This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 6, 2022

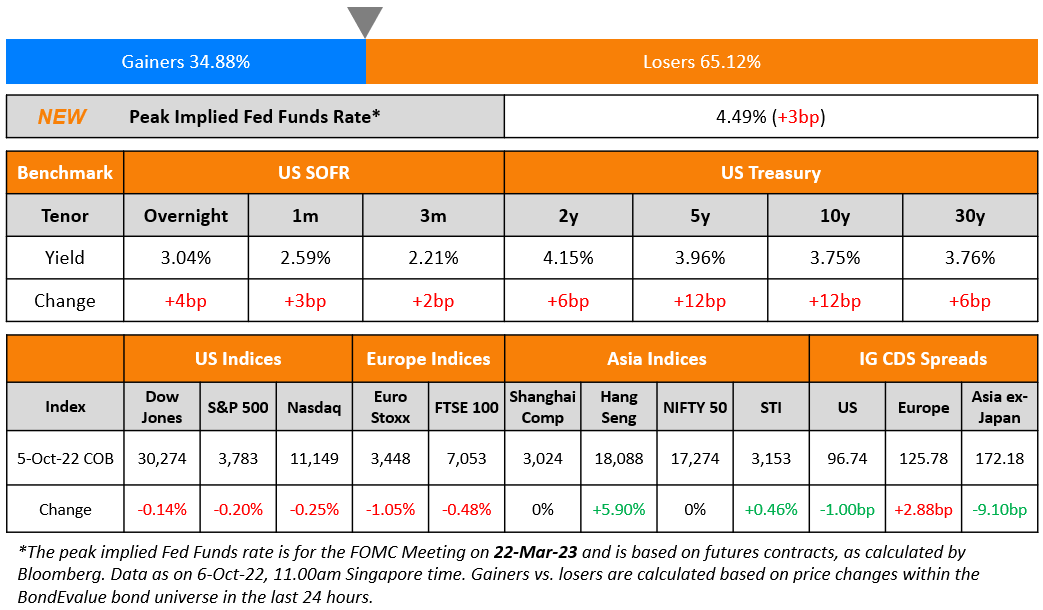

US Treasury yields jumped across the board on Wednesday with the the 5Y and 10Y yields leading the rise, up 12bp to 3.96% and 3.75%. The peak Fed Funds Rate currently stands at 4.49% for the FOMC’s March 2023 meeting, 3bp higher than yesterday. US credit markets saw a tightening of CDS spreads, with IG tightening by 1bp and HY tightening by 1.4bp. US equity markets saw their two-day rally end with the S&P and Nasdaq ending 0.2% and 0.3% lower respectively. As per Lipper, global bond funds witnessed an outflow of $175.5bn in the first nine months of 2022. This was the first time since 2022 that global bond funds on aggregate have seen outflows during the 9-month period. Adding to PIMCO and Fidelity that came out with calls in favor of buying bonds, Charles Schwab has also joined the chorus (scroll below to the Talking Heads for more details).

European equity markets ended in the red and credit markets saw EU Main CDS spreads widen by 2.8bp and Crossover spreads widen by 18bp. Fitch revised the UK’s outlook to negative, from stable while affirming the issuer’s ratings at AA-. In Italy, the 10Y BTP sold-off by 30bp, its biggest single day downward move since March 2020, with Moody’s issuing a warning about the nation’s finances. Asia ex-Japan CDS spreads tightened 9.1bp and Asian equity markets have opened broadly mixed today.

Complimentary Webinar | How to Use the BondEvalue App to Better Track Your Bonds | 10 Oct 2022

New Bond Issues

Philippines raised $2bn via a three-tranche deal. It raised

- $500mn via a 5Y bond at a yield of 5.17%, 35bp inside initial guidance of T+155bp area. The new bonds are priced at a new issue premium of 27bp over its existing 3.229% 2027s that yield 4.9%

- $750mn via a 10.5Y bond at a yield of 5.609%, 35bp inside initial guidance of T+220bp area. The new bonds are priced a tad wider to its older 3.556% September 2032s that currently yield 5.18%

- $750mn via a 25Y sustainability bond at a yield of 6.1%, 45bp inside initial guidance of 6.55% area. The new bonds are priced at a new issue premium of 25bp over its existing 4.2% 2047s that yield 5.85%

The senior unsecured bonds have expected ratings of Baa2/BBB+/BBB. Proceeds will be used for general budget financing and to finance assets in line with the nation’s sustainable finance framework. The bonds received orders over $9.2bn, 4.6x issue size. The 5Y saw 37% allocation to the US, 30% to Asia ex-Philippines, 28% to EMEA and 5% to Philippines. Fund/asset managers took 75%, bank treasuries 15%, insurers/pension funds 6% and private banks/others 4%. The 10.5Y saw 40% allocation to the US, 23% to Asia ex-Philippines, 33% to EMEA and 5% to Philippines. Fund/asset managers were allocated 67%, bank treasuries 28%, insurers/pension funds 12% and private banks/others 3%. The 25Y saw 40% allocation to the US, 28% to Asia ex-Philippines, 29% to EMEA and 3% to Philippines. Fund/asset managers were allocated 78%, insurers/pension funds 17%, bank treasuries 3% and private banks/others 2%.

Public Investment Fund raised $3bn via a three-tranche green deal. It raised

- $1.25bn via a 5Y green bond at a yield of 5.214%, 25bp inside initial guidance of T+150bp area.

- $1.25bn via a 10Y green bond at a yield of 5.403%, 25bp inside initial guidance of T+190bp area.

- $500mn via a 100Y green bond at a yield of 6.7%, 55bp inside initial guidance of 7.25% area.

The senior unsecured green bonds have expected ratings of A1/A. Proceeds will be used for general corporate purposes and to finance Eligible Green Projects, as described in the Guarantor’s Green Finance Framework dated February 2022. The bonds are issued by Gaci First Investment Co and guaranteed by Public Investment Fund.

Credit Agricole raised €1bn via a 4NC3 social bond at a yield of 4.053%, 15bp inside initial guidance of MS+150bp area. The bonds have expected ratings of A3/A-/A+, and received orders over €1.5bn, 1.5x issue size. Proceeds will be used to finance Eligible Social Assets of Credit Agricole Group and its subsidiaries.

New Bonds Pipeline

- Aozora Bank hires for $ 3Y Green bond

Rating Changes

- Telecom Operator Turkcell Downgraded To ‘B’ From ‘B+’ After Similar Action On Turkiye; Outlook Stable

- Telecom Operator Turk Telekom Downgraded To ‘B’ From ‘B+’ After Similar Action On Turkiye; Outlook Stable

- Fitch Revises the United Kingdom’s Outlook to Negative; Affirms at ‘AA-‘

- CIFI Holdings ‘B+’ Ratings Withdrawn At The Company’s Request

Term of the Day

Chapter 15

Chapter 15 is a legal bankruptcy filing where a foreign debtor files for bankruptcy in US courts. In general Chapter 15 bankruptcy is an ancillary case to a primary proceeding brought in another country, typically the debtor’s home country. As an alternative, the debtor may commence a complete Chapter 7 or Chapter 11 bankruptcy case in the US provided its assets in the US are sufficiently complex to warrant a full-blown domestic bankruptcy case. Bloomberg notes that non-US based companies that are in financial jeopardy tend to file for Chapter 15 bankruptcy to ensure that they will not be sued by creditors in the US or have assets seized there. Chapter 15 gives foreign creditors the right to participate in US bankruptcy cases and prohibits discrimination against foreign creditors.

Talking Heads

On Buying Bonds Could Be a Great Investing Move Right Now

Kathy Jones, chief fixed income strategist at Charles Schwab

“For the first time in a long time, there is actually income in fixed income”

James J. Burns, certified financial planner and president of JJ Burns & Company

“It’s a bad year if you held bonds starting on January 1st… It’s a great year for someone who’s got cash to invest”

Tom Lauricella of Morningstar

“This year is well on its way to being the worst in modern history for bond investors”… bonds seem like “a tough sell” right now.

On Fed’s Bostic saying inflation fight “still in early days”

Inflation is likely “still in early days”… Despite “glimmers of hope, the overarching message I’m drawing…is that we are still decidedly in the inflationary woods, not out of them”… There is “considerable speculation already that the Fed could begin lowering rates in 2023 if economic activity slows and the rate of inflation starts to fall”

“We are monitoring the situation. They are working on a strategy due to come out at the end of October

On Junk Market Only Open to Familiar Firms Offering High Yields

Madelaine Jones, a high yield PM at Oaktree Capital Management

“Investors are being quite cautious about putting their money at work and as we get toward the end of the year, that caution will increase”

Peter Low, an analyst at Lucror Analytics

“The high yield market might not be accessible to all companies currently. Companies with solid business models would still be able to access the debt markets, but will likely need to pay a higher coupon”

Top Gainers & Losers – 06-October-22*

Go back to Latest bond Market News

Related Posts: