This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 18, 2021

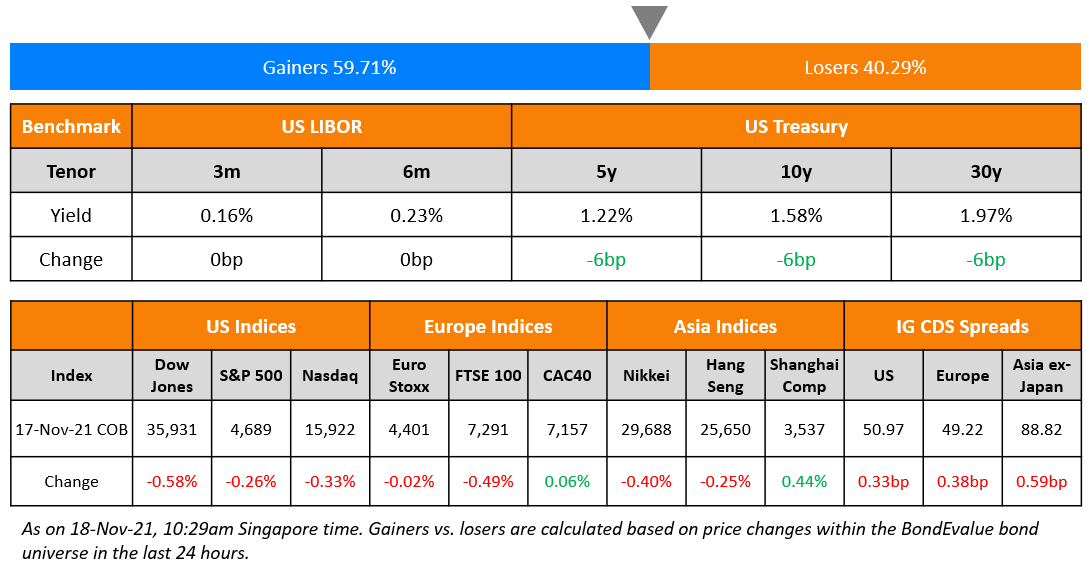

US equities ended lower with the S&P and Nasdaq down 0.3% each. Sectoral losses were led by Energy and Financials, down 1.7% and 1.1% each. US 10Y Treasury yields dropped 6bp to 1.58%. European markets were trading slightly weak with the DAX and CAC almost flat and the FTSE down 0.5% respectively. Brazil’s Bovespa ended 1.4% lower. In the Middle East, UAE’s ADX was down 0.2% and Saudi TASI was flat. Asian markets have opened broadly lower – Shanghai, HSI, and Nikkei were down 0.1%, 1.3%, 0.9% while STI was almost flat. US IG CDS spreads widened 0.3bp and HY CDS spreads were 3bp wider. EU Main CDS spreads were 0.4bp wider and Crossover CDS spreads were 1.9bp wider. Asia ex-Japan CDS spreads widened 0.6bp.

US crude oil weekly inventories saw a drawdown of 2.1mn bpd, significantly lower than forecasts of a pile-up of 1.4mn bpd. Brent however, was down ~3% and currently has dropped below $80.

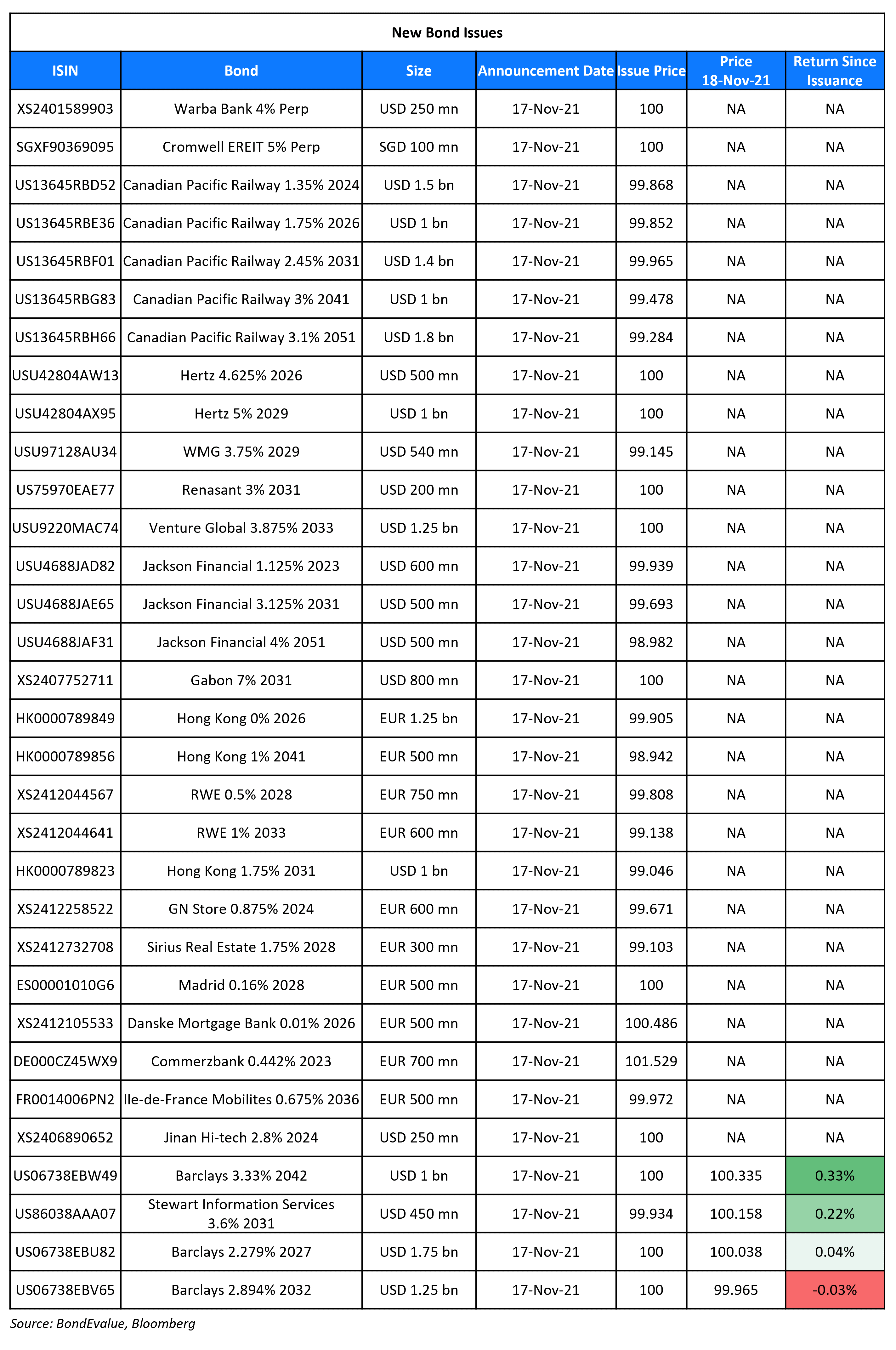

New Bond Issues

- Export-Import Bank of Malaysia $ 5Y at T+90bp area

- Sinochem Hong Kong $ 3/5Y at T+110/140bp area; Sinochem Hong Kong € 4Y at MS+120bp area

- Port of Newcastle $ 10Y at 6% area

- Taizhou State-owned Assets Investment $ 3Y at 2.35% area

- Renesas Electronics $ 3Y green / 5Y @ T+90/115bp area

Barclays raised $4bn via a three-trancher. It raised:

Barclays raised $4bn via a three-trancher. It raised:

- $1.75bn via a 6NC5 bond at a yield of 2.279%, 20bp inside initial guidance of T+125bp area

- $1.25bn via a 11NC10 bond at a yield of 2.894%, 20bp inside initial guidance of T+150bp area

- $1bn via a 21NC20 bond at a yield of 3.33%, 20bp inside initial guidance of T+150bp area

The bonds have expected ratings of Baa2/BBB/A. Proceeds will be used for general corporate purposes. The new 11NC10s were priced 8bp tighter to its 5.088% 2030s callable in June 2029 that yield 2.97%.

The Government of Hong Kong SAR raised $3bn via a dual-currency green three-trancher. It raised:

- $1.75bn via a 10Y bond at a yield of 1.855%, 27bp inside initial guidance of T+50bp area

- €1.25bn 0% five-year note priced at 99.905 to yield 0.019%, 20bp inside initial guidance of MS+30bp area

- €500mn via a 1% 20Y bond at a yield of 1.059%, 10bp inside initial guidance of MS+75bp area

The bonds have expected ratings of AA+/AA– (S&P/Fitch). Proceeds will be used exclusively to finance and/or refinance eligible projects under the government’s green bond framework. For the dollar bond, final order were at $2.9bn, 1.7x issue size – Asia took 72% and the Europe the remainder. Banks bought 63%, the public sector 21%, fund managers 10% and insurers 6%. Final combined orders for the euro tranches stood at over €2.2bn, 1.3x issue size. For the 5Y bond, Europe took 67% and the rest went to Asia. For the 20Y bond, Europe took 89% and the rest went to Asia. The 10Y USD bond was priced at a new issue premium of 6.5bp over its 1.375% 2031s that yield 1.79% in secondary markets.

Jinan Hi-tech Holding raised $250mn via a 3Y bond at a yield of 2.8%, 50bp inside initial guidance of 3.3% area. The bonds have expected ratings of BBB (Fitch), and received orders over $1bn, 4x issue size. Proceeds will be used to repay its existing $250mn 6.4% bonds due December 2021.

Warba Bank raised $250mn via a PerpNC5 Tier 1 sukuk at a yield of 4%, 37.5bp inside initial guidance of 4.375% area. The notes are unrated and issued by Warba Tier 1 Sukuk (2) Ltd. The notes have a first call on 29 November 2026, and if not called, the coupon will reset on 29 November 2026 and every five years thereafter to the prevailing US 5Y Treasury + 274.8bp. There is a dividend stopper.

Cromwell EREIT raised S$100mn via a PerpNC5 bond at a yield of 5%, 12.5bp inside initial guidance of 5.125% area. The bonds are unrated. The bonds have a coupon reset at the end of the fifth year on November 24, 2026, and every five years thereafter, to the prevailing 5Y SORA-OIS plus the initial credit spread of 361.5bp. There is no step-up. Cromwell EREIT can use the proceeds for financing or refinancing acquisitions, investments, asset enhancement projects, refinancing debt and general corporate needs.

Guotai Junan Securities raised $300mn via a 3Y Yulan bond at a yield of 1.619%, 40bp inside initial guidance of T+115bp area. The bonds have an expected rating of BBB+ by S&P. Guotai Junan Holdings is the issuer while the Shanghai and Hong Kong-listed parent is the guarantor. Proceeds will be used for debt refinancing and general corporate purposes. The bonds received orders over $1.2bn, 4x issue size. This is only the second issuance of Yulan bonds ever, after Bank of China, acting through its Hong Kong branch, printed the first Yulan bond raising $500m in January.

New Bonds Pipeline

- NTT hires for € bond

- Plaza Indonesia hires for $ 5NC3 sustainability-linked bond

Rating Changes

- Moody’s upgrades ratings of Hertz, assigns Caa1 to new senior unsecured notes; outlook remains stable

- Hertz Global Holdings Inc. Upgraded To ‘BB-‘, Outlook Stable; Senior Unsecured Notes Rated ‘B’

Term of the Day

Gender Bonds

Gender Bonds are bonds that are broadly issued to support the advancement, empowerment and equality of women. Like other themed bonds, they can be issued as senior unsecured notes referencing the issuer’s balance sheet where proceeds are for specific use on eligible ‘gender’ activities. Most bonds issued with a ‘gender’ label have so far relied on the ICMA’s Social Bond Principles, the UN’s Sustainable Development Goals or the UN Women’s Empowerment Principles as reference standards. Gender related areas include addressing financial inclusion of women, female entrepreneurship in emerging markets, access to leadership positions and gender-positive corporate policies. Turkey’s Garanti Bank was the first private sector bank in the world to launch a gender bond dedicated to financing women-owned small businesses in emerging markets in April 2019.

ICMA is trying to spur more gender bond issuances with new guidelines, including types of potential projects and gender-based targets.

Talking Heads

On Goldman’s Solomon Saying Market Greed Is Now Outpacing Fear

“When I step back and think about my 40-year career, there have been periods of time when greed has far outpaced fear — we are in one of those periods… My experience says those periods aren’t long lived. Something will rebalance it and bring a little bit more perspective… Chances are interest rates will move up, and if interest rates move up that in of itself will take some of the exuberance out of certain markets”

“We think that as lift-off gets under way, the slope is likely to increase as some of the uncertainties around the global economy, such as supply-chain bottlenecks, start dissipating”

On Worst yet to come for China’s housing market as new home prices fall by most in 6 years

Raymond Cheng, head of China and Hong Kong research at CGS-CIMB Securities

“China’s home price correction is likely to persist until the second quarter of 2022 because of a dip in the confidence of buyers… The worst for the property market is yet to come

Andy Lee Yiu-chi, chief executive for southern China at Centaline Property Agency

“The government data is lagging behind the market. New home prices in major cities have fallen by up to 15 per cent from the peak early this year…Home prices have not bottomed out. Buyers are staying on the sidelines, wary that builders may fail to deliver their homes on schedule”

On ECB Warning of exuberance’ in housing, junk bonds and crypto assets

“Concerns particularly relate to pockets of exuberance in credit, asset and housing markets as well as higher debt levels in the corporate and public sectors…A correction in markets could be triggered by a weaker than expected economic recovery, spillovers from adverse developments in emerging market economies, a re-intensification of stress in the non-financial corporate sector or abrupt adjustments in market expectations regarding the prospective path of monetary policy normalisation”

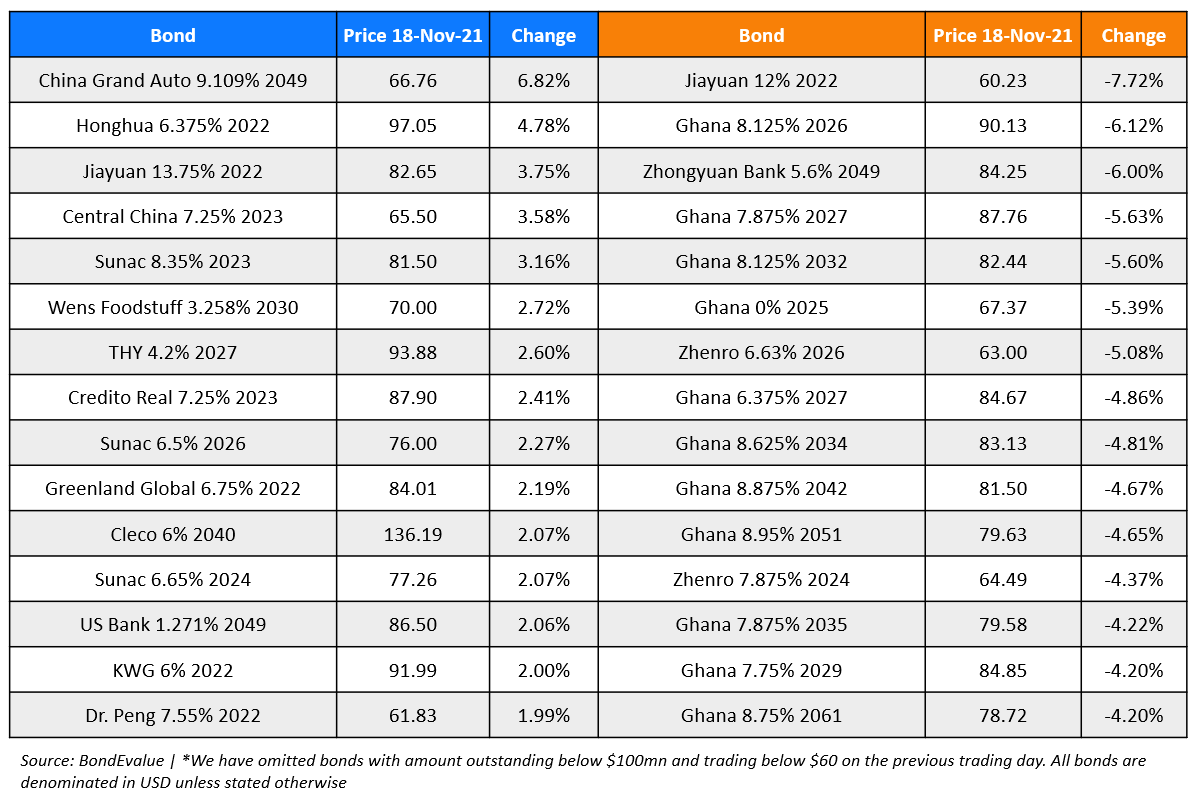

Top Gainers & Losers – 18-Nov-21*

Go back to Latest bond Market News

Related Posts: