This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 19, 2022

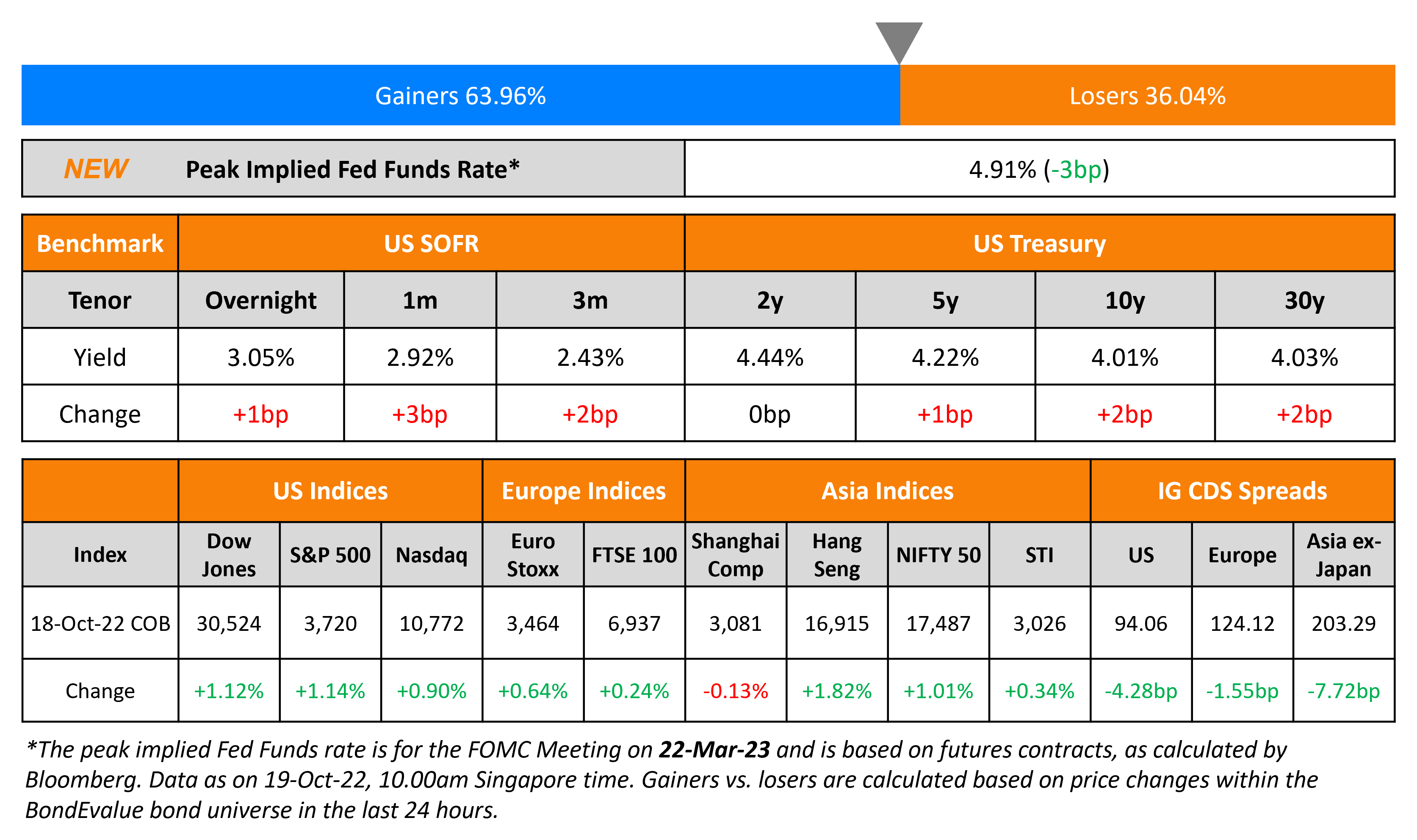

US Treasury yields rose slightly with the 10Y yields up 2bp to 4.01%. The peak Fed Funds Rate was down 3bp to 4.91% for the FOMC’s March 2023 meeting. In the credit markets, US IG CDS spreads tightened 4.3bp and HY CDS spreads saw a 20bp tightening. US equity markets saw a second consecutive day higher on Tuesday with the S&P and Nasdaq up 1.1% and 0.9% respectively.

European equity markets saw gains of over 0.2% with CDS spreads tightening across the board – EU Main and Crossover CDS spreads tightened by 1.5bp and 5.5bp respectively. Asian equity markets have opened mixed today. However, Asia ex-Japan CDS spreads saw a 7.7bp tightening after having widened to its highest levels in over 2.5 years.

%20x%20311px%20(h).jpg)

New Bond Issues

- Chiyu Bank $ PerpNC5 AT1 at 8% area

- Zhenjiang Transportation Industry Group $ 3Y at 6.9% area

Emirates NBD raised $500mn via a 5Y bond at a yield of 5.745%, 20bp inside initial guidance of T+175bp area. The senior unsecured bonds have expected ratings of A2/A+, and received orders over $1bn, 2x issue size.

Morgan Stanley raised €2.75bn via a two-tranche deal. It raised

- €1bn via a 6NC5 bond at a yield of 4.813%, 20bp inside initial guidance of MS+195bp area. The bonds received orders over €1.6bn, 1.6x issue size. If not redeemed by the call date of 25 October 2027, the coupon rate resets quarterly at 3M Euribor plus a margin of 176.2bp.

- €1.75bn via a 11.25NC10.25 bond at a yield of 5.151%, 25bp inside initial guidance of MS+225bp area. The bonds received orders over €2.6bn, 1.5x issue size. If not redeemed by the call date of 25 January 2033, the coupon rate resets quarterly at 3M Euribor plus a margin of 195.4bp.

The senior unsecured bonds have expected ratings of A1/A-/A. Proceeds will be used for general corporate purposes.

Carnival raised $2bn via a 5.5NC2.5 bond at a yield of 10.75%, 75bp inside initial guidance of 11.5% area. The bonds are senior to its unsecured notes and second priority to secured, with expected ratings of B2/B+. Proceeds will be used to temporarily repay amounts outstanding under the company’s revolver debt and for general corporate purposes. The new bonds are priced 315bp wider to its existing first lien 4% 2028s that yield 7.6% and 625bp tighter to its 6.65% senior unsecured notes due 2028 that yield 17%. The new bond’s coupons are at 11.5%, higher than its existing bonds’ coupons.

New Bonds Pipeline

- Chiyu Bank hires for $ Perp NC5 AT1 bond

- Export Finance Australia hires for $ 5Y bond

- Aozora Bank hires for $ 3Y Green bond

Rating Changes

Term of the Day

Social Bond

These are bonds issued by companies to specifically fund projects with social benefits (new/existing), which should be mentioned in the prospectus. ICMA’s social bond principles set out a standard covering four elements as follows:

- Use of proceeds (range of 6 categories but not limited to them)

- Process of evaluation and selection of social projects

- Management of proceeds

- Reporting

Examples of projects for social bonds include affordable housing, socioeconomic empowerment, essential service access and projects of their like. The European Commission is planning to issue €100bn worth of social bonds, proceeds of which will be disbursed to member states for projects related to employment work schemes. Shriram Transport Finance has launched an offer to buyback up to $250mn of its 5.1% social bonds due 2023.

Talking Heads

On Wall Street Credit Traders Head for Worst Year Since 2012

Mollie Devine, research director at Coalition Greenwich

“This year feels especially challenging in light of the excellent revenue environment we saw in 2020 and 2021. When revenue pools contract we tend to see banks think more critically about personnel needs”

Max Castle, a fixed income portfolio manager at Mediolanum

“Flows which drive revenues have been very low as the huge volatility and corresponding low liquidity in turn lowers volumes… Many investors are more likely to sit on existing cash bond positions rather than make big changes due to the liquidity challenges”

On Bill Gross Criticizing ‘Total Return’ Bond Funds

“These total return funds are actively managed with the ability to go low in terms of maturity duration, but they all seem to be chasing ‘index-plus’ performance as opposed to ‘total return’ management… have lost their total return ‘charter,’ or vision, of what such funds should offer to investors in the form of capital preservation”

On Fed may need to push policy rate above 4.75% – Minneapolis Fed President Neel Kashkari

“I’ve said publicly that I could easily see us getting into the mid-4%s early next year. But if we don’t see progress in underlying inflation or core inflation, I don’t see why I would advocate stopping at 4.5%, or 4.75% or something like that. We need to see actual progress in core inflation and services inflation and we are not seeing it yet.”

On reasonable chance of U.S. recession in 2023

Goldman CEO, David Solomon

“There’s a reasonable chance of a recession in the U.S., but it’s not certain. I could still see a scenario with a soft landing.”

Olu Sonola, head of Fitch Ratings U.S. regional economics

“Fitch expects the U.S. economy to enter genuine recession territory — albeit relatively mild by historical standards — in 2Q23… The projected recession is quite similar to that of 1990–1991, which followed similarly rapid Fed (Federal Reserve’s) tightening in 1989–1990”

Top Gainers & Losers – 18-October-22*

Other Stories

Go back to Latest bond Market News

Related Posts: