This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

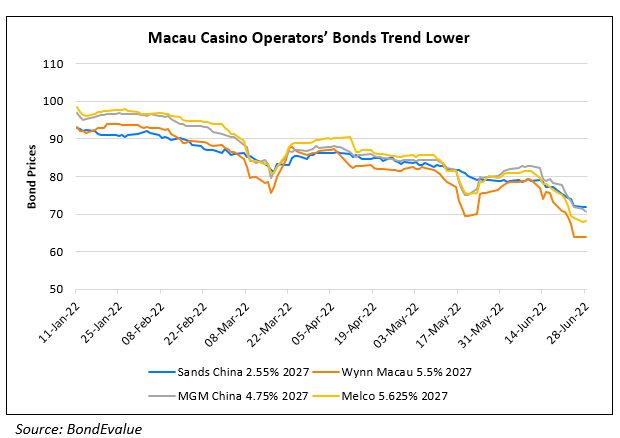

Macau Casino Operators’ Bonds Drop

June 28, 2022

Macau casino operators’ bonds were trending lower last week as investors were selling off their bonds, following Sands China’s downgrade to a fallen angel and a new outbreak of Covid cases, as reported by IFR. IFR notes that coupled with mainland China’s border restrictions, this exacerbates the liquidity issues already plaguing the industry. This further weighs down on investors’ bearish sentiment on the gaming sector in Macau following Fitch’s downgrade of Sands China from BB from BBB- to BB+ and SJM from BB to BB-. Eric Liu, an analyst from Nomura said, “Last week’s sell-off was mainly because of the weak sentiment in the bond market, aside from the mass [Covid] testing and the increasing concern over their liquidity…The casino operators are having a tough time in the past two years, and many of them are burning cash most of the time.” Other potential risks in the industry include casino license renewals, increased capital requirements for casinos and junket liability.

Go back to Latest bond Market News

Related Posts:

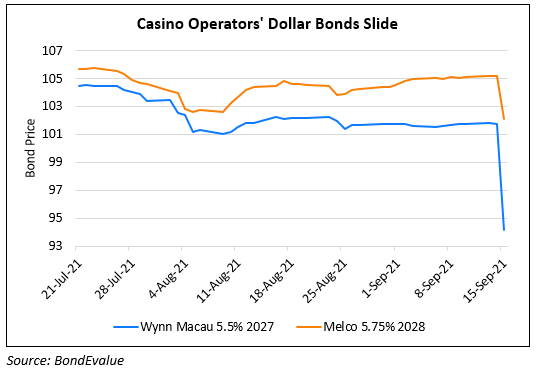

Casino Operators’ Dollar Bonds Drop on Tightened Supervision of Casinos

September 16, 2021

Macau Casino Bonds Trade Weaker after Mogul Gets Detained

November 30, 2021