This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 14, 2023

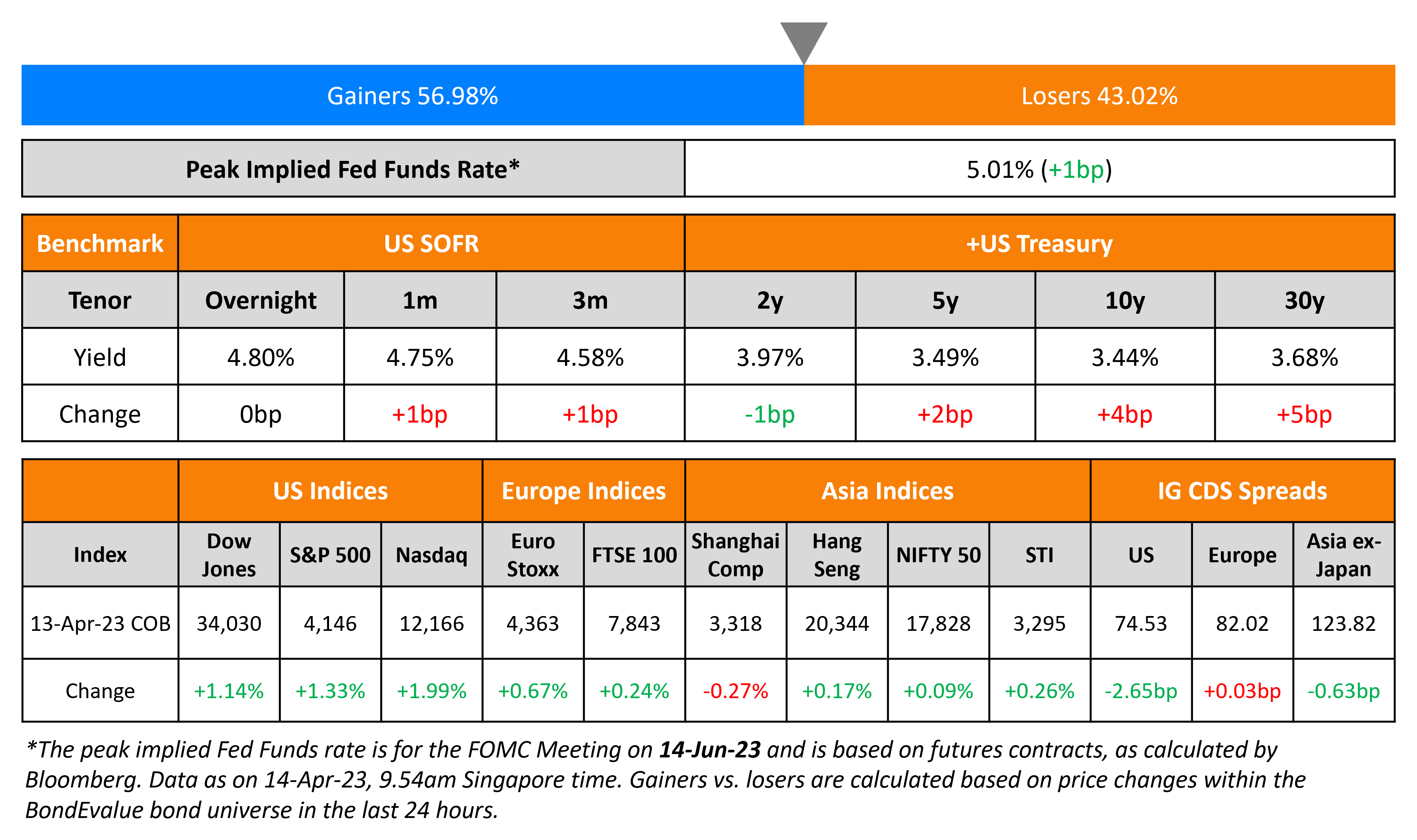

US Treasury yields were stable with the 2Y yield down 1bp and the 10Y yield up 4bp. The peak Fed funds was 1bp higher at 5% and the probability of a 25bp rate hike in the May meeting is just slightly lower at 68% as compared to 71% going by the CME’s maximum probabilities. US initial jobless claims for the prior week edged higher to 239k, above estimates of 235k. US headline PPI for March saw a 2.7% YoY rise with a 6.4% drop in energy costs as compared to a 4.9% print the month prior. This was the smallest YoY rise since Jan’21. Core PPI fell to 3.4% YoY, lower than the 4.8% in the previous month, showing some signs of easing inflation. US IG and HY CDS spreads tightened 0.8bp and 15.4bp respectively. US equity indices rallied with the S&P and Nasdaq higher by 1.3% and 2%.

European equity markets ended slightly higher. European main CDS spreads and Crossover spreads were almost unchanged. Asia ex-Japan CDS spreads tightened by 0.6bp. Asian equity markets have opened in the green this morning.

New Bond Issues

-

Jinan Energy Group $ 364-Day Green at 6.5% area

ABN AMRO raised €2.75bn via a dual-trancher. It raised:

- €1.5bn via a 2Y senior preferred bond at a yield of 3.805%, 30bp inside initial guidance (Term of the Day, explained below) of MS+65bp area. The bonds have expected ratings of A1/A/A+

- €1.25bn via a 5.5Y senior non-preferred bond at a yield of 4.391%, 25bp inside initial guidance of MS+160bp area.

The bonds have expected ratings of Baa1/BBB/A

Credit Agricole raised €1.5bn via a 8Y bond at a yield of 3.909%, 25bp inside initial guidance of MS+120bp area. The bonds have expected ratings of Aa3/A+/AA-.

New Bonds Pipeline

- Damac Real Estate Development hires for $ 3Y Sukuk bond

- Mauritius Commercial Bank hires for $ 5Y bond

- Cargill hires for € 7Y bond

- Abu Dhabi National Energy Company hires for $ 5Y/10Y Green bond

Rating Changes

-

Fitch Upgrades Saudi Aramco to ‘A+’; Outlook Stable

-

Fitch Revises Meituan’s Outlook to Stable from Negative, Affirms Ratings at ‘BBB-‘

Term of the Day: Initial Price Guidance

Initial price guidance (IPG) refers to the proposed yield on a new bond issue. Based on the IPG, investors will place orders with the lead managers of the new bond issue. Once the lead managers have received orders for the proposed bond, they will decide the final pricing on the bond, which in most cases will be tighter (lesser) than the IPG.

Talking Heads

Our members have expected to see the impact of rising interest rates for some time, and we’re beginning to see more credit stress and defaults in corporate borrowers now. Unfortunately, this could take some time to work its way through the system”

On China Property Firms’ Turnaround Plans Disappointing, Adding Stress to a $730bn Market

Fitch analysts

“Recent debt restructuring proposals of distressed Chinese developers are mostly debt extensions rather than sustainable and permanent restructuring”

Kenny Chung, an HK-based portfolio manager at Astera Capital Partners

“Many of the restructuring proposals are not really favorable for investors, but more like investors have to accept it. The property market also shows slower recovery, signs which don’t give investors good incentive to add property positions.”

On The Once-Mighty Eurodollar Futures Contract No More Being There

Paul Muoio, CEO of Yellowhook Capital

“It’s the end of an era. A lot of people cut their teeth in and made their fortunes off of eurodollars”

Friday is when CME Group lists the contracts, will convert those expiring after June to futures or options on the SOFR, a relatively new benchmark that officials favor as a successor to Libor in dollar funding markets.

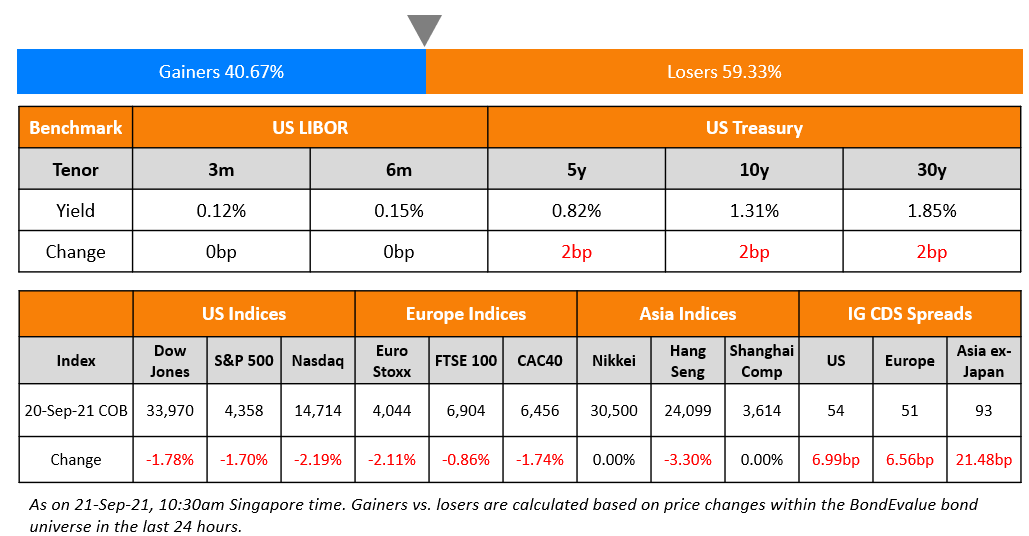

Top Gainers & Losers –14-April-23*

Go back to Latest bond Market News

Related Posts: