This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

June 7, 2023

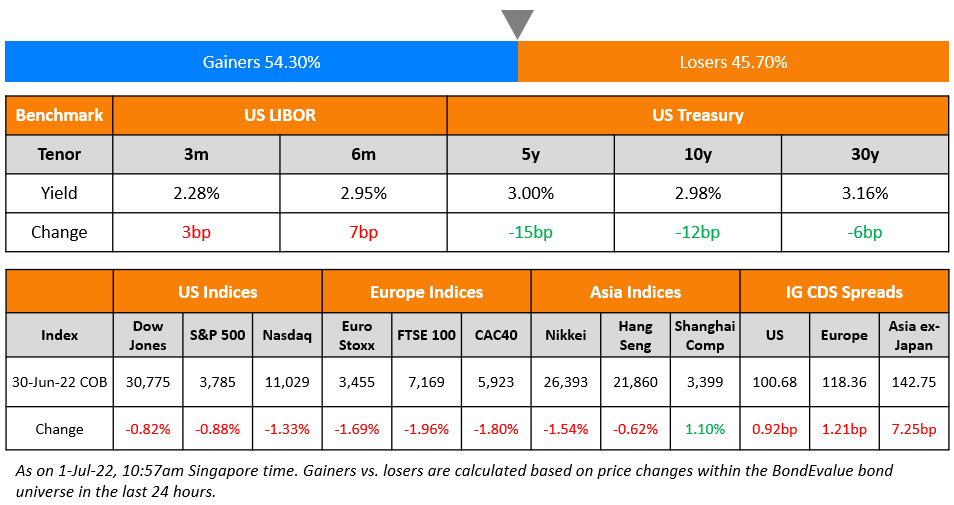

US Treasury yields were rangebound on Tuesday with no major data releases. Markets continue to price-in a status quo at the Fed’s June meeting with an 81% probability and for July, CME probabilities indicate a 25bp rate hike in July with a 51% probability. The peak Fed Funds Rate was 1bp lower at 5.26% for July. Equity indices moved marginally higher on Tuesday as the S&P and Nasdaq rose 0.2-0.4%. US IG and HY CDS spreads tightened 0.8bp and 5.5bp respectively.

European equity indices closed higher too. European main CDS spreads tightened 1.1bp and Crossover spreads were 7.4bp tighter. Asia ex-Japan CDS spreads saw a 1.1bp widening and Asian equity markets have opened broadly higher this morning.

Exclusive Event for BondEvalue Subscribers in Dubai | 19 June

New Bond Issues

-

ASB Bank $ 3Y at T+130bp area

National Australia Bank (NAB) raised $2.5bn in a three-part deal. It raised:

- $850mn via a short 2Y bond at a yield of 5.208%, 25bp inside initial guidance of T+95bp area. The new bonds offer a new issue premium of 14.8bp over its existing 1.388% 2025s that yield 5.06%.

- $650mn via a short 2Y FRN bond at a yield of 5.841%.The floating coupon will be set at the overnight SOFR + 76bp, and will be paid quarterly. The new floater was priced 53.1bp wider to its existing 5.402% floating 2025s that currently yield 5.31%.

- $1bn via a 5Y bond at a yield of 4.939%, 25bp inside initial guidance of T+135bp area.

The bonds have expected ratings of Aa3/AA-. Proceeds will be used for general corporate purposes.

CMB London raised $400mn via a 3Y floating rate blue bond at a yield of 5.742%, 45bp inside initial guidance of SOFR+110bp area. The floating coupon will be set at the overnight SOFR + 65bp, and will be paid quarterly. The senior unsecured bonds have expected ratings of A2 (Moody’s). Proceeds will be used to finance/refinance sustainable water or marine development related eligible green projects as per China Merchants Bank’s green, social and sustainability bond framework.

Guatemala raised $1bn via a 13Y bond at a yield of 6.6% in line with initial guidance of 6.6% area. The bonds have expected ratings of Ba1/BB/BB. The bonds have a 3-month par call, as well as a make-whole call. It will also have three equal amortizations in 2034, 2035 and 2036. Proceeds will be used for general budgetary purposes.

Hangzhou Shangcheng raised $200mn via a 364-day bond at a yield of 5.9%, 40bp inside initial guidance of 6.3% area. The senior unsecured bonds have expected ratings of BBB (Fitch). Proceeds will be used for refinancing existing debt, project construction and general corporate purposes.

Zhongtai International raised $200mn via a 2Y bond at a yield of 6.7%, 30bp inside initial guidance of 7% area. The bonds are expected to be unrated. That said, the senior unsecured notes are guaranteed by its parent company, Zhongtai Financial International Ltd. and Zhongtai Securities Co Ltd (rated Baa3/BBB-) has provided a keepwell. The bonds also have a change of control put (Term of the Day, explained below) at 101. Proceeds will be used to refinance the principal of medium and long-term offshore bonds due in August 2023.

New Bonds Pipeline

- Spain hires for € Long 10Y bond

- EDF hires for bond

- SK Broadband hires for $ 3Y or 5Y bond

- Pertamina Geothermal hires for bond

- Commercial Bank of Dubai plans debut green bonds

- H&H International hires for $ 3Y bond

Rating Changes

- Unigel Participacoes S.A. Downgraded To ‘CCC+’ From ‘B+’ And Placed On CreditWatch Negative On Debt Restructuring Risk

Term of the Day

Change of Control Put

A change of control put is a common covenant in bond offerings, mentioned in the bond’s prospectus. Bonds that carry a change of control put offer bondholders the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of a change of control event, which is typically a change in ownership of the issuer. The option to redeem the bonds in this case lies with the bondholder, as against a call option, which lies with the issuer, not the bondholder.

Talking Heads

On Bond Returns Amid a Delay in Rate Cuts

Mark Kiesel, chief investment officer for global credit at Pimco

“We haven’t seen this return potential in bonds in 14 years. We don’t think these yields will be here a year from now.”

Dan Ivascyn, chief investment officer at Pimco

“(The) most attractive asset is agency mortgages…(they are trading at) record-wide spreads…We do think there’s going to be disappointment (in senior secured loans and private credit)…Stay away from those sectors today until they reprice.”

On Adani’s Improving Debt Metrics – Lakshmanan R, senior research analyst at CreditSights

“We have observed an improvement in credit metrics for a majority of the Adani Group companies in FY23 versus FY22, while a couple of them have managed to keep their credit metrics stable or seen only a modest deterioration.”

He stressed that the CreditSights figures for Adani were still “materially weaker” than those the company itself reported, due to different methodologies.

“We are also wary of the Group’s lingering corporate governance headwinds,” he said. The research firm also sees “some execution risks to the Group’s external fundraising plans that could pose debt refinancing risks for select upcoming debt maturities.”

On the Possibility of Lower Long-Term Interest Rates Returning

Gene Tannuzzo, global head of fixed income at Coloumbia Threadneedle Investments

“I’d argue the Fed is regaining their inflation credibility, slowly…As they get inflation closer to the target, their long-run rate will again serve as a credible anchor for yields.”

Kenneth Rogoff, an economist at Harvard University

Rates will settle at a higher level over the longer haul tanks to factors including costlier supply chains and stepped-up defense spending.

Donald Ellenberger, senior portfolio manager at Federated Hermes

“Over the next couple years we think long-term rates should be lower…If the Fed is serious about getting inflation down to 2% it’s going to take a recession to do it. And recessions usually result in a flight-to-quality buying of Treasuries.”

Jim Grant, founder of “Grant’s Interest Rate Observer”

“(I see a) long cycle of rising rates (ahead).”

On Second-Round Effects Keeping Inflation High – ECB Governing Council Member Klaas Knot

“Energy prices have found their way into other items in the consumer basket, and wages and services in particular have taken over the inflation torch…It is likely that price pressures in these areas will prove more difficult to bring down…Because inflation was high for a long period, underlying inflationary pressures have built up…As a consequence, we now observe second-round effects.”

On Global Banks’ Estimates on Turkish Interest Rate Hike this Month as well as Key Rates beyond June

JPMorgan Chase & Co. and Barclays Plc believe a hike of 16.5 percentage points will be on the table. This is more than twice what Societe Generale SA expected.

In terms of forecasts on the central bank’s key rates beyond June, Societe Generale predicts two consecutive increases of five percentage points that follow a 6.5 percentage-point move on June 22, bringing the benchmark to 25% in August from its current 8.5%. On the other hand, Barclays forecast that the key rate will be 35% in October, whereas for JPMorgan this forecast is 30% at the end of the year.

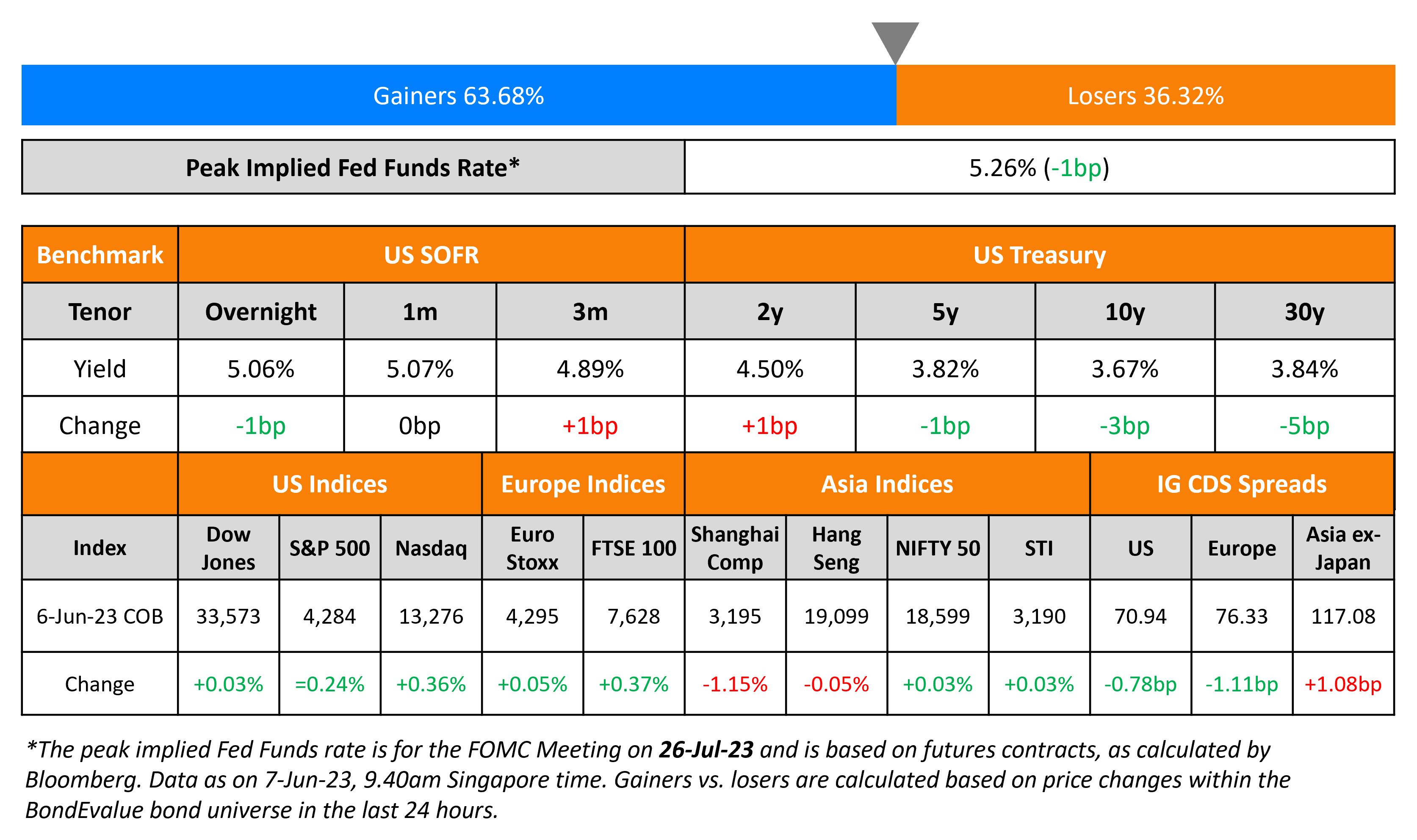

Top Gainers & Losers – 07-June-23*

Other News

PDVSA bondholders dismiss claims that Citgo-backed notes are invalid

Go back to Latest bond Market News

Related Posts:-1.png)