This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

March 14, 2023

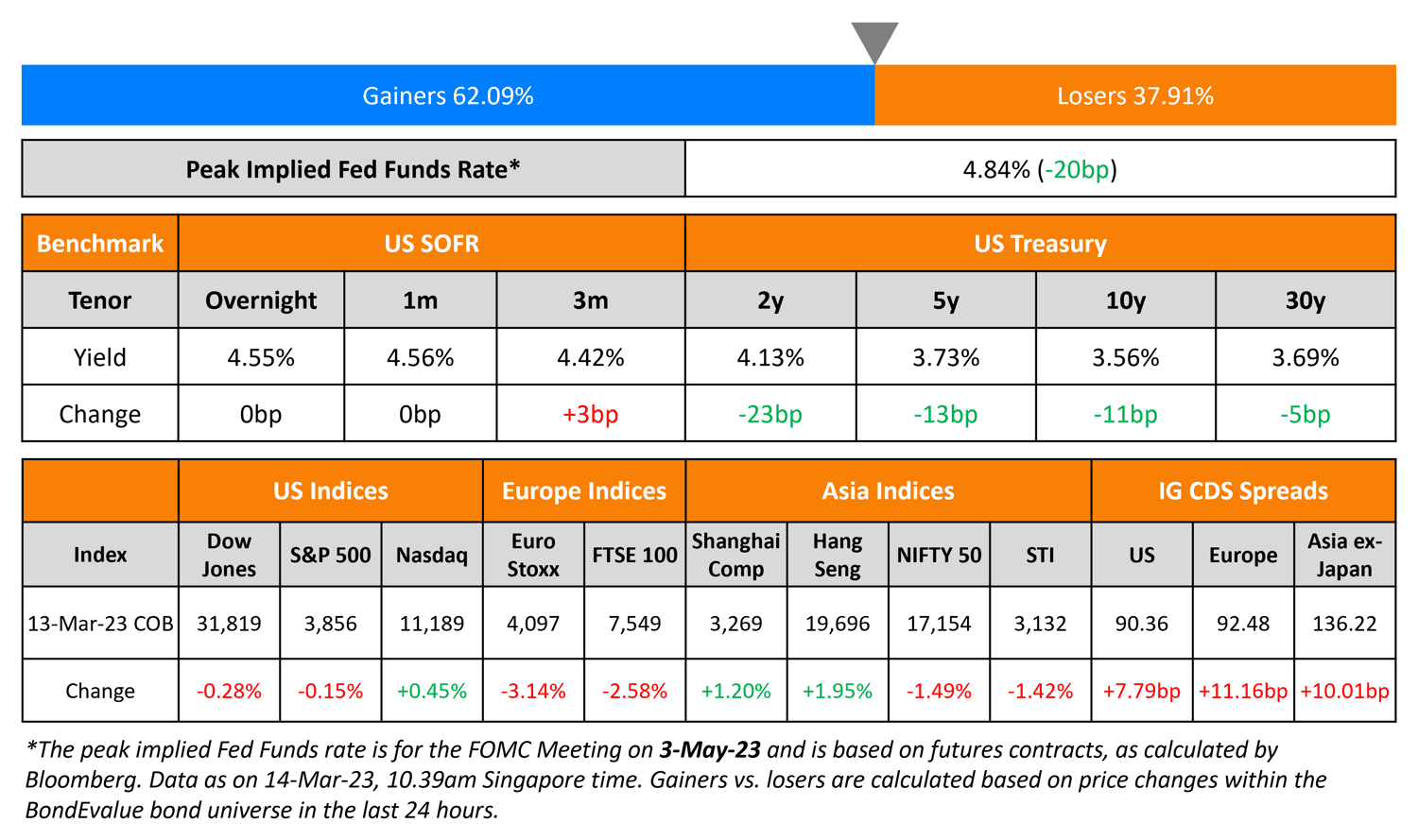

Monday saw another flight to safety move in the US with the 2Y Treasury yield falling a strong 23bp to 4.13% and the 10Y easing 11bp to 3.56%. The over 100bp drop in the 2Y since last Thursday is the largest 3-day drop in yields since the 1987 stock market crash. This was on the back of a broad selloff in bank stocks and bonds following the SVB collapse. The iBoxx CoCo USD AT1 index fell by 2.33% while the S&P Banking Index (equities) fell by 7%, the biggest one-day drop since June 2020. Markets are now pricing in a 76% chance of a 25bp hike on 22 March, based on CME probabilities. Meanwhile, some market participants including Nomura are predicting a 25bp cut at next week’s FOMC meeting. The peak Fed Funds rate moved a further 20bp lower to 4.84% for the May meeting. Credit spreads widened for a second day across the board – US IG and HY CDS spreads widened by 7.8bp and 36.4bp respectively. The S&P and Nasdaq ended mixed, down 0.15% and up 0.45% respectively.

European equity markets sold-off by 2.5-3.0% on the back of the selloff in bank stocks. European main CDS spreads widened 11.2bp while Crossover widened by a massive 50.3bp. Asian equity markets have opened in the red today. Asia ex-Japan CDS spreads widened by 10bp.

New Course on Bonds for Investors | Take This Quiz to Find Out if This Course is for You

New Bond Issues

New Bonds Pipeline

- Shinhan Bank hires for $ senior bond

- REC hires for $ Long 5Y Green bond

- Qatar plans for $ bond

Rating Changes

- Moody’s affirms Pfizer’s A1 rating; revises outlook to negative

- Fitch Affirms Adani Electricity Mumbai’s USD Notes at ‘BBB-‘

- Fitch Affirms Adani Transmission at ‘BBB-‘; Outlook Stable

Term of the Day: Z-Spread

Z-Spread, also known as Zero-volatility spread is a fixed spread over the Treasury spot curve that makes the present value of the bond equal to its price. The Z-spread indicates the extra compensation or spread for credit, liquidity and optionality risk that investors would receive for buying that bond. The idea of calculating the spread is that a coupon paying bond can be valued as a series of zero-coupon bonds and the present value of these should be equal to the price of the bond. A simple approximate formula to understand Z-spread better is:

Treasury Yield + Z-Spread of the Bond ≈ Yield of the Bond

A widening z-spread indicates increased risk in the bond and a tightening z-spread indicates reducing risk.

To learn more about z-spreads and how they can be used effectively when comparing bonds, sign up for our upcoming course How to Buy Bonds with Confidence on 13 April.

Talking Heads

On influence of High yield ETFs on underlying bond market jumps

Kevin McPartland, head of market structure and technology research at Coalition Greenwich

“Inflation and higher rates means bonds are cool again … ETFs are an easy way to gain exposure to that.”

Brett Pybus, global co-head of iShares fixed income ETFs for BlackRock

“ETFs are a central and catalysing force in the modernisation of the bond markets that have helped to improve transparency and reduce costs for investors.”

Adam Gould, global head of equities at Tradeweb “The growth of fixed income ETFs is interlinked with the growth of portfolio trading … Liquidity providers are in a better place to price bonds alongside portfolios and fixed income ETFs. The additional outlets have generally led to tighter spreads on ETFs, benefiting the end user.”

Bryan Armour, director of passive strategies research for North America at Morningstar

“It would be wrong to suggest that the ETF tail was beginning to wag the bond dog … Yet, the corporate bond market dwarfs the assets under management of ETFs, $10.1tn to $185bn … These figures demonstrate the increasingly central role ETFs have in bond trading. But rather than dominating the market, they simply provide another source of liquidity and a better view of bond prices than opaque bond markets.”

On Evergrande’s Restructuring Scenarios

Nicholas Chen, credit analyst at CreditSights

“Any detailed restructuring plan could lead to “some knee-jerk reaction of distressed high-yield property bonds trading higher … But we don’t see a sustained rally of the sector given the still weak contracted sales and waning investor interest.”

Top Gainers & Losers – 14-March-23*

Go back to Latest bond Market News

Related Posts:

NWD’s China Unit Planning $732mn Project in Guangzhou

August 26, 2021

SBI Reports 62% Quarterly Profit Jump

February 7, 2022