This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kraft Heinz to Buyback $2.8bn in Debt

June 8, 2021

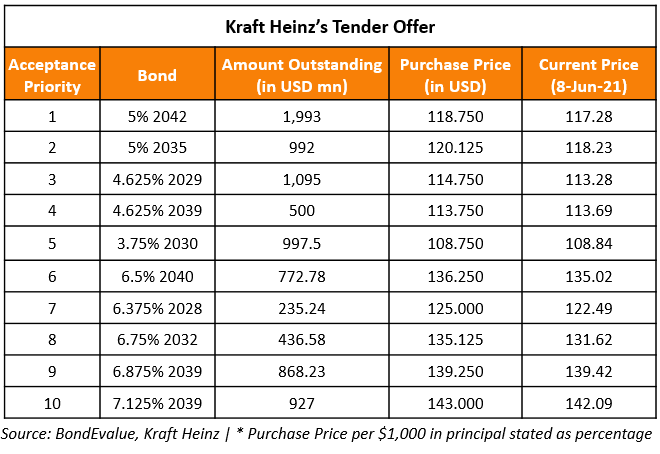

Kraft Heinz announced a bond buyback (Term of the day, explained below) of bonds worth $2.8bn, launching a tender offer to repurchase 10 outstanding bonds. The buyback is part of its efforts to reduce its debt load post its $3bn sale of Planters to Hormel. This is their second debt buyback after a $1bn transaction in March. The $2.8bn buyback includes principal and premium in its purchase price, but does not include accrued and unpaid interest. Below are the details of their tender offer:

For the full story, click here

Go back to Latest bond Market News

Related Posts: