This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Li & Fung Launches Tender Offer and Consent Solicitation for 2024s

October 28, 2022

Li & Fung launched a tender offer for its $500mn 4.375% 2024s, offering to purchase for cash any and all of the notes. The consent solicitation was for certain modification of the terms and conditions of the notes to insert a new condition entitling the company to redeem all of the outstanding notes with accrued interest except unpaid interest. Those holders agreeing before the early tender consideration of November 9 will receive $940 per $1,000 per principal. Subsequent tender considerations beyond that date would see holders receive $890 per $1,000 in principal. Regarding the consent solicitation, Li & Fung proposes to amend the optional redemption notice period to five days with an optional redemption amount of $890 per $1,000 in principal. Li & Fung plans to reduce its indebtedness via the above offer and will fund the tender with internal resources.

Li & Fung’s 4.375% 2024s are currently trading at 87.47, yielding 11.84%, a discount to tender purchase price.

Go back to Latest bond Market News

Related Posts:

Cathay Sells $650mn 5.5Y Bond at 4.875%

May 11, 2021

Cathay’s Granted $1bn Loan Extension

June 9, 2021

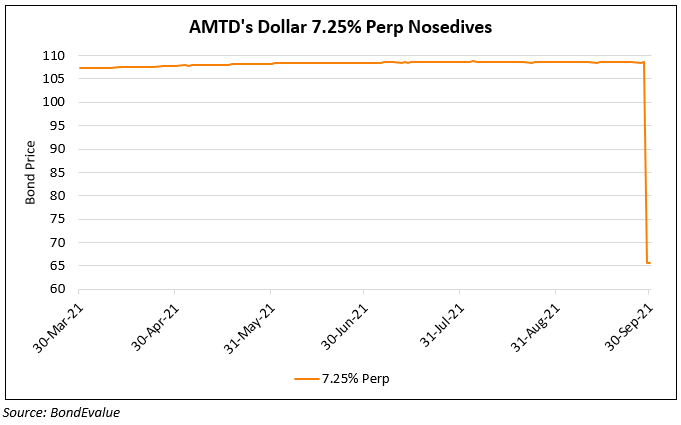

AMTD’s Dollar Perp Crashes

October 1, 2021