This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 8, 2022

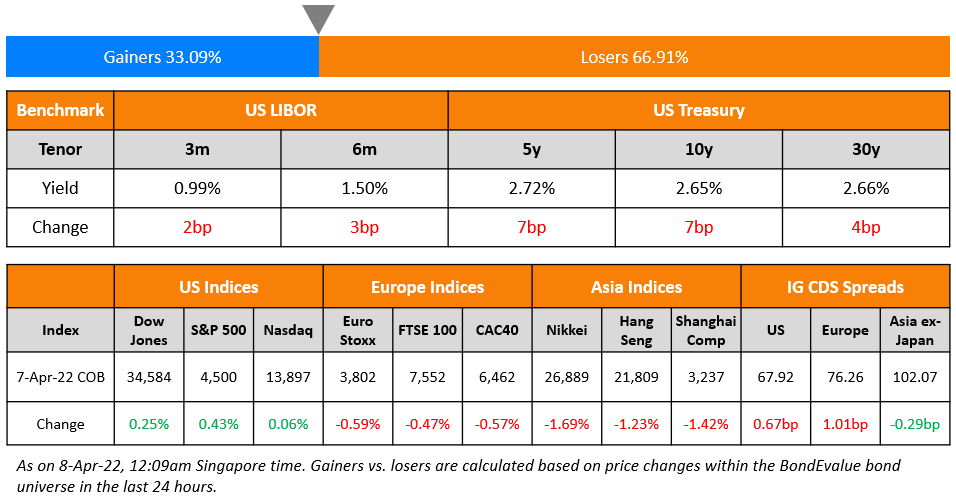

US equity markets rose slightly with the S&P and Nasdaq up 0.4% and 0.1% each. Sectoral gains were led by Healthcare, Energy and Consumer Staples, up over 2% each. US 10Y Treasury yields moved 7bp higher to 2.65%. European markets were lower – the DAX, CAC and FTSE were down 0.5%, 0.6% and 0.5%. Brazil’s Bovespa ended 0.5% higher. In the Middle East, UAE’s ADX was down 0.7% and Saudi TASI was up 0.4%. Asian markets have opened with a negative bias – Shanghai, HSI and STI were down 0.1%, 0.6% and 0.8% while Nikkei was up 0.1%. US IG CDS spreads widened 0.7bp and HY spreads were 4.2bp wider. EU Main CDS spreads were 1bp wider and Crossover CDS spreads were 6.3bp wider. Asia ex-Japan CDS spreads tightened 0.3bp.

New Bond Issues

Freeport Indonesia raised $3bn via a three trancher. It raised:

- $750mn via a 5Y bond at a yield of 4.763%, 50bp inside initial guidance of T+255bp area

- $1.5bn via a 10Y bond at a yield of 5.315%, 45bp inside initial guidance of T+310bp area

- $750mn via a 30Y bond at a yield of 6.20%, 40bp inside initial guidance of T+390bp area

The bonds are rated Baa3/BBB- (Moody’s/Fitch) and received orders over $5.5bn, 1.8x issue size. Fund managers took 84%, insurers and central banks 9%, banks 4% and private banks, brokers and others 3%. APAC accounted for 44%, North America 47% and EMEA 9%.There is a change of control put (Term of the Day, explained below) at 101 if parent Freeport-McMoRan and its affiliates and the Indonesian government collectively own less than 76%. Proceeds will be used to fund smelter projects, refinance debt and meet general corporate needs.

South32 raised $700mn via a 10Y bond at a yield of 4.415%, 25bp inside initial guidance of T+200bp area. The bonds are rated Baa1/BBB+ (Moody’s/S&P). There is a change of control event at 101. Proceeds will be used to repay an acquisition bridge loan that partially funded the company’s purchase of a 45% interest in the Sierra Gorda copper mine in Chile.

New Bonds Pipeline

- Korea Midland Power hires for $ bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

- Kalyan Jewellers India hires for $ bond

- Korea Mine Rehabilitation and Mineral Resources hires for $ 5Y bond

Rating Changes

- Moody’s downgrades Times China to B2/B3; outlook negative

- Moody’s downgrades Redsun to B3/Caa1; outlook remains negative

- China Hongqiao Outlook Revised To Positive Amid Deleveraging Trend, Favorable Industry Conditions; ‘BB-‘ Rating Affirmed

- Mongolian Mining Rating Placed On CreditWatch Negative On Low Cross-Border Throughput

Term of the Day

Change of Control Put

Change of control put is a common covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner below to know more.

Talking Heads

On Chinese property firms’ bond issuances fell sharply in first quarter – BRI Research

“The risk associated with this industry persists, and investors and creditors – offshore in particular – are still concerned about Chinese developers’ debts. Even if we see more supportive measures being rolling out, time is needed to restore confidence,”

Daniel Zhou, an analyst at Moody’s

“We expect developers’ refinancing ability to remain constrained, particularly for financially weak developers”

S&P credit analyst Esther Liu

“We expect an ‘L-shaped’ dynamic in China’s residential property market, with a large fallout in the first half followed by flatter year-on-year patterns in sales”

On Fed’s Bostic, Evans back rate rises with dovish overtones

Atlanta Fed President Raphael Bostic

“It’s time that we get off of our emergency stance — I think it’s really appropriate that we move our policy closer to a neutral position — but I think we need to do it in a measured way,”

Chicago Fed President Charles Evans

“I’m optimistic that we can get to neutral, look around, and find that we’re not necessarily that far from where we need to go.”

On Short-dated bonds offering best protection – Janus Henderson

“Their prices are less volatile because they are certain to repay their capital quite soon, making them less susceptible to changing market conditions… Higher inflation and expectations of rising interest rates have now been largely priced in by bond markets. Bond yields have risen in recent months, meaning that new investors receive more interest income for each dollar they invest. And since yields move in the opposite direction to prices, that means prices are lower and bonds are now much better value.”

On Recession signal from bond yield inversions could prompt portfolio rebalance: Experts

Colin Cieszynski, chief market strategist at SIA Wealth Management

“It’s a little bit more of an active market for investors right now. It’s the kind of time where you need to be paying attention and it’s not necessarily good to just sit back and just pretend everything is fine.”

Jules Boudreau, an economist at Mackenzie Investments

“And that’s very far from inverting, so by looking only at the 10 minus two, which inverted for 15 seconds, we’re kind of cherry-picking the indicator we want. So until we see the three month minus 10 year also invert, there’s probably room to discount it a little bit.”

Craig Fehr, investment strategist at Edward Jones

“We’ve seen the yield curve flatten dramatically many times in the past without producing a recession.”

Top Gainers & Losers – 08-Apr-22*

Go back to Latest bond Market News

Related Posts: