This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Agile, SGX Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 26, 2021

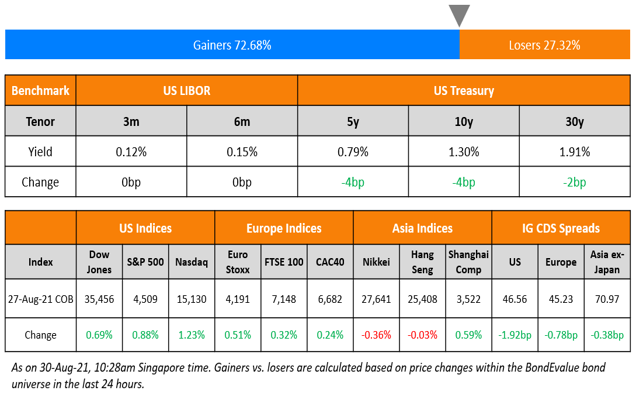

US markets inched higher to extend the record breaking streak for another day – S&P and Nasdaq gained ~0.2%. Financials were up 1.2% while Energy and Industrials were up more than 0.5%. Healthcare and Real Estate were down 0.3% and 0.2% respectively. European markets looked for direction – FTSE and CAC were up 0.3% and 0.2% while the DAX was down 0.3%. Saudi’s TASI extended its gains by 0.1% while UAE’s ADX was down 0.2%. Brazil’s Bovespa gained another 0.5%. Asian markets have opened lower – HSI and Shanghai are down ~0.5% to 1%, while Nikkei and Singapore’s STI are hovering near yesterday’s close. US 10Y Treasury yields edged up another 5bp to 1.34%. US IG tightened 0.7bp while HY CDS spreads tightened 2.5bp. EU Main and Crossover CDS spreads also tightened 0.2bp and 0.3bp respectively and Asian ex-Japan CDS spreads tightened by 0.5bp. The Asian primary markets are having a rather busy day after a few slow weeks with six new dollar deals launched today, the highest number of deals in a day since July 19 that saw 8 new deals.

German Business Expectation in August posted 97.5 vs. expectations of 100 and against last month’s 101. Spanish PPI came in at 15.3% inline with expectation. Brazil’s mid-month CPI for August came in at 9.3%, slightly higher than expectations of 9.24% and above 8.59% YoY.

With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

- Hassle-free onboarding in 3 simple steps: SingPass MyInfo onboarding available for Singapore residents

- Curated list of fractional bonds

- Yields of up to 7-9%

- Fully transparent fee structure

- Instant settlement

For a limited time, investors get to enjoy up to 50% rebate off annual fees. Now, enjoy an even lower cost of bond ownership.

New Bond Issues

- Agile Group Holdings $ 364-day at 5.25% area

- SGX $ 5Y at T+70bp area

- Zhuhai Huafa Group $ 200 mn 3.5Y at 3.35% area

- Taizhou Urban Construction $ 3Y at 2.35% area

- Huainan Construction $ 3Y at 2.8% final

- Lionbridge Capital $ 364-day at 5.8% final

.png?width=1400&upscale=true&name=New%20Bond%20Issues%2026%20Aug%20(1).png)

China Merchants Bank Luxembourg branch raised $600mn through a dual trancher. It raised $300mn via a 2Y SOFR (Term of the day, explained below) sustainability bond at a yield of 0.55%, 35bp inside the initial guidance of SOFR+85bp area. It also raised 300mn via a 5Y carbon neutrality-themed green fixed-rate bond at a yield of 1.345%, 40bp inside the initial guidance of T+95bp area. The bonds have expected ratings of A3 and received combined orders over 3bn, 5x issue size. Proceeds will be used to finance and/or refinance eligible projects as defined in the bank’s green, social and sustainability bond framework. China Merchants Bank would become only the second Chinese issuer in the SOFR market after Bank of China printed the first SOFR bond in 2019, as per IFR.

Bank of Nova Scotia raised €750mn via a 7Y bond at a yield of MS+50bp, 15bp inside the initial guidance of MS+65bp area. The bonds have expected ratings of A2/A-/AA- and received orders over €860mn, 1.1x issue size. The issuance comes just a day after it reported earnings for the quarter ended July.

New Bonds Pipeline

- Perusahaan Pengelola Asset hires for $ bond

Rating Changes

- Fitch Upgrades Macy’s IDR to ‘BB+’; Outlook Stable

- Fitch Upgrades Dillard’s to ‘BB+’; Outlook Positive

- Fitch Upgrades Tapestry to ‘BBB-‘; Outlook Stable

- Olin Corp. Upgraded To ‘BB+’ On Debt Repayment And Improving Credit Measures, Outlook Stable by S&P

- Moody’s downgrades Burgan Bank’s long-term bank deposit ratings to Baa1 and affirms BCA at ba2; changes outlook to stable

- Moody’s downgrades Huarong Financial Leasing to Baa3; ratings remain on review for downgrade

- United Airlines Holdings Inc. Outlook Revised To Stable From Negative On Improving Demand, ‘B+’ ICR Affirmed by S&P

- Moody’s assigns a Baa3 issuer rating to Vesta

Term of the Day:

SOFR

Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. SOFR is calculated as a volume-weighted median of three rates – tri-party repo data collected from BNY Mellon, General Collateral Financing (GCF) Repo transaction data and data on bilateral Treasury repo transactions cleared through FICC’s DVP service, which are obtained from DTCC Solutions LLC. SOFR was selected as the representative rate for use in USD derivatives, and was suggested as an alternative to LIBOR. The transition from LIBOR to SOFR is expected to happen by next year.

China Merchants Bank Luxembourg branch priced a 2yr sustainability floating rate note linked to SOFR on Wednesday.

Talking Heads

“The ECB is not a passive bystander.” “If there are spillovers to euro-area financing conditions, we are willing and able to move as appropriate, as we have already demonstrated.” “We don’t need a huge lead time to think about it.” “The autumn and the winter will give us further information on what happens to the pandemic, so we should use the autumn to think about these issues,” Lane said.

Tom Essaye, former Merrill Lynch trader

“The key for markets is how quickly the Fed removes the accommodation, because that dictates how soon until we have none, which then translates into when the first rate hike comes.”

Guneet Dhingra, head of U.S. interest-rate strategy at Morgan Stanley

“When the Fed actually announces the taper, it will likely also give some degree of information on what pace it will take and how flexible or inflexible they want to be with the process.” “That could provide a key signal for the rate-hike cycle — particularly with regard to the pace of the hikes.”

Steven Barrow, Standard Bank Group’s head of G-10 strategy

“It would be dangerous for the Fed to do this because it needs to be in a position — from the middle of next year — to start putting out the rhetoric that they maybe raising rates.” “And we know it’s not out of the realm of possibilities that the Fed could lift rates some time around the end of next year. So I’m focused more on the end point for Fed tapering than the starting point.”

George Goncalves, head of U.S. macro strategy at MUFG Securities Americas

“Liquidity on the margin is what matters in these markets.” “So the taper will effect periphery assets, beginning with cryptocurrencies and including certain stocks and high-yield debt, more than Treasuries. These securities will have to stand on their own.”

Chen Shujin, an analyst at Jefferies

“For the several banks that have already reported their first-half earnings, overall loan growth has kept up with the strong momentum we saw in 2020.” “The improvement was also driven by better asset quality.”

Cindy Wang, analyst at DBS

“We are expecting a solid set of results for the first half,” said Wang. “Even going into the second half, Chinese banks’ results would still be better than the second half of last year.” “Chinese banks will continue to get support from the central bank in the form of reserve requirement cut this year, which will also be supportive to the real economy,” said Wang.

“Risk assets are rallying as the potential adverse impacts of Covid on global economic growth have investors pushing back their timeline for Fed tapering.” “Within Asia, widening had been led by China. However, Huarong has largely been resolved and volatility emanating from China Evergrande Group has diminished.”

“We doubt CCCs can keep up the same momentum as seen earlier in the year — slowing macro, global QE tapering and the first signs of rising distress in the U.S. high-yield market will act as headwinds.” “Yet with such a lack of yield opportunities in euro fixed income today, we still believe CCCs can eke out positive performance from here.”

“The usual course of things is the emerging markets that have a lot of U.S.-denominated debt and do not have a lot of exports that are U.S.-dollar based would be the ones to get into difficulty.” “Given the way tapering will happen, which is probably incredibly gradually and not sudden, probably the impact on emerging markets will be something that is slower.” “The third job of the Fed, which is stability of the global economy, the U.S. economy of course, but also the global economy, will not be something that Jay Powell will be forgetting to consider.”

“Even before Covid, there was risk that had been built up in the corporate space.” “There’s still a lot of incremental debt,” he said.

Aash Shah, senior portfolio manager with Summit Global Investments

“If rates go up, they will underperform.” “That’s nothing against their business, just a reality of discounted cash flow.”

Chris Murphy, co-head of derivatives strategy at Susquehanna International

“If economic growth holds up, 10-year yields and the Nasdaq can rally together,” he said. “If the focus switches to the Fed tapering, then that’ll be bad for the Nasdaq and the relationship starts to become more negative.”

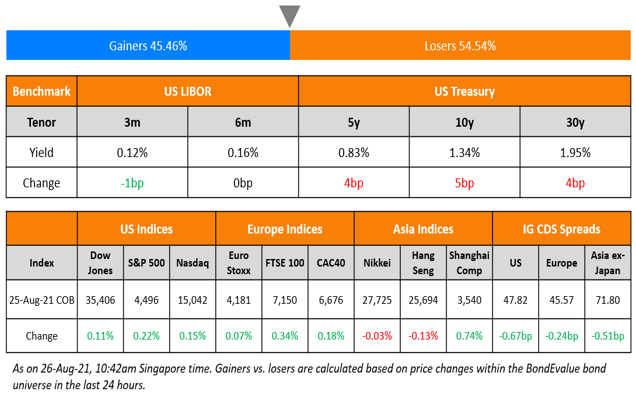

Top Gainers & Losers – 26-Aug-21*

.png?width=1400&upscale=true&name=BondEvalue%20Gainer%20Losers%2026%20Aug%20(1).png)

Other Stories

Go back to Latest bond Market News

Related Posts:%20(1).jpg?width=1400&upscale=true&name=CapbridgeBonds_Newsletter%20(1)%20(1).jpg)