This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

September 13, 2021

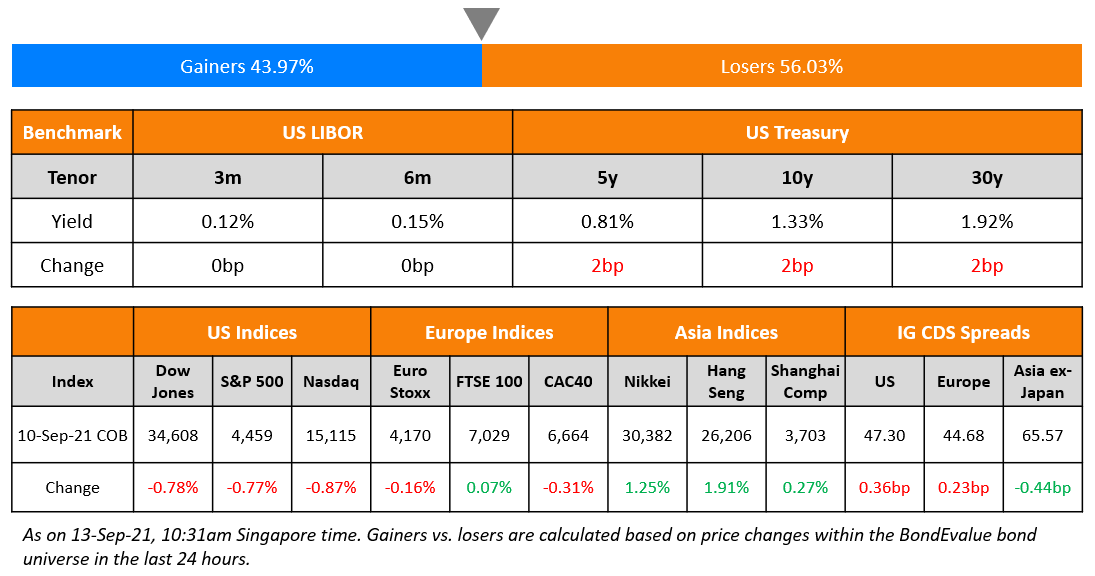

US markets retreated after early gains on Friday – Nasdaq and S&P ended the day 0.9% and 0.8% lower and the full week 1.6% and 1.7% down. All sectors in the market ended in the red with the drop led by Utilities and Real Estate which were down more than 1%. IT, Healthcare and Communications Services followed with losses of over 0.9%. Apple, down 3.3% led the losses after a Federal judge ruled that the tech giant could no longer force developers to use in-app purchasing. European stocks had a similar story as they reversed early gains – CAC and DAX slid 0.3% and 0.1% respectively while FTSE inched 0.1% higher. Brazil’s Bovespa dropped 0.9% on Friday. Negative sentiment spread to middle east markets as well where the Saudi TASI and UAE’s ADX fell 0.7% and 0.5% respectively on Sunday. Asian markets have also had a rocky start – HSI and Singapore’s STI were down 1.3% and 0.8% in early trade while Nikkei was 0.3% lower and Shanghai was broadly flat. US 10Y Treasury yields inched 2bp higher to 1.33%. US IG and HY CDX spreads widened 0.4bp and 0.8bp respectively. EU Main CDS spreads were 0.2bp wider and Crossover CDS spreads widened 1.6bp. Asia ex-Japan CDS spreads tightened 0.4bp.

Industrial production numbers for July came in better than expected for UK, Italy and India. UK reported a 3.8% growth against expectations of 3%, Italy reported a 7% growth against expectations of 5.4% and India reported a 11.5% pick-up against expectations of 10.8%.

Join Us for The Upcoming 8-Module Course on Bonds – Curated for Investors & Professionals

The course will be conducted via Zoom over 8 modules on 27-30 September and 4-7 October (Monday-Thursday) at 5pm Singapore / 1pm Dubai / 10am London. The course will be conducted by senior debt capital market bankers and professionals who will cover both fundamental concepts as well as the practical aspects of bonds.

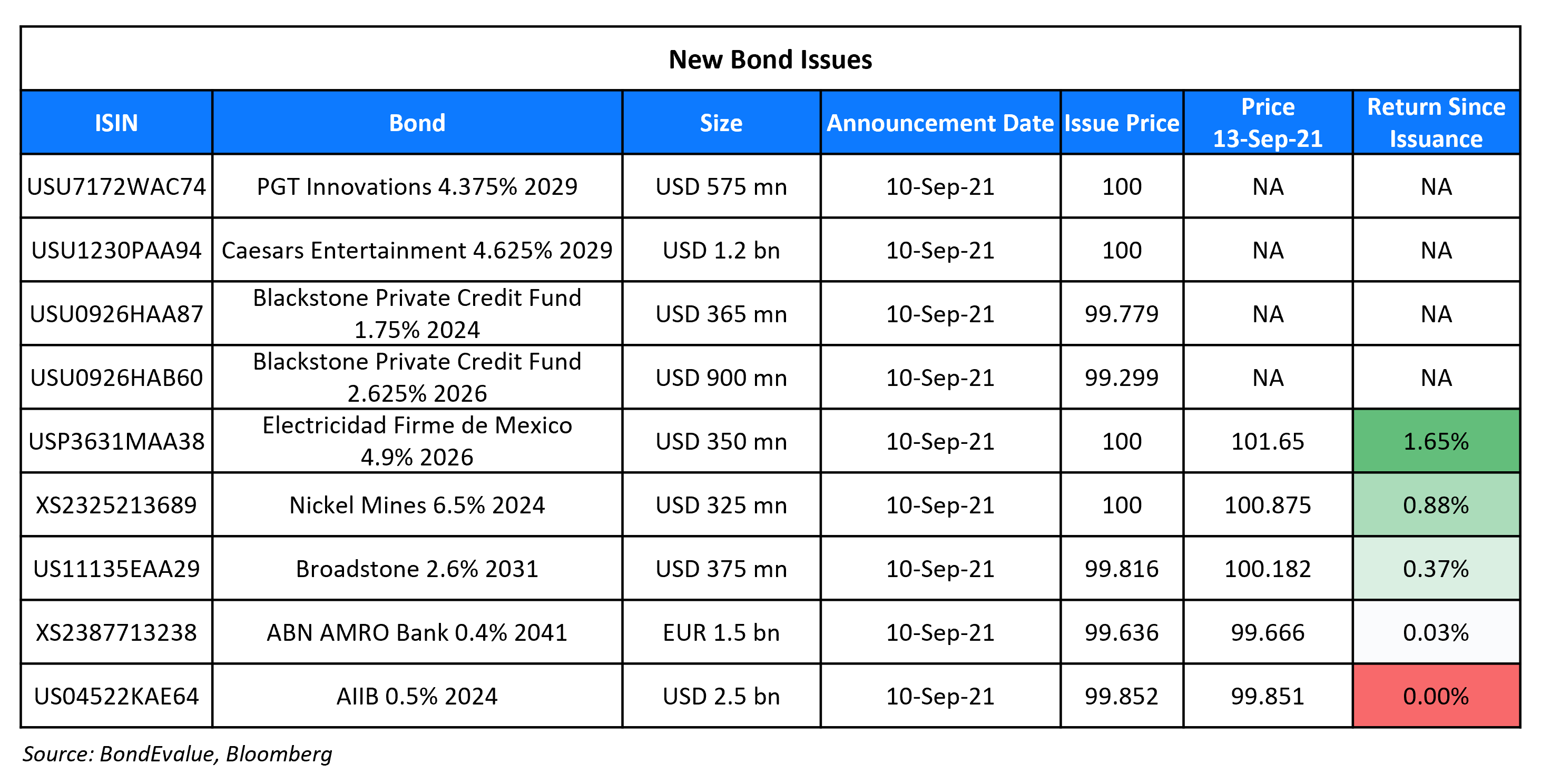

New Bond Issues

- Indonesia $ tap 2.15% 2031s @ 2.5% area; $ new 40Y @ 3.6% area

- Shimao Group $ 2Y/5.3NC3 green at 4.375%/5.625% area

- Redsun Properties $ 2Y green at 10.85% area

- Industrial Bank of Korea (IBK) $ 3Y sustainability at T+50bp area

- Nissan Motor Acceptance Corp (NMAC) $ 3/5/7Y at T+100bp SOFR equiv/130-135bp/165bp areas

- Radiance Holdings $ 2.5Y green at 8% final

- Sumitomo Mitsui Financial Group (SMFG) $ 5/7/10/20Y tier 2 at T+80/100/110/140bp areas

Asian Infrastructure Investment Bank (AIIB) raised $2.5bn via a 3Y green bond at a yield of 0.548%, 1bp inside the initial guidance of MS+17bp area. The bonds have expected ratings of Aaa/AAA, and received orders over $4.4bn, 1.8x issue size.

Nickel Mines raised $150mn via a tap of 6.5% 2024s bond at a yield of 6.5%. The bonds are rated B1/B+ (Moody’s/Fitch). Proceeds of the tap will be used for working capital and general corporate purposes. The original issuance was yielding 6.15% on Friday.

New Bonds Pipeline

- C C Land Holdings hires for $ 4NC2 bond

- Marubeni hires for $ 5Y green bond

- Guangzhou Metro Group hires for $ 200 mn 5Y green bond

- Jinan City Construction Group hires for $ bond

- eHi Car Services hires for $ bond, alongside tender offer

- Maldives’ HDC hires for $ sustainability bond

Rating Changes

- Sysco Corp. Upgraded To ‘BBB’; Debt Ratings Raised; Outlook Stable

- Sinic Holdings Outlook Revised To Negative As Financing Channels Narrow; Rating Affirmed

- M&T Bank Corp. Long-Term Rating Lowered To ‘BBB+’ From ‘A-‘ On Weakening Asset Quality; Outlook Stable

- Perrigo Co. PLC Downgraded Two Notches To ‘BB’ On High-Multiple Acquisition; Outlook Stable

- Moody’s withdraws China South City’s rating for business reasons

- Moody’s changes JSW’s rating outlook to positive, affirms Ba2 and assigns Ba2 to proposed notes

- Fitch Upgrades Cheniere Energy Partners’ IDR to ‘BB+’; Outlook Stable

- Fitch Revises Abanca’s Outlook to Stable; Affirms at ‘BBB-‘

- Fitch Revises Ibercaja’s Outlook to Positive; Affirms at ‘BB+’

- Fitch Downgrades Meituan to ‘BBB-‘ from ‘BBB’; Outlook Remains Negative

- Fitch Upgrades Taiwan, China to ‘AA’; Outlook Stable

Term of the Day

Haircut

Haircut refers to a reduction in value of an asset for the purpose of calculating either margin requirements, level of collateral or salvage value. The haircut is generally stated as a percentage and is the difference between the value of the asset and its reduced value. For example, in a restructuring, if a bond worth $100mn faces a haircut of 20%, then holders would receive only $80mn. In the case of a loan, if the collateral is worth $100mn, a haircut of 30% would imply that a loan of $70mn, giving the lender a cushion in case the market value of the collateral falls.

Evergrande’s dollar bond investors may have to take a 75% haircut as per Nomura’s credit analysts.

Talking Heads

“Buyers have not been scared at all. We have not seen spreads back up or any deals struggle to get done.” “Us investors are saying ‘Hey, keeping bringing more. We’re not getting enough bonds.’”

Martin Dropkin, head of Asian fixed income at Fidelity International

“The tailor-made nature of both sustainability performance targets and interest coupon adjustment potentially gives rise to concerns around greenwashing.”

According to Radi Annab and Cathy Cheng, DBRS Morningstar analysts

“As investors focus more on ethical and sustainable portfolios, the link between achieving or missing ESG objectives and the cost of debt may become an increasingly important credit consideration.”

Paul Lukaszewski, head of corporate debt for Asia-Pacific at Aberdeen Standard Investments

“When markets move this far this quickly, inevitably some corners end up being cut,” he said. “We see a risk that money will flow into investments whose ESG credentials don’t stand up to closer scrutiny.”

“When markets move this far this quickly, inevitably some corners end up being cut,” he said. “We see a risk that money will flow into investments whose ESG credentials don’t stand up to closer scrutiny.”

Sheldon Chan, portfolio manager for Asia credit bond strategy at T. Rowe Price

“SLBs are a growing segment of the ESG-labelled bond markets, but the sample size in Asia currently remains small and the market has yet to gravitate toward a set of best practice standards,” he said.

Henrik Johnsson, co-head of investment banking EMEA at Deutsche Bank

“We are now able to go to issuers and tell them ‘if you issue your debt in green format, you will actually save money,’ meaning that the hurdles we had to overcome for our clients to issue green bonds are now gone.” “We are in a Goldilocks moment.” “At some point, this will stop because if over time 100% of bonds are issued in the green/ESG format, the premium for green will go away and that will become the new cost of financing. In the meantime, it is a really extraordinary time.”

Pablo de Ramon-Laca, director general of Spain’s Treasury

“Everything else equal, investors are willing to pay more for a green bond than for a conventional bond.”

Arthur Krebbers, head of sustainable finance, corporates at NatWest Markets Plc

“The greenium tends to be higher, because the starting point is higher.”

Weligamage Don Lakshman, Central Bank of Sri Lanka Governor

“Getting things done according to my policy perspectives was not an easy task. My plan was to tender my resignation on my 80th birthday coming next month.” “The unpleasant events over the last week or 10 days have shortened my intended period by about six weeks,” he said.

On El Salvador bond spreads on track for biggest weekly widening in a year

Nathalie Marshik, head of EM sovereign research at Stifel

“We continue to see more probability of downside given the current administration’s uncompromising political agenda in defiance of the U.S. as well as an ever-pressing need to maintain high spending to keep popularity levels high.”

Fabiano Borsato, chief operating officer at Torino Capital

“The risk of fiscal unsustainability could increase as fiscal revenues would be exposed to the evolution of the exchange rate USD/Bitcoin.”

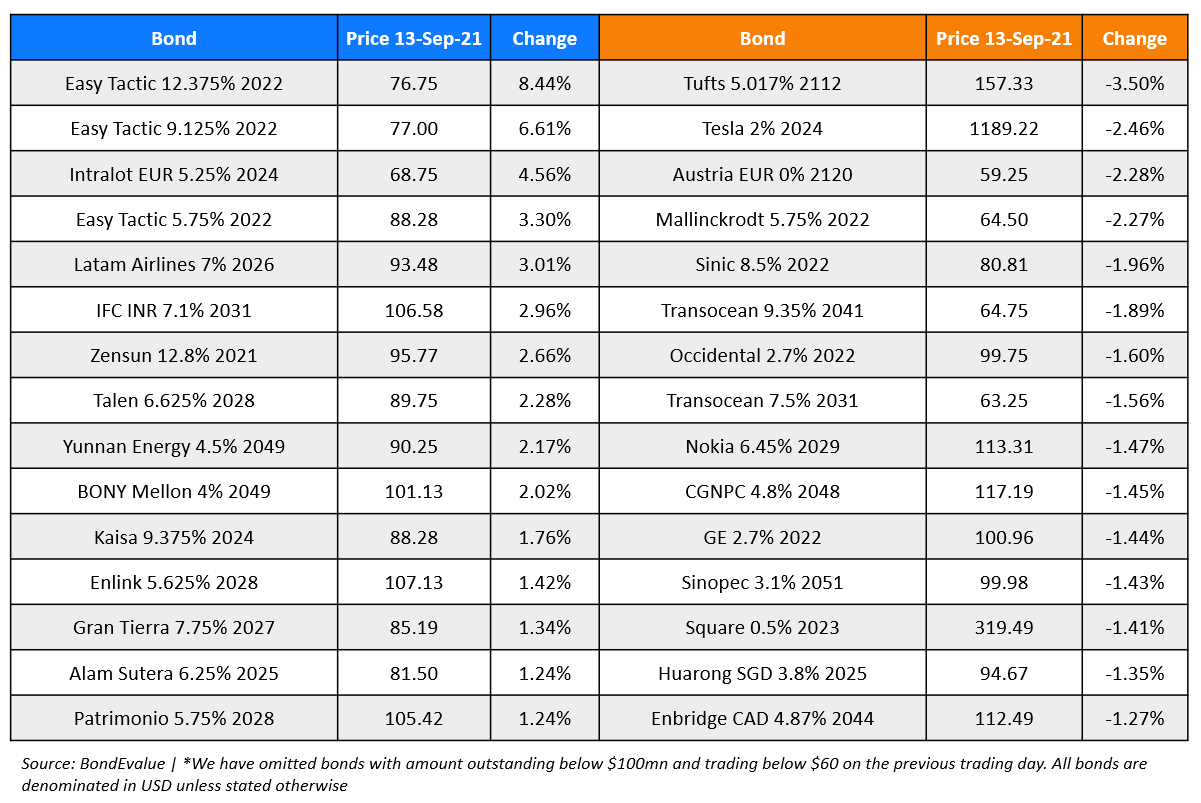

Top Gainers & Losers – 13-Sep-21*

Go back to Latest bond Market News

Related Posts: