This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

December 9, 2021

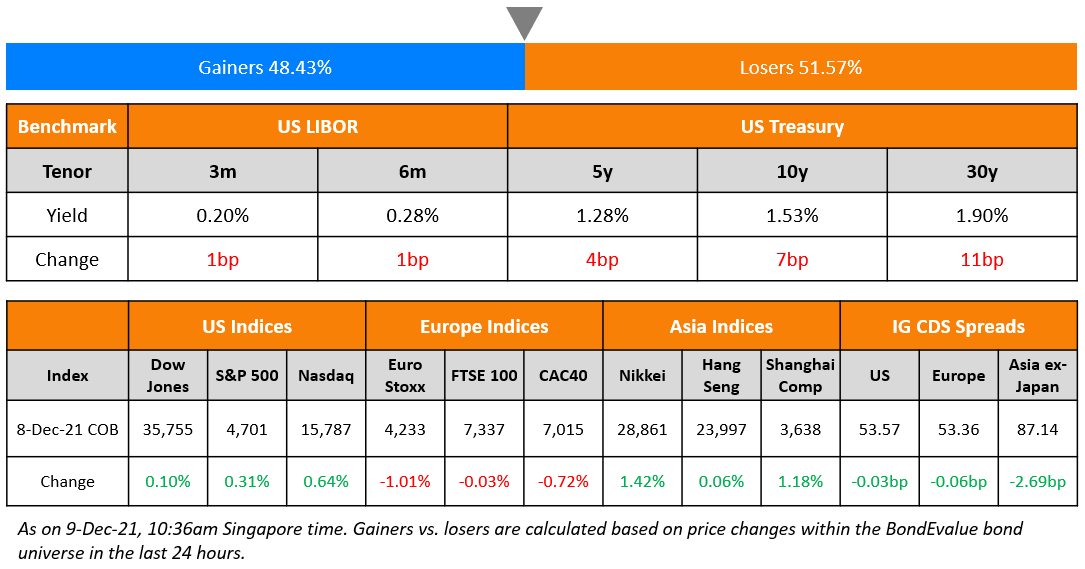

US equity markets continued its upward move with the S&P and Nasdaq closing 0.3% and 0.6% higher. Most sectors were in the green led by Communication Services and Healthcare, up over 0.7% each. US 10Y Treasury yields moved 2bp higher to 1.46%. European markets were broadly lower with the DAX and CAC down 0.8% and 0.7% while FTSE was flat. Brazil’s Bovespa was up 0.5%. In the Middle East, UAE’s ADX was down 0.3% while Saudi TASI was down 1.1%. Asian markets have opened largely higher – Shanghai and HSI were up over 1% each, STI was up 0.3% while Nikkei was down 0.1%. US IG CDS spreads were flat while HY CDS spreads widened 0.8bp. EU Main CDS spreads were 0.1bp tighter and Crossover CDS spreads were 0.5bp wider. Asia ex-Japan CDS spreads tightened 2.9bp.

China’s CPI YoY came at 2.3%, lower than expectations of 2.5%. The $36bn US 10Y Treasury auction saw solid demand at a yield of 1.518%, with a bid-to-cover of 2.43 with foreign buyers taking about 69% of the size. The CME’s FedWatch tool shows an 81.5% chance of a rate hike in June 2022, up from ~50% at the beginning of November.

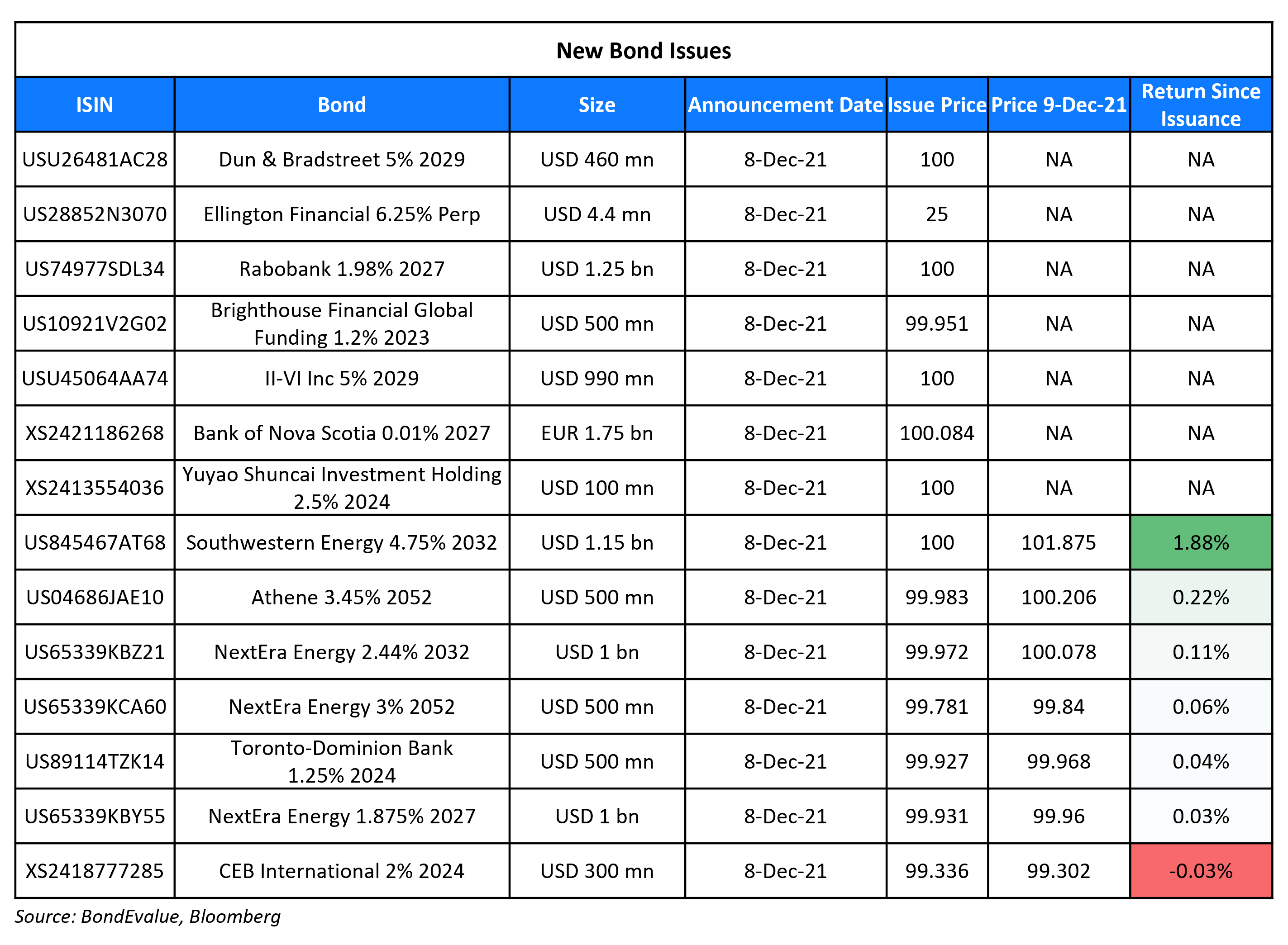

New Bond Issues

- Qingdao Jimo District Urban Tourism Development and Investment $ 3Y at 3.2% area

- Pingdu Construction Investment Development $ 3Y at 5.3% area

Rabobank raised $1.25bn via a 6NC5 bond at a yield of 1.98%, 17-22bp inside initial guidance of T+90/95bp area. The bonds have expected ratings of A3/A-/A+. The bonds are first callable on December 15, 2026, and if not called, the coupon will reset to the prevailing US 1Y Treasury + 73bp. The new bonds are priced 15bp wider to its existing 1.106% 2027s callable in February 2026 that yield 1.83%.

Southwestern Energy raised $1.15bn via a 10NC5 bond at a yield of 4.75%, 25-50bp inside initial guidance of 5-5.25%. The bonds have expected ratings of Ba3/BB (Moody’s/S&P). Proceeds, along with net proceeds associated with its proposed term loan credit agreement, borrowings under its revolving credit agreement and cash on hand will be used to fund the cash portion of its $1.85bn acquisition of GEP Haynesville and its previously announced tender offers and pay a portion of the outstanding balance of its revolving credit. The bonds are first callable on February 1, 2027. Southwestern Energy Company is an independent energy company primarily focused on natural gas and crude oil exploration, development and production (E&P).

CEB International raised $300mn via a 3Y bond at a yield of 2.23%, 45bp inside initial guidance of T+170bp area. The bonds have expected ratings of BBB (Fitch), and received orders over $2.2bn, 7.3x issue size. Proceeds will be used for the replacement of maturing offshore loans. The bonds are issued by CEBI Splendid, a wholly owned subsidiary of the Hong Kong-based financial services company. CEB International Investment is wholly owned by China Everbright Bank.

Yuyao Shuncai Investment Holding raised $100mn via a 3Y bond at a yield of 2.5%, 10bp inside initial guidance of 2.6% area. The bonds have expected ratings of Baa3/BBB– (Moody’s/Fitch). The proceeds from the Hong Kong-listed notes will be used for refinancing offshore bonds. The bonds are issued by Yuyao Economic Development Zone Construction Investment and Development and guaranteed by Yuyao Shuncai Investment. Yuyao Shuncai Investment is the primary asset management and capital operation entity of the Yuyao municipal government in China’s Zhejiang province.

Rating Changes

- Moody’s upgrades ENN Energy to Baa1; outlook stable

- Fitch Upgrades Gran Tierra’s IDR to ‘B-‘; Outlook Stable

-

Moody’s changes Bayer’s outlook to negative on litigation risks, affirms Baa2

- Moody’s changes Costa Rica’s outlook to stable, affirms B2 ratings

-

Moody’s affirms Sappi’s Ba2 rating, outlook changed to stable

-

Moody’s changes Novafives’ outlook to stable from negative, affirms Caa1 CFR

-

Fitch Affirms Toll Brothers’ IDR at ‘BBB-‘; Outlook Revised to Positive

-

Fitch Revises Outlook on Dominican Republic to Stable; Affirms Ratings at ‘BB-‘

- Fitch Revises Outlook on Longfor to Stable; Affirms at ‘BBB’

Term of the Day

Selective Default

An SD rating is assigned by S&P Global Ratings when it believes that the obligor/issuer has selectively defaulted on a specific issue or class of obligations but it will continue to meet its payment obligations on other issues or classes of obligations in a timely manner. A rating on an obligor is also lowered to ‘D’ or ‘SD’ if it is conducting a distressed debt restructuring. China Aoyuan was downgraded to SD from CCC earlier this week.

Talking Heads

On Brazil Seeing Another 150 Basis Point Key Rate Hike in February

“The Committee considers that, given the increase in its inflation projections and in the risk of a deanchoring of long-term expectations, it is appropriate to advance the process of monetary tightening significantly into the restrictive territory.

On Sri Lanka will handle debt repayments ’seamlessly’: Governor Ajith Cabraal

“The repayments (for 2022) will go through seamlessly, we are confident we’ll be making those payments on time. There is absolutely no worry about that… At the same time we are taking many steps to deal with our debt in a sustainable manner and not just depend on a single instrument, we are developing several new instruments, several new inflows, which will hold us in better stead over the longer term, and that’s the whole plan we have initiated.”

On Emerging Markets’ Pandemic-Fueled Debt Party Is Coming to An End

Sara Grut, a strategist at Goldman Sachs Group in London.

“If tighter developed-market policy comes alongside slowing global growth and weaker risk sentiment, then we would expect overall emerging-market issuance to decline, and vice versa”

BofA strategists Jane Brauer and Lucas Martin

“We expect strong support from crossover investors into EM debt due to a shortage of U.S. and EUR bonds in the corporate markets”

On JPMorgan Seeing Asia ESG Dollar Bonds Hitting $100 Billion in 2022

JPMorgan expects Asian ESG dollar bond issuance of between $90 billion and $100 billion in 2022.

Wilfred Chia, JPMorgan’s executive director for equity-linked origination for APAC

“Greater attention on the ESG strategy of issuers, be it at the board or investor level on greater disclosure requirements, has meant that now more than ever we’re having conversations with clients about having CBs with an ESG focus”

Gaurav Maria, head of equity-linked origination and private capital markets, APAC

“We’ve recognized a trend that there are more and more $1 billion-plus transactions. Larger deals attract more investors, and certainly there will be a portion of those deals that will be ESG-related.”

On JPMorgan Seeing Investment-Banking Fees Up 35% in Fourth Quarter

JPMorgan Co-President Daniel Pinto

Pipeline “looks quite strong into next year across M&A, debt and equity. How is it going to play out? Difficult to know, because I think it will be very linked to the path of interest rates. So we have a smooth path of normalization of interest rates, most likely that pipeline will be executed and probably we’ll have a good year in banking. If there is a very volatile and very disruptive increase in interest rates, probably a couple of markets will suffer and it will be more difficult…. Probably we’re going to see some normalization next year across fixed income and equities.”

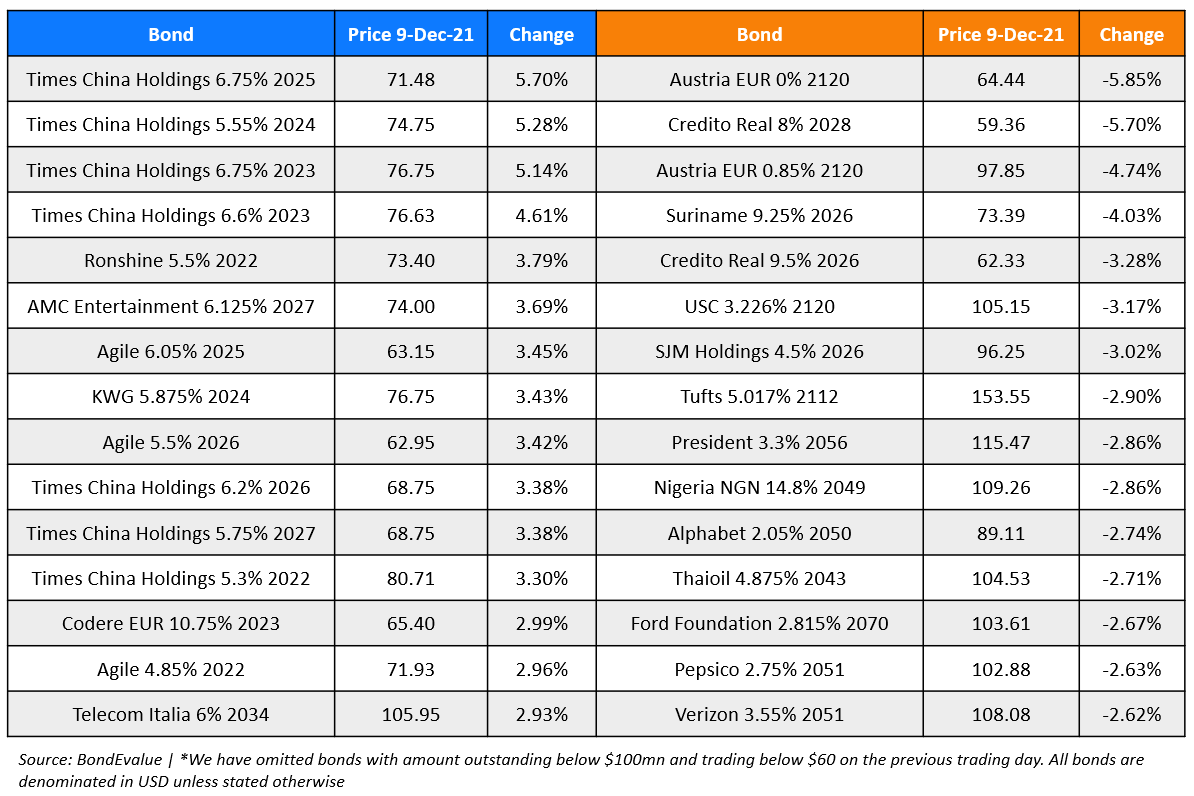

Top Gainers & Losers – 09-Dec-21*

Other Stories

Cenovus Energy May Keep Selling Assets After Hitting Debt Target

Go back to Latest bond Market News

Related Posts: