This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 1, 2022

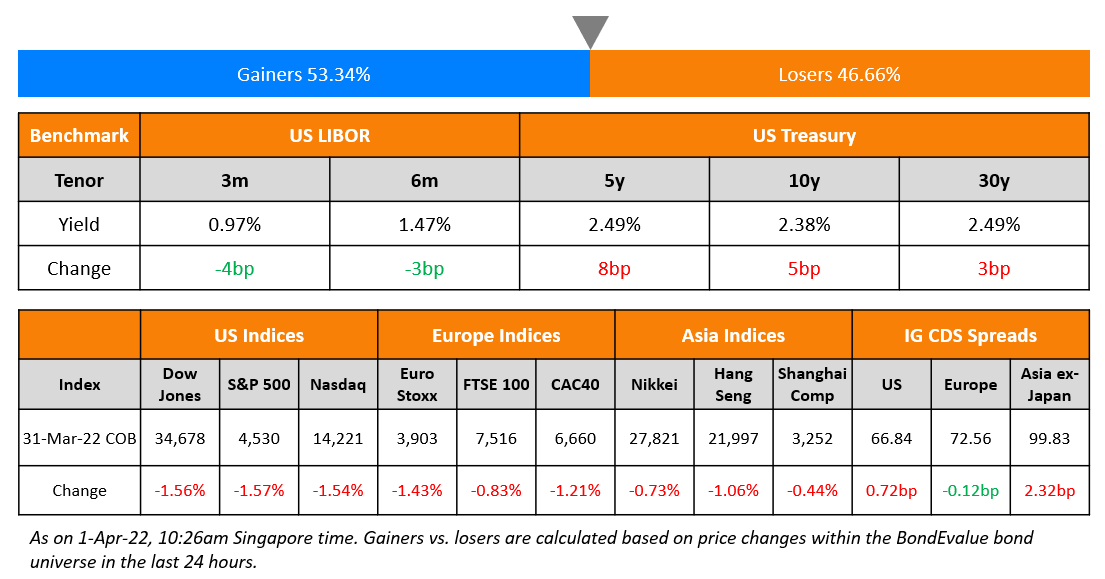

US equity markets fell again with the S&P and Nasdaq down 1.6% and 1.5%. Sectoral losses were led by Financials and Communication Services, down over 2% each. US 10Y Treasury yields jumped 5bp to 2.38%. European markets were mixed – the DAX, CAC and FTSE were down 1.3%, 1.2% and 0.8%. Brazil’s Bovespa ended 0.2% lower. In the Middle East, UAE’s ADX was up 1% and Saudi TASI was up 0.4%. Asian markets have opened mixed – Shanghai and STI were 0.6% and 0.1% higher while HSI and Nikkei were down 0.7%, 0.4%. US IG CDS spreads widened 0.7bp and HY spreads were 5bp wider. EU Main CDS spreads were 0.1bp tighter and Crossover CDS spreads were 1.4bp wider. Asia ex-Japan CDS spreads widened 2.3bp.

US has ordered the largest ever Strategic Petroleum Reserve release of 1mn bpd into the oil market in an effort to tackle rising oil and gas prices. Separately, at least 33 Hong Kong firms were halted from trading after missing their annual 2021 earnings deadline, as per Business Times. US headline PCE inflation was at 6.4% YoY in February vs 6% in January, its highest since February 1982. US Core PCE inflation came at 5.4% in February vs. 5.2% in January, its highest since April 1983.

Happening Today | Masterclass on Using Excel to Understand Bond Calculations

Last chance to sign up for modules 5-8 of the Bond Trader’s Masterclass that will cover Using Excel for Bond Calculations, Analyzing AT1 Perps, Introduction to ESG Bonds and a focused session on Asian High Yield Bond Analysis. Each session will begin 5pm Singapore / 1pm Dubai / 9am London as per the schedule below.

New Bond Issue

-

Yuyao LGFV sets IPG for $ 3Y at 4% area

UOB raised $2.1bn via a three-tranche deal. It raised:

- $750mn via a 3Y bond at a yield of 3.059%, 30bp inside initial guidance of T+90bp area

- $350mn via a 3Y FRN at SOFR+70bp vs. initial guidance of SOFR equivalent area

- $1bn via a 10.5NC5.5 Tier 2 bond at a yield of 3.863%, 40bp inside initial guidance of T+185bp area

The 3Y fixed rate and FRN notes are rated Aa1/AA-/AA- while the 10.5NC5.5 is a subordinated debt (Term of the Day, explained below) and is rated A2/BBB+/A. The bonds received orders over $6.2bn, 3x issue size, majorly towards the subordinated notes as per IFR. The 10.5NC5.5 bonds do not have a coupon step-up. Proceeds will be used for general corporate purposes.

BNP Paribas raised €1.5bn via a 10Y bond at a yield of 2.118%, 35bp inside initial guidance of MS+125bp area. The bonds have expected ratings of Baa1/A-/A+, and received orders over €4bn, 2.7x issue size.

First Abu Dhabi Bank raised €500mn via a 5Y Green bond at a yield of 1.69%, 15bp inside initial guidance of MS+85bp area. The bonds have expected ratings of Aa3/AA-/AA-, and received orders over €685mn, 1.4x issue size. An amount at least equal to the net proceeds will be used to finance/refinance Eligible Green Projects in line with FAB’s Sustainable Finance Framework.

First REIT Management raised S$100mn via a 5Y social bond at a yield of 3.25%, 25bp inside the initial guidance of 3.5% area. The bonds are rated AA, and received orders over $2bn, 2.7x issue size. Perpetual (Asia), as trustee for First REIT, is the issuer and Credit Guarantee and Investment Facility will provide a guarantee. Proceeds will be used to refinance a loan due in May.

New Bonds Pipeline

- Shinhan Bank hires for $ Green bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- Moody’s downgrades MGM Resorts CFR to B1, outlook stable

- Heineken Outlook Revised To Stable From Negative On Improved Rating Headroom; ‘BBB+’ Ratings Affirmed

Term of the Day

Subordinated Debt

Subordinated debt refers to any type of debt that rank below senior debts on the capital structure. In the event of liquidation, holders of subordinated debt would only be paid after all the senior debt is repaid. Thus, the ratings and yield of subordinated debt tend to be lower and higher respectively, to account for the greater risk associated with subordinated vs. senior debt. There are different kinds of subordinated debt that can include perpetuals/AT1 CoCos, payment-in-kind notes, mezzanine debt, convertible bonds, vendor notes etc. Subordinated debt rank higher to preferred equity and common equity in the capital structure.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

Talking Heads

On Citi’s Economist Seeing ‘Significant’ Chance of Recession – Chief Economist Nathan Sheets

“The geopolitical situation, the energy situation is very severe. While the U.S. may be insulated somewhat, former Federal Reserve chair Alan Greenspan “once said, the United States cannot long remain an island of prosperity and stability in a world that’s struggling”

On High-Rolling ‘Fujian Gang’ Caught in China Property Crisis

“Fujian-based developers such as Ronshine, Yuzhou, Zhenro have been aggressively funding land acquisitions with debts. This has left them vulnerable in a property market downturn and in a scenario where capital markets shut down.”

Bloomberg Intelligence analysts Kristy Hung and Lisa Zhou

Dan Wang, Credit analyst at Bloomberg Intelligence

“The liquidity strain of China’s property sector is set to cast a long shadow over the land market. This has left them vulnerable in a property market downturn and in a scenario where capital markets shut down.”

Kenny Ng, a strategist at Everbright Securities International

“It’s common for the second-tier developers to team up to compete against the top ones”

Zhijun Zhang, chairman of private fund manager Beijing DingNuo Investment Management Co

“We have been cautious on the bonds issued by Fujian developers, as they are typically more aggressive than peers. Investors are expecting more bond defaults”

On Losing 5% Was Best You Could Do in Stocks and Bonds This Quarter

Fiona Cincotta, senior market analyst at City Index

Things “really came together in a cocktail of bad timing between the high inflation, the Fed looking to tighten monetary policy in a hawkish manner. And throw into that the uncertainty for Putin’s war and what that means for energy and oil prices, which still need to ripple out in the economy, there is definitely more bad news to come.”

Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management

“No one’s happy, right? Interestingly, from a relative perspective, you’ve been even happier owning stocks than bonds, and I think it means you need to complement those with real assets.”

Jason Pride, chief investment officer of private wealth at Glenmede

“It’s a function of the Fed taking the punch bowl away. As you get into late 2022 and into 2023, it’s possible that you’re in a lower inflationary environment naturally, both because of what the Fed has done, and perhaps supply chains get better, perhaps omicron or Covid-19 get put behind us”

Top Gainers & Losers – 01-Apr-22*

Go back to Latest bond Market News

Related Posts: