value in the two-year at 2.55%.”

Strategists at Wells Fargo

U.S. defined-benefit corporate pension funds will add $4 billion to bonds, which “could extend the recent rally in the long end over the next couple of days… It depends on “how big the short-base is that wants to cover prior to the May 4 FOMC”

Citi Strategists Edward Acton and Bill O’Donnell

A one-sided short position has been built up in Treasuries, “driven by deleveraging activity” as flattener trades were “closed out in size last week

On ECB has room for 2-3 rate hikes this year – Latvia ECB Head, Martins Kazaks

“A rate rise in July is possible and reasonable. Markets are pricing two or three 25 basis point steps by the end of the year. I have no reason to object to this, it’s quite a reasonable view to take. Whether it happens in July or September is not dramatically different, but I think July would be a better option… Ending the Asset Purchases Programme in early July is appropriate. The APP has fulfilled its purpose so it’s not necessary anymore.”

On World-Beating Gain for China Bonds Showing Power of PBOC Policy

Winson Phoon, head of fixed-income research at Maybank Securities

“The outperformance of Chinese government bonds is largely due to monetary policy divergence, with an easing bias by the PBOC when other major central banks are tightening”

Eugene Leow, a rates strategist at DBS Bank

“The PBOC appears to have more leeway to keep rates low as compared to other emerging-market central banks”

Top Gainers & Losers – 27-Apr-22*

Go back to Latest bond Market News

Related Posts: