This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 20, 2022

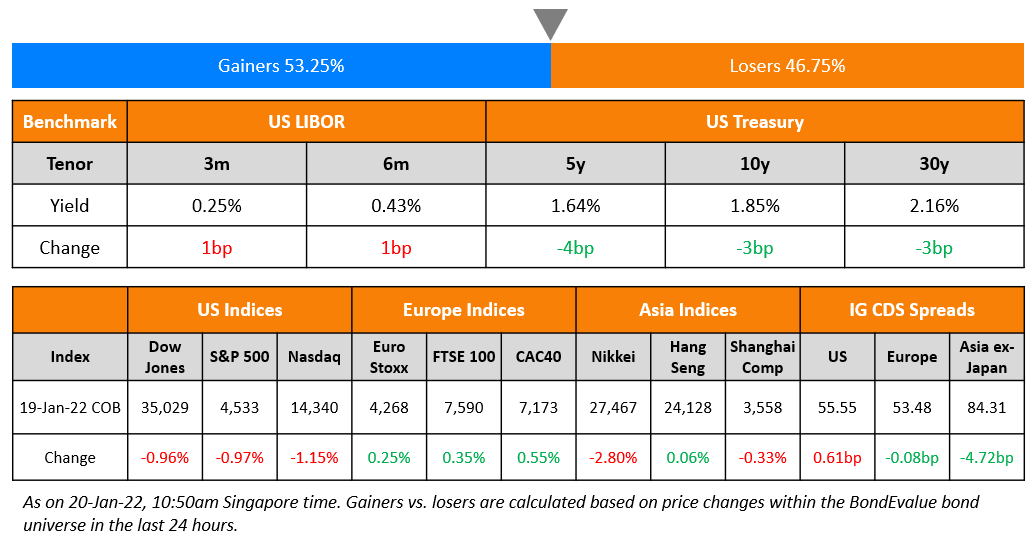

US equity markets dropped again with the S&P and Nasdaq down 1% and 1.2%. The latter is down 10% from its November 2021 high. Most sectors were in the red with Consumer Discretionary, Financials and IT down 1.4-1.8%. US 10Y Treasury yields eased 3bp to 1.85%. European markets closed higher with the DAX, CAC and FTSE up 0.2%, 0.6% and 0.4% respectively. Brazil’s Bovespa closed 1.3% higher. In the Middle East, UAE’s ADX and Saudi TASI were up 1.6% and 0.5%. Asian markets have opened broadly higher – HSI, STI and Nikkei were up 1.9%, 0.1% and 0.5% while Shanghai was down 0.2%. US IG CDS spreads were 0.6bp wider and HY CDS spreads were 3.5bp wider, EU Main CDS spreads were 0.1bp tighter and Crossover CDS spreads were 1.7bp tighter. Asia ex-Japan CDS spreads were 4.7bp tighter.

China cut its 1Y and 5Y Loan Prime Rate (Term of the Day, explained below) by 10bp and 5bp respectively to 3.7% and 4.6% in an effort to boost lending in the economy. While it was the second consecutive month of 1Y LPR cuts, this was the first 5Y LPR cut since April 2020.

New Bond Issues

- China Water Affairs $150mn tap of 4.85% green 2026 at $97 final

- Greentown China $400mn 3Y green at 2.4% area

- Shenwan Hongyuan HK $ 364-day at 1.9% area

- Huzhou Nanxun Tourism Investment $ 3Y at 2.25% area

- Shinhan Card $ 5Y social at T+125bp area

- BNZ $ 5/10Y at T+85-90/115-120bp area

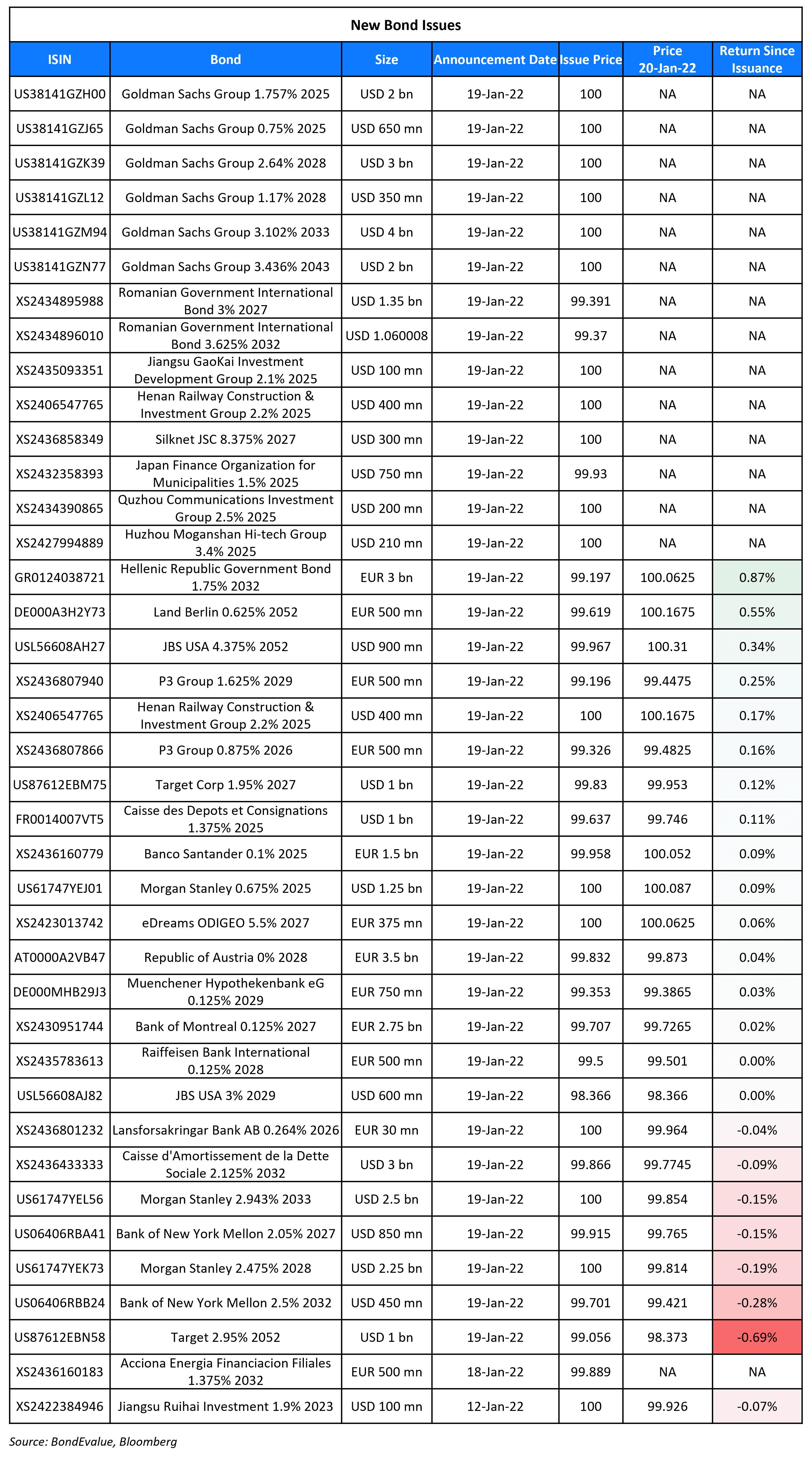

Goldman Sachs raised $12bn via a six-tranche deal. Details are given in the table below:

-png.png)

The bonds have expected ratings of A2/BBB+. Proceeds will be used for general corporate purposes. This marks the third-largest ever deal from a US bank, after Bank of America’s $15bn and JPMorgan’s $13bn deals, both raised in April 2021. The new 3NC2 fixed-rate bonds are priced 38.3bp tighter to its existing 3.75% 2025s that yield 2.14%.

Morgan Stanley raised $6bn via a three-tranche deal. It raised:

- $1.25bn via a 3NC2 bond at a yield of 0.675%, 12.5bp inside initial guidance of SOFR+75bp area. The new bonds are priced 82.5bp tighter to its existing 0.864% 2025s that yield 1.5%.

- $2.25bn via a 6NC5 bond at a yield of 2.475%, ~15bp inside initial guidance of T+100/105bp area

- $2.5bn via a 11NC10 bond at a yield of 2.943%, ~20bp inside initial guidance of T+130/135bp area. The new bonds are priced 21.3bp wider to its existing 1.928% Apr 2032s that yield 2.73%.

The bonds have expected ratings of A1/BBB+/A. Proceeds will be used for general corporate purposes.

China Water Affairs raised $150mn via a tap of its 4.85% Green bond due 2026 at a price of 97, inline with final guidance, and yielding 5.64%. The bonds are rated Ba1/BB+ (Moody’s/S&P) and guaranteed by its offshore subsidiaries. Proceeds will be used to repay bonds due February 2022 and other debt, as well as for working capital. An amount equal to the net proceeds will finance or refinance green projects, particularly water supply projects. The new bonds are priced at a new issue premium of 61bp over the existing 4.85% 2025s that yield 5.03%.

Henan Railway Construction & Investment raised $400mn via a 3Y green bond at a yield of 2.2%, 25bp inside initial guidance of 2.45% area. The bonds have expected ratings of A2 (Moody’s), and received orders over $1.65bn, 4.1x issue size. Proceeds will be used to finance, refinance and replenish the working capital of eligible green projects.

Huzhou Moganshan Hi-tech raised $210mn via a 3Y bond at a yield of 3.4%, unchanged from final guidance. The bonds are unrated. Proceeds will be used for funding project development and for working capital.

Quzhou Communications Investment Group raised $200mn via a 3Y green bond at a yield of 2.5%, 40bp inside initial guidance of 2.9% area. The bonds have expected ratings of BBB- (Fitch). Proceeds will be used for project construction in accordance with the issuer’s green finance framework.

Jiangsu Gaokai Investment Development raised $100mn via a 3Y bond at a yield of 2.1%, unchanged from final guidance. The bonds are unrated and supported by a letter of credit from Bank of Jiangsu Nantong branch.

Jiangsu Ruihai Investment raised $100mn via a 364-day bond at a yield of 1.9%. The bonds are unrated. Proceeds will be used for debt refinancing and working capital. The bonds are supported by a letter of credit from Bank of Shanghai Nanjing branch.

New Bonds Pipeline

- JY Grandmark hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Kalyan Jewellers India hires for $ 5Y bond

- Health and Happiness hires for $ 400 mn bond

- Dongtai Communication hires for $ 65 mn 180-day bond

- Hanwha Life hires for $ 10NC5 sustainability tier 2 bond

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Pakistan hires for $ 7Y sukuk

Rating Changes

- Fitch Upgrades Saudi Electricity Company to ‘A’; Stable Outlook

- Moody’s downgrades Shanghai Electric to Baa1; outlook remains negative

- Fitch Revises Outlook on GMR Hyderabad International Airport to Stable; Affirms ‘BB+’

- Fitch Revises Outlook on Delhi International Airport to Stable; Affirms at ‘BB-‘

- Embraer Outlook Revised To Positive From Negative On Faster Leverage Reduction; ‘BB’ Ratings Affirmed

Term of the Day

Loan Prime Rate

The loan prime rate (LPR) is a benchmarking reference rate in China with regarding to funding costs. For example the 1Y LPR is the rate on which most new and outstanding loans are based while the 5Y LPR is the rate on which most mortgages are based. China cut its 1Y and 5Y LPR rate on Thursday by 15 and 5bp respectively. The LPR is annnounced on the 20th of every month by the PBOC using quotations from 10 contributing banks and eight banks, that includes two foreign institutions.

Talking Heads

“Quantitative tightening most hurts risk markets like the equity market, the corporate bond market.” “Those markets are going to struggle.” “The Fed did wait way too long in trying to address this issue,” said Bianco. “I don’t think there is a magic policy they could do that would help quell the inflation concerns, help the financial markets, help the economy at the same time. Because everybody is concerned about inflation, they ultimately are going to respond to it, and the risk is that they’re going to go too far.”

“We’re going to see a deceleration of growth due to tighter financial conditions and this higher inflationary rate, that stymies the consumers’ ability to spend. That’s what’s gonna happen in the next year,” he said. “Earnings will be up 8 or 10% this calendar year and with that companies are in good shape,” he said. “It’s not a corporate default rate event that happens now. Save that one for the recession.” “I think that every market’s incredibly vulnerable from here.”

On surging treasury yields putting pressure on emerging market assets

Antje Praefcke, FX and EM analyst at Commerzbank

“Even though market expectations have already run a long way, it is difficult for the market to gauge whether it will be surprised on the slightly restrictive side next week.”

In a note by Societe Generale analysts

“Price action (in Russian assets) could get a lot worse if the next diplomatic effort on Friday between Moscow and Washington comes to nothing.” “New sanctions would inflict more pain on the currency and the country’s debt market, and possibly prompt intervention by the central bank.”

“The simple reality is that the very serious public health impacts of omicron and the associated economic consequences do not outweigh the pressing need to withdraw monetary stimulus.” “Even with this pace of tightening, the real policy rate would remain negative at the end of this year.”

“We have to make inequality a priority and not the spending cap.” “Brazil has to put the poor back in the budget and tax the rich.”

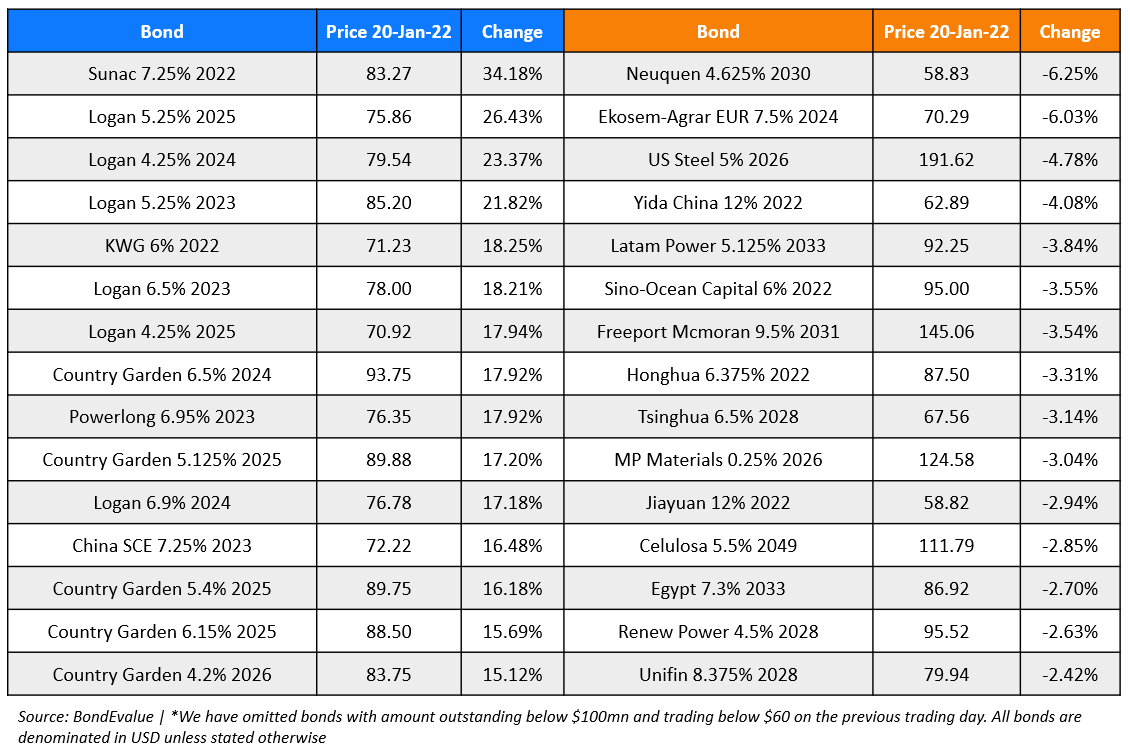

Top Gainers & Losers – 20-Jan-22*

Other Stories:

Go back to Latest bond Market News

Related Posts: