This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

June 9, 2023

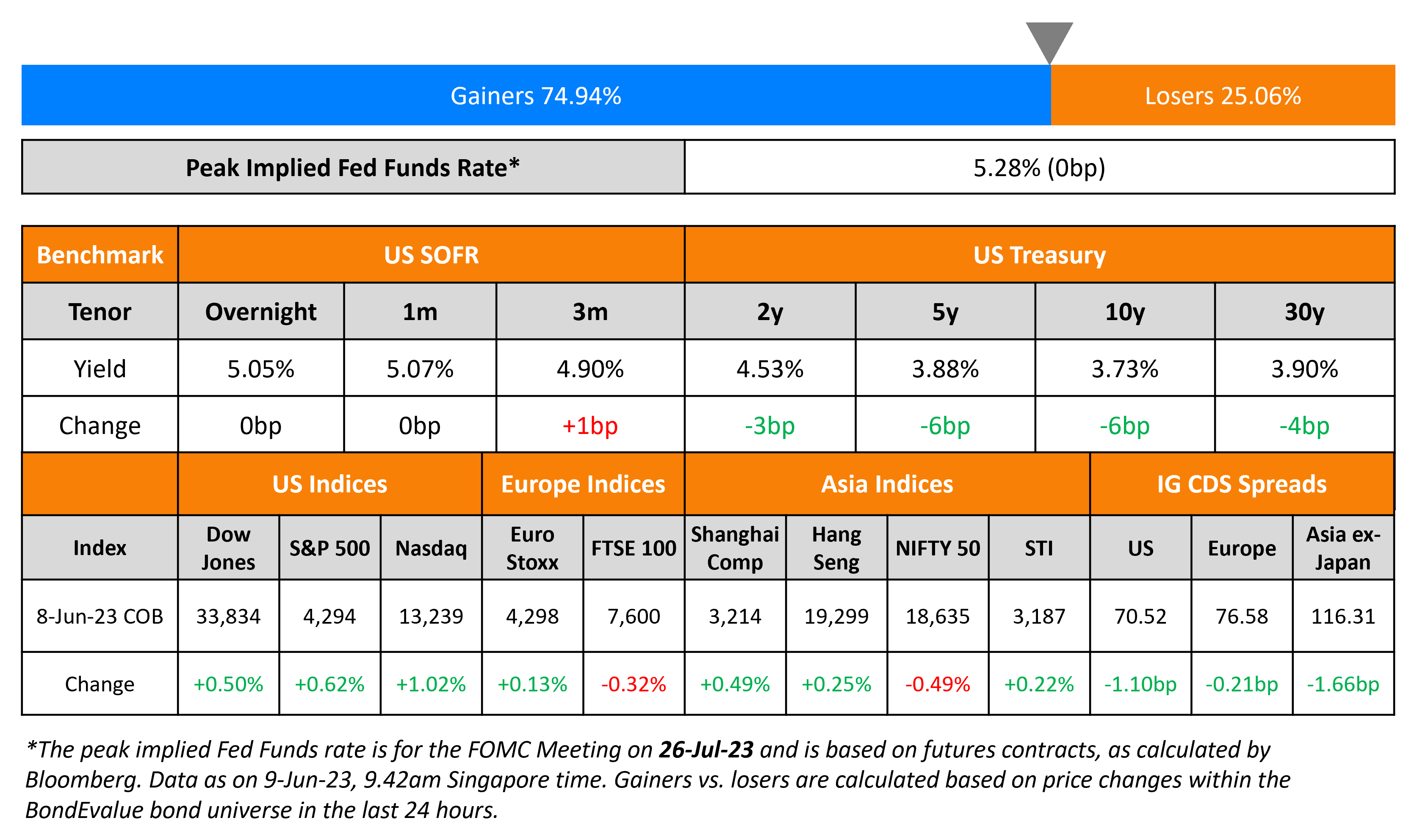

US Treasury yields moved lower on Thursday following the weekly jobs data with the 5Y and 10Y yields down 6bp each. Initial jobless claims for the prior week jumped 28k to 261k, the highest level since October 2021, and well above the 235k forecast. Expectations continue for a status quo at the 13-14 June FOMC meeting while markets are pricing-in a 66% probability of a 25-50bp rate hike in the July meeting. The peak Fed Funds Rate was unchanged at 5.28% for July. Equity indices ended higher yesterday with the S&P and Nasdaq up by 0.6% and 1%. US IG and HY CDS spreads tightened 1.1bp and 7.6bp respectively.

European equity indices closed higher too. European main CDS spreads tightened 0.2bp and Crossover spreads were 1.6bp tighter. Asia ex-Japan CDS spreads saw a 1.7bp tightening and Asian equity markets have opened with a positive bias this morning.

Exclusive Event for BondEvalue Subscribers in Dubai | 19 June

New Bond Issues

EDF raised $1.5bn via a PerpNC10 Hybrid bond at a juicy yield of 9.125%, a strong 62.5bp inside initial guidance of 9.75% area. The junior subordinated bonds have expected ratings of Ba2/B+/BBB-. Proceeds will be used for general corporate purposes, including the potential refinancing of its 5.625% Perps callable in January 2024 that are currently trading at 99.5, up from 97.8 earlier this week. The bonds also have a make-whole call (Term of the Day, explained below) at 50 until June 2033.

Santander USA raised $500mn via a 6NC5 bond at a yield of 6.565%, 15bp inside initial guidance of T+285bp area. The senior unsecured bonds have expected ratings of Baa3/BBB+/BBB+. Proceeds will be used for general corporate purposes. The bond will reset at the overnight SOFR + 270bp in June 2028 and coupons will be paid quarterly thereafter.

NatWest raised $1.25bn via a 6.25NC5.25 bond at a yield of 5.808%, 30bp inside initial guidance of T+225bp area. The senior unsecured bonds have expected ratings of A3/BBB+/A. Proceeds will be used for general corporate purposes. The bond will reset to the US 5Y Treasury + 195bp in September 2028 if not called. The new bonds offer a small new issue premium of 2.8bp over its existing 4.892% 2029s, callable in 2028, that yield 5.78%.

CapitaLand Integrated Commercial Trust (CICT) raised S$400mn via a 7Y green bond at a yield of 3.938%, 26.2bp inside initial guidance of 4.2% area. This is the first SGD-denominated green bond from the Singapore-based group. The bonds have expected ratings of A3 (Moody’s). The senior unsecured notes are guaranteed by HSBC Institutional Trust Services Singapore Ltd (rated A3/A-). Proceeds will be used to finance/refinance eligible green projects undertaken by CICT and its subsidiaries in accordance with CICT’s green finance framework.

New Bonds Pipeline

- United Airlines hires for bond

- SK Broadband hires for $ 3Y or 5Y bond

- Pertamina Geothermal hires for bond

- H&H International hires for $ 3Y bond

Rating Changes

- Moody’s upgrades US Foods’ CFR to Ba3

Term of the Day

Make Whole Call

A Make Whole Call (MWC) is a type of call option on a bond that gives the issuer the right to redeem a bond before its maturity date by compensating (making whole) bondholders for future coupon payments. MWC provisions were introduced in the 1990s and are rarely exercised by issuers. If exercised, the issuer has to pay a lump sum amount to the bondholders that represent the net present value of future foregone coupon payments, typically stated as a formula in the bond prospectus.

MWCs are different from traditional call options in that investors are compensated for foregoing future coupon payments. With traditional call options, the issuer can exercise the call option at the predefined call price without having to pay bondholders for foregoing future coupons. This makes MWCs beneficial to bondholders as compared to traditional call options and are typically expensive for the issuer to exercise.

Talking Heads

On Pakistan’s Expected Interest Rate Pause Amid High Inflation

Uzair Younus, Director of the Pakistan Initiative at the Atlanic Council’s South Asia Center

“They’ll point to a ‘plateauing of inflation’ as evidence that rates don’t need to go up.”

Fahad Rauf, head of research at Ismail Iqball Securities

“The inflation readings are expected to fall due to high base effect…We expect 30% inflation for June 2023 vs 38% in May.”

Shivaan Tandon, economist at Capital Economics

“The central bank cannot afford the luxury of keeping the policy rate on hold given the need to tame record high inflation and support the currency through monetary tightening…Rate hikes may also prove to be a signal to potential creditors about the authorities’ commitment towards resolving external imbalances.”

On ECB’s Expected Rate Hikes in June and July

Carsten Brzeski, global head of macro at ING

“A 25 basis point rate hike looks like a done deal for next week’s meeting…the ECB is fully determined right now to err on the side of higher rates.”

Mark Wall, chief Europe economist at Deutsche Bank

“The ECB might not be convinced by the September meeting inflation is declining sufficiently to pause.”

“If inflation does prove to be more persistent than expected, then the Fed may need to push interest rates higher for longer… see challenges over the medium term for the global economy, and that requires policy measures to be taken now…central banks should stay the course on monetary tightening to decisively reduce inflation… Fed would need to stay the course on monetary policy to ensure a durable reduction in inflation”

On the Euro Zone Technical Recession – Analysts at Oxford Economics

“Domestic demand is not in a good place…Going forward, growth will remain soft despite dropping wholesale energy prices, as monetary policy tightening dents investment and still-present inflationary pressures constrain consumption.”

Top Gainers & Losers – 09-June-23*

Go back to Latest bond Market News

Related Posts:-1.png)