This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

HSBC Launches $ PerpNC5.5 at 8.5% area; Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

February 28, 2023

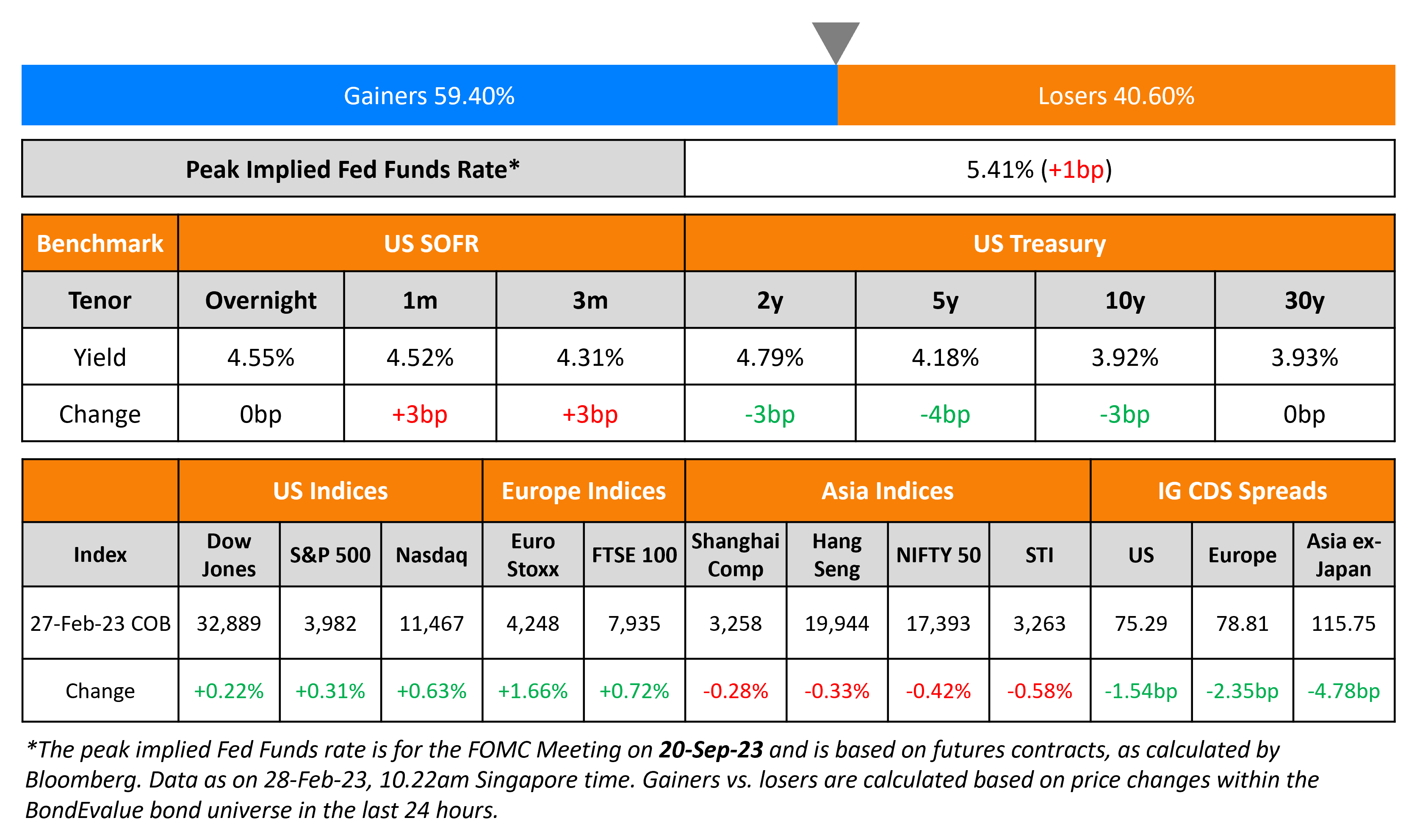

US short-end Treasury yields were 3-4bp lower across the curve. The peak Fed funds rate inched another 1bp higher to 5.41% for the July 2023 meeting. Markets continue to price in a 25bp hike at each of the Fed’s next three meetings in March, May and June, based on the CME’s maximum probability calculations. US IG and HY CDS spreads tightened by 2.7bp and 7bp respectively. The S&P and Nasdaq ended the day higher, up by 0.3% and 0.6% on Friday.

European equity markets ended over 1% higher. European main CDS spread tightened by 1.7bp and the crossover CDS spread tightened 8.9bp. Asian equity markets have opened in the green, following the broad uptick in global equities. Asia ex-Japan CDS spreads tightened by 4.8bp.

New Bond Issues

- HSBC $ PerpNC5.5 AT1 at 8.5%

- Nanyang Commercial Bank $ PerpNC5 AT1 at 7.65% area

- Kasikornbank $ 5Y at T+160bp area

- SMFG $ tap of 3Y/5Y/7Y/10Y at T+130/165/180/195bp area

- €1.5bn via a 5NC4 bond at a yield of 5.105%, 20bp inside initial guidance of MS+190bp area. The new bonds received orders over €3bn, 2x issue size, and were priced at a new issue premium of 42.5bp to its existing 4.75% Green 2027s that yield 4.68%. If not called on the optional redemption date (8-March-2027), the current fixed coupon of 5% will be reset to 3M Euribor+170bp quarterly.

- €750mn via a 10Y bond at a yield of 5.725%, 20bp inside initial guidance of MS+270bp area. The new bonds received orders over €2bn, 2.7x issue size, and are priced at a greenium of 65.5bp to its existing 6.833% 2032s that yield 6.38%.

The senior green bonds have expected ratings of Baa3/BBB-/BBB-. Proceeds will be used to (re)finance Green Categories as defined within the issuer’s framework.

AT&T raised €1.25bn via a 2Y FRN bond at a yield of 3.096%, 5bp inside initial guidance of 3mE+45bp area. The senior unsecured bonds have expected ratings of Baa2/BBB/BBB+, and received orders over €2bn, 1.6x issue size. Proceeds will be used for general corporate purposes, including the repayment of the issuer’s $2.5bn Term Loan Agreement.

Lloyds Bank raised $1.25bn via a 6NC5 bond at a yield of 5.871%, 20bp inside initial guidance of T+190bp area. The senior unsecured bonds have expected ratings of A3/BBB+/A. Proceeds will be used for bail-in and general corporate purposes. If not called on or after the optional redemption date (6-March-2028), the current fixed coupon of 5.871% will be reset to 1Y Treasury+170bp. The new bonds are priced at a new issue premium of 24.1bp to its existing 4.375% 2028s that yield 5.63%.

NatWest raised $2bn via a two-tranche deal. It raised

- $1bn via a 4NC3 bond at a yield of 5.847%, 30bp inside initial guidance of T+165bp area. The new bonds are priced in line with its existing 7.472% 2026s (callable in 2025) that yield 5.84%.

- $1bn via a 11NC10 bond at a yield of 6.016%, 30bp inside initial guidance of T+240bp area.

The senior unsecured bonds have expected ratings of A3/BBB/A. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Morocco hires for $ bond

- Qatar plans for $ bond

- REC hires for $ Long 5Y Green bond

Rating Changes

- Iris Holding Inc. Downgraded To ‘B-‘ On Weaker-Than-Expected Financial Measures; Outlook Stable

Term of the Day

Sovereign Risk Premium

Sovereign risk premium refers to the additional implied spread that a country’s sovereign bonds offer vs. a benchmark for a particular currency. Put differently, it is the incremental return (or yield) that investors demand from a country to buy its sovereign bonds vs. the benchmark.

For instance, Nigeria’s 7.375% dollar bond due 2033 currently yields 11.59% whereas the US Treasury’s 3.5% 2033s yield 3.92%. Thus the sovereign risk premium is the difference between the two at 767bp.

Talking Heads

On buying bonds ‘for first time in a long time’ – Steve Eisman of the Big Short

“Buying bondsfor the first time in a long time… I like 4.8% because it’s bigger than 4.4%… I think the days of people beating the market just by investing in tech are going to be over. And we’re going to go to a new paradigm…I think the days of investing in companies that have no earnings that have multiples of 200x will be gone”

On “No illusion” inflation fight will be quick – Federel Reserve Governor Philip Jefferson

“Core goods inflation has started to come down. Several indicators suggest that housing services inflation is likely to come down in the coming months. There is more uncertainty surrounding inflation in core services excluding housing… I’m under no illusion that it’s going to be easy to get the inflation rate back down to 2%”

On Cash-Equivalent ETF Attracting $2.5bn, the Biggest Since 2020

Kristen Bitterly, head of North America investments at Citi

“The number one question that we get, especially once that six-month T-bill crossed over that 5% threshold, is why wouldn’t I sit this out and hang out in T-bills?… We don’t think there’s really any need to stretch in terms of yield. You don’t have to go into high yield, you can certainly take advantage of those short-duration T-bills”

Peter Chatwell, head of global macro trading at Mizuho International

“I don’t think, given the strength of the growth data, that the inflation upside surprises will diminish soon. The risk of further hawkish rates repricings will make the short-end of the curve look even more attractive as an income generating safe haven”

Top Gainers & Losers – 28-February-23*

Go back to Latest bond Market News

Related Posts:.png)