This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

December 6, 2021

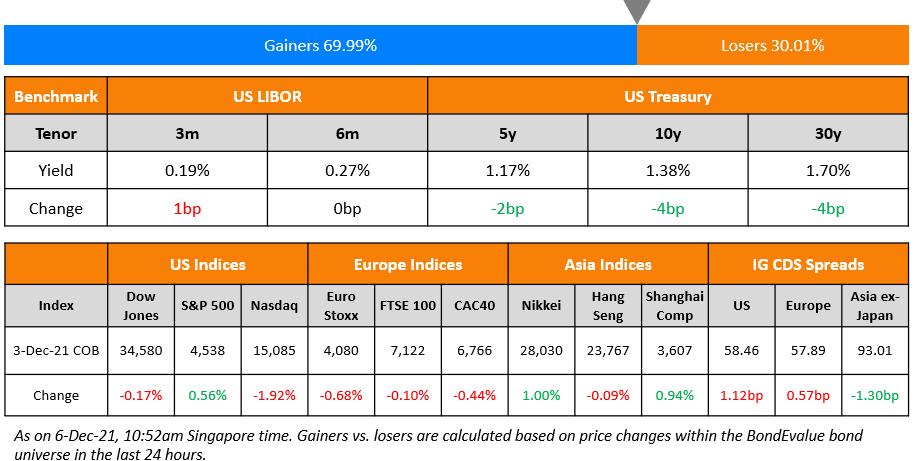

US equity markets dropped on Friday with the S&P and Nasdaq closing 0.8% and 1.9% lower respectively as Omicron jitters hit markets along with softer payrolls data. Most sectors were in the red led by Consumer Discretionary and IT, down over 1.7% each. US 10Y Treasury yields moved 4bp lower to 1.38% after falling over 10bp intra-day on Friday due to the risk-off sentiment and softer NFP data. European markets were lower too with the DAX, CAC and FTSE down 0.6%, 0.4% and 0.1% respectively. Brazil’s Bovespa was up 0.6%. In the Middle East, UAE’s ADX was closed while Saudi TASI was up 2.4% on Sunday. Asian markets have opened mixed – Shanghai and STI were up 0.4% and 0.8% while HSI and Nikkei were down 1.4% and 0.6% respectively. US IG CDS spreads widened 1.1bp and HY CDS spreads widened 7bp. EU Main CDS spreads were 0.6bp wider and Crossover CDS spreads were 2.4bp wider. Asia ex-Japan CDS spreads tightened 1.3bp.

Regarding November economic data, US NFP was softer than expected at 210k vs. forecasts of 550k while the Unemployment Rate came in lower at 4.2% vs. forecasts of 4.5%. Average Hourly Earnings came in softer at 0.3% MoM and 4.8% YoY vs. forecasts of 0.4% and 5% respectively, possibly indicating some slack in the labor market. ISM Non-Manufacturing for November came at a record 69.1 vs. forecasts of 65. Italy was upgraded to BBB by Fitch. Turkey’s inflation soared to 21.31% YoY, to a 3Y high vs. forecasts of 20.7%.

New Bond Issues

- Yantai Guofeng Investment Holdings Group $ 3Y at 2.7% area

- Junfeng International $ 3Y at 2.7% area

.png)

New Bonds Pipeline

- Greenko hires for $ 7Y bond

- Del Monte Pacific hires for $ 3NC2 bond

- SGSP (Australia) hires for $ green bond

- Ming Yang Smart Energy Group hires for $ green bond

- Wuxi Construction and Development Investment hires for $ green bond

Rating Changes

- Marfrig Global Foods S.A. Upgraded To ‘BB’ From ‘BB-‘ On Stronger Credit Metrics And Robust Liquidity; Outlook Stable

- Fitch Downgrades KWG to ‘B+’, Removes from UCO; Outlook Negative

- Fitch Revises Unicaja’s Outlook to Stable; Affirms IDR at ‘BBB-‘

- AES Andres B.V. Outlook Revised To Stable From Negative Following Similar Action On Sovereign; ‘BB-‘ Ratings Affirmed

Term of the Day

Risk-off

Risk-off is an indication of global market sentiment wherein investors switch out from risky assets (i.e. risk-off) into safer assets on the back of increased uncertainty. This can be due to geopolitical risk, poor economic data or a crisis. The most noteworthy risk-off event this year was in late March 2020, when fears about the coronavirus pandemic pushed financial markets lower across the board. Most typically, during a risk-off environment, US Treasuries and gold tend to perform better as they are considered safe haven assets. On the other hand, risk-on indicates positive investor sentiment wherein investors switch into risky assets (i.e. risk-on) from safer assets on improved prospects of economic growth. This can be due to improved political environment, strong economic data, strong corporate earnings, or a recovery from a crisis.

Talking Heads

On Faster Fed taper, earlier rate hikes in sight as unemployment falls

St. Louis Fed President James Bullard

“The danger now is that we get too much inflation… it’s time for the (Fed) to react at upcoming meetings… The inflation numbers are high enough that I think (ending the taper by March) would really help us to create the optionality to do more if we had to, if inflation doesn’t dissipate as expected in the next couple of months”

Barclays economists

“We think the Fed will view the economy as near full employment

Blackrock CIO Rick Rieder

“We think that it is clear that QE has overstayed its welcome… the next few months will be fertile with information on Omicron risks, supply and demand influences, a potentially moderately slowing demand for goods and services”

On Bond Market’s Faith in Fed Set For Biggest Test Since the 1980s

Jason Pride, CIO for private wealth at Glenmede Investment Management

“Our view is that inflation pressure will ease during the course of next year. In the near term, hotter inflation numbers will put pressure on the Fed to move faster.”

Bob Miller, head of Americas fundamental fixed income at BlackRock

“We have been short breakevens and they look a little more fairly priced. We expect CPI peaks by the end of the first quarter next year, and long-dated breakevens had reflected a view of higher inflation for longer than that.”

On Lagarde Saying 2022 Hike Unlikely But ECB Will Act If Needed

“When the conditions of our forward guidance are satisfied, we will not hesitate to act…A hump eventually declines (regarding inflation), and this is what we project for 2022. We believe that we are now at the high level of the hump and that it will start declining”

On China’s Special Bonds Can’t Halt Property-Led Investment Slump

Wei He, an analyst at Gavekal Dragonomics

“The positive factors such as money that hasn’t been spent this year will be countered by the negative impact from land sales… Therefore I do not expect a significant acceleration in infrastructure spending to materialize next year.”

On Credit Funds Signal More Pain as Record Cash Swamps Treasury ETF

Sameer Samana, Wells Fargo Investment Institute senior global market strategist

“There is some caution starting to seep in on the part of investors towards credit, given the tight spreads, omicron concerns, and the shift in the Fed’s focus from the labor market to inflation… You should see defensives perk up — it’s no surprise staples and utilities are outperforming.”

Peter Chatwell, head of multi-asset strategy at Mizuho International

“The trade here is to sell LQD and maybe sit on the cash for a while”

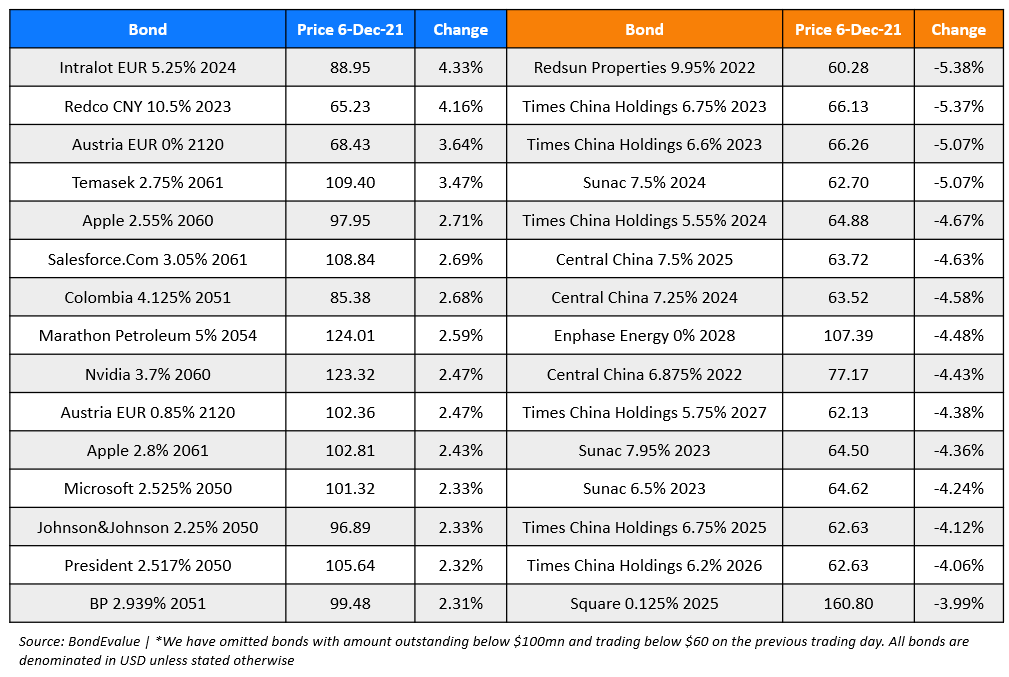

Top Gainers & Losers – 06-Dec-21*

Other Stories:

Repeat Chinese Defaulter Sunshine 100 Misses Another Payment

Go back to Latest bond Market News

Related Posts: