This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 14, 2021

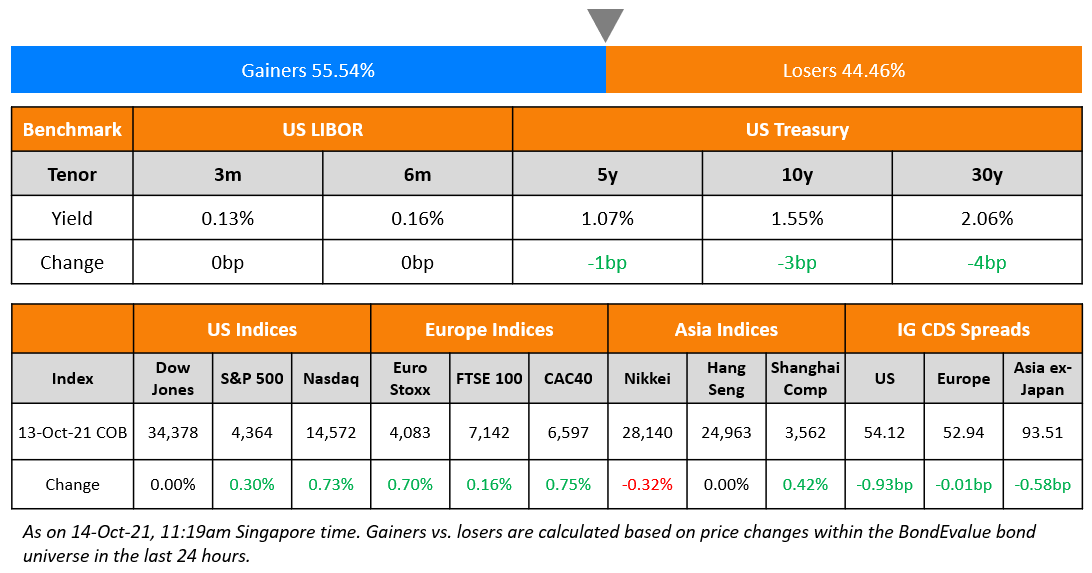

US equities closed in the green after three days of losses with the S&P and Nasdaq up 0.3% and 0.7%. Utilities led the gains by ending 1.1% higher with most sectors ending positive, while Financials were down 0.6% despite JPMorgan’s strong earnings (scroll below for details). US 10Y Treasury yields eased 3bp to 1.55%. European stocks were also higher with the DAX, CAC and FTSE up 0.7%, 0.8% and 0.2% respectively. Brazil’s Bovespa ended 1.1% higher. In the Middle East, UAE’s ADX was flat and Saudi TASI was up 0.7%. Asian markets are broadly mixed with Shanghai and STI flat while Nikkei was up 1%. HSI remains closed. US IG and HY CDS spreads tightened 0.9bp and 4.1bp respectively. EU Main CDS spreads were flat and Crossover CDS spreads tightened 2.2bp. Asia ex-Japan CDS spreads tightened by 0.6bp.

US CPI jumped 5.4% YoY in September, with the Core CPI up 4% YoY with food, rents and motor vehicle costs accounting for a bulk of the increase. The Federal Reserve’s September meeting minutes reinforced expectations for a tapering announcement at the next policy meeting in November.

New Bond Issues

.png)

Xinhu Zhongbao raised $250mn via a tap of 11% 2024s bond at a yield of 11%, inline with inside initial guidance of 11% final. The bonds have expected ratings of B– (S&P). The bonds are issued by Xinhu (BVI) 2018 Holding and guaranteed by Xinhu Zhongbao. The notes have an issuer call option and investor put option, both at par, which are exercisable on 28 September 2023. There is also an optional coupon step-up effective from that same date. This brings the total amount outstanding to $500mn. The existing 11% 2024s were trading at 100.05, yielding 10.96%.

Kookmin Bank raised €500mn via a 5Y green bond at a yield of 0.048%, 4bp inside initial guidance of MS+18bp area. The bonds have expected ratings of AAA/AAA (S&P/Fitch), and received orders over €1bn, 2x issue size. Proceeds will be used to finance or refinance projects that fall under green eligible categories as defined by the bank’s sustainable financing framework.

Nanyang Technological University raised S$650mn via a 15Y sustainability-linked bond at a yield of 2.185%, 16.5bp inside the initial guidance of 2.35% area. The bonds have expected ratings of Aaa (Moody’s). NTU has set a sustainability performance target to achieve carbon neutrality for its Yunnan campus by 2035 by reducing gross carbon emissions intensity by at least half from a baseline in 2019. If it fails to meet that target, it will have to make a one-time payment of 50bp of the outstanding aggregate principal amount when the bond matures. This money will either be used to make additional investment in research on climate research and technologies on climate change mitigation, or to buy renewable energy certificates or certified carbon offsets.

Nanjing Jiangning Economic and Technological Development raised $210mn via a 364-day bond at a yield of 2.9%, same as initial guidance. The bonds have expected ratings of BBB (Fitch). The bonds will be issued by Jiangning Jingkai Overseas Investment. Nanjing Jiangning Economic and Technological Development Group has provided a keepwell.

New Bonds Pipeline

- Sumitomo Mitsui Trust Bank hires for € 7Y bond

- China plans for $ 4bn 3/5/10/30Y bond

Rating Changes

-

Fitch Upgrades Ukreximbank’s VR to ‘b-‘; Affirms IDR at ‘B’/Positive

- Moody’s downgrades Sinic to Ca; outlook negative

- Greenland Holding Downgraded To ‘B+’, Greenland HK To ‘B’ On Impaired Funding, Weak Operating Conditions; Outlook Neg

- E-House Downgraded To ‘B’ On Tough Operating Conditions And Tightening Liquidity; Outlook Negative

- Melco Resorts And Studio City Downgraded On Slow Recovery In Macau’s Gaming Revenue; Outlook Negative

- Wynn Resorts Ltd. Ratings Lowered On Slow Recovery In Macau’s Gaming Revenue, Removed From CreditWatch; Outlook Negative

-

Fitch Revises Outlook on Australia to Stable; Affirms at ‘AAA’

- Moody’s changes ConocoPhillips’ rating outlook to positive, affirms A3 rating

Term of the Day

Put Option

A put option gives the buyer of the option the right but not the obligation to sell the underlying instrument at a particular price known as the strike price at expiration. Put options in bonds are in the hands of the bondholders unlike call options, which lie with the issuer. Exercising a put would require the issuer to redeem the bonds at the predefined price on the put date, leading to a cash outflow.

Talking Heads

According to the Federal Open Market Committee meeting minutes

“Participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate.” “Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.” “Most participants saw inflation risks as weighted to the upside because of concerns that supply disruptions and labor shortages might last longer and might have larger or more persistent effects on prices and wages than they currently assumed.”

Michael Pond, head of global inflation market strategy at Barclays

“There is a bit of a pivot happening where there is a worry that transitory inflation might be transitioning to concern that it might be structural.” “Even the doves on the committee want to make sure that inflation expectations and financial conditions don’t start to cause alarm.”

Ian Shepherdson, chief economist at Pantheon Macroeconomics

“The minutes make it clear that the Fed will announce tapering at the next FOMC meeting, on Nov. 2-3, unless disaster strikes.”

“With end-2021 in sight, growth expectations are lower, and inflation expectations are in the driving seat,” Major said. “But our forecast and our methodology are very much looking at the longer-term drivers. There’s a difference between predicting climate change and a weather forecast.” “I understand people are concerned about inflation, and I’m not being dismissive about it.” “But I just think that what drives the current narratives is not going to change our longer-term outlook. Something temporary should not change one’s fundamental view. We will only change our view on this if we can put together a constructive piece of work that shows all the central bank’s models are wrong.”

On the legal options for Evergrande’s offshore creditors

Matthew Chow at S&P Global Ratings

“The fundamental question in front of investors is whether the keepwell agreement is enforceable and what difference that may make in the recovery process should the group default.”

David Billington, restructuring partner at Cleary Gottlieb Steen & Hamilton

“Instead of enforcing the keepwell itself, the bondholders could put the offshore issuer company into liquidation or other insolvency process.” “Instead of giving a judgment requiring a payment directly to a bunch of foreign creditors, the Chinese court would just be upholding a promise that a mainland parent gave to its subsidiary, which it failed to perform on.”

Karl Clowry, restructuring partner at Addleshaw Goddard

“Evergrande is almost like a quasi-sovereign debt restructuring in that the significant stakeholders and the authorities are no doubt dictating what should be done, although with the sponsor still in place,” he said. “The hand of the government and authorities is never far away.”

Alberto Fernandez, Argentina President

“We want to reach that agreement as soon as we have the right conditions.”

Martin Guzman, Argentine Economy Minister

According to Guzman, he hopes the IMF would take steps to change its “ethos” to one “shaped by global financial powers that contributed to a more unequal and insecure world, for another favoring the sustainable development of the people.”

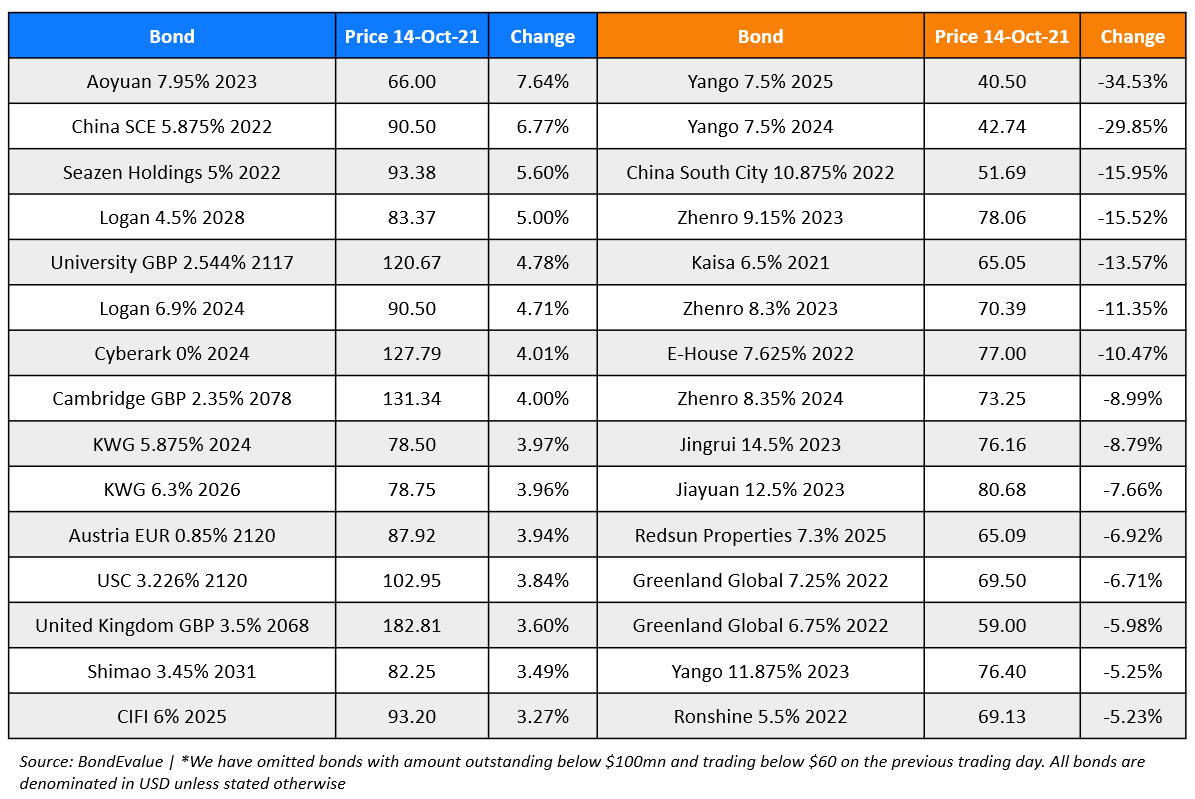

Top Gainers & Losers – 14-Oct-21*

Go back to Latest bond Market News

Related Posts: