This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

July 5, 2021

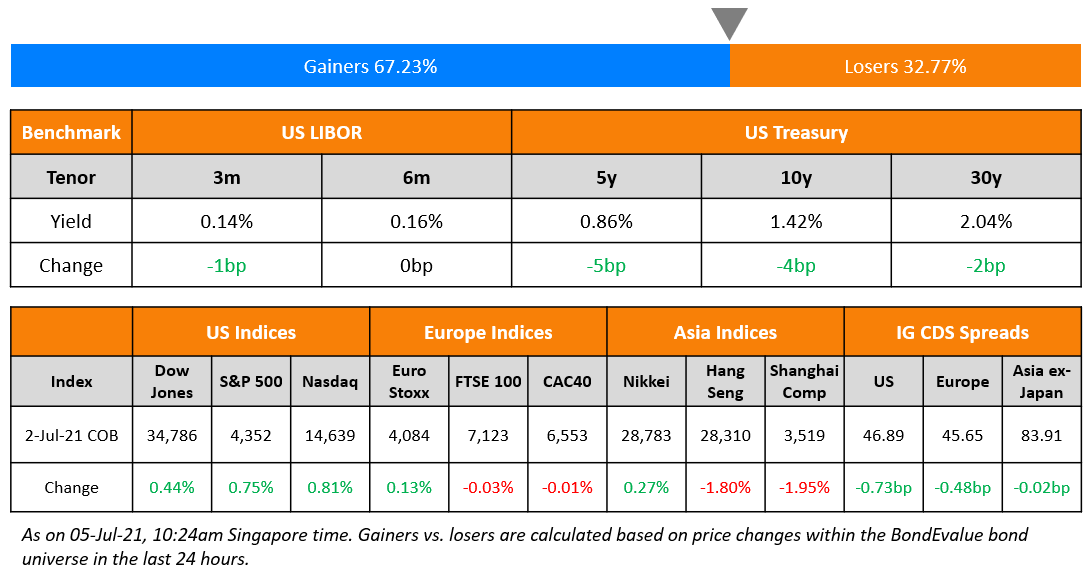

US markets carved another day and week of gains on better than expected June Non-Farm Payroll (NFP) data before closing in for a long weekend to celebrate US Independence Day. NFP came in at 850k vs. the revised 583k last month and above the forecasted number of 720k. Unemployment was marginally higher at 5.9% vs. 5.8% last month. S&P and NASDAQ were up 0.8% creating new records. IT, Consumer Discretionary and Communications were up 1.4%, 1.1% and 0.9% pushing the bourses up. US 10Y Treasury yields were 4bp tighter to close at 1.42%. European markets were calm – DAX up 0.3% while FTSE and CAC were broadly flat. US IG and HY CDS spreads tightened 0.7bp and 3.7bp respectively. EU main and crossover CDS tightened 0.5bp and 2.8bp respectively. Saudi TASI and Abu Dhabi’s ADX were up 0.5% and 0.7% respectively. Brazil’s Bovespa reversed its losses to close 1.6% higher. Asian markets again had a mixed start – Singapore’s STI and Shanghai were up 0.3% and 0.2% respectively while Nikkei and HSI were down 0.6% and 0.1% respectively. Asia ex-Japan CDS spreads were flat.

New Bond Issues

New Bond Pipeline

- Fujian Investment & Development Group hires for $ bond issue

- Hyundai Assan Otomotiv Sanayi hires for US$ 5yr bond with HMC guarantee

- Korea Gas Corp hires for $ 5Y and/or 10Y bond

-

REC hires for $ 5.5Y bond issue

-

Zhejiang Expressway hires for $ bonds

-

China Modern Dairy Holdings hires banks for bond offering

-

Hongkong Land hires for $ green bond

-

Shenwan Hongyuan Securities hires for $ bonds

Rating Changes

- Fitch Upgrades Phoenix’s IFS Rating to ‘AA-‘; Outlook Stable

-

Moody’s affirms Uzbekistan’s B1 rating, changes outlook to positive

-

Moody’s revises Zhongsheng’s outlook to positive on potential acquisition; ratings affirmed

- Fitch Downgrades Delhi Airport to ‘BB-‘; Outlook Negative

- Moody’s downgrades Diamond’s CFR to Caa2; negative outlook

- Brazilian Auto Supplier Tupy Outlook Revised To Positive By S&P On Acquisition Of Teksid’s Assets, ‘BB’ Ratings Affirmed

- Fitch Affirms and Withdraws Tianjin Binhai New Area Construction’s Ratings; Outlook Stable

- Fitch Affirms IHS Holding at ‘BB-‘; Withdraws IHS Netherlands Ratings on Bondholders Consent

- Fitch Publishes Oil and Natural Gas Corporation’s ‘BBB-‘ Rating; Outlook Negative

ICYMI: 67% Dollar Bonds Trade Higher in Q2, Staging a Recovery from Q1

In case you missed it, click on the button below to read the report for the quarter ended June with box and whisker plots of price returns of investment grade and high yield bonds, largest deals and top gainers and losers.

The Week That Was

US primary market issuances dropped to $13.2bn vs. $23.1bn in the week prior. IG issuances fell last week to $9.6bn vs. $15.1bn in the prior week and HY issuances were lower at $3.1bn vs. $6.4bn in the prior week. The largest deals in the IG space were led by Salesforce’s $8bn six-trancher followed by American Homes 4 Rent’s $750mn two-trancher. In the HY space, Elastic NV’s $975mn two-trancher and APX Group’s $800mn deal led the table. In North America, there were a total of 28 upgrades and 16 downgrades combined across the three major rating agencies last week. LatAm saw $3.5bn vs. $4.51bn in new bond issuances in the prior week. Issuances were led by the Brazil government’s $2.25bn dual-trancher and Suzano’s $1bn issuance. EU Corporate G3 issuances were also lower at $17.3bn vs. $21.6bn in the week prior – Vallourec, SocGen, Credit Agricole and UniCredit raised €1bn ($1.18bn). Across the European region, there were 28 upgrades and 19 downgrades across the three major rating agencies. Overall, GCC and Sukuk G3 issuances rose sharply to $13.6bn vs. $1bn in the week prior singlehandedly led by Qatar Petroleum’s $12.5bn four-part offering, the largest deal in APAC and Middle East since the Saudi Government issued a $12.5bn three-trancher in September 2017. Across the Middle East/Africa region, there was 1 upgrade and 6 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances were slightly higher at $10.25bn vs. $9.1bn in the prior week – The Philippines government’s $3bn two-trancher led the table followed by NAB’s €850mn ($1.01bn) deal, BOCOM Hong Kong and Mongolia’s $1bn issuances each. In the Asia ex-Japan region, there were 9 upgrades and 7 downgrades combined across the three major rating agencies last week. Within Asia (including Japan), SoftBank raised over $7bn via a USD & EUR issuance, Asia’s second largest bond deal YTD which was issued on the back of good market conditions and to expand their investor base.

US primary market issuances dropped to $13.2bn vs. $23.1bn in the week prior. IG issuances fell last week to $9.6bn vs. $15.1bn in the prior week and HY issuances were lower at $3.1bn vs. $6.4bn in the prior week. The largest deals in the IG space were led by Salesforce’s $8bn six-trancher followed by American Homes 4 Rent’s $750mn two-trancher. In the HY space, Elastic NV’s $975mn two-trancher and APX Group’s $800mn deal led the table. In North America, there were a total of 28 upgrades and 16 downgrades combined across the three major rating agencies last week. LatAm saw $3.5bn vs. $4.51bn in new bond issuances in the prior week. Issuances were led by the Brazil government’s $2.25bn dual-trancher and Suzano’s $1bn issuance. EU Corporate G3 issuances were also lower at $17.3bn vs. $21.6bn in the week prior – Vallourec, SocGen, Credit Agricole and UniCredit raised €1bn ($1.18bn). Across the European region, there were 28 upgrades and 19 downgrades across the three major rating agencies. Overall, GCC and Sukuk G3 issuances rose sharply to $13.6bn vs. $1bn in the week prior singlehandedly led by Qatar Petroleum’s $12.5bn four-part offering, the largest deal in APAC and Middle East since the Saudi Government issued a $12.5bn three-trancher in September 2017. Across the Middle East/Africa region, there was 1 upgrade and 6 downgrades across the three major rating agencies. APAC ex-Japan G3 issuances were slightly higher at $10.25bn vs. $9.1bn in the prior week – The Philippines government’s $3bn two-trancher led the table followed by NAB’s €850mn ($1.01bn) deal, BOCOM Hong Kong and Mongolia’s $1bn issuances each. In the Asia ex-Japan region, there were 9 upgrades and 7 downgrades combined across the three major rating agencies last week. Within Asia (including Japan), SoftBank raised over $7bn via a USD & EUR issuance, Asia’s second largest bond deal YTD which was issued on the back of good market conditions and to expand their investor base.

Term of the Day

Goldilocks Economy

A goldilocks economy is a term used to characterize a state of the economy when it is neither growing too fast nor too slow. This is the ideal rate of growth where interest rates don’t move much higher as inflation doesn’t rise too much, nor do rates fall since the economy is growing at a moderate pace, hence reducing uncertainty of monetary policy.

The latest NFP data saw an 850k increase in June which economists say was a goldilocks jobs report – “not too hot, not too cold…Enough new jobs to confirm the economy is on a roll, but enough jobless to give the Fed’s current strategy a warm hug” as per Danni Hewson, analyst at AJ Bell.

Talking Heads

“The economy is really shaping up nicely.” “It is appropriate to consider tapering asset purchases later this year or early next year,” she said. “That timeframe has been evolving of course, but I really see the economy as being able to start functioning more and more on its own, which means we can withdraw a little bit of our accommodation, of course not the majority of it.” “We are still not near our full employment goals. We are still likely to be missing, going forward, on our inflation target, our price stability goals, despite the temporary runups in measured inflation,” she said. “Those are things I’m really rigorously sticking to.”

“We agreed to maintain (PEPP) until at least March 2022, and in any case, until we judge that the coronavirus crisis phase is over.” “While the recovery is now beginning to get under way, it remains fragile.”

In a report by Christopher Bergman and team, Moody’s analysts

“Hotel loans will have an outsized share of CMBS delinquencies, driven by the slow recovery of the meeting and group and international-demand segments for lodging.” “While lodging demand will continue to improve as the pandemic’s stranglehold on travel eases, the asset class will remain stressed across the nation, with hotel delinquency rates more likely to rise before they make major improvement.” “Regional mall loans account for nearly three times more delinquencies than their share of CMBS, with two large markets – Orange County and Tampa – having mall delinquency rates exceeding 50%.”

Tricia Hazelwood, managing director and international head of securitized products at Mitsubishi UFJ Financial Group Inc.

“This is the golden era of structured products.” “The performance of these assets has proven to be very, very strong, and we’re at all-time lows in defaults and delinquencies across the board in asset-backed securities. Moreover, this is a time of innovation, with new types of non-traditional, esoteric deals getting done in different securitized sectors.”

Conan Tam, head of Asia Pacific debt capital markets at Bank of America

“Diverging borrowing costs have been mainly driven by waning investor sentiment in the high-yield primary markets, particularly relating to the China real estate sector.” “This is expected to continue until we see a significant sentiment shift here.”

Anne Zhang, co-head of asset class strategy, FICC in Asia at JPMorgan Private Bank

“However, as the relative yield differential between Asia and the U.S. becomes more pronounced there will be demand for yield that could help narrow the gap.”

“China’s goal of achieving carbon neutrality by 2060 will create more opportunities for China to issue green bonds.” “International investors will be interested to invest in these green bonds.” “As global interest rates remain low, this has increased the attractiveness of the mainland’s bond market.” “The Bond Connect scheme can play an important role to attract international investors to the Chinese bond market.”

Shamaila Khan, head of EM debt strategies at AllianceBernstein

“Given the delay in the passage of reform the downgrade was expected by the market.” “Though there may be some forced short term selling, it is mostly priced in.”

In a note by Alberto Ramos, Goldman Sachs’ chief of economics for Latin America

Colombia’s central bank’s “degrees of freedom to preserve a high level of monetary accommodation have narrowed considerably.”

Top Gainers & Losers – 05-Jul-21*

Go back to Latest bond Market News

Related Posts: