This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macau’s Incumbent Casino Operators Face Uncertainty After Bid from Genting Chairman

September 16, 2022

Macau’s government opened bids from seven companies for licenses to operate casinos, including one bid from GMM, backed by Genting’s Chairman Sri Lim Kok Thay. New casino licenses are set to begin in 2023 and one among six of the incumbents namely Galaxy Entertainment, Melco Resorts, SJM Holding, Las Vegas Sands, Sands China and Wynn Macau is set to lose out since only six winners would be announced. Analysts said that the application by Genting was seen as a surprise to many executives and would pose extra uncertainty for local operators. Genting currently operates casinos in Singapore, Malaysia, USA and UK. Besides, it also has extensive non-gaming operations which are said to be a key priority for the Macau government. “There is a chance they can topple one of the incumbents, they (Genting) think so, too, otherwise they wouldn’t have laid out a HK$10 million ($1.27 million) buy in bet”, said Ben Lee, founder of Macau gaming consultancy IGamiX.

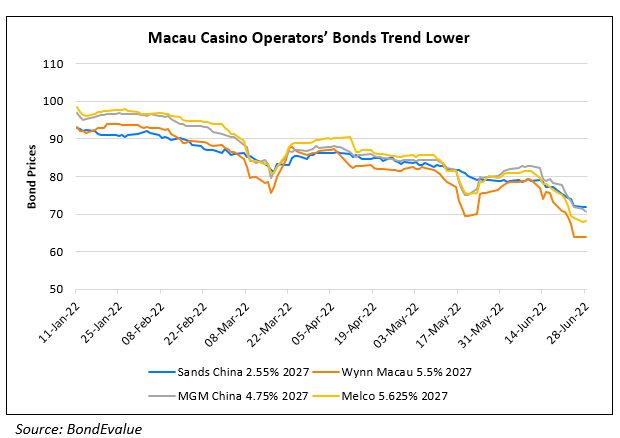

The bid by Genting adds to uncertainty in Macau’s already-troubled casino sector. Casino revenues had dropped 68% YoY to MOP 3.3bn ($400mn) in May due to China’s zero-Covid policy, given that the mainland accounts for 90% of visitors to the gambling hub. At that time, Reuters had reported that all six incumbents were facing daily revenue losses. Besides, downgrades across the sector have also added to a weak sentiment.

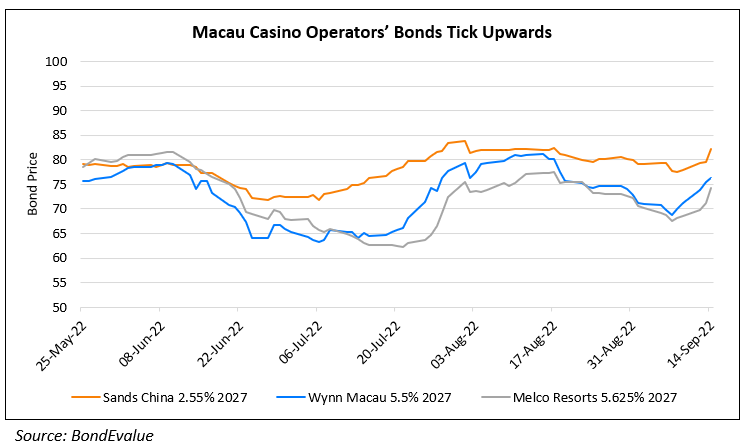

Wynn’s USD 5.125% 2029s are down 0.9 points to 70.85, yielding 11.1%. Sands China’s USD 3.1% 2029s fell 0.5 points to 76.38, yielding 7.82%. Melco’s USD 5.375% 2029s are down 0.6 points to 65, yielding 13%

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Casino Operators Wynn, Studio City and Melco Downgraded by S&P

October 14, 2021

Macau Casino Operators’ Bonds Drop

June 28, 2022