This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

BOC HK Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 17, 2022

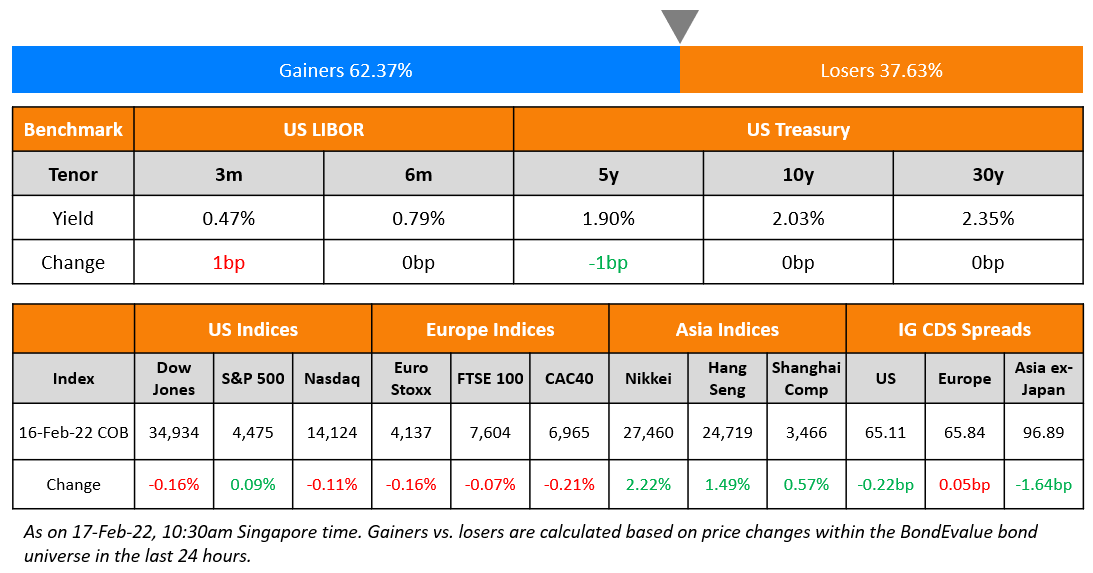

S&P and Nasdaq were near flat on Wednesday, after rallying 1.6% and 2.5% respectively on Tuesday. Most sectors were in the green, led by Energy, Materials and Industrials, up over 0.5% each. The US 10Y Treasury yield was flat at 2.03%. However, US Treasuries volatility as measured by the MOVE Index, crossed 100bp for the first time since March 2020. European markets were marginally lower with the DAX, CAC and FTSE down 0.3%, 0.2% and 0.1% each. Brazil’s Bovespa closed 0.3% higher. In the Middle East, UAE’s ADX was up 0.3% and Saudi TASI closed 1.2% higher. Asian markets have opened broadly higher with Shanghai, HSI and STI up 0.4%, 0.3% and 0.4% respectively, while Nikkei was down 0.2%. US IG CDS spreads were 0.2bp tighter and HY CDS spreads were 4.9bp tighter. EU Main CDS spreads were 0.05bp wider and Crossover CDS spreads were 0.8bp tighter. Asia ex-Japan CDS spreads were 1.6bp tighter. Primary markets returned to action with several large deals yesterday. Among sovereigns, Turkey raised $3bn via a sukuk with other big deals dominated by large banks such as JPMorgan, Citigroup, Morgan Stanley, Deutsche Bank, UniCredit and KDB.

The US Fed minutes of its January 2022 meeting were released yesterday. Regarding the balance sheet run-off, it said, “Participants observed that, in light of the current high level of the Federal Reserve’s securities holdings, a significant reduction in the size of the balance sheet would likely be appropriate”. US Retail Sales jumped 3.8% in January, the most in 10 months. Singapore maintained its 2022 GDP forecast at 3-5% after the economy grew 7.6% in 2021.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

New Bond Issues

- BOC HK branch $ 3/5Y at T+75/90bp area

The Republic of Turkey raised $3bn via a 5Y sukuk at a yield of 7.25%, 25-37.5bp inside the initial guidance of 7.5-7.625% area. The bonds have expected ratings of B2/B+ (Moody’s/Fitch). The bonds were priced flat as compared to its 6% 2027s that yield 7.25%.

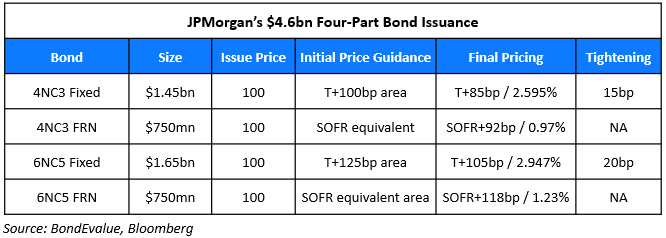

JPMorgan raised $4.6bn via a four-trancher. It raised:

Proceeds will be used for general corporate purposes. The 4NC3 fixed-rate bonds were priced 13.5bp less than its 1.045% 2026s that yield 2.73%.

Morgan Stanley raised $2.5bn via a two-tranche deal. It raised:

- $1.75bn via a 4NC3 fixed-rate bond at a yield of 2.63%, 12.5bp inside the initial guidance of T+100bp.

- $750mn via a 4NC3 FRN bond at a yield of 0.998%, vs initial guidance of SOFR-equiv.

The bonds have expected ratings of A1/BBB+/A. Proceeds will be used for general corporate purposes. The 4NC3 fixed-rate bonds were priced 14bp less than its 0.985% 2026s that yield 2.77%.

Citigroup raised $3bn via a two-part deal. It raised $2.25bn via a 6NC5 bond at a yield of 3.07%, 10bp inside initial guidance of T+125bp area. It also raised $500mn via a 6NC5 FRN at a yield of 1.33%, or SOFR equivalent + 128bp as compared to initial guidance of SOFR equivalent. The bonds are rated A3/BBB+. Proceeds will be used for general corporate purposes.

Deutsche Bank raised €1.25bn via a 6NC5 green bond at a yield of 1.973%, 17bp inside initial guidance of MS+155bp area. The bonds have expected ratings of Baa2/BBB-/BBB+. Proceeds will be used for the refinancing of Green Assets according to the Issuer’s Green Financing Framework, dated September 24, 2020. Coupon is fixed at 1.875% until call date. If not called, the coupon resets to the 3m Euribor +138bp, quarterly.

UniCredit raised €1bn via a 5Y covered bond at a yield of 0.595%, 5bp inside initial guidance of at MS+105bp area. The bonds have expected ratings of Aaa and received orders over €2.4bn, 2.4x issue size.

Midea Group raised $450mn via a 5Y green bond at a yield of 2.905%, 37bp inside initial guidance of T+135bp area. The bonds have expected ratings of A/A (S&P/Fitch), and received orders over $2.4bn, 5.3x issue size. The bonds are issued by Midea Investment Development Co and guaranteed by the Shenzhen-listed parent. S&P has issued a second party opinion on the Chinese electrical appliance manufacturer’s green financing framework. Proceeds from the proposed bond issue will be used to finance and/or refinance eligible green assets in accordance with the framework.

Verizon raised $1bn via a 30Y green bond at a yield of T+155bp,15bp inside initial guidance of T+170bp. Proceeds would be used for energy facilities renewal or the purchase of renewable energy. The bonds are rated BBB+/A- by S&P/Fitch. The issuance marks Verizon’s fourth $1bn green bond issuance since 2019.

Beijing State-owned Capital Operation and Management raised €1bn via a 3Y bond at a yield of 1.206%, 25bp inside initial guidance of at MS+105bp area. The bonds have expected ratings of A1/A+ (Moody’s/S&P) and received orders over €3bn, 3x issue size. The bond ratings reflect the expected strong support from the Beijing government and ultimately the government of China. Proceeds will be used to repay debt. There is a change of control put at 101% with accrued interest.

Chinalco raised $600mn via a 5Y bond at a yield of 1.924%, 40bp inside initial guidance of T+175bp area. The bonds have expected ratings of A- by Fitch and received orders over $4.55bn, 7.6x issue size. The bonds are issued by Chinalco Capital Holdings with Chinalco as guarantor. There is a change of control put at 101%. Proceeds will be used to refinance the group’s offshore debt. Chinalco is the world’s largest aluminium producer and is wholly owned by the SASAC.

KDB raised $1.5bn via a two-trancher. It raised:

- $1bn via a 3Y bond at a yield of 2.127%, 25bp inside initial guidance of T+60bp area

- $500mn via a 5Y bond at a yield of 2.359%, 17bp inside initial guidance of T+60bp area

The bonds have expected ratings of Aa2/AA/AA-. Proceeds for the 3Y and 5Y bonds will be used for general purposes, including extending foreign currency loans and the repayment of maturing debt and other obligations. The final order book for the 3Y tranche was over $1.7bn, 1.7x issue size – APAC took 26%, EMEA 33% and the US 41%. Central banks/agencies took 64%, asset managers 21%, banks 9%, insurers/pension funds 5% and private banks/brokers 1%. The 5Y saw orders of over $750mn, 1.5x issue size – APAC took 33%, EMEA 54% and the US 13%. Banks took 48%, agencies 27%, asset managers 18% and insurers/pension funds 7%. KDB was also marketing a 10Y green but it was not mentioned when final price guidance was announced for the two shorter-dated tranches. The 10Y green bonds have a carbon neutrality focus with proceeds to be used for financing and/or refinancing new and/or existing projects from the eligible green categories in KDB’s sustainable bond framework with preferential allocation to renewable energy and/or clean transportation projects.

Mizuho Financial Group raised $1.85bn via a four-part deal. It raised:

- $600mn via a 4.25NC3.25 fixed-rate bond at a yield of 2.651%, 15 bp inside initial guidance of T+105bp area

- $750mn via a 4.25NC3.25 FRN bond at a yield of SOFR+96bp as compared to initial guidance of SOFR equivalent area

- $500mn via a 8.25NC7.25 bond at a yield of 3.261%, 10bp inside initial guidance of T+135bp area

Mizuho initially marketed a 20.25Y tranche at T+140bp area, dropped the issuance. The TLAC (Term of the Day, explained below) eligible notes are expected to be rated A1/A– (Moody’s/S&P). Proceeds will be used for a loan to Mizuho Bank, which intends to use the funds from the green tranche to finance and/or refinance existing and/or new eligible green projects and those from the conventional bonds for general corporate purposes.

New Bonds Pipeline

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Kalyan Jewellers India hires for $ 5Y bond

- Dongtai Communication hires for $ 65 mn 180-day bond

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

Rating Changes

- Las Vegas Sands Corp. And Sands China Ltd. Downgraded One Notch To ‘BB+’ On Slower 2022 Macau Recovery; Outlook Negative

- Moody’s downgrades Pitney Bowes’ CFR to B1; outlook stable

- Two Turkish Banks Downgraded On Higher Stress In Economic Environment And Weakening Capitalization; Outlooks Negative

- Marriott International Outlook Revised To Positive From Negative On Faster-Than-Expected Deleveraging, Ratings Affirmed

- Moody’s changes Vedanta’s outlook to negative; affirms B2 CFR and B3 senior unsecured rating

- Moody’s changes the outlook on 3M to stable; affirms its A1 unsecured rating

- Moody’s withdraws RiseSun’s rating due to insufficient information

Term of the Day

TLAC

Total Loss Absorbing Capacity (TLAC) is an international standard designed for banks, particularly Global Systemically Important Banks (G-SIBs) by the Financial Stability Board (FSB) in 2015 to ensure that these banks have ample equity and bail-in debt in place to minimize tax payer and government bailout mechanisms. Currently G-SIBs are required to hold a TLAC amount equal to 16% in Risk Weighted Assets (RWAs), or 6% of the leverage exposure measure, which will increase to 18% of RWA and 6.75% of leverage exposure measure by January 2022. Securities eligible under TLAC include common equity, subordinated debt, some senior debt and unsecured liabilities with a maturity greater than one year. FSB requires 33% of TLAC be filled with debt securities and a maximum of 67% with equity.

Talking Heads

On Pimco Sours on Chinese Sovereign Debt as Policy Splits From Fed

Arthur Lau, head of Asia ex-Japan fixed income in Hong Kong

“The seven-year part of government bond curve is the sweet spot, given our view in near-term monetary policy… Short-end has rallied, because rates have dropped to reflect the easing cycle in China, while the long end seven to 10 years part of the curve has not reacted to such a move.”

On Fed Eyes Rate Hike Soon and Faster Tightening Pace If Needed

Gus Faucher, chief economist for PNC Financial Services Group

The minutes report “tells us that they will raise the fed funds rate in March, and that a 50 basis point rate hike is in play… Given that the economy appears to be at full employment, it depends on what inflation looks like ahead of the meeting. Some participants could be looking at the strong January CPI report as a reason to raise by 50 basis points in March.”

Ian Shepherdson, chief economist at Pantheon Macroeconomics

“With no explicit discussion of a date to begin balance sheet runoff, or of the idea of a 50 basis point hike in March, the minutes are on the less-hawkish side of expectations… But they aren’t the last word on anything”.

Simona Mocuta, chief economist at State Street Global Advisors

“The market correctly interpreted them as dovish relative to expectations… There’s been so much hype recently that I think everybody was braced for a very hawkish tone in the minutes, and the minutes were more like, ‘We’ll do it, of course, but we’ll walk before we run… It seems enough for the Fed to do four hikes. Talk the hawkish talk, tell everybody that we are watching this closely, and if we need to do more we can do more”.

On US retail sales racing to a record high; economy showing strength ahead of rate hikes

Sal Guatieri, a senior economist at BMO Capital Markets

“The strong rebound in January retail sales, though partly in response to last year’s weak finish and inflated by higher prices, suggests consumers still have plenty in the tank to propel the expansion forward this year… Rate hikes won’t cool their jets for a while, making the Fed’s job of driving down inflation that much harder”

Christopher Rupkey, chief economist at FWDBONDS

“Despite some caveats to the retail sales report, at least we can be assured that consumers are not pulling back their crucial support for the economy even though they are experiencing a marked decline in confidence if not being downright depressed about what the future holds”

Daniel Silver, an economist at JPMorgan

“The recent volatility in the data makes it hard to detect the underlying trend, but the recent momentum for consumer spending now looks stronger than we were anticipating”

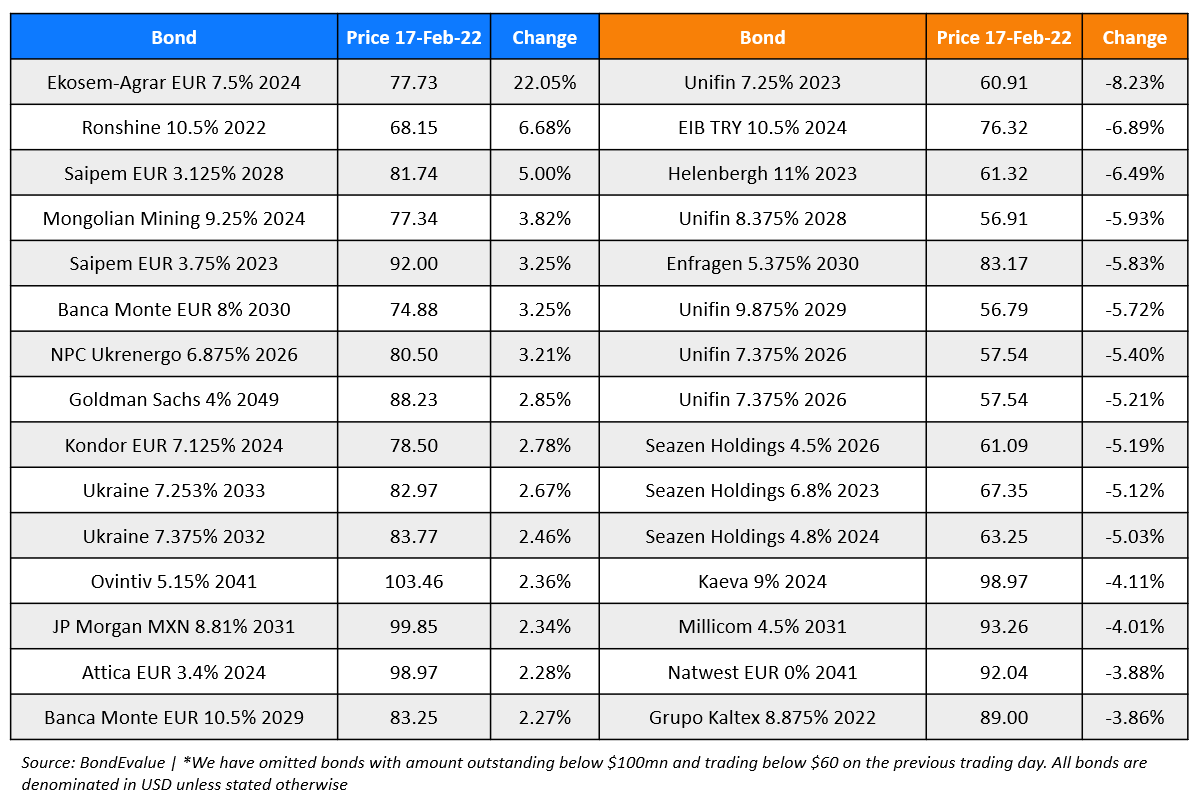

Top Gainers & Losers – 17-Feb-22*

Go back to Latest bond Market News

Related Posts:

.png)