This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macquarie Launches $ 5-Trancher; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

March 15, 2022

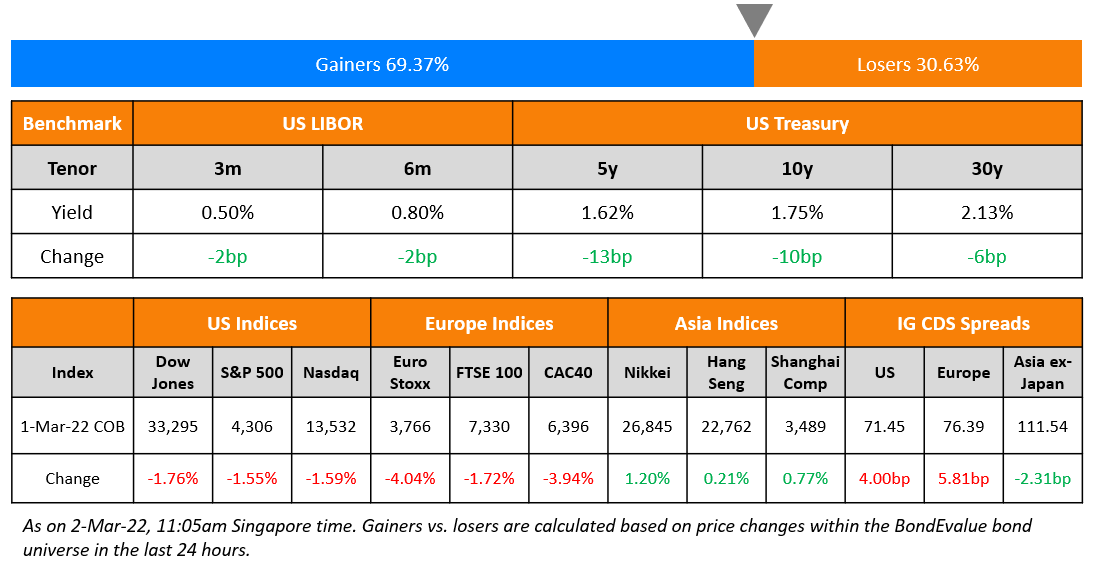

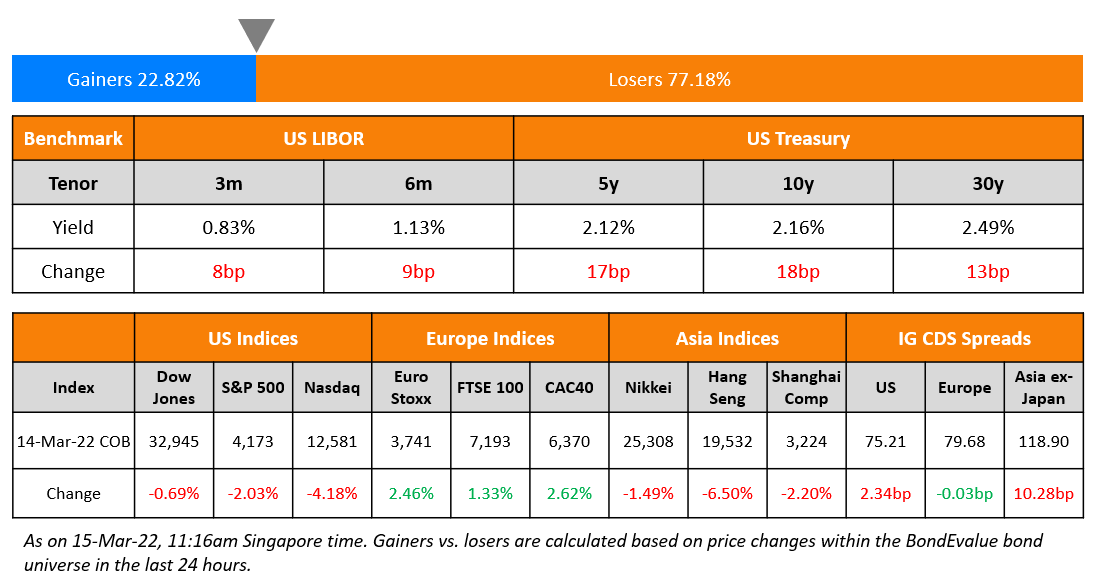

US equity markets started the week in the red with the S&P and Nasdaq closing 0.7% and 2% lower. Sectoral losses were led by Energy, down 2.9% and IT down 1.9%. US 10Y Treasury yields jumped 18bp to 2.16% with all eyes now set on the two-day FOMC meeting that starts today. European markets rose – the DAX, CAC and FTSE were up 2.2%, 1.8% and 0.5% respectively. Brazil’s Bovespa ended 1.6% lower. In the Middle East, UAE’s ADX was down 1% and Saudi TASI was down 0.9%. Asian markets have opened mixed – Shanghai and HSI were down 2.2% and 3% while and STI and Nikkei were up 0.7% and 0.3% respectively. US IG CDS spreads widened 2.3bp and HY spreads were 6.8bp wider. EU Main CDS spreads were flat and Crossover CDS spreads were 4.9bp tighter. Asia ex-Japan CDS spreads were 10.3bp wider.

Learn About Bonds from Senior Bankers | Starting 28 March

In the current environment marred by geopolitical concerns, impending rate hikes and crisis in China real estate, it is imperative for investors and advisors to be able to analyze bonds effectively. This course will help you do just that via 8 interactive sessions conducted live via Zoom by senior bankers starting 28 March. Click on the banner below to know more and to sign up.

New Bond Issues

- Macquarie $ 3Y/6.25NC5.25/11.25NC10.25 at T+135/210/240bp area; $ 3Y FRN/6.25NC5.25 FRN at SOFR-equiv areas

UBS Group raised €1.5bn via a 3NC2 bond at a yield of 1.109%, 20bp inside initial guidance of MS+100bp area. The bonds have expected ratings of A-/A+ (S&P/Fitch), and received orders over €4.2bn, 2.8x issue size. Proceeds will be used for general corporate purposes. If the bonds are not called on March 21, 2024, the coupon resets to 1Y MS+80bp.

Credit Agricole raised €1.25bn via a 3.5Y bond at a yield of 1.037%, ~22.5bp inside initial guidance of MS+60/65bp area. The bonds have expected ratings of Aa3/A+/AA-, and received orders over €2bn, 1.6x issue size.

BOCOM HK raised $400mn via a 3Y bond at a yield of 2.456%, 40bp inside initial guidance of T+85bp area. The bonds are rated A2/A (Moody’s/Fitch). Proceeds will be used for working capital and general corporate needs.

CICC Hong Kong raised $600mn via a 3Y bond at a yield of 3.059%, 30bp inside initial guidance of T+135bp area. The bonds are rated BBB+ by S&P, and received orders over $1.3bn, 2.2x issue size. The bonds are issued by CICC Hong Kong Finance 2016 MTN and guaranteed by CICC HK. CICC is providing a keepwell. The guarantor’s and the keepwell provider are rated at Baa1/BBB+/BBB+ ratings. The proceeds from the Hong Kong-listed trade will be used to repay debt, as well as for working capital and general corporate purposes. CICC HK dropped its 3Y FRN tranche

New Bonds Pipeline

- Mumbai International Airport hires for $ bond

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- The Carlyle Group Inc. Rating Raised To ‘A-‘ On Reduced Leverage, AUM Growth, And Diversification; Outlook Stable

- Fitch Downgrades Hong Yang and Redsun to ‘B’; Outlook Negative

- Correction: Fitch Upgrades Dillard’s IDR to ‘BBB-‘; Outlook Stable

Term of the Day

Exchange Traded Notes (ETNs)

Exchange Traded Notes (ETNs) are structured debt securities that trade of an exchange and track a benchmark. ETNs differ from ETFs as follows:

- ETFs hold assets such as stocks, commodities, or currencies. ETNs don’t hold any portfolio securities. ETNs are senior, unsecured debt securities issued by a bank.

- ETNs promise to pay at maturity, the full value of the index, minus the management fee, just like a bond. Hence, they also expose the investor to the issuing bank’s credit risk

- ETNs are less liquid than ETFs and they may also contain holding-period risk implying that their performance over long periods can differ from that of the benchmark

Barclays has suspended issuance and sales of ETNs with combined assets of $1bn linked to oil prices and volatility.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

Talking Heads

On The Unloved 20-Year Bond Offers Opportunities Galore for Traders

Citigroup strategist Jason Williams

Treasury-market selloff “hit the 20y bond, driven by spread and curve relative value trades”…20-year sector “tends to cheapen up when liquidity is low” because of “the lack of real money demand and participation”

Anshul Pradhan, Barclays Strategist

It “has tended to cheapen sharply when liquidity conditions worsen reflecting stop outs from the leveraged community”

On Petrobras Bondholders Wary as Fuel Price Hike Sparks Backlash

Jeff Grills, head of EM debt at Aegon Asset Management

“Government concerns with the hikes will limit the upside for Petrobras bonds and will be one to monitor going forward”

Jaimin Patel, a senior credit analyst at Bloomberg Intelligence

“While the price increase is positive for Petrobras’ earnings and credit profile, it also increases the risk of a consumer and political response”

On Time Running Out for China Developers to Come Clean on Debt

CCBI analysts Lung Siufung and Elena Chen

“We expect the results for most developers to paint an ugly picture… The market is well aware of just how deep the rot goes, so developers have little to gain by attempting to suppress auditor comments or suspending their results announcements or even share trading.”

On Mexican Local Bonds Being a Bargain as Selloff Risk Seen Contained

Juan Carlos Alderete Macal, Mexico City-based executive director at Grupo Financiero Banorte

“Long-dated MBonos offer very attractive value for longer-term investors. Mexico stands out as a deep and relatively stable market when compared to Latam peers”

Kathryn Rooney Vera, the Miami-based head of global macro research at Bulltick LLC

MBonos are “attractively priced for buy-and-hold investors

Top Gainers & Losers – 15-Mar-22*

Go back to Latest bond Market News

Related Posts: