This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 16, 2021

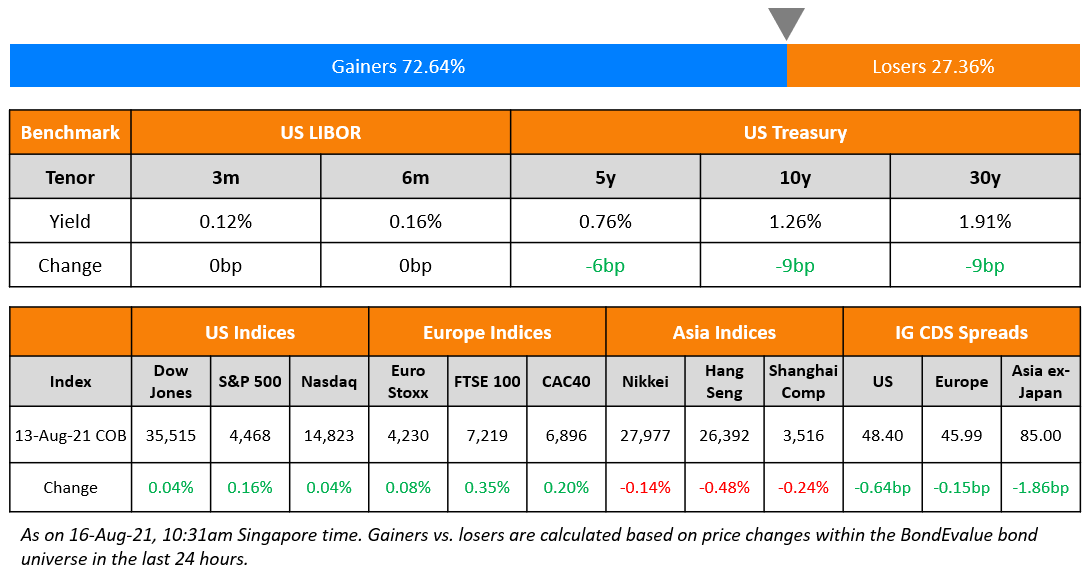

US markets moved up on Friday with the S&P and Nasdaq closing 0.16% and 0.04% higher. S&P scaled new highs as Consumer Staples, Real Estate, Healthcare, Utilities and IT were up over 0.5%. Energy and Financials were down 1.3% and 0.7% respectively. European markets also ended higher – DAX, CAC and FTSE ended ~0.3% stronger. Saudi’s TASI was up 0.3% and UAE’s ADX ended 0.1% higher. Brazil’s Bovespa reversed its losses and ended 0.4% higher. APAC stocks opened in the red – the Nikkei was down ~1.5%, Singapore’s STI down 0.7% and HSI down 0.5% and Shanghai was broadly flat. US 10Y Treasury yields tightened 9bps to 1.26%. US IG and HY CDS spreads tightened 0.6bp and 1.7bp. EU Main and Crossover CDS spreads tightened 0.2bp and 0.4bp respectively. Asia ex-Japan CDS spreads were 1.9bp tighter.

The US Michigan Consumer Sentiment for August recorded its largest decline since 2011 at 70.2 vs. forecasted and previous month’s 81.2. French and Spanish CPI (MoM) for July posted 0.1% and 2.9% respectively, inline with expectations.

%20(1).jpg?upscale=true&width=1400&upscale=true&name=CapbridgeBonds_Newsletter%20(1)%20(1).jpg) With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

%20(1).jpg?upscale=true&width=1400&upscale=true&name=CapbridgeBonds_Newsletter%20(1)%20(1).jpg) With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

- Hassle-free onboarding in 3 simple steps: SingPass MyInfo onboarding available for Singapore residents

- Curated list of fractional bonds

- Yields of up to 7-9%

- Fully transparent fee structure

- Instant settlement

For a limited time, investors get to enjoy up to 50% rebate off annual fees. Now, enjoy an even lower cost of bond ownership.

{{cta(‘210d66b2-ffd2-4b20-b579-148f7fdecb03’)}}

New Bond Issues

- Central Nippon Expressway 5Y bond at Mid-Swaps+35bp area

- PCGI Holdings $ 5NC3 at 4.5% area

Chongqing International Logistics Hub Park Construction raised $160mn via 5NC3 bonds at a yield of 5.3%, 45bps inside initial guidance of 5.75% area. The bonds have an expected rating of BBB- and received orders over $460mn, 2.9x issue size. Asia took 97% of the bonds and Europe 3%. Banks and financial institutions received 96% and private banks 4%. Proceeds will be used for debt refinancing.

New Bonds Pipeline

- HDFC Bank hires for $ PerpNC5

- Perusahaan Pengelola Asset hires for $ bond

- Ping An International Financial Leasing hires for $ bonds; calls tomorrow

- Henan Investment Group hires for $ bonds; calls tomorrow

Rating Changes

- Fitch Upgrades Gran Tierra’s IDR to ‘CCC+’

-

Moody’s affirms Ireland’s A2 ratings, changes outlook to positive from stable

- Fitch Downgrades Agung Podomoro to ‘CCC’ on Weaker Liquidity

- Argentine Conglomerate CLISA Downgraded To ‘SD’ From ‘CC’ By S&P Following Exchange Offer, ‘CCC’ Rating On New Notes Affirmed

- PBF Holding Co. LLC, PBF Logistics L.P. Downgraded To ‘B’ From ‘B+’ By S&P On Weak Margins; Outlook Negative

- Westinghouse Air Brake Technologies Corp. Outlook Revised To Stable From Negative By S&P On Strong Operating Performance

- Midland Cogeneration Venture L.P. Debt Outlook Revised To Stable From Negative By S&P; ‘BB’ Rating Affirmed

- Fitch Revises Yorkshire Building Society’s Outlook to Stable; Affirms at ‘A-‘

- Fitch Revises Coventry’s Outlook to Stable; Affirms at ‘A-‘

Term of the Day

Risk-off

Risk-off is an indication of global market sentiment wherein investors switch out from risky assets (i.e. risk-off) into safer assets on the back of increased uncertainty. This can be due to geopolitical risk, poor economic data or a crisis. The most noteworthy risk-off event this year was in late March 2020, when fears about the coronavirus pandemic pushed financial markets lower across the board. Most typically, during a risk-off environment, US Treasuries and gold tend to perform better as they are considered safe haven assets. On the other hand, risk-on indicates positive investor sentiment wherein investors switch into risky assets (i.e. risk-on) from safer assets on improved prospects of economic growth. This can be due to improved political environment, strong economic data, strong corporate earnings, or a recovery from a crisis.

Talking Heads

On the view that more strong job reports are needed before bond taper can begin – Neel Kashkari, Federal Reserve Bank of Minneapolis President

“If we see a few more jobs reports like the one we just got, then I would feel comfortable saying yeah, we are — maybe haven’t completely filled the hole that we’ve been in — but we’ve made a lot of progress, and now, then will be the time to start tapering our asset purchases,” Kashkari said. “I’m not convinced we were actually at maximum employment before the Covid shock hit us. So, that’s exactly why I want us to be really humble about declaring, ‘This is as good as it can get’,” he said. Getting labor force participation and employment rates “at least back to where they were before, but not necessarily even declaring victory when we do that — I think that’s a reasonable thing for us to try to achieve.”

Greg Peters, head of fixed income multi-sector and strategy at PGIM

“Supply is a big story that is not being talked about.” “The fundamentals ultimately drive things, but I do think the lack of supply . . . makes the [Fed] taper somewhat irrelevant.”

“Supply is a big story that is not being talked about.” “The fundamentals ultimately drive things, but I do think the lack of supply . . . makes the [Fed] taper somewhat irrelevant.”

John Briggs, head of strategy at NatWest Markets

“Global liquidity is massive. That is definitely going to put a cap on US long yields or just be a weight on them going forward.”

“Global liquidity is massive. That is definitely going to put a cap on US long yields or just be a weight on them going forward.”

Alejandro Diaz de Leon, Bank of Mexico (Banxico) Governor

“They are an asset that computes as international reserve,” Diaz de Leon said. “All foreign currency that the federal government can get from the central bank is purchased.” “This is not a contribution,” he said. “The whole intention of the IMF of doing this is to increase the international reserve availability for their membership.”

Gerry Rice, IMF spokesman

“A member country’s domestic legal and institutional arrangements determines which institution records the SDRs on its balance sheet and how the allocated SDRs are used,” Rice said. “For many IMF member countries, SDRs are administered by the central bank. Some of these central banks can on-lend resources related to the SDRs to the government.”

Paul Lukaszewski, head of corporate debt for the Asia Pacific region at Aberdeen Standard Investments

“There’s a confidence crisis in Chinese high-yield debt.” “This much negativity in prices is rare.”

Sheldon Chan, an Asia credit portfolio manager at T. Rowe Price

“A lot of the tension is focused on the property sector, and it’s really been driven by [China’s] policy.” “The three red lines policy is proving effective to push developers to reduce debt, and cutting access to funds,” Mr. Chan said. “Along the way, some accidents will happen and some developers will run into default, which may bring some contagion and volatility,” he added.

Sandra Chow, co-head of Asia-Pacific research at CreditSights

“If there’s no clarity on a turnaround story, it would be brave to stick your neck out.” “The market is cheap, but it could get cheaper,” Ms. Chow added.

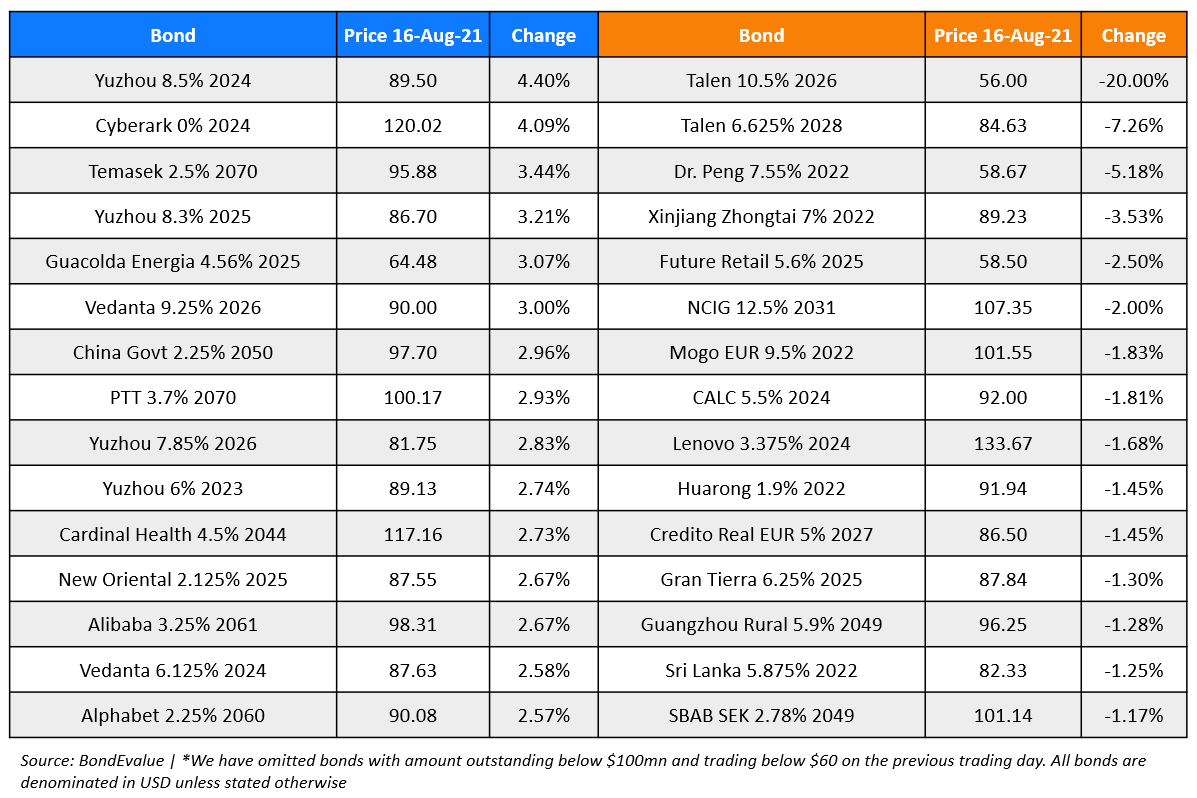

Top Gainers & Losers – 16-Aug-21*

Go back to Latest bond Market News

Related Posts: