This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Mirae, TSMC Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 19, 2022

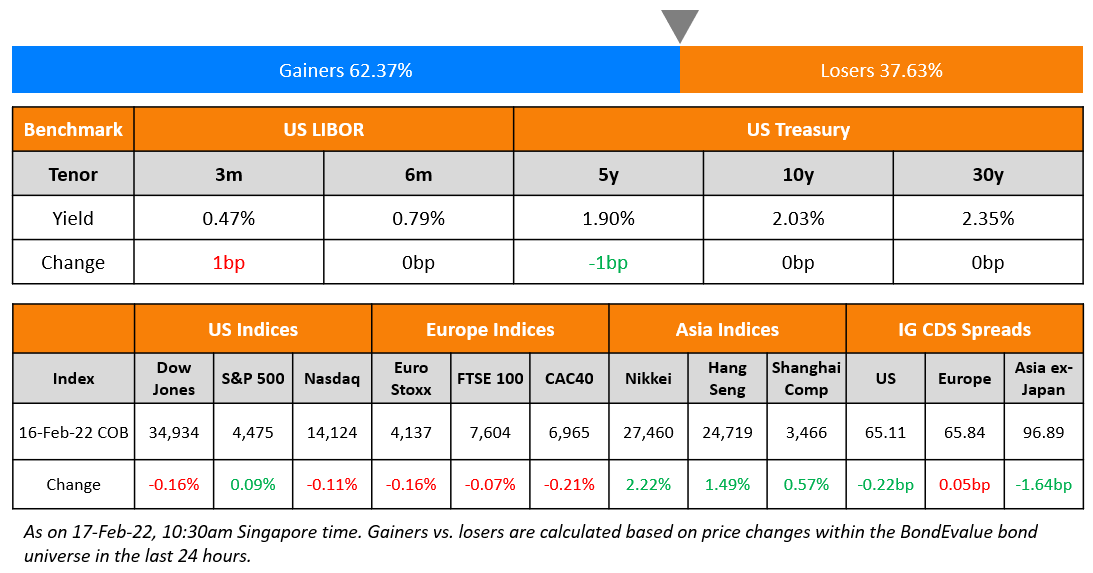

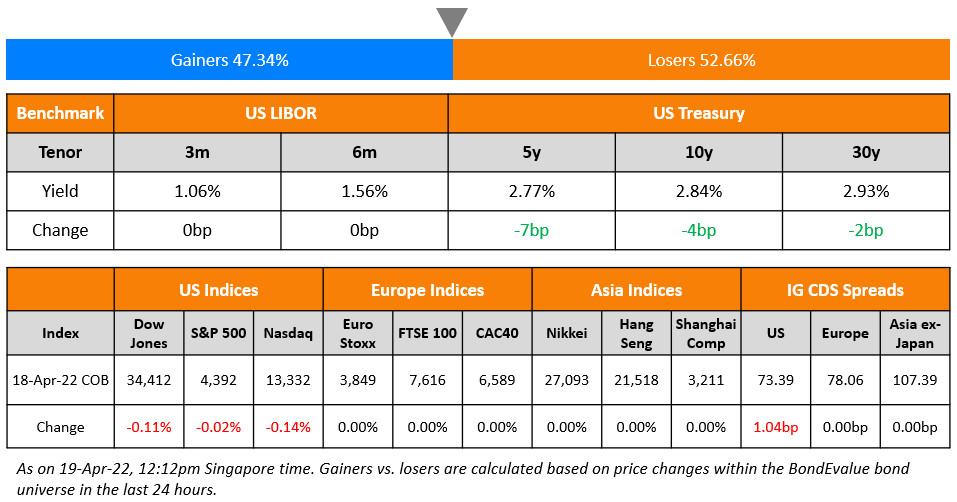

S&P and Nasdaq closed largely flat on Monday after the Good Friday long weekend. Energy led the gainers, up over 1.5% while Healthcare led the losses, down over 1.1%. US 10Y Treasury yields eased 4bp to 2.84%. European markets were closed due to Easter Monday. Brazil’s Bovespa ended 0.4% lower. In the Middle East, UAE’s ADX was down 1.5% and Saudi TASI was up 0.4%. Asian markets have opened with a broad positive bias – Shanghai, STI and Nikkei were up 0.1%, 0.6% and 0.5% while HSI was down 1.8%. US IG and HY CDS spreads widened 1bp each. Asia ex-Japan CDS spreads were flat.

China’s GDP grew 4.8% YoY in Q1 2022, beating expectations of 4.3% and up from 4% in the prior quarter. Retail sales fell by 3.5% YoY in March, while industrial production grew by 5%. The World Bank lowered its global growth estimate for 2022 to 3.2% from its January estimate of 4.1% owing to the Russia-Ukraine crisis. Separately, global bond funds saw $14.5bn in outflows in the week ended April 13 as compared to the prior week’s $1.15bn in net outflows. These were the largest outflows since the week ended March 16. Here, US bond funds saw outflows of $12.6bn while European and Asian funds saw $2.99bn and $400mn in outflows respectively.

New Bond Issues

- Mirae Asset Securities $ 3Y at T+165bp area

- TSMC $ 5Y/7Y/10Y/30Y at T+120/137.5/155/175bp areas

Morgan Stanley raised $7bn via a four-trancher. Details are in the table below:

Wells Fargo raised $6.75bn via a three trancher. It raised:

- $2.75bn via a 4NC3 bond at a yield of 2.658%, 17.5bp inside initial guidance of T+140/145bp area

- $750mn via a 4NC3 FRN at SOFR+132bp vs. initial guidance of SOFR equivalent area

- $3.25bn via a 31NC30 bond at a yield of 4.611%, 17bp inside initial guidance of T+185bp area

The bonds are rated A1/BBB+. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- ST Engineering hires for $ 5Y and/or 10Y

- Nanyang Commercial Bank mandates for $ AT1

- Continuum Energy Aura hires for $ Green Bond

- Korea Water Resources hires for $ Green bond

- Mirae Asset Securities hires for 3Y/5Y SLB bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

- Kalyan Jewellers India hires for $ bond

Rating Changes

Term of the Day

Special Drawing Rights (SDR)

Special Drawing Rights (SDR) issued by the IMF to its member countries’ central banks are a reserve asset that can be exchanged for hard currencies with another central bank. The value of an SDR is set daily based on a basket of five major international currencies: the USD (42%), the EUR (31%), the CNY (11%), the JPY (8%) and the GBP (8%). An allocation of SDRs requires approval by IMF members holding 85% of the total votes and US is the biggest holding 16.5% of the votes.

Talking Heads

On Fed’s Bullard Saying a 75 Basis-Point Hike Could Be Option If Needed

Federal Reserve Bank of St. Louis President James Bullard

“More than 50 basis points is not my base case at this point. I wouldn’t rule it out, but it is not my base case here…. You can’t do it all at once, but I think it behooves us to get to that level by the end of the year… We want to get to neutral expeditiously, I guess is the word of the day… I’ve even said we want to get above neutral as early as the third quarter and try to put further downward pressure on inflation at that point.”

Stephen Innes, managing partner at SPI Asset Management

“The fact that Bullard is talking about a seventy-five basis point hike suggests other hawks are on the same page”

On Earnings Facing Inflation Headwind – Morgan Stanley’s Wilson

“Margin expectations look overly optimistic for the balance of ‘22 given the myriad of cost pressures companies face… a spike in energy and food costs which serve as nothing more than a tax on a consumer that is already struggling with high inflation.” “We think the positive effects of inflation on earnings growth have reached their peak and are now more likely to be a headwind to growth, particularly as inflation forces the Fed to remain max hawkish”

On Barclays Ditching Bullish Treasury Bet as Yields March Higher

Barclays’s Anshul Pradhan

Comments from Fed officials have “increased uncertainty about how restrictive the Fed is prepared to be. As a result, investors have pared back somewhat the odds of the Fed’s overtightening in favor of its not tightening enough. This has resulted in pricing in a reduced likelihood of a hard landing and increased likelihood of inflation persisting above its 2% target, leading to the bear-steepening of the curve.”

On Petrobras electing a new CEO, who pledges to maintain pricing policies

“Market prices are a necessary condition to create a competitive business environment, attract investment and new players, expand the country’s infrastructure, and secure supply”

Top Gainers & Losers – 19-Apr-22*

Go back to Latest bond Market News

Related Posts: