This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

June 6, 2023

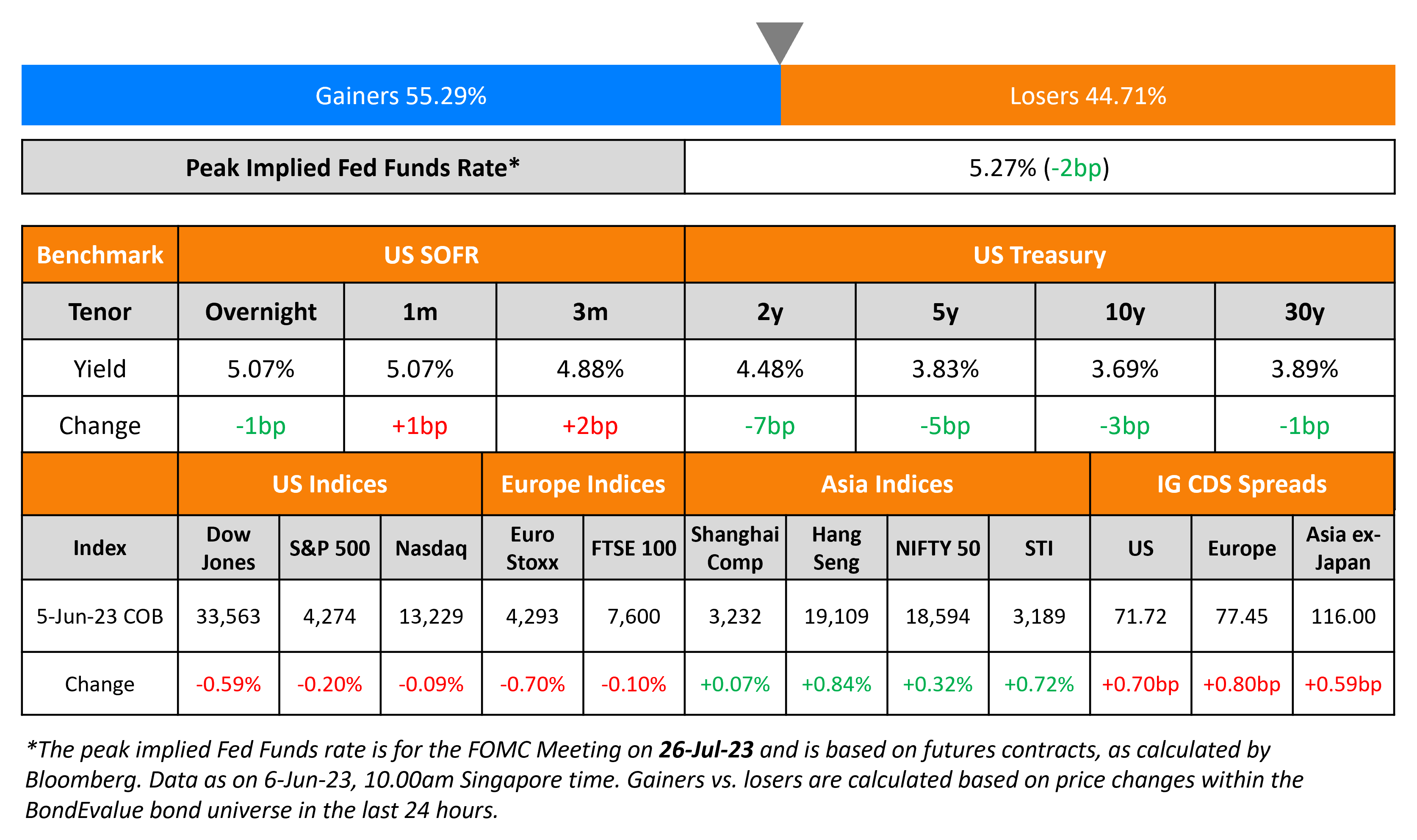

US Treasury yields dipped across the curve after the US ISM Services report delivered a negative surprise. The ISM Services Index saw a decline in May to 50.3 vs. expectations of a 52.4 print. The prices paid index witnessed a 3.4 point drop to a three-year low of 56.2, indicating some easing in price pressures across the services sector.

Markets continue to price-in a status quo at the Fed’s June meeting with an 82% probability vs. 70% yesterday, For July, CME probabilities indicate a 25bp rate hike in July with a 53% probability. The peak Fed Funds Rate was 2bp lower at 5.27% for July. Equity indices moved marginally lower on Monday as the S&P and Nasdaq declined 0.1-0.2%. US IG and HY CDS spreads widened 0.7bp and 3bp respectively.

European equity indices closed lower too. European main CDS spreads widened 0.8bp and Crossover spreads were 5.3bp wider. Asia ex-Japan CDS spreads saw a 0.6bp widening and Asian equity markets have opened slightly higher this morning.

Exclusive Event for BondEvalue Subscribers in Dubai | 19 June

New Bond Issues

- CMB London $ 3Y Blue FRN at SOFR+110bp area

- NAB $ Short 2Y/5Y FRN at T+95/SOFR+135 area

- Zhongtai International $ 2Y at 7% area

- Hangzhou Shangcheng $ 364-Day at 6.3% area

BNP Paribas raised $1.5bn via a 6NC5 bond at a yield of 5.335%, 25bp inside initial guidance of T+175bp area. The senior preferred bonds have expected ratings of Aa3/A+/AA-. The new bonds offer a small new issue premium of 1.5bp over its existing 5.125% 2029s, callable in 2028, that yield 5.32%.

Scotiabank raised $2.25bn via a three-part deal. It raised

- $1.1bn via a 2Y bond at a yield of 5.468%, 25bp inside initial guidance of T+125bp area.

- $400mn via a 2Y FRN at a yield of 6.192%. The floating coupon will be set at the overnight SOFR+109bp, and will be paid quarterly.

- $750mn via a 5Y bond at a yield of 5.289%, 23bp inside initial guidance of T+170bp area.

The senior unsecured bonds have expected ratings of A2/A-/AA-. The fixed rate bonds also have make-whole call (MWC) clauses. Proceeds will be used for general corporate purposes.

Ford raised $1.75bn via a two-tranche deal. It raised $900mn via a 3Y bond at a yield of 6.95%, 17.5bp inside initial guidance of 7.125% area. The new bonds offer a new issue premium of 22bp over its existing 6.95% 2026s that yield 6.73%. It also raised $850mn via a 7Y bond at a yield of 7.2%, also 17.5bp inside initial guidance of 7.375% area. The new bonds offer a new issue premium of 26bp over its existing 7.35% 2030s that yield 6.94%. The senior unsecured bonds have expected ratings of Ba2/BB+/BB+. Additionally, the bonds have make-whole calls. Proceeds will be used for general corporate purposes.

Macquarie raised $1.75bn via a three-part deal. It raised:

- $700mn via a 3Y bond at a yield of 5.208%, 25bp inside initial guidance of T+135bp area. The new bonds offer a new issue premium of 25.8bp over its existing 3.9% 2026s that yield 4.95%.

- $300mn via a 3Y FRN at a yield of 6.342%. The floating coupon will be set at the overnight SOFR+124bp, and will be paid quarterly.

- $750mn via a 11NC10 bond at a yield of 5.887%, 15bp inside initial guidance of T+235bp area. After the call date, the coupon will reset at the overnight SOFR rate plus a spread of 238bp and will be paid quarterly until the maturity date. The bonds offer a 68bp yield pick-up over JP Morgan’s recently issued 5.35% 11NC10 bonds rated A1/A-/AA- that are yielding 5.2%.

Both 3Y tranches are issued at the Opco level by Macquarie Bank and have expected ratings of A1/A+/A. Meanwhile, the 11NC10s have expected ratings of A2/BBB+/A because they are issued by Macquarie Group, at the Holdco level. Proceeds will be used for general corporate purposes.

Santander raised €1bn via a 7Y senior preferred bond at a yield of 4.268%, 25bp inside initial guidance of MS+150bp area. The bonds have expected ratings of A2/A+/A, and received orders over €1.7bn, 1.7x issue size.

Zhejiang Changxing raised $160mn via a 3Y bond at a yield of 6.95%, 20bp inside initial guidance of 7.15% area. The bonds are not expected to be rated by the three major rating agencies and have a change of control put at 101. Proceeds will be used for repayment of the group’s existing offshore debt.

New Bonds Pipeline

- Commercial Bank of Dubai plans debut green bonds

- H&H International hires for $ 3Y bond

- BGK hires for $ 10Y bond

- GS Caltex hires for bond

- Unicredit hires for € Long 3Y/Long 7Y bond

Rating Changes

- NVIDIA Corp. Upgraded To ‘A+’ As It Is Set To Benefit From A Strong AI Investment Cycle; Outlook Stable

- Dalian Wanda Commercial Downgraded To ‘BB’ On Parent’s Weakening Liquidity; Ratings Remain On CreditWatch Negative

- Moody’s changes British Airways’ outlook to positive from stable and affirms Ba2 CF

Term of the Day

Blue Bond

Blue bonds are a type of sustainable debt wherein the proceeds from such issuance are earmarked for marine/water projects related to ocean conservation (hence the name blue bonds). These are similar to green bonds, which are earmarked for green or environmentally-friendly projects. Blue bonds became popular in late 2018 when Seychelles issued the world’s first sovereign blue bond.

China Merchants Bank has launched a 3Y blue bond at SOFR+110bp area.

Talking Heads

“So I speculate that we are embarked on a long cycle of rising rates…it would not surprise me at all if we were embarked on something resembling a generation length bear market in bonds, meaning rising yields and falling prices that would fit the form.”

On Price Pressures and ECB Rate Hike – ECB President Christine Lagarde

“Price pressures remain strong… Our future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our 2% medium-term target and will be kept at those levels for as long as necessary…In my view, it’s by no means certain that inflation will peak as early as this summer.”

On ECB Rate Hike – Bundesbank President Joachim Nagel

“From today’s perspective, several more rate hikes are still necessary…For me, it is not certain that we will reach the interest rate peak in the summer. Underlying pricing pressures are also far too high and so far show little sign of abating…We have to be even more persistent than the current inflation.”

On UniCredit Replacing AT1 Bonds – UniCredit CEO Andrea Orcel

“We have a very high level of capital and of our total Tier1 (capital), less than 9 per cent is AT1s…we called back the 1.25 billion euro (AT1 bond) that we had in June and won’t replace it until the market stabilises.”

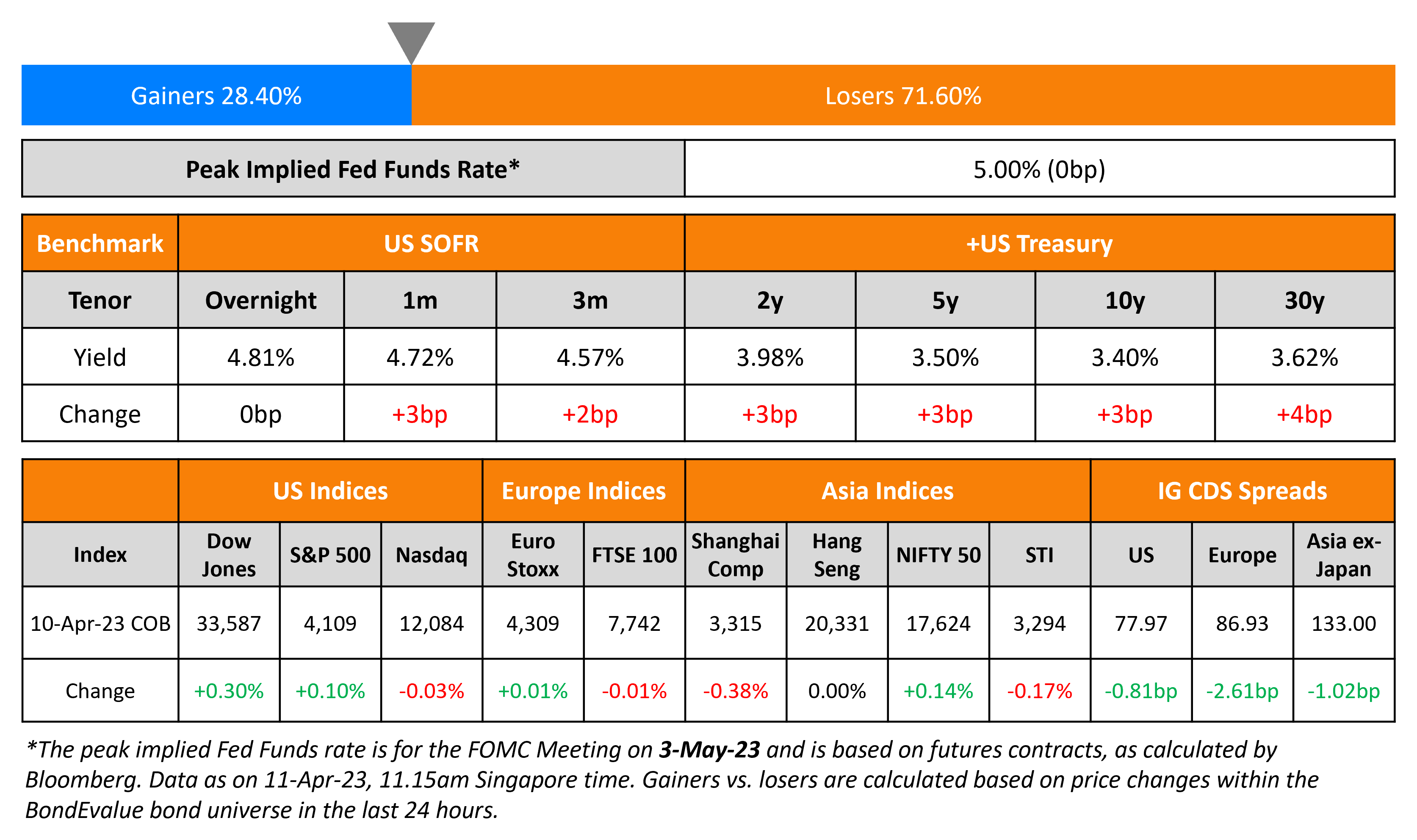

Top Gainers & Losers – 06-June-23*

Other News

Dell Technologies Sales Fall On Soft Demand For Infrastructure, Commercial PC

Go back to Latest bond Market News

Related Posts:-1.png)