This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

July 12, 2021

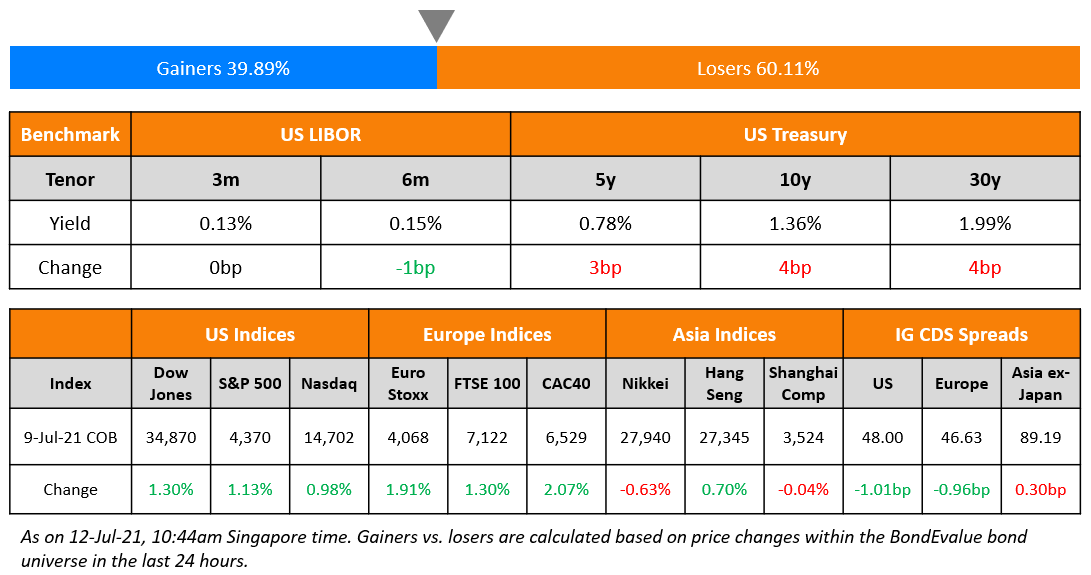

US Markets ended the week in positive territory with the S&P up 1.1% creating another record and Nasdaq up 1%, just shy of its record high. Sectors across reversed to end in the green. Financials, up 2.9% led the gains followed by Energy and Materials up 2%. US 10Y Treasury yields rose 4bp to 1.36%. The earnings season kicks-off with JPMorgan Chase and Goldman Sachs set to report on Tuesday, BofA, Citigroup and Wells Fargo on Wednesday and Morgan Stanley on Thursday. Banking Q2 results are expected to be weaker – revenues could be down ~28% and loans could see a drop of 3% as per Bloomberg. Overall earnings for the S&P 500 are expected to be up a sharp 65%, compared to a year ago. European markets surged higher shrugging the previous day’s sell-off – CAC, DAX and FTSE were up 2.1%, 1.7% and 1.3% respectively. Mining was up 4% leading the gains. US IG and HY CDS spreads tightened 1bp and 5.9bp respectively. EU main and crossover CDS tightened 1bp and 4.6bp respectively. Saudi TASI was down 1.3% while Abu Dhabi’s ADX was up 0.4%. The People’s Bank of China is set to cut the reserve requirement ratio (RRR) for banks by 50bp from July 15 to inject more liquidity. Asian markets have taken a cue from the US markets and have opened in green – Nikkei reversed Friday’s losses and is up 2.2%, Shanghai, HSI and Singapore’s STI were up 0.9%. 0.7% and 0.3% respectively. Asia ex-Japan CDS spreads were 0.3bp wider.

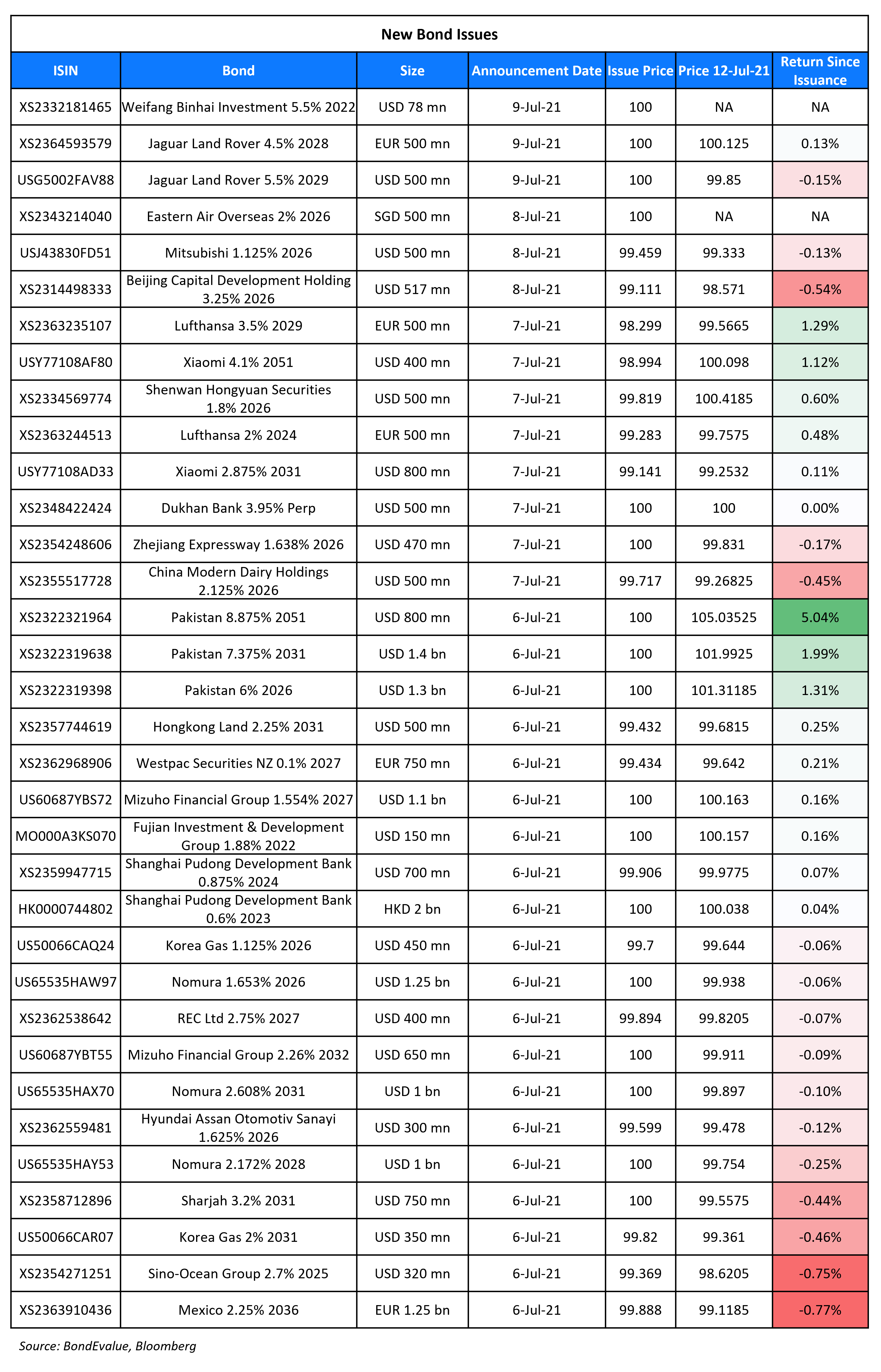

New Bond Issues

-

MUFG $ 4NC3/6NC5/11NC10 at T+75bp/T+95bp/T+115bp areas

- Minor International $ PerpNC5 at 3.15% area; books over $1bn

-

Korea Investment & Securities $ 3Y/5Y at T+140ap/T+165bp areas

-

Yuyao Shuncai Investment 364-day $ notes at 2.9% area

New Bonds Pipeline

-

Zhejiang Provincial Energy hires for $ bonds

Rating Changes

-

Fitch Takes Actions on Colombian and Central American FIs Following Colombia’s Sovereign Downgrade

- Boral Ltd. ‘BBB’ Rating Placed On CreditWatch Negative By S&P As Seven Group’s Stake Exceeds 40%

Term of the Day

Credit Impulse Indicator

The Credit Impulse Indicator is a metric used to measure the growth in new credit issuances as a percentage of GDP. Particularly in China, this metric is often watched indicator of the government’s economic policy stance – it rises when the government adopts a pro-growth policy stance and falls when it moves to cut back on stimulus measures, as per NikkeiAsia. NikkeiAsia reports that the credit impulse index peaked in November 2020 at 32% and has fallen to 25% in May, the lowest since February 2020.

Talking Heads

“At times when inflation has significantly accelerated in the past, such as in the 1960s, markets have lagged rather than anticipated developments,” he said. “The primary risk to the US economy is overheating — and inflation”.

“We are putting an end to the race to the bottom and the digital giants will now pay their fair share of taxes,” he added. “It’s a once-in-a-century tax revolution.”

“In view of the better outlook for growth and inflation and the associated upside risks, it was . . . argued that, to provide the same degree of accommodation, asset purchases should be scaled back somewhat,” the minutes said. Maintaining bond purchases “might hinder structural change in the corporate sector and resource reallocation in the labour market. In addition, property price dynamics were accelerating”.

“As we push through the summer here you start to get some fears that in the fall we might be shutting down again, that is really kind of the worry.” “Everything

is sort of getting pushed back where we were supposed to have this great breakout from the pandemic, that is one of the big issues.”

Gennadiy Goldberg, U.S. rates strategist at TD Securities

“This is a function of too much cash in the system and too few attractive assets for investors to put their cash into,” he said.

John Abendroth, a portfolio manager at Neuberger Berman

“There is little room for error.” “There is yield to capture no matter how inflation persists and what changes in the rates landscape occur.”

Rick Rieder, chief investment officer of global fixed income at asset manager BlackRock

“With the expectation of limited credit defaults over the coming months and quarters, the demand for that ‘safe’ yield seems never-ending, even in the face of historically high supply.”

On bond contrarians vindicated by US Treasury yield plungeStephen Liberatore, lead portfolio manager of fixed income strategies at Nuveen

“Ultimately the market ran too far in front of the recovery.” “We are more likely to go below 1 per cent [on the 10-year] than we are to be substantially above 1.5 or 1.75 per cent,” he said.

Robert Tipp, fund manager at PGIM

“The market was banking on a dovish contingency at the Fed.”

Mark Lindbloom, Western Asset fund manager

“We do not believe the Fed today, or in the future will sacrifice its credibility” from taming inflation in the 1980s, he said.

“Given the persistence that we need to demonstrate to deliver on our commitment, forward guidance will certainly be revisited.” “We need to be very flexible and not start creating the anticipation that the exit is in the next few weeks, months.” “We’re going to look at the circumstances, we’re going to look at what forward guidance we need to revisit, we’re going to look at the calibration of all the tools we are using to make sure that it is aligned with our new strategy,” she said. “We have to use the tools, and we have a big toolbox, to actually deliver that 2%,” she said. “We have to do it.”

“We expect a continuation of strong issuance levels driven by a combination of refinancing and strategic activity as companies seek to take advantage of what they believe is going to be a multi-year elevated growth.”

Top Gainers & Losers – 12-Jul-21*

Go back to Latest bond Market News

Related Posts: