This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

May 30, 2023

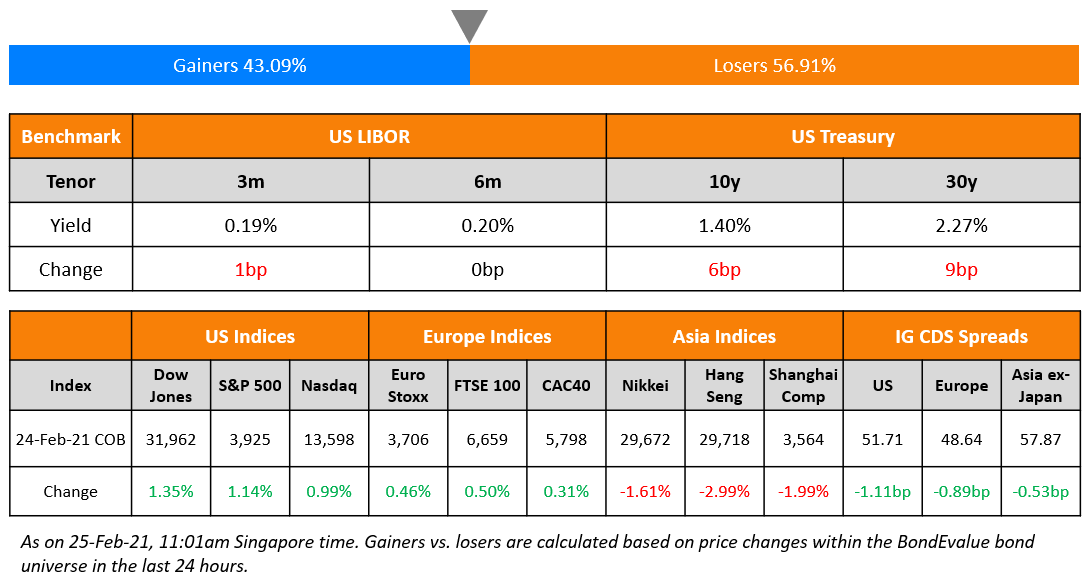

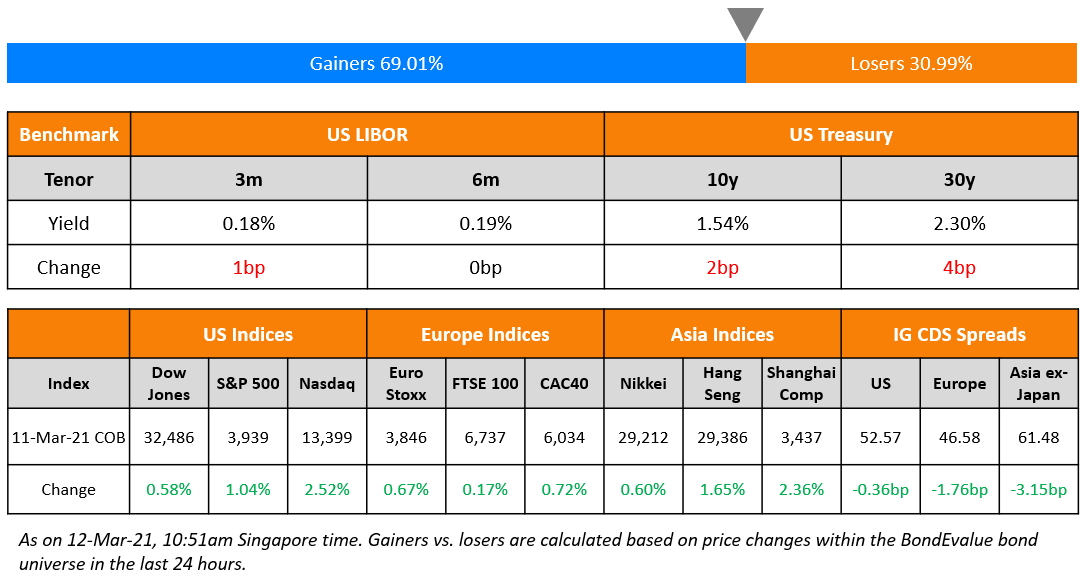

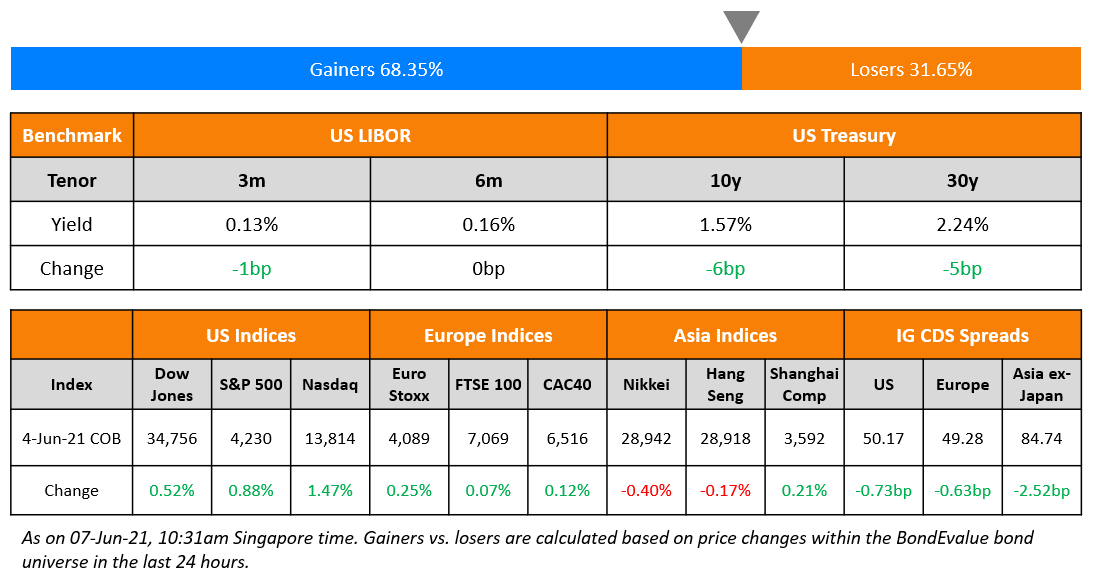

US Treasury yields were near flat as US markets were closed yesterday due to the Memorial Day holiday. Overall, US government default fears have receded following the weekend debt ceiling agreement reached by President Joe Biden and House Speaker Kevin McCarthy. Markets continue to price-in a 63% chance of a 25bp rate hike in June as per CME probabilities. The peak Fed Funds Rate was unchanged at 5.31% for July. US equity indices and CDS markets were shut.

European equity indices were slightly lower and CDS markets were closed. Asia ex-Japan CDS spreads tightened by 1.5bp and Asian equity markets have opened with a negative bias this morning.

Exclusive Event for BondEvalue Subscribers in Dubai | 19 June

-2.png)

New Bond Issues

- HSBC S$ 6NC5 at 4.75% area

- Huzhou City Investment $ 3Y Sustainability at 6% area

- Kexim $ 10Y at T+120bp area

.png)

New Bonds Pipeline

- Hong Kong hires for $/€ Green bond

- BGK hires for $ 10Y bond

- GS Caltex hires for bond

Rating Changes

- Moody’s downgrades Azure Power Energy to B1 and Azure Power Solar Energy to Ba3; places ratings on review for downgrade

Term of the Day

Extension Risk

Extension risk is the risk of bonds not getting called by the issuer and thus extending the life of the bond. This is particularly significant in the case of far maturity bonds, Perpetual Bonds (Perps) and AT1s. While market participants often assume that Perps/AT1s will be called on their first call date, that is not always the case. There are a few examples in recent times. Santander and Deutsche Bank shocked the markets in 2019 and 2020 when they did not call their AT1s on the first call date. In 2022 where Allianz decided to skip the call on its $1.5bn 3.875% Perp in February, which led to a fall in its price. Investors must thus account for non-call risk when investing in such bonds.

Talking Heads

On Fed Rate Hikes for June – Chicago Fed President Austan Goolsbee

“I try … to make it a point not to prejudge and make decisions when you are still weeks out from the meeting.. going to get a lot of important data between now and then… actions that the Fed takes take months or even years to work their way through the system…

On Inflation Risks in the US economy and its impact on the Fed

Minneapolis Fed President, Neel Kashkari

“I think if I had to err, I would err on being a little bit too aggressive in terms of bringing inflation down”

Raghuram Rajan, former Indian central bank governor

“They’re a little bit in a situation where they’re damned if they do, and damned if they don’t.. If they do raise short-term policy rates, clearly, at some point, something more breaks.”

Wendy Edelberg, director of The Hamilton Project at the Brookings Institution

“Fed has no desire to conduct monetary policy through financial crises… they have to thread a needle if they see their actions creating crises. Then they need to mitigate that.”

James Tabacchi, CEO of South Street Securities

“The market is confused as to whether the Fed is tightening or easing. We try to follow what they’re going to do. And right now, the market doesn’t know which Fed to follow.”

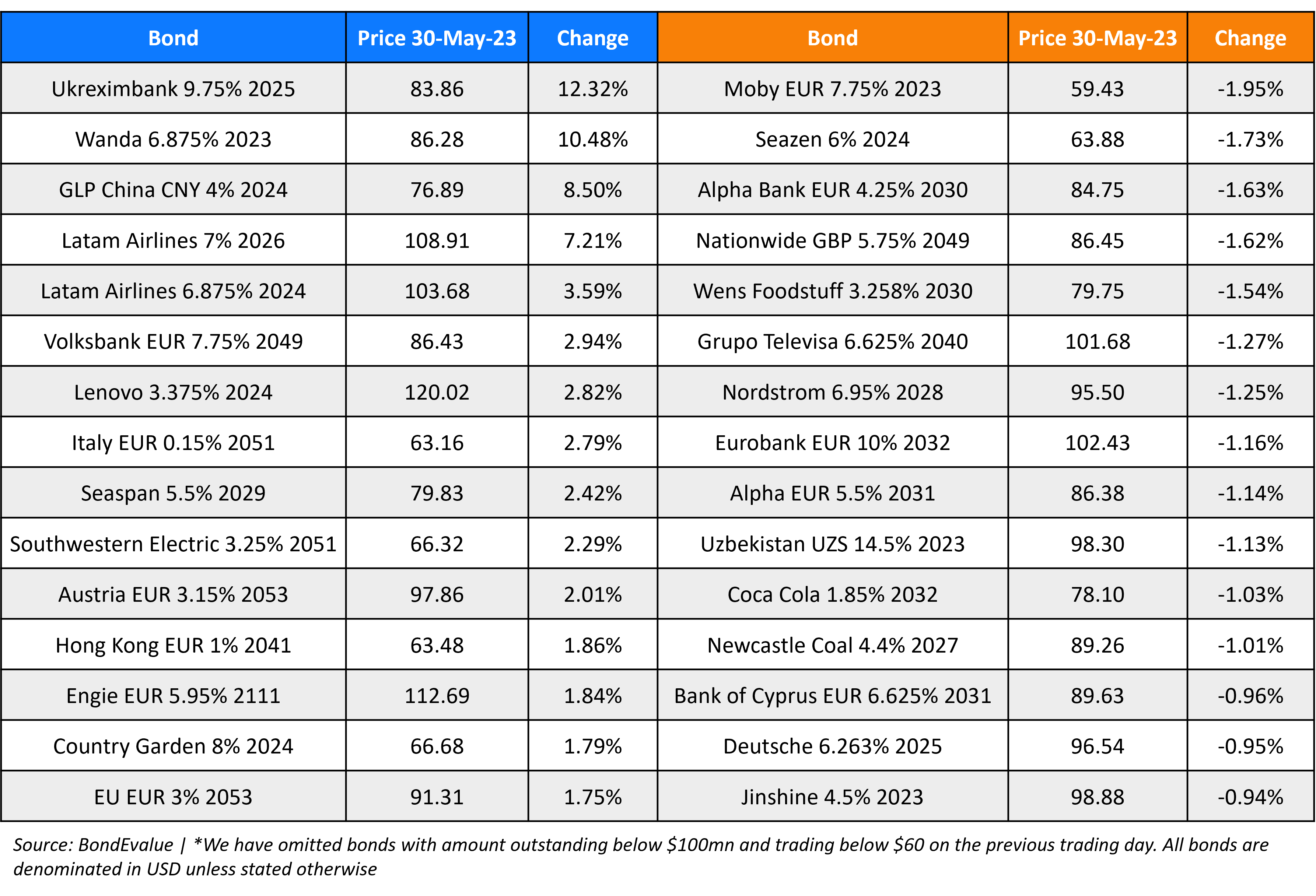

Top Gainers & Losers – 30-May-23*

Go back to Latest bond Market News

Related Posts: