This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Keppel REIT Launches Tap of S$ Perp; Temasek Extends $ Curve to 50Y; Evergrande Bonds Recover; JPM Fined $920mn for Spoofing

September 30, 2020

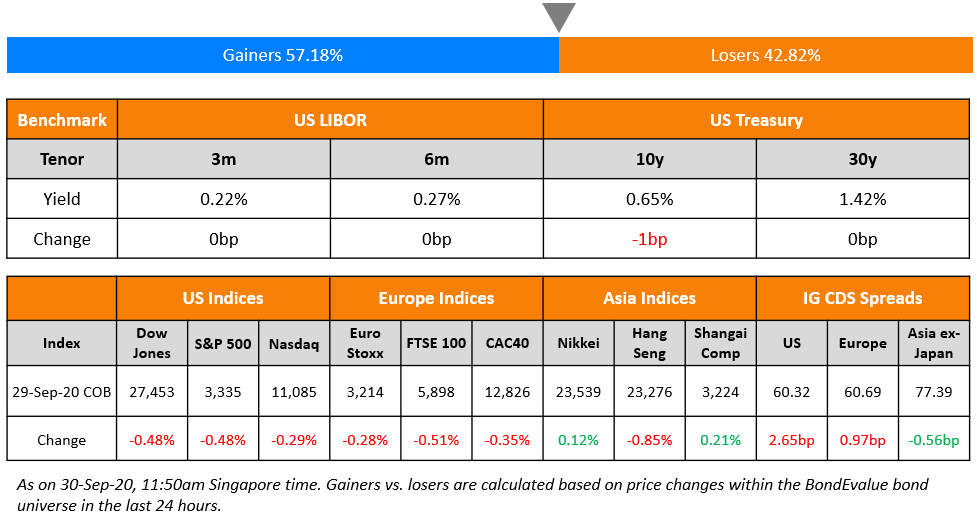

S&P ended lower by 0.5% ahead of the eagerly awaited presidential debate with major stocks marginally lower. Microsoft and Amazon were down ~1% while the 10Y Treasury yield was slightly changed. German bond yields fell slightly as their inflation dropped more than expected. Investment grade issuance topped $158bn for September. Asian equities opened mixed today while China’s Purchasing Managers Index (PMI) improved slightly across manufacturing and services. US Consumer Confidence data saw its biggest jump in seventeen years up by 15.5 points to 101.8, back above 100 for the first time in six months. US IG CDS spread rose 3bp while the HY CDS rallied ~1.5bp. Asia ex-Japan CDS tightened slightly.

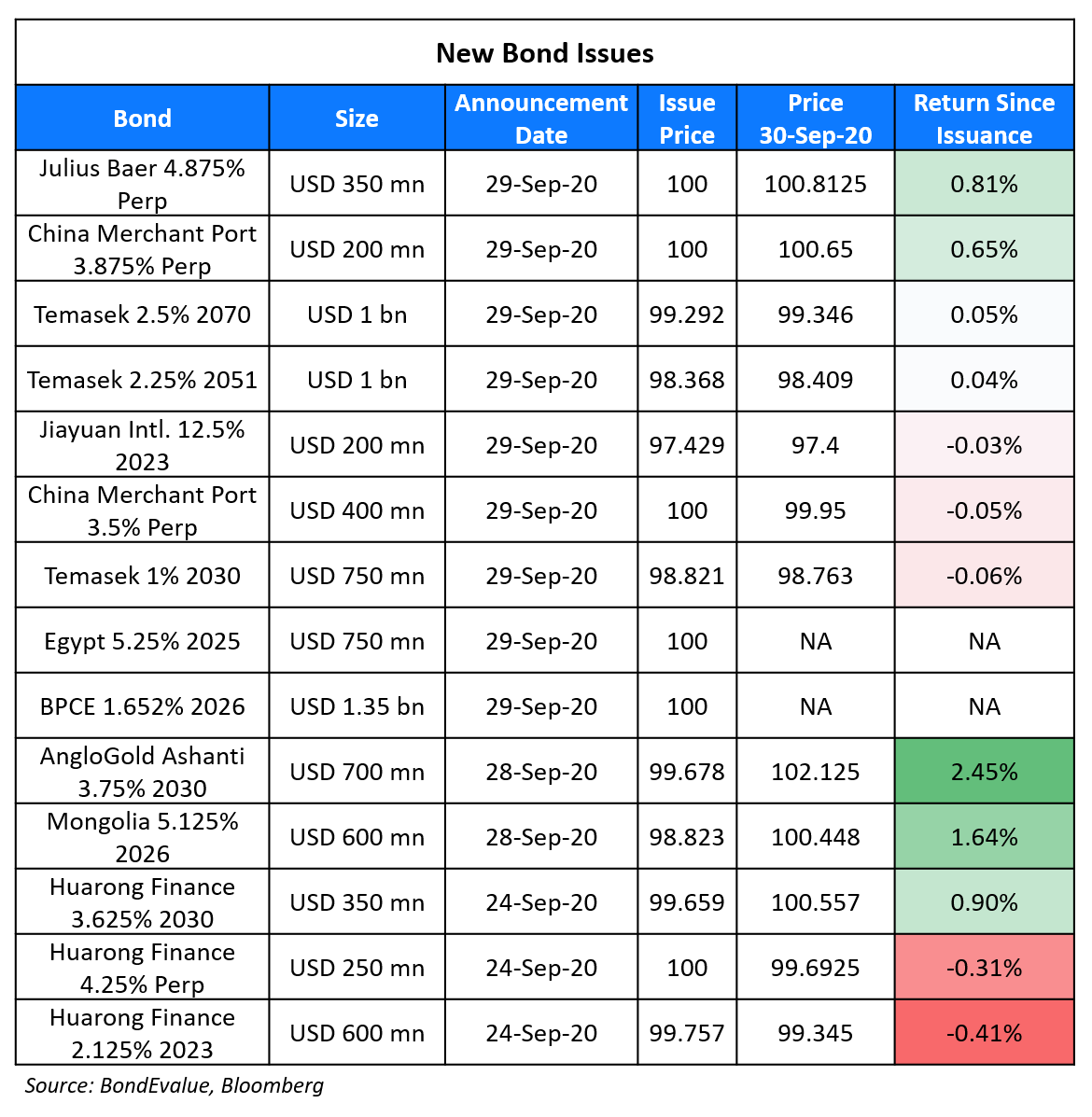

New Bond Issues

- Keppel REIT S$ tap 3.15% Perp NC5 @ 3.15%

Julius Baer Group raised $350mn via Perpetual non-call 6Y (PerpNC6) additional tier 1 bonds to yield 4.875%, 12.5bp inside initial guidance of 5% area. The bonds, with expected rating of Baa3, received orders over $1.5bn at the time of final guidance, 4.29x issue size. Julius Baer priced the AT1 perpetual just a week after it was forced to withdraw a similar offering that was priced at 4.375% due to poor market conditions.

Egypt raised $750mn via 5Y green bonds to yield 5.25%, 50bp inside initial guidance of 5.75% area. The bonds have ratings of B2/B/B+. Proceeds of the green bonds will be used to finance or refinance eligible Green Projects in accordance with The Arab Republic of Egypt’s Sovereign Green Financing Framework, which may include the following categories: Clean Transportation, Renewable Energy, Pollution Prevention & Control, Climate Change Adaptation, Energy Efficiency and Sustainable Water and Wastewater Management.

China Merchants Port Holdings raised a total of $600mn via a dual-tranche bond offering. It raised $400mn via a Perpetual non-call 3Y (PerpNC3) bond to yield 3.5%, 35bp inside initial guidance of 3.85% area. It also raised $200mn via a Perpetual non-call 5Y (PerpNC5) bonds to yield 3.875%, 42.5bp inside initial guidance of 4.3% area. The bonds, with expected rating of Baa2, received total orders exceeding $3.4bn at the time of final guidance, 5.67x issue size. The coupons of both tranches will reset at the initial spread of 335.4bp and 362.3bp over 3Y and 5Y Treasury yields respectively plus a 300bp step-up if not called on the first call date. CMHI Finance (BVI) is the issuer and China Merchants Port Holdings is the guarantor.

BPCE raised $1.35bn via 6Y non-call 5Y (6NC5) bonds to yield 1.625%, 140bp over Treasuries and 15bp inside initial guidance of T+155 area. The bonds have expected ratings of Baa2/A-/A. Coupon of the bonds is fixed until October 2025 and reset to the US SOFR rate plus a spread of 152bp if not called on the same date.

AngloGold Ashanti Holdings raised $700mn via 10Y bonds to yield 3.789%, 312.5bp over Treasuries and 50-62.5bp inside initial guidance of T+362.5-375bp. The bonds have ratings of Baa3/BB+/BB+.

New Bonds Pipeline

Star Energy $ Green amortizing bond

Pakistan $ Bond/Sukuk

Japan Tobacco EUR hybrid 60.5Y non-call 5.5Y and 63Y non-call 8.25Y

Sumitomo Mitsui Trust Bank 7Y EUR covered bond

Mizuho EUR 5Y green and/or 10Y bond

Rating Changes

Moody’s reviews Alam Sutera’s ratings for downgrade; downgrades existing bond ratings to Caa3

Alam Sutera Realty Downgraded To ‘CC’ By S&P On Distressed Exchange; Outlook Negative

Fitch Places Bankia on RWP, Affirms CaixaBank on Merger Announcement

Fitch Places Devon Energy’s Ratings on Positive Watch Following Announced Merger with WPX Energy

Moody’s affirms ratings for Argentinean financial institutions; changes outlook to stable

Moody’s affirms Argentine non-financial companies’ ratings, changes outlooks to stable

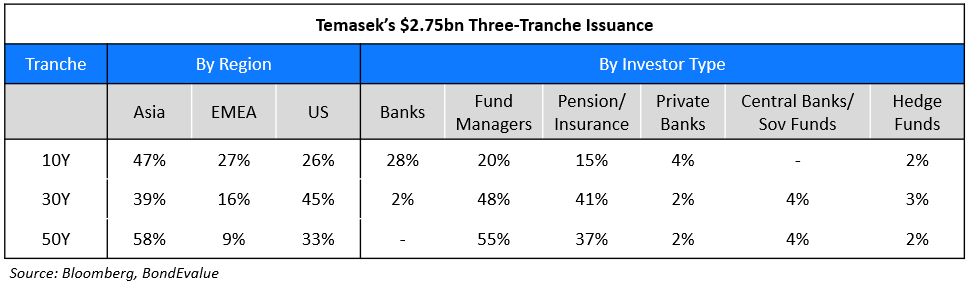

Temasek Raises $2.75 Billion via Three-Trancher, Extends Curve to 50Y

Singapore’s state-owned investment company Temasek Holdings raised $2.75bn via a three-tranche issuance priced on Tuesday. It raised:

- $750mn 10Y 1% bonds at a yield of 1.124%, 47.5bp over Treasuries and 27.5bp inside initial guidance of T+75bp area

- $1bn 30Y 2.25% bonds at a yield of 2.325%, 90bp over Treasuries and 20bp inside initial guidance of T+110bp area

- $1bn 2.5% 50Y bonds at a yield of 2.525%, 110bp over Treasuries and 25bp inside initial guidance of T+135bp area

The 50Y tranche is the longest tenor offering from the Aaa-rated issuer ever. Its previous longest tenors have been 30Y for US dollar or euro bonds and 40Y for SGD bonds. This marks the third 50Y issuance from Asia this year after Thailand’s PTT and Indonesia sovereign. Temasek Financial (I) will issue the bonds guaranteed by Temasek. This is the first dollar bond from Temasek since July 2018. The 10Y bonds offer a yield pick-up of 30bp over 10Y bonds issued by supranationals IFC and IBRD, which are currently yielding 0.8017% and 0.817% respectively. Both the IFC and IBRD bonds were issued earlier this year and are Aaa-rated. However, the bonds priced ~4bp tighter compared to Aaa-rated US corporate Johnson & Johnson’s 10Y bonds issued earlier this year yielding 1.16% on the secondary markets. The bonds received ~$5bn of combined orders with the split by region and investor type in the table below.

For the full story, click here

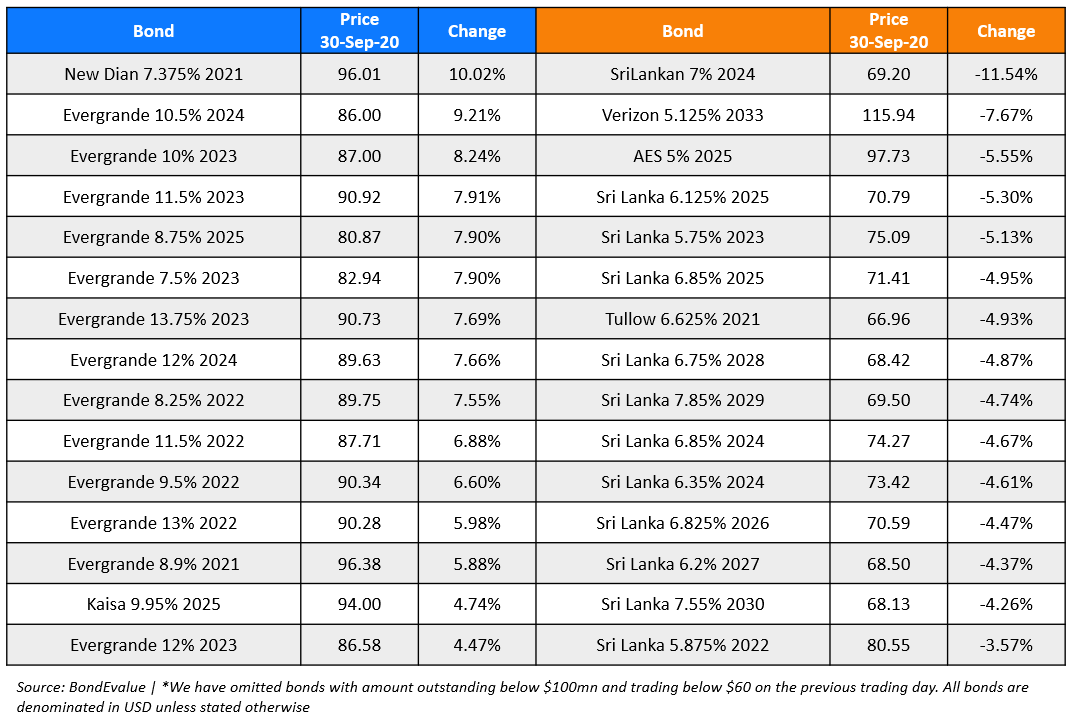

Evergrande Reassured Investors With Commitment from Strategic Investor to Not Demand Repayments; Dollar Bonds Continue to Rally

Evergrande said it reached an agreement with a group of strategic investors to avoid repayments of up to RMB 130bn ($19bn) should the company fail to list Hengda on the Shenzhen exchange by January 31, 2021. In an exchange filing published on Tuesday, Evergrande reassured investors by stating that it has entered into a supplemental agreement with investors holding RMB 86.3bn ($12.7bn) worth of interest. Under the agreement, the investors have agreed to hold on to their equity interest and not require a repurchase. Further, negotiations with investors holding RMB 15.5bn ($2.3bn) are completed and the investors are “going through approval procedures”. Negotiations with the balance holders of RMB 28.2bn ($4.1bn) are in process.

Hengda Real Estate’s bond guaranteed by Evergrande was an outlier on Monday when it fell 11% while other Evergrande bonds rallied. Hengda’s 11.5% 2022s traded up by 5 points to 86 cents on the dollar yesterday with a yield of 20.3%. Hengda’s 12% 2023s traded up by 5.6 points to 85, currently yielding 18.6%.

Sri Lanka’s Dollar Bonds Tumble Post Moody’s Two-Notch Downgrade

A day after Moody’s downgraded Sri Lanka by two notches to Caa1, dollar bonds of the sovereign tanked on Tuesday. Before the current rating action, Moody’s had rated the nation as B2 which is one notch higher than the rating of B- by Fitch and S&P. However, the new rating action pushes the sovereign very close to default. Moody’s cited Sri Lanka’s decline in revenues due to an economic slowdown and lower reserve coverage for upcoming debt repayments as reasons for the downgrade. Morgan Stanley estimates that Sri Lanka needs to service debt payments of $3.2bn till the year-end, which could increase to $6.5bn over the next 12 months due to other costs describing the situation as a “tightrope walk” due to low forex reserves of only $7.4bn, as reported by Reuters. Sri Lanka’s Ministry of Finance called the move a “reckless reaction” and “unwarranted” based on “erroneous” analysis, adding that it had repeatedly expressed both its “ability and willingness” to pay all its debt obligations.

.png?upscale=true&width=1400&upscale=true&name=Sri%20Lankas%20$%20Bonds%20Face%20the%20Heat%20of%20Rating%20Action%20by%20Moodys%20(2).png)

Sri Lanka’s dollar bonds fell by ~4 points on Tuesday in reaction to the downgrade. The bonds have been trending down since the beginning of this month with yields only lower to defaulted or close-to-default sovereigns such as Argentina, Belize, Venezuela, Lebanon and Maldives.

For the full story, click here

JP Morgan Fined $920mn on Manipulation of Treasuries and Commodities Markets

JP Morgan agreed to pay $920mn in fines while admitting misconduct related to Treasury and commodities market manipulation. Commodity Futures Trading Commission (CFTC) Chairman Heath Tarbert said, “Spoofing is illegal—pure and simple, this record-setting enforcement action demonstrates the CFTC’s commitment to being tough on those who intentionally break our rules, no matter who they are.” The unlawful trading in precious metals involved 10 traders according to the Justice Department. The total fine includes a penalty of $437mn, restitution of $311mn and disgorgement of $172mn (requirement to pay back profits illegally earned), the CFTC said. The Justice Department said that spoofing caused losses of $106mn to others trading in Treasuries and Treasury futures while losses amounted to $205mn for other trading precious metals.

For the full story, click here

CapitaLand Gets Unitholders’ Approval for Merger of CMT and CTT; Keppel Announces Strategic Plans to Revamp Business

CapitaLand won approval from unitholders for its proposed merger of CapitaLand Mall Trust (CMT) and CapitaLand Commercial Trust (CMT) to form a new real estate investment trust (REIT). Under the trust scheme, CMT will be acquiring all units in CCT held by CCT holders in exchange for 0.72 CMT units and S$0.259 in cash per CCT unit. The merged entity, called CapitaLand Integrated Commercial Trust (CICT), will be one of Asia-Pacific’s largest REITs and the largest in Singapore with a market cap of S$12.7bn ($9.3bn) and total portfolio property value of S$22.4bn ($16.4bn). The merger is expected to become effective on October 21 subject to necessary approvals. CapitaLand’s SGD and USD bonds traded stable on the secondary markets.

For the full story, click here

Another Singapore-based conglomerate Keppel Corp unveiled strategic plans to revamp its operations on Tuesday. It has identified assets worth S$17.5bn ($12.8bn) to monetize and has started a review of its struggling offshore and marine (O&M) business. CEO Loh Chin Hua said, “Over the next three years, we plan to monetise about S$3-S$5 billion ($2.2-3.6bn) of the assets from this substantial S$17.5 billion ($12.8bn) base to seize new opportunities that can help us achieve our desired returns.” He added that the company plans to “to eliminate the gap between our share price and the sum of the parts valuation”. Keppel’s stock has been under pressure having fallen ~15% since the mid-August announcement of Temasek pulling out a S$4bn ($2.9bn) deal to increase its stake in Keppel. The strategic plans announcement has been well received from investors as its stock has traded up by 10% since last Friday.

For the full story, click here

Alam Sutera Launches Exchange Offer

Alam Sutera Realty, the Indonesian real estate developer launched an exchange offer of its dollar bonds. Moody’s placed its Caa1 rating on review for downgrade and said it expects the exchange offer to cause “a significant economic loss to the existing bondholders”. It also downgraded its senior unsecured 2021s and 2022s issued by Alam Synergy to Caa3 from Caa1 and placed the ratings on review for further downgrade. The summary of the exchange offer is as below:

- Exchange all of its $115mn 11.5% April 2021s for new 2024 bonds. The new 2024s will pay either 6% in cash for its first two coupons or 6.25% in-kind for the first and 6% in cash for the second. There is a coupon step-up to 8% and 11% beginning in the second and third year respectively. The 2024s will also amortise 5% of principal on each of the last three interest payments prior to maturity

- Exchange the $370mn 6.625% April 2022s in two sects: 25% of the bonds will be exchanged for new 2024 bonds while the remaining 75% for new 2025 bonds. The new 2025s will pay either 6.25% in cash for the first two coupons or 6.5% in-kind for the first and 6.25% in cash for the second. There is a coupon step-up to 8.25%, 11% and 12% in the beginning of the second, third and fourth year respectively. The 2025s will amortise 7.5% of principal on each of the last two interest payments prior to maturity

The exchange offer will be successful only if 85% of the holders of its 2021s and 2022s choose to participate. The exchange offer will end on October 20 with new bonds issued on October 29. Both new bonds are secured by a mortgage over Mall@Alam land lot and a commercial land lot and guaranteed by Alam Sutera subsidiaries. S&P also downgraded Alam to CC from CCC- with a ‘Negative’ outlook. Alam’s 11.5% 2021s fell to 74 cents on the dollar with yields higher by 324bp while its 6.625% 2022s fell to 58 cents on the dollar with yields rising 25bp. Both bonds currently yield 78% and 47% respectively.

For the exchange filing, click here

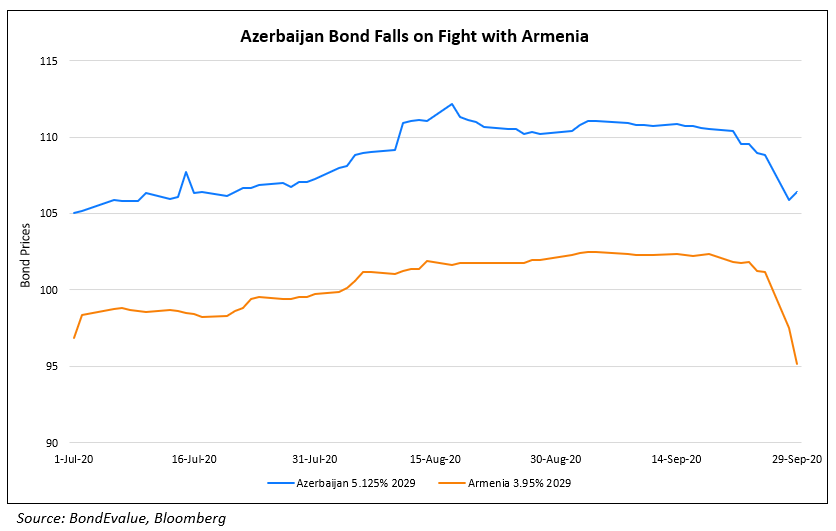

Azerbaijan and Armenia Dollar Bonds Fall on Fears of Escalation to a Full Blown War

Azerbaijan and Armenia continue to mobilise forces as the conflict between Azerbaijan and self-ruled Nagorno-Karabakh region continues into the third day. The Nagorno-Karabakh region, which is at the centre of the dispute is officially part of Azerbaijan but has been ruled by ethnic Armenians since 1994. It is claimed by both Armenia and Azerbaijan. The conflict between Azerbaijan and the Nagorno-Karabakh region, which started three day ago and has already witnessed many casualties, seems to be spreading towards the Armenian Azeri borders as both the countries have accused each other of shelling across the borders. While Azerbaijan’s President Ilham Aliyev has rejected any possibility of talks with neighboring Armenia citing unacceptable demands, Armenian Prime Minister Nikol Pashinyan said talks were not possible while military action lasted.

The bonds of both the countries took a beating of ~5 points on growing concerns that the two countries may directly get involved in the conflict, which could then spiral into a full fledged war. Azerbaijan’s 5.125% bonds due 2029 traded at 105.8 while Armenia’s 3.95% bonds due 2029 traded at 95 cents on the dollar.

For the full story, click here

Term of the Day

REIT

REIT stands for Real Estate Investment Trusts. These are companies that own or finance real estate properties that produce an income. These real estate companies have to meet several requirements to be eligible to be a REIT. REITs often trade on stock exchanges, and they offer a number of benefits to investors. It allows investors to invest in a range of real estate portfolios without the hassles of managing actual real estate. Another benefit is that REITs allow smaller investors exposure to real estate without the requirement of a large investment sum, which is required for direct real estate investments.

There are different types of REITs ranging from residential, commercial and mortgage to retail (mall REITs etc.), industrial and others. The companies managing the REIT essentially lease out space and collect rental payments thereby generating income. This income is then passed on to the shareholders of the REIT. Most REITs are required to payout 90% of its income to holders to qualify as a REIT. Singapore’s CapitaLand was a pioneer of REITs and business trusts in Singapore.

Talking Heads

On BOE yet to reach judgment on negative rates – Andrew Bailey, Bank of England Governor

“I just say to people, with all this speculation about whether we are or we aren’t, we aren’t there at the moment,” Bailey said. “What we are doing is all the groundwork that we need to do to have another tool in the box and have it effectively in the box.”

“We want to get back to maximum employment as soon as possible,” Williams said, adding that the economy would be strong and close to full employment “in about three years time.”

On the dramatic gap between banks and bond market over scale of Covid risks

Stuart Plesser, a bank analyst at Standard & Poor’s

“Credit markets are looking at the relative risk for an investment and now they are looking in an almost zero-rate environment,” said Plesser. “Those things just do not enter in a bank’s determination of whether they need to take a reserve.”

Hans Mikkelsen, credit strategist at Bank of America

“The Fed is pretty much going to backstop investment-grade bonds through this crisis [so] spreads are very tight, even when the economy is not all right,” said Mikkelsen. “When you think about the loans on banks’ balance sheets, some of it is companies that could sell investment-grade bonds, but most of it is smaller, medium-sized companies, restaurants, other places that are struggling and that are not getting bailed out by the Fed,” Mr Mikkelsen said.

On the volume of fallen angels entering junk territory far below forecasts

Eric Beinstein, who heads the U.S. investment-grade research activity at JPMorgan

“That action from the Fed really helped open up the funding markets and probably contributed to the lower number of fallen angels,” Beinstein said.

Shobhit Gupta, head of U.S. credit strategy at Barclays

“That was a major factor in alleviating investors’ concern about their ability to withstand the crisis,” Gupta said.

Frederic Gits, Fitch’s group credit officer for corporate debt

“This long-term approach explains why the number of downgrades has not been greater despite the magnitude of the crisis,” Gits said.

On the big risk to bonds of a smooth US election

Gregory Staples, head of fixed income at DWS

“A strong, broad, blue victory, one that empowers the more progressive caucus in the House, is the only scenario I see in which long-end rates would spike by a lot after the election,” said Staples. “A mandate to significantly stimulate fiscally would possibly scare bond vigilantes, steepening the yield curve. I don’t view this as likely. But we are confronted with multiple scenarios, of which this is one.”

Mark Heppenstall, chief investment officer of Penn Mutual Asset Management

“A sweep by either side could lead to an increase in long-end rates, which are more susceptible to greater fiscal stimulus and a lack of gridlock, similar to what occurred after Trump’s victory in 2016,” said Heppenstall.

On Bank of Japan’s expanded stimulus curbing the issuance of long-term debt

Yusuke Ueda, chief credit analyst at Mitsubishi UFJ Morgan Stanley Securities Co

“The BOJ’s corporate bond buying operation has helped issuers and the Japanese economy, but it’s challenging active managers’ abilities to continue with their strategies,” said Ueda.

Masayuki Tsujino, a senior fund manager at Asahi Life Asset Management Co

“I’ve requested that companies sell seven- to 10-year bonds,” said Tsujino.

On markets on edge over Evergrande’s ability to cut its debts

Soo Cheon Lee, chief investment officer at SC Lowy

“If someone believes it is too big to fail . . . this was a buying opportunity for them,”, said. “That’s effectively the bet — that’s why some people are buying it and some people are selling it,” he added.

Christopher Yip, a director at S&P Global Ratings

Evergrande is “so highly leveraged it’s likely to breach all of the alleged thresholds”, said Yip. “Even though it has plans to deleverage, we haven’t seen progress nor understand the details on how these may align with reported government initiatives,” he added.

Top Gainers & Losers – 30-Sep-20*

Go back to Latest bond Market News

Related Posts: