This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; Talking Heads; Top Gainers & Losers

February 5, 2021

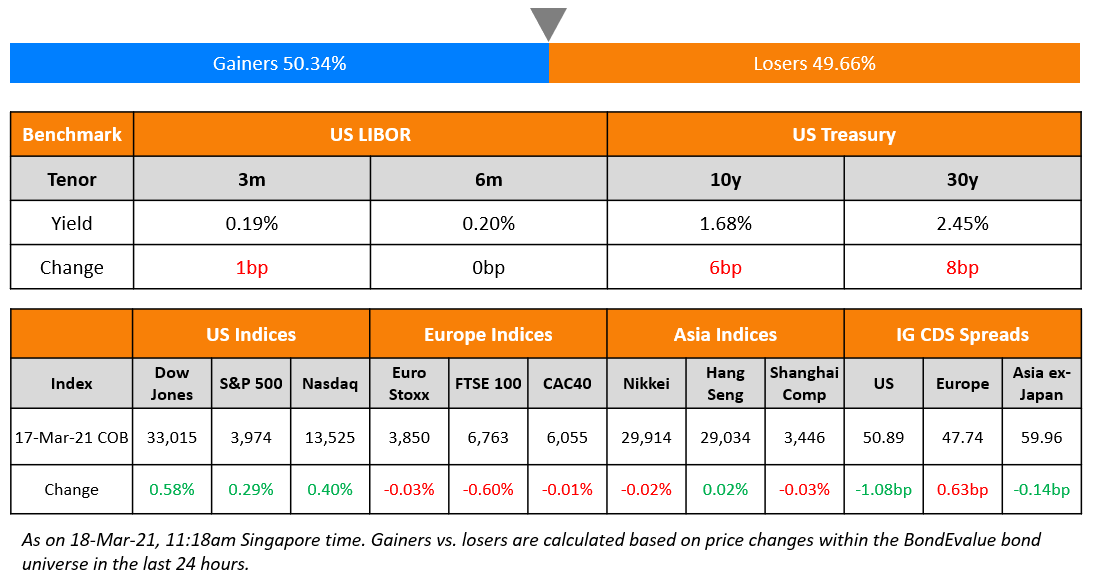

US markets saw another move higher as S&P and Nasdaq were up 1.1% and 1.2%. US jobless claims dipped by 33k to 779k last week while expected progress towards passing President Biden’s $1.9trn fiscal relief bill helped keep sentiment positive. US Treasury yields firmed with the 5s30s at its steepest level since Oct 2015 (Term of the day: curve steepening, explained below) trading at 147.3bp. “Economic activity is going up and it is already going to be fairly strong… More stimulus just makes the already strong number stronger” said Tom Porcelli, chief US economist at RBC Capital Markets. In the Eurozone, Italy’s FTSE MIB outperformed, up 1.65% a day after former ECB chief Draghi agreed to try and form a new government. US IG CDS spreads were 1.3bp tighter and HY was 7bp tighter. EU main CDS spreads tightened 0.7bp and crossover spreads tightened 4bp. Asia ex-Japan CDS spreads are 0.2bp tighter while Asian equities are ~0.5% higher today.

Bond Traders’ Masterclass

If your first language is Spanish and you are keen on learning the fundamentals of bonds, do join our masterclass on A Practical Introduction to Bonds, which will be conducted in Spanish on February 17 at 9am Mexico City / 3pm London / 7pm Dubai. The session will be conducted by bond market veterans that have previously worked at premier global institutions such as HSBC and Citibanamex. Click on the image below to register.

New Bond Issues

For commentary on Alibaba’s $5bn and Lufthansa’s €1.6bn issuance, refer to the story lower down in the newsletter.

Petroperu raised $1bn via a reopening of their 5.625% 2047s at a yield of 4.65%. The bonds received orders over $2.5bn, 2.5x issue size. Proceeds will be used to complete the modernization of the company’s largest oil refinery Talara, located in the pacific coast of northern Peru. “The transaction was carried out through the reopening of the bond maturing in 2047 at an interest rate of 4.65%, which represents the minimum historical interest rate for Petroperu,” the company said in a letter to local regulators.

Fantasia Holdings raised $150mn via a tap of their 11.875% 2023s at a yield of 10.1%, 30bp inside initial guidance of 10.4% area. The bonds have expected ratings of B3 and received orders over $775mn, 5.2x issue size. Proceeds from the tap will be used for offshore debt refinancing, alongside an exchange offer to purchase its outstanding $480.429m 8.375% 2021s. The purchase price is $1,001.50 plus accrued and unpaid interest per $1,000 in principal. The tender offer will be subject to a cap equal to the size of the reopening. The 8.375% 2021s currently trade at 100.13. The tap was priced at a new issue premium of 32bp over the initially issued 2023s that currently yield 9.79%.

Jinchuan Group raised $280mn via a 3Y bond at a yield of 4%, 50bp inside initial guidance of 4.5% area. The bonds have expected ratings of BBB- and received orders over $950mn, 3.4x issue size. Proceeds will be used for repaying offshore borrowings and supplementing offshore working capital. The bonds will be issued by wholly owned subsidiary Jinchuan Golden Ocean Capital and will be guaranteed by the state-owned parent company.

New Bond Pipeline

- India Toll Roads / IRB Infrastructure $ 3.5NC2 bond

- India Green Power/Renew Power $ green bond

- Ultratech Cement $ 10Y sustainability-linked bond

- Liberty Mutual Group

Rating Changes

- Moody’s upgrades Aker BP to Baa3; stable outlook

- Moody’s downgrades Ferroglobe’s PDR to Ca-PD; affirms CFR and instrument ratings

- Fitch Downgrades Meinian to ‘B+’; Outlook Stable

- Fitch Revises Fonterra’s Outlook to Stable, Affirms Rating at ‘A’

- Fitch Revises GeoProMining’s Outlook to Negative; Affirms IDR at ‘B+’

- Moody’s affirms Bristol’s A2 rating; revises outlook to stable

- Moody’s changes Morocco’s outlook to negative, affirms Ba1 rating

- Moody’s assign’s Baa1 to Biogen’s notes; on review for downgrade

Term of the Day

Curve Steepening

A yield curve tells us the yield of each bond from an issuer across the maturity spectrum, with yield on the Y axis and years to maturity on the X axis. Yield curve steepening refers to the gap between short term yields and long term yields increasing. This indicates that long term yields are rising at a faster rate than short term yields, or that short term yields are falling at a faster rate than long term yields. Yield curve steepening is associated with expectations of strong economic activity, rising inflation expectations and higher interest rates. We have been witnessing a yield curve steepening in the US Treasury curve over the past few days as the 30Y Treasury yield has been rising at a faster pace compared to short term Treasury yields with the 5s30s (spread between the 30Y yield and 5Y yield) at ~150bp, the highest since October 2015.

Talking Heads

“My message to the markets is: you really should not try to read the future behaviour of the MPC from these decisions and these actions we’re taking on the toolbox,” Bailey said.

On US yield curve steepest since 2015 on stimulus hopes

Leslie Falconio, senior fixed-income strategist at UBS Global Wealth Management

“This is due to a rise in inflation expectations and the market’s belief that a fairy large fiscal stimulus is on the way,” said Falconio. “When yields rise like this, the ability to disappoint and have yields come down becomes greater. The curve will continue to steepen, but it won’t be in a straight path,” she said. “Now, it is going to be the ‘show-me’ market.”

Tom Porcelli, chief US economist at RBC Capital Markets

“Economic activity is going up and it is already going to be fairly strong,” said Porcelli. “More stimulus just makes the already strong number stronger.”

Subadra Rajappa, head of US rates strategy at Société Générale

“You need some level of confidence on vaccine dissemination as well as the broader trajectory of herd immunity before [10-year Treasury yields] can break out above 1.2 per cent,” she said.

On sustainable bond market to top $650 bln in 2021 – according to a study by Moody’s

“The total $650 billion will be comprised of approximately $375 billion of green bonds, $150 billion of social bonds and $125 billion of sustainability bonds. Sustainable bonds may represent 8%-10% of total global bond issuance in 2021,” Moody’s said.

On China’s bond traders repricing a future with tighter liquidity

Xing Zhaopeng, an economist at Australia & New Zealand Banking Group

“Investors are pricing in rather tight liquidity in the first quarter,” Xing said. “They will have to keep reducing leverage.”

Becky Liu, head of China macro strategy at Standard Chartered Plc

“The anticipation on short-term easing has died down,” said Liu. “Given the great effort the central bank invested in turning around investors’ expectations on easing, I don’t think it will take any actions that could be regarded as loosening signals in the near-term.”

On the need for investors to take on more risks to keep returns – Vincent Magnenat, Lombard Odier’s Asia private banking head

“The traditional way of investing — the so-called balanced portfolio of 60% in fixed income and 40% in equity — will be challenged,” he says. “If we want to maintain the returns that we had in the past, most probably we have to take a bit more risks,” he says.

Top Gainers & Losers – 5-Feb-21*

Go back to Latest bond Market News

Related Posts: