This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 25, 2022

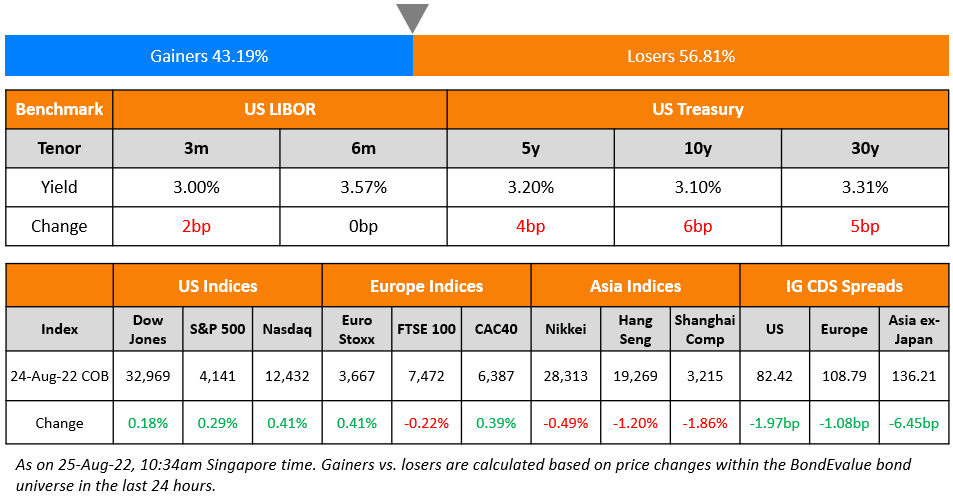

US equity markets ended in the green on Tuesday with the S&P up 0.3% and Nasdaq closing 0.4% higher. All sectors ended in the green led by Energy, up 1.2% and Real Estate up by 0.7%. US 10Y Treasury yields were 6bp higher at 3.04%. European markets were mixed – DAX and CAC ended 0.2% and 0.4% higher while FTSE was down 0.2%. Brazil’s Bovespa closed flat yesterday. In the Middle East, UAE’s ADX was down 0.2% while Saudi TASI ended 0.2% higher. Asian markets have opened on a broadly positive footing today – Shanghai, Nikkei and STI were up 0.4%, 0.2% and 0.5% respectively while HSI was down 1.2%. US IG CDS spreads tightened by 2bp and US HY spreads were tighter by 9.1bp. EU Main CDS spreads were 1.1bp tighter and Crossover spreads tightened by 6.3bp. Asia ex-Japan IG CDS spreads tightened 6.5bp.

New Bond Issues

- Deutsche Bank S$ 4NC3 senior non-preferred at 5.3% area

ANZ raised S$600mn via a 10.25NC5.25 Tier 2 bond at a yield of 4.501%, 29.9bp inside initial guidance of 4.8% area. The bonds have expected ratings of Aa3/AA-/A+. The bonds are callable from 2 December 2027 to (but excluding) the maturity date of 2 December 2032. If not called during this time, the coupon rate will reset to 5Y SORA OIS plus a spread of 174.3bp.

Public Utilities Board raised S$800mn via a 30Y Green bond at a yield of 3.433%. The bonds are unrated. Proceeds are used to finance new or existing eligible green projects under PUB’s green financing framework.

New Bonds Pipeline

- Macquarie Bank hires for € 5Y bond

- Aozora Bank hires for $ 3Y Green bond

- Tianjin Binhai New Area Construction & Investment hires for $ bond

- NH Investment hires for $ 3Y and/or 5Y Green bond

Rating Changes

Term of the Day

Poseidon Principles

Poseidon Principles are a global framework for assessing and disclosing the climate alignment of financial institutions’ shipping portfolios. They establish a common, global baseline to quantitatively assess and disclose whether financial institutions’ lending portfolios are in line with adopted climate goals. They apply to lenders, relevant lessors, and financial guarantors including export credit agencies. Currently, 29 financial institutions are signatories to the Poseidon Principles.

Yesterday, Olam Agri secured a $2.9bn facility based on ‘Poseidon Principles’ with a 3Y tenor to refinance its existing loans, and for other corporate objectives.

Talking Heads

On Stiglitz Says Rate Hikes That Are Too Steep May Worsen Inflation

“Raising interest rates doesn’t solve the supply-side problems. It can even make it worse, because what we want to do right now is invest more in the supply-side bottlenecks, but raising interest rates makes it more difficult to make those investments… How will raising interest rates lead to more food, more energy, and solve the chip supply problem? Not at all”

On Pimco Saying Chinese Bonds Look Expensive, Yuan Can Keep Falling

Stephen Chang, MD and PM at Pimco Asia

“We have been more defensive in China rates, being neutral to slight underweight in our positions. We have a few different models to see how China rank versus developed/emerging markets. Based on the valuation of other markets, China looks kind of rich… For 2.60%-to-2.70% 10-year China government bond yield, hedging the currency to USD, you would pick up less than 50 basis points.”

On Investors pricing in a $130bn loss on China developers’ dollar bonds

Cedric Lai, a senior credit analyst at Moody’s

“We still believe defaults will continue through the rest of 2022, particularly for developers with large offshore debt maturities and weak sales.”

Veteran investment banker in Hong Kong

“There’s a good reason these bonds are trading at distressed levels. The odds of a lot of these guys ever repaying is anyone’s guess.”

Robin Xing, chief China economist at Morgan Stanley

“A more centralised bailout is probably the necessary solution here”

On Traders Boosting ECB, BOE Rate-Hike Bets as Energy Costs Surge

Peter Chatwell, head of global macro strategies trading at Mizuho International

“It is all about energy prices… To stop that spiral the central banks need to get ahead of the move by raising rates much more aggressively than they were planning”

Rohan Khanna, rates strategist at UBS Group

“If the gas is shut off and the growth outlook materially deteriorates then the ECB may have to move more prudently. In our scenario forecasts, we have the ECB staying pat in case of a total shut off of Russian gas.”

Top Gainers & Losers – 24-August-22*

Go back to Latest bond Market News

Related Posts: