This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kasikornbank Launches $ AT1; JLR Raised $700mn via 5NC2 Bond; Santander’s Euro Perp Jumps on Redemption Speculation

October 8, 2020

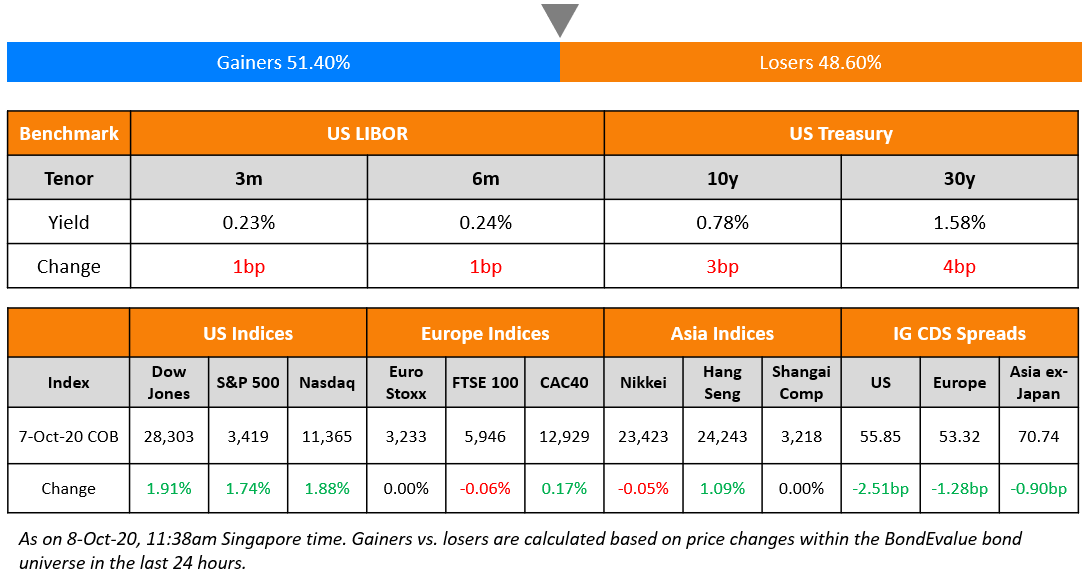

A day after disappointment from Trump on calling off negotiations for a relief bill, US equities moved higher by 1.7% with Nasdaq higher by 1.9%, industrials and consumer discretionary sectors up over 2.2%. The rally in equities has been attributed to Trump expressing backing for a $25bn airline relief plan and a $135bn payroll programme to begin with, so that a temporary package approval happens earlier. Airline stocks were higher by over 3%. US 10Y Treasury yields rose ~3bp with the positive sentiment. US IG CDS spreads tightened 2.5bp, HY was flat and European CDS spreads also tightened across. Asian equities are mixed in trade today while Asia Ex-Japan CDS Spreads tightened marginally.

New Bond Issues

- Kasikornbank $ Perp NC5 AT1 @ 5.7% area

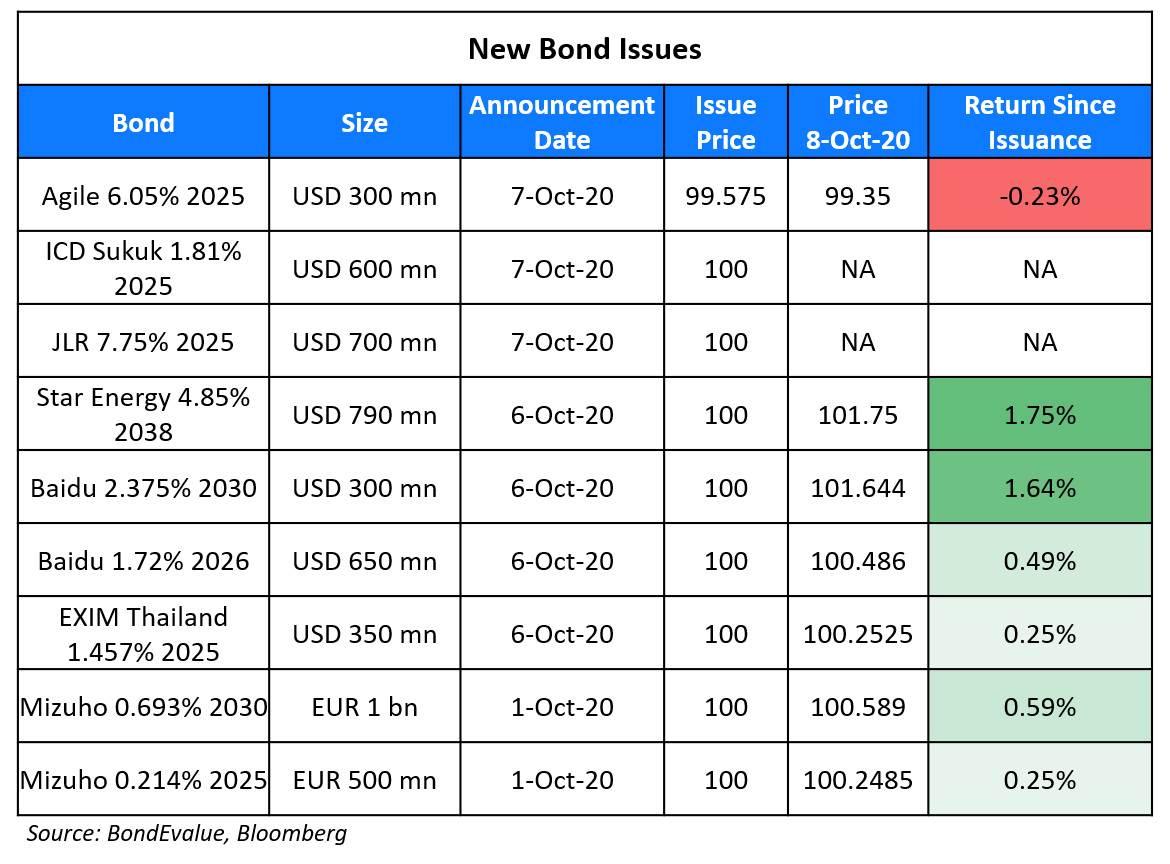

Islamic Corp for the Development of the Private Sector (ICDPS) raised $600mn via 5Y sukuk to yield 1.81%, 140bp over Mid-swap and 20bp inside initial guidance of MS+160bp area. The bonds have expected ratings of A2/A/A+.

Chinese property developer Agile Group Holdings raised $300mn via 5Y bonds to yield 6.15%, 25bp inside initial guidance of 6.4% area. The bonds, with expected ratings of Ba3, received orders over $890mn when final guidance was announced, 2.97x issue size. The new bonds offered a new issue premium of ~25bp over its 5.75% bonds due January 2025, which are yielding 5.91% currently.

New Bonds Pipeline

China $6bn Bond

Turkey $ 5Y bond

Goshawk Aviation $ Perp with letter of support from NWS Holdings

Shinhan Card $ 3Y or 5Y Covid-19 response bond

JSW Steel $600mn 3Y and/or 5.5Y

Rating Changes

Fitch Upgrades Minerva S.A. to ‘BB’; Outlook Stable

Moody’s downgrades Nabors’ CFR to B2, NII’s unsecured notes to Caa1

Fitch Revises SK Telecom’s, SK Broadband’s Outlook to Stable, Affirms Ratings at ‘A-‘

China Merchants Bank’s MTN Program ‘BBB+/A-2’ Ratings Withdrawn By S&P At Company’s Request

European Commission Announces Issuance of €100bn SURE Social Bonds

The European Commission (EC) announced yesterday plans of an upcoming €100bn Social bond (Term of the day, explained below) issuance, called SURE bonds (Support to mitigate Unemployment Risks in an Emergency). These will be the first SURE bonds which are likely to be issued in the second half of October 2020. The proceeds will be transferred to member states in installments through loans to cover costs related to the financing of national short-time work schemes and similar measures in response to the pandemic under the EU SURE Social Bond Framework – complying with the International Capital Markets Association Social Bond Principles (ICMA SBP). Reuters expects €30bn of SURE issuance in 2020. On April 2, the EC created SURE and so far 17 member states will receive support under the scheme. “This will give investors the chance to contribute to our efforts and up to €100 billion will help keep people in jobs in our Member States”, the President of the EC said. Currently, the EU has roughly €53bn of bonds outstanding with its most recent bond issued in June 2020. The AAA-rated EUR 500mn 0.125% 2035 bond trades at 102.3 yielding -0.03%.

For the full story, click here

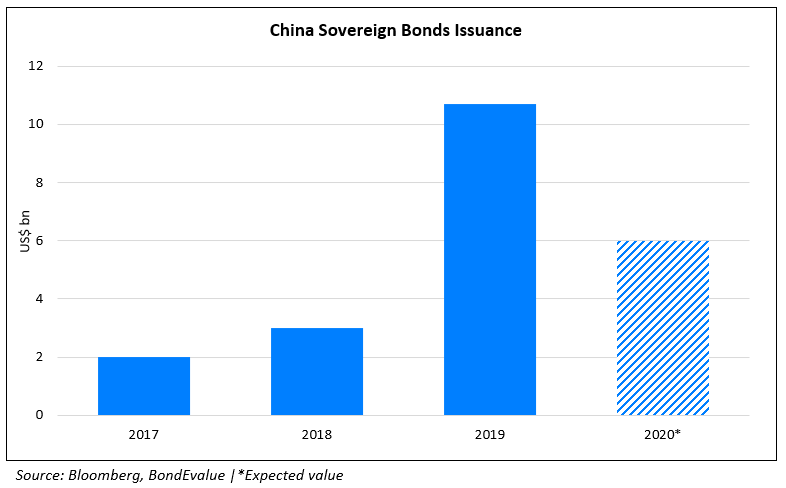

China to Return to The Offshore Dollar Bond Market with a $6 Billion Deal

Bloomberg reported that China is looking to raise $6bn through new debt issuance in the international dollar bond market next week. The debt could be raised through the issue of multi-tranche dollar notes with tenor ranging between 3-30 years. The sovereign had sold debt of ~$10bn last November when it issued $6bn of dollar bonds and €4bn ($4.71mn) euro notes. The offering received investor demand of almost 2x issue size with orders of ~$20bn. Global bond issuance has been on the rise due to the low interest rate environment. China’s 3.5% bonds due 2028 are currently trading at 117 with a yield of 1.26% (z-spread of 62.3bp).

JLR Raises $700 Million via 5NC2 Bond at 7.75%

Jaguar Land Rover Automotive raised $700mn via a 5Y non-call 2Y bond at a yield of 7.75%, 25bp inside the wide end of initial guidance of 7.75-8.00%. The bonds, expected to be rated B, priced at a spread of 741bp over Treasuries. While, final order book details were not available at the time of writing, demand seemed to have been strong as the Tata Motors-owned company managed to upsize the deal from $500mn to $700mn. Pricing on the new bonds was generous as its old 4.5% 2027s are currently offering a yield of 7.39%, 36bp lower than the new bonds despite a longer tenor. In its rating release, Fitch stated that risks related to disruption in operations have reduced as all of JLR’s plants have resumed production and all of its dealers are open. Fitch added that total liquidity as at end-September stood at GBP 5bn ($6.5bn), which includes GBP 3bn ($3.9bn) of cash and short-term investments and a GBP 1.94bn ($2.5bn) committed revolving credit facility. The new bond issuance was timed well after it reported strong sales numbers, particularly from China for Q3.

S&P places SMIC on Negative CreditWatch with Possible Downgrade to Junk after US Sanctions

S&P placed SMIC, the Chinese semiconductor company’s BBB- rating on negative CreditWatch, given the possible impact of US export restrictions. If this leads to a rating downgrade, SMIC would be pushed into junk territory. S&P mentioned the possibility of lowering the rating by at least one notch if the sanction affects SMIC’s wafer fabrication business significantly, constricts capacity expansion, or delays technology and efficiency developments. S&P estimates the sanctions to increase debt leverage and increase debt to EBITDA but aims to resolve the CreditWatch in 90 days. SMIC currently has a net funds position of over $3bn inclusive of financial assets at amortized cost, an overall leverage of ~20% and long-term debt payable of roughly $2.5bn. SMIC, China’s biggest chipmaker by revenues ($3.5bn annually on a TTM basis) with a capacity of 480,000 wafers per month has already fallen back on the technology front against global competitors TSMC and Samsung in building sub 10nm chip nodes for premium handsets. The sanctions could further delay SMIC’s capability and affect financial performance. SMIC’s 2.693% bonds due 2025 traded slightly lower at 98.6 with yields up 3bp.

For the full story, click here

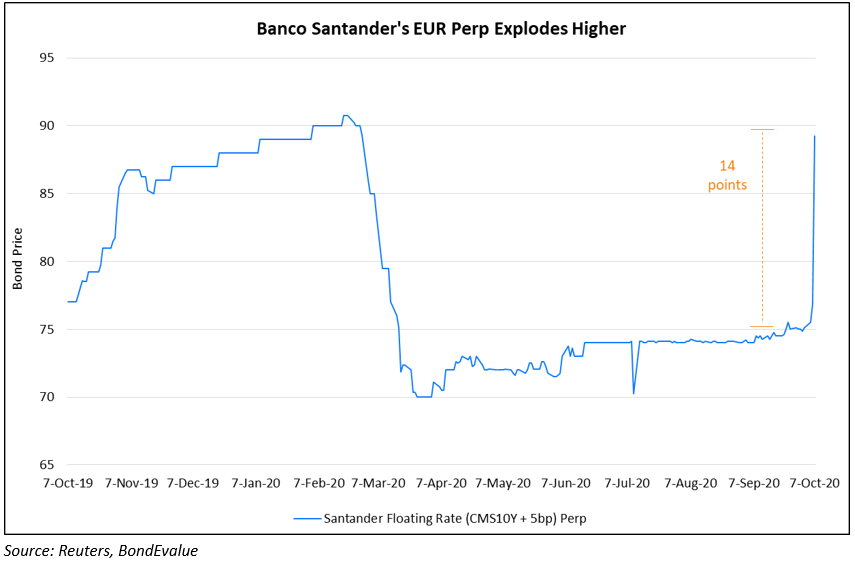

Santander’s Euro Perpetuals Jump on Speculation of Getting Called

Banco Santander’s non-cumulative floating-rate preferred shares (perpetual) rallied 14 points on Wednesday as speculation hit that they might call back the bonds. The €300mn perps were initially issued in 2004 at a coupon formula of EUR CMS 10Y+5bp capped at 8% callable on or after September 30, 2009. Limitations to distributions/dividends on the perps include:

- Distributable profits in the fiscal year being lesser than the aggregated distributions and/or

- Non profitability

Santander recently was the first major EU bank to propose dividends on this year’s earnings payable in 2021 according to Bloomberg. Banco Santander’s latest report shows €1.9bn in net profits for 1H2020 and a CET1 Ratio of 11.84%, above the minimum set by Basel III (8%) but lower than many other European Banks.

Fitch had recently downgraded the preferred securities (rated A at the time of issuance in 2004) from BB to CCC on account of risks of Santander making losses, which would make coupons unpayable and render the securities as ‘non-performing’ in 2021. However, coupons should begin in 2022. While no statement has been made by the bank, the last coupon on September 30 was -0.18% based on Reuters data. The perpetuals carry a dividend stopper clause wherein non-payment of coupon on the perps would restrict the bank from paying a dividend on its ordinary shares. With its plans to announce a dividend payment next year, there was speculation that the perps could be called on the next call date of March 30, 2021 at par. This led to a massive 14 point jump in the perp’s price from 75 to 89 currently. There has been no statement from the company on its intention to call (or not) the perps. Santander’s other perpetual AT1s traded stable.

Amazon Sends Legal Notice to Future Retail for Breach Of Contract on Sale to Reliance

Amazon has sent a legal notice to the Kishore Biyani held Future Group alleging that the deal between Reliance and Future group breaches the non-compete clause of the contract between Amazon and Future group. Amazon owns 7.3% in Future Retail after it bought a 49% stake in Future Coupons for ~INR15bn (~$205mn) in Aug 2019. Future Retail has been struggling to repay its debt and was in talks with Amazon for additional funding, which did not fructify. Future Group got into a deal with Reliance Industries in August. Reliance competes with Amazon in the Indian retail space. As per the deal, Reliance Retail Ventures Limited is set to acquire the retail & wholesale and the logistics warehousing business from Future Group for a consideration of Rs 247bn ($3.37bn). In case the breach of contract is proved in the court, the deal between Future Group and Reliance Industry could come under the lens. This could have an impact on Future Retail’s dollar bonds, which have recovered to 88 cents on the dollar from ~30 levels in April.

For the full story, click here

Tabreed Gains Shareholders Approval to Raise $1 Billion via Bonds or Sukuk

Tabreed, the National Central Cooling Company, revealed through the minutes of the General Assembly Meeting held on October 6 that it had gained unanimous approval of shareholders to issue non-convertible bonds and/or sukuk upto a value of $1bn (or equivalent). The issuance can be done in one or more tranches with a tenor upto 30 years, expected over the next one year. According to the minutes, “the instrument would be offered to qualified investors at a profit rate not exceeding the prevailing market rate and would be available to companies with the same credit rating as the Company.”

Tabreed provides district cooling solutions in the UAE and across the GCC including Saudi Arabia, Bahrain, Qatar and Oman. Some of its projects include Dubai Metro, Abu Dhabi’s Yas Island and Jabal Omar Project in the Holy City of Mecca. The news of the Dubai-listed looking to tap the international debt market had first broken out on Sep 22. Moody’s had rated the company at Baa3 in April following the purchase of Emaar District Cooling assets. Fitch had rated the company BBB on the acquisition. Tabreed’s 5.5% sukuk due 2025 traded stable at 115 on the secondary markets.

For the full story, click here

Term of the Day

Social Bonds

These are bonds issued by companies to specifically fund projects with social benefits (new/existing), which should be mentioned in the prospectus. ICMA’s social bond principles set out a standard covering four elements as follows:

- Use of proceeds (range of 6 categories but not limited to them)

- Process of evaluation and selection of social projects

- Management of proceeds

- Reporting

Examples of projects for social bonds include affordable housing, socioeconomic empowerment, essential service access and projects of their like. The European Commission is planning to issue €100bn worth of social bonds, proceeds of which will be disbursed to member states for projects related to employment work schemes.

For a list of social bonds, click here

Talking Heads

On recent economic developments and the challenges ahead – Jerome Powel, Federal Reserve Chair

“The recovery has progressed more quickly than generally expected. The most recent projections by FOMC (Federal Open Market Committee) participants at our September meeting show the recovery continuing at a solid pace.”

“I think we have the capacity to do more asset purchases,” Evans said. The Fed could also ease financial conditions by weighting its purchases to more longer-term securities, he said. But though there will come a time when the Fed will need to give more explicit guidance on the pace and type of its asset purchases, Evans said he is comfortable with the Fed’s current guidance that focuses on the path of interest rates.

“In future meetings it would be appropriate to further assess and communicate how the committee’s asset-purchase program could best support” the Fed’s dual-mandate objectives.

Bond purchases equal to 30% of U.S. economic output, or about $6.5 trillion, are required to offset the impact of the Fed’s benchmark rate already being nearly zero, wrote Kiley. The Fed has so far purchased bonds — through so-called open-market operations and emergency lending facilities — equal to about $3 trillion since March. That implies another $3.5 trillion is needed, in Kiley’s view, to make up for the monetary policy handicap of zero rates.

On Asian companies rushing to issue dollar bonds ahead of US election

Rishi Jalan, Citigroup’s co-head of Asia Pacific debt syndicate

“New supply is likely to be meaningful all the way until the election as issuers try to navigate a big market event,” said Jalan. “There was a lot of volume in the first few weeks of September and continued to build throughout the month.”

Ernst Grabowski, Morgan Stanley’s head of Asia Pacific debt syndicate

“There was a very conducive global market backdrop which helped,” said Grabowski. “In Asia, on a year to date basis, market growth has lagged the U.S., but Asia is making up for some of this now.”

John McClain, Diamond Hill Capital Management portfolio manager

“I would continue to expect a torrid pace of issuance pre-election. Because of the uncertainty, companies want to lock in financing needs,” McClain said. “What’s the biggest driver of risk assets in the near term? The election.”

On the rising risk of Asia’s largest junk bond market

In a report by S&P Global Ratings

“We revised the outlooks to negative because Evergrande’s short-term debt has continued to surge, partly due to its active acquisition of property projects. We had previously expected the company to address its short-term debt, especially given the tough economic climate,” the ratings agency said. “In our view, Evergrande faces increasing challenges to improve its liquidity because of the sheer size of its debt,” S&P added.

In a note by ANZ Research

“The incident poses an event risk to China’s property market in the coming quarters,” it said, referring to China Evergrande. “We cannot exclude the possibility of more developers facing challenges during the process of deleveraging.” “The new regulations may limit developers’ ability to roll over their debts, fueling a demand for cash and dampening property investment activity,” the ANZ Research note said.

Christopher Yip, senior director of corporate ratings at S&P Global Ratings

“Dollar refinancing needs are higher than ever for the sector going into 2021,” says Yip, who added that issuers could also face weak investor appetite.

In a note by Capital Economics

“The speed at which officials in China have pivoted from crisis response to another round of restrictions on property developers has caught many by surprise.” “For a leadership concerned about credit risks, the motivation is clear: property developers account for all of the increase in leverage among listed firms in China over the past decade,” it said.

“The higher likelihood of a blue sweep scenario seems to be the more dominant narrative,” said Cohn. “While we had previously looked to fade backups in rates ahead of the election — given our expectation for fiscal stimulus discussions to remain stuck, corporate supply to taper off, and the Fed to keep conditions accommodative — the meaningful change to the election calculus overwhelms these considerations and suggests leaning short (and toward steepening) is most prudent,” Cohn said.

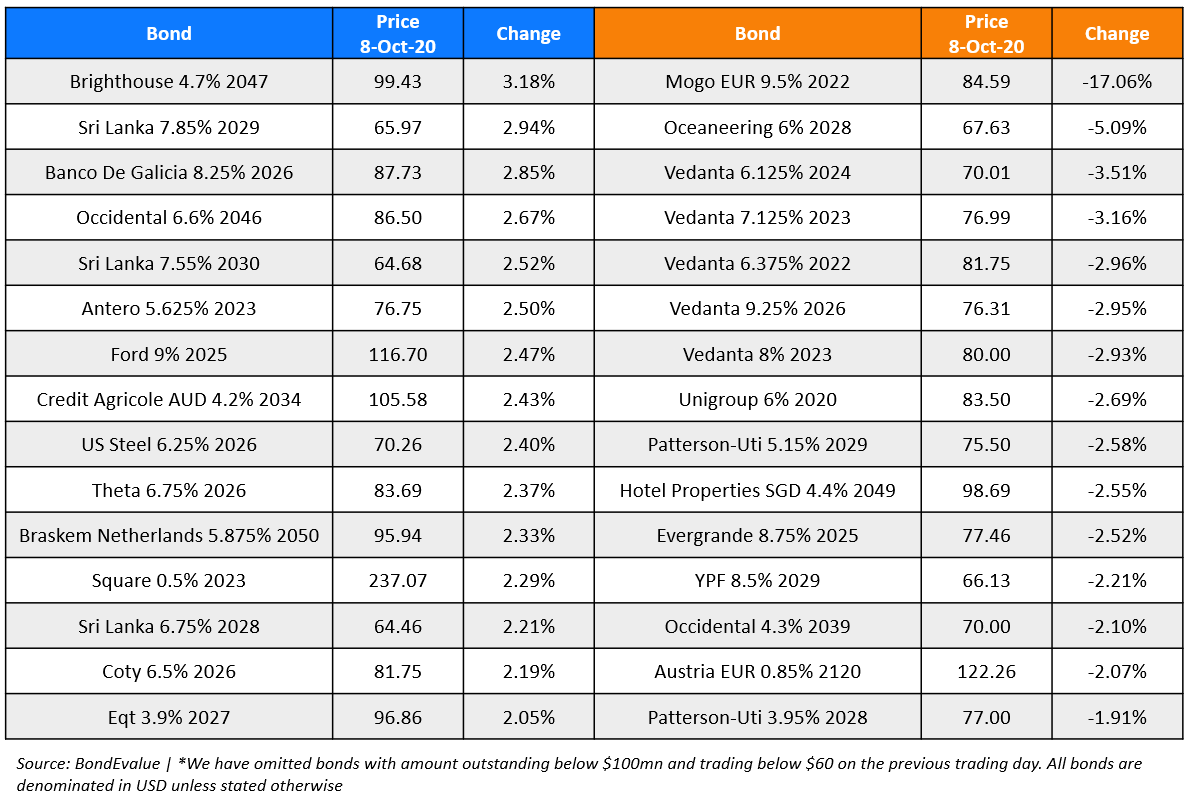

Top Gainers & Losers – 8-Oct-20*

Go back to Latest bond Market News

Related Posts: