This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Logan, ReNew Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

March 31, 2021

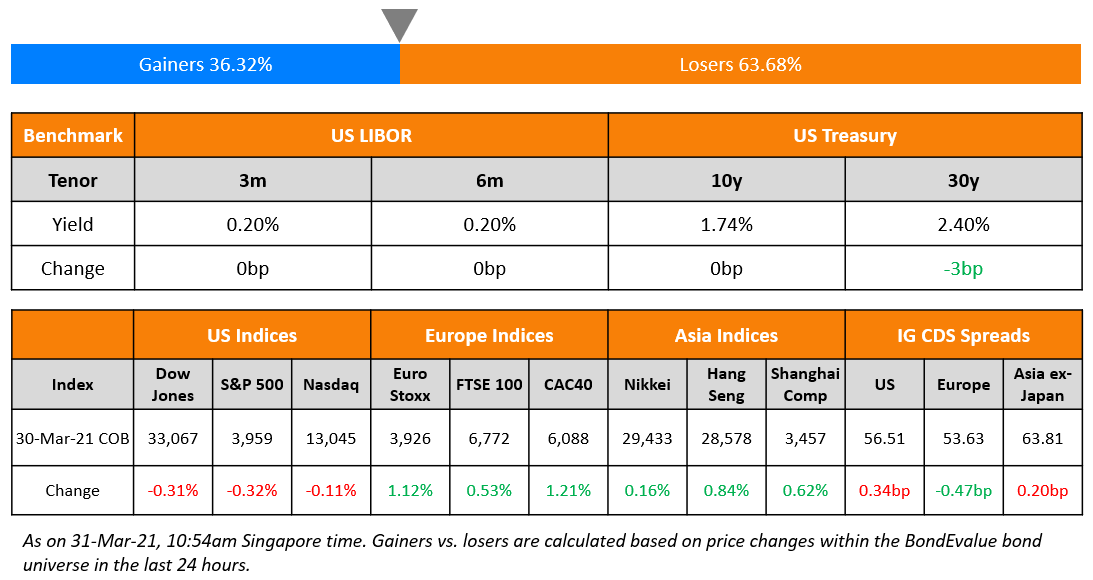

US equities saw a slight drop on Tuesday with the S&P down 0.3% and Nasdaq down 0.1%. The US 10Y Treasury yield spiked to 1.78% before retracting to 1.74%. DAX advanced 1.3% while the FTSE and CAC 40 rose 0.53% and 1.21%. US IG CDS spreads were 0.3bp wider and HY was 2.6bp wider. EU main CDS spreads were 0.5bp tighter and crossover spreads tightened 2.3bp. Asian equity markets are lower 0.4% and Asia ex-Japan CDS spreads are 0.2bp wider. Asian primary markets have taken a breather with just 3 new deals today following 8 new bonds priced on Tuesday.

Bond Traders’ Masterclass

Missed the Bond Traders’ Masterclass sessions last week? Join us for the upcoming session on Bond Portfolio Optimization & Risk in Perpetual Bonds at 6pm SG/HK today.

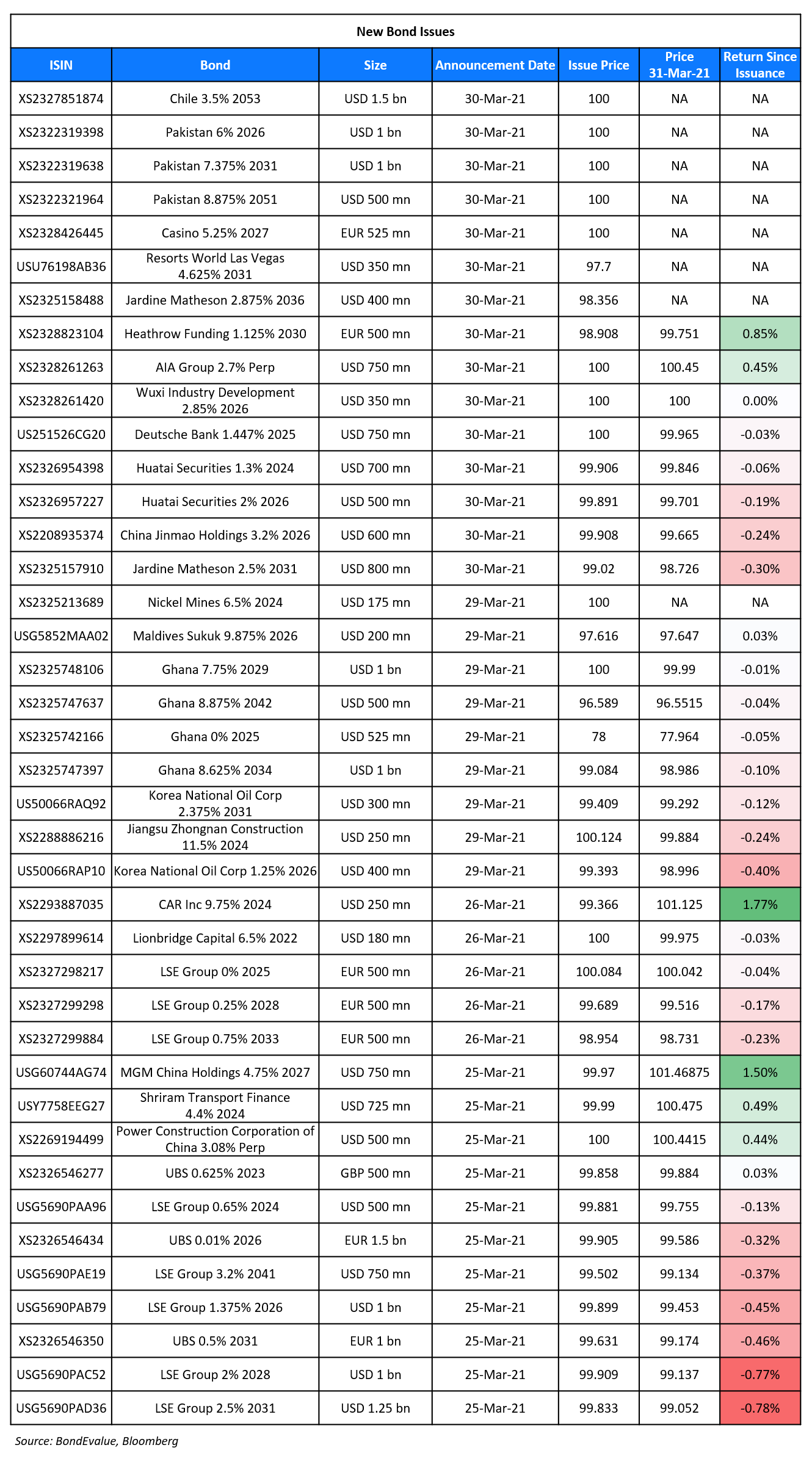

New Bond Issues

- Logan Group $ 4.25NC2.25 bond at 4.7% area

- ReNew Power $ 7.25NC2.5 green Yankee at 4.75% area

- Chengdu Jiaozi Financial Holding capped $200mn 5Y at 3.1% area

Resorts World Las Vegas raised $350mn via a 10Y bond at a yield of 4.919%, or T+320bp, 40bp inside initial guidance of at T+360bp area. The bonds have expected ratings of BBB-/BBB and received orders over $1.9bn, 5.4x issue size. US took 59%, EMEA 23% and Asia 18%. Asset/fund managers bought 87%, insurers 12% and banks and private banks 1%. Wholly-owned subsidiary RWLV Capital is a co-issuer. Both Resorts World Las Vegas and the co-issuer are indirect wholly-owned subsidiaries of Genting Bhd. The ultimate parent is the keepwell deed provider of the new bonds. There is a change of control put at 101 on a control change trigger event and a rating downgrade to below investment grade status. Proceeds will be used to repay outstanding borrowings.

Heathrow raised €500mn ($585mn) via a 9.5Y bond at a yield of 1.247%, 20bp inside initial guidance of T+140bp area. The bonds have expected ratings of BBB+/A- and received orders over €1.1bn, 2.2x issue size. If not redeemed on October 8, 2030, the coupon will reset to 12m EURIBOR +400bp. Proceeds will be used for general corporate purposes.

Deutsche Bank raised $750mn via a 4Y non-call 3Y (4NC3) bond at a yield of 1.447%, 22.5bp inside initial guidance of T+135bp area. The SEC-registered bonds have expected ratings of Baa3/BBB- and proceeds will be used for general corporate purposes.

China Jinmao Holdings raised $600mn via 5Y bonds at a yield of 3.22%, 40bp inside initial guidance of T+270bp area. The bonds have expected ratings of BBB- and received orders over $2bn, 3.3x issue size. Proceeds will be used for debt refinancing. Franshion Brilliant is the issuer and the Hong Kong-listed parent company is the guarantor.

AIA Group raised $750mn via a PerpNC5 Tier 2 bond at a yield of 2.7%, 42.5bp inside initial guidance of 3.125% area. The bonds have expected ratings of A3/A- and received orders over $5bn, 6.7x issue size. There is no principal loss absorption on the bonds and coupons can be deferred, but are cumulative and compounding. If the bonds are not called, the coupon will reset to the initial spread of 175.8bp over 5Y US Treasuries. Asset/fund managers took 70%, sovereign wealth funds, public institutions, pension funds and insurers 23%, and banks and financial institutions 3%, while private banks and others took 4%. Asian investors booked 90% and Europe the remaining 10%.

Huatai Securities raised $1.2n via a two-part offering. It raised $700mn via a 3Y bond at a yield of 1.332%, a massive 60bp inside initial guidance of T+160bp area. It also raised $500mn via a 5Y bond at a yield of 2.023%, also 60bp inside initial guidance of T+170bp area. The bonds have expected ratings of Baa1 and received orders over $4.5bn, 3.8x issue size, down from peak orders of $8bn. Banks took 95% of both tranches, and the remainder went to fund managers, sovereign wealth funds and private banks. Proceeds will be used for debt refinancing and general corporate purposes. The senior bonds will be issued by wholly-owned subsidiary Pioneer Reward and guaranteed by Huatai Securities.

Wuxi Industry Development raised $350mn via a 5Y bond at a yield of 2.85%, 40bp inside initial guidance of 3.25% area. The bonds have expected ratings of BBB and received orders over $1.1bn, 3.1x issue size. Proceeds will be used for debt refinancing and working capital. Nomura’s trading desk views the guarantor as a weak local SOE and said the deal is “very expensive” even at the IPG level. The desk also said that they are concerned about Wuxi’s short-debt focused maturity profile, its minority equity interests in most of its investments and its reliance on earnings contributions from two core listed units.

Jardine Matheson raised $1.2bn via a dual-trancher. It raised $800mn via a 10Y bond at a yield of 2.612%, 42.5bp inside initial guidance of T+130bp area. It also raised $400mn via a 15Y bond at a yield of 3.012%, 52.5bp inside initial guidance of T+180bp area. The bonds have expected ratings of A1/A+ and received orders over $4.5bn, x issue size.

Chile raised $1.5bn via a 32Y sustainability Formosa at a yield of 3.5%, or T+111.9bp, 28.1bp inside initial guidance of T+140bp area. Proceeds will be used to invest in projects that qualify as eligible green or social expenditures under the sovereign’s sustainable bond framework.

New Bond Pipeline

- Macquarie Bank GBP 4.75Y bond

- Ooredoo $ 10Y bond

- IRFC $ 5Y bond

- Korea Resources Corp $ 5Y bond

Rating Changes

- Fitch Upgrades La Banque Postale to ‘A’; Stable Outlook

- Fitch Upgrades Bankia on Merger Completion; Withdraws Ratings

- Credit Suisse Outlook Revised To Negative By S&P On Concerns About The Group’s Risk Management

- Fitch Affirms Ally Financial’s IDR at ‘BBB-‘; Outlook Revised to Stable

- Fitch Affirms Owens Corning’s IDR at ‘BBB-‘; Outlook Revised to Positive

- Moody’s changes outlook on JSW’s ratings to stable from negative; affirms Ba2 ratings

- Moody’s affirms Oil India’s Baa3 ratings; downgrades BCA to ba1

- SK Telecom Co. Ltd. Outlook Revised To Stable On Improving Operating Performance; ‘A-‘ Rating Affirmed

- Agile Group Outlook Revised To Stable On Improving Earnings Growth; ‘BB’ Rating Affirmed

- SK Hynix Inc. Outlook Revised To Positive On Improving Operating Performance, Financial Metrics; ‘BBB-‘ Rating Affirmed

- SK Broadband Outlook Revised To Stable From Negative After Rating Action On Parent; ‘A-‘ Rating Affirmed

- Moody’s affirms Silknet’s B1 CFR; changes outlook to negative from stable

Term of the Day

Modern Monetary Theory

Modern Monetary Theory (MMT) is a school of thought in economics that encourages countries, which control their own currency, to “print” money and use it towards government spending to boost the domestic economy in an environment where inflation is relatively low. Advocates of MMT argue that the accompanying rise in the level of national debt and deficit is not a problem as money can be “printed” to pay it off. While inflation is expected to be a natural fallout from this, theorists say that it can be controlled by monetary policy.

Given the current environment where government’s have been providing stimulus measures to boost economies amid the pandemic, industry professionals are likening this to MMT with some referring to the current state as “MMT-lite”

Talking Heads

“I’m optimistic about the overall economy,” Williams said. “We’re making great strides on the vaccination program…I think we have a lot of positives going forward.”

On willingness to embrace ultra-low interest rates and record fiscal spending a flirtation with Modern Monetary Theory (Term of the day, explained above)

Viktor Shvets, head of Asian strategy with Macquarie Capital Ltd

“What Covid-19 has done is accelerated fiscal policy and fiscal response, and married closer and closer coordination with monetary tools,” said Shvets. “It’s not MMT yet, but it comes very close to it. The result is market signals atrophy and deteriorate.” “Most investors are asking how do we normalize fiscal policy,” he said. “Well you don’t. The only thing that can derail it is if suddenly we have stagflation. But it’s very hard to generate inflation in a world that’s highly leveraged, highly financialized.”

Mary Nicola, global multi-asset portfolio manager at PineBridge Investments

“We see the COVID-19 crisis as a deflationary shock which enables these ‘MMT-lite’ strategies to be adopted, at least for now,” Nicola said.

Scott Berg, global equities portfolio manager at T. Rowe Price

“I don’t get too wrapped up in the exact particulars of historic average values when we’re in a totally different zipcode for interest rates,” said Berg. “We’re in this crazy weird world — stay invested, stay in the game.”

Andrew Sheets, chief cross-asset strategist at Morgan Stanley

“What we’ll remember is that the benefits of very aggressive policy intervention appeared to vastly outweigh the cost,” said Sheets.

“I think it is very credible to expect the committee to be comfortable with inflation somewhat over our 2% target,” he said. “Over time we will look to average, and I think that is a very credible commitment from the committee and I am very supportive of it.” “We shouldn’t jump the gun. Let’s wait until we see those outcomes,” Quarles said. “And clearly the performance of the macro economy, and the performance of monetary policy, not just over the last decade but really even 15, 20 years, would argue that that leads to superior outcomes.”

“There will be a difference in the size of the deal, but we will have a well-rounded product to play head-to-head in the U.S. market too,” Noya said. “We can build on the capacity to use the balance sheet in a smart way,” Noya said. “Given the interest rates at a macro level, the activity of the funds and financial sponsors, the amount of resources they’re raising, the size of the liabilities of the CLOs, that the number of CLOs is increasing, this is a very favorable scenario for a strong M&A activity.”

“We have a very powerful platform with an excellent team that in Europe was focused on internal transactions of the bank,” he said. “Now we are going to do it more for our clients, from hedge funds to private equity and companies.” “Before clients asked ‘how many points in savings am I going to have if I do a green issuance,’ and now it is much more strategic,” he said. “If it’s not green it will not exist.”

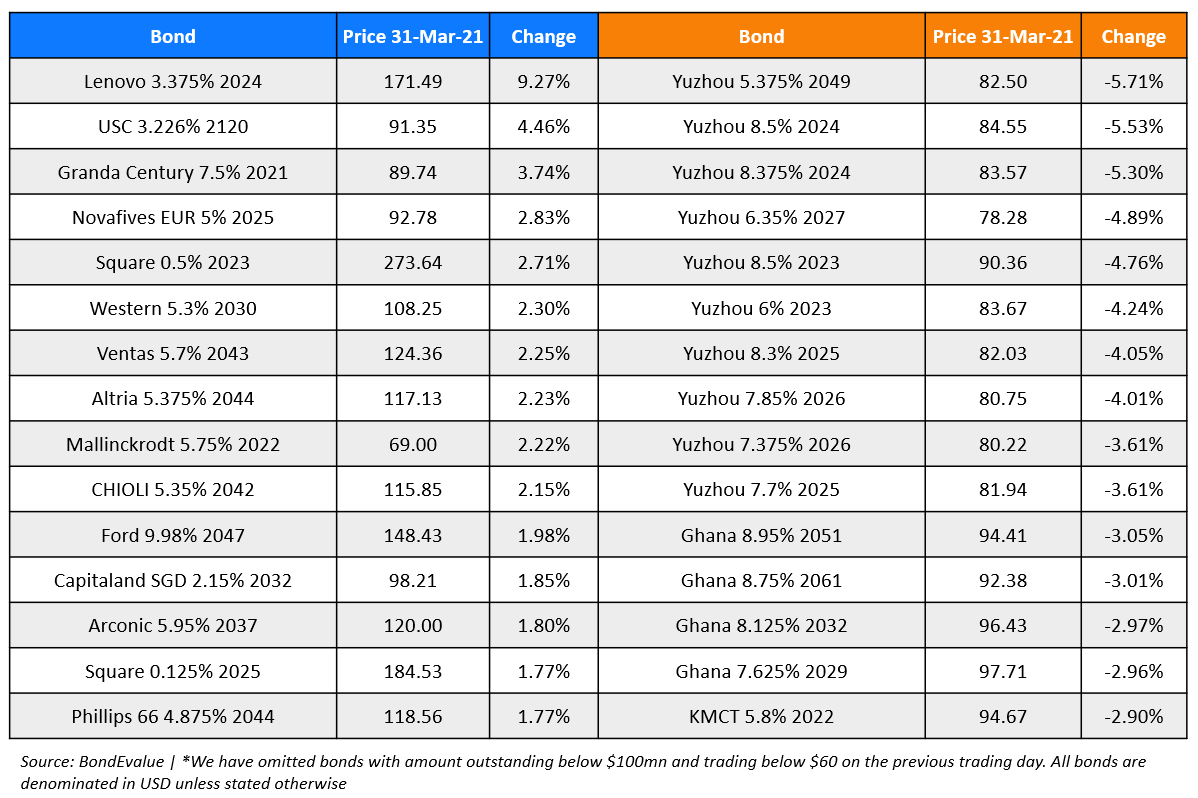

Top Gainers & Losers – 31-Mar-21*

Go back to Latest bond Market News

Related Posts: