This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Three Gorges Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

July 21, 2022

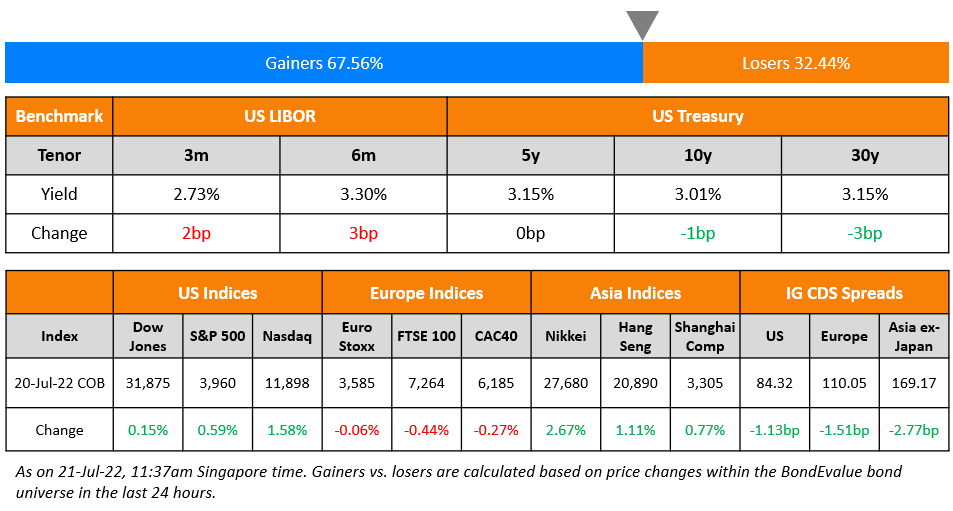

US equity markets continued its upward trend on Wednesday with the S&P and Nasdaq up 0.6% and 1.6% respectively. Sectoral gains were led by Consumer Discretionary up 1.8%, followed by IT gaining 1.6%, while Utilities were down 1.4%. US 10Y Treasury yields were 1bp down at 3.01%. European markets were lower with the DAX, CAC and FTSE down 0.2%, 0.3% and 0.4% respectively. Brazil’s Bovespa was flat. In the Middle East, UAE’s ADX and Saudi TASI were up 1% and 0.9%. Asian markets have opened mixed – Shanghai, HSI, and STI were down 0.4%, 1.2%, and 0.7% respectively while Nikkei was up 0.2%. US IG CDS spreads narrowed 1.1bp and US HY spreads were tighter by 31.5bp. EU Main CDS spreads were 1.5bp tighter and Crossover spreads were tighter by 3.2bp. Asia ex-Japan IG CDS spreads tightened 2.8bp.

June CPI inflation in the UK rose to 9.4%, higher than expectations of 9.3% and May’s print of 9.1%, marking the highest CPI print in 40 years. Thus, expectations for a 50-bps rate hike next month by BoE have risen. Canada CPI rose 8.1% in June. the highest in four decades. Higher gasoline and food prices had quickened inflation. Investors expect a 75bp hike in September by Bank Of Canada.

IBF-STS Course on Digital Assets | 11 Aug 2022 (In-person in Singapore) | 70/90% Funding

New Bond Issues

- China Three Gorges $ 3Y at T+100bp area

- Guangzhou Development $ 3Y Sustainabilityat 4.7% area

IBM raised $3.25bn via a four trancher. It raised:

.png)

- $625mn via a 5.5Y bond at a yield of 5.831%, 25bp inside initial guidance of T+290bp area. The bonds received orders over $1.1bn, 1.8x issue size. Proceeds will be used to support a tender offer to repurchase 4.75% March 2023s with an outstanding principal amount of $686.78mn.

- $625mn via a 10Y Green bond at a yield of 6.536%, 20bp inside initial guidance of T+370bp area. The bonds received orders over $1.3bn, 2.1x issue size. The bond will be issued under the company’s green finance framework and proceeds will be used to finance or refinance eligible projects, including green buildings and renewable energy projects.

The bonds have expected ratings of Baa2/BBB–/BBB.

Korea Hydro & Nuclear Power raised $700mn via a 5Y bond at a yield of 4.395%, 27bp inside initial guidance of T+150bp area. The bonds have expected ratings of Aa2/AA (Moody’s/S&P), and received orders over $2bn, 2.9x issue size. Proceeds will be used for general corporate purposes. The new bonds are priced at a new issue premium of 25.5bp over its existing 3.75% 2027s that yield 4.14%.

New Bonds Pipeline

- Lotte Property hires for $ 3Y Green, Sustainability bond

- Busan Bank hires for $ Social bond

- Continuum Energy Aura hires for $ Green Bond

Rating Changes

- Moody’s upgrades T-Mobile to Baa3; outlook stable

- Moody’s downgrades Bed Bath & Beyond’s CFR to Caa2; outlook negative

Term of the Day

Keepwell Provider

A keepwell provision is a legal agreement between a parent company and a subsidiary to ensure solvency and financial stability of the subsidiary for the duration of the agreement. Keepwell provisions are included in bond terms to offer bondholders confidence on the issuer’s ability to repay. The keepwell structure emerged around 2012-2013 to assuage concerns of investors over a bond issuer’s creditworthiness. However, it is important for investors to understand that keepwells are not a guarantee that the parent company will support the subsidiary in the event of a default, and there has previously been no precedent on the enforcement of keepwell structures.

Talking Heads

On Citi Economists Calling Global Recession a Clear and Present Danger

“On balance, our forecast sees the global economy skating through and avoiding a synchronized downturn. The risks to our forecast look skewed heavily to the downside. As such, we also reaffirm our 50% recession call articulated… Global recession is, indisputably, a clear and present danger”

On Blackstone Seeing Fed Funds Rate Near 5% on Longer Hiking Cycle

“My own view is the Fed funds rate could exceed 4%. I think they could go above 4.5%, maybe even closer to 5%

On U.S. welcoming Ukraine debt freeze, calling on creditors to join – US Treasury Secy, Janet Yellen

“I reiterate the call to all other bilateral official and private creditors to join this initiative and assist Ukraine as it defends itself from Russia’s unprovoked and brutal war, which has had a devastating impact on Ukraine’s people and economy, with spillover effects throughout the world”

On ADB Cutting Developing Asia GDP Outlooks as Risks Remain Elevated

“Risks to developing Asia’s economic outlook remain elevated and mainly associated with external factors”. China is expected to grow 4% this year, down from the 5% forecast previously. East Asia’s growth forecast is revised to 3.8% from 4.7% for 2022. South Asia’s growth forecast is lowered to 6.5% from 7% for 2022, and to 7.1% from 7.4% for 2023

Top Gainers & Losers – 21-July-22*

Other Stories

Tesla profits jump despite production turmoil and China shutdowns

Go back to Latest bond Market News

Related Posts:%20no%20logo-1.png)