This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kaisa, R&F, Greenland Downgraded by Moody’s

October 19, 2021

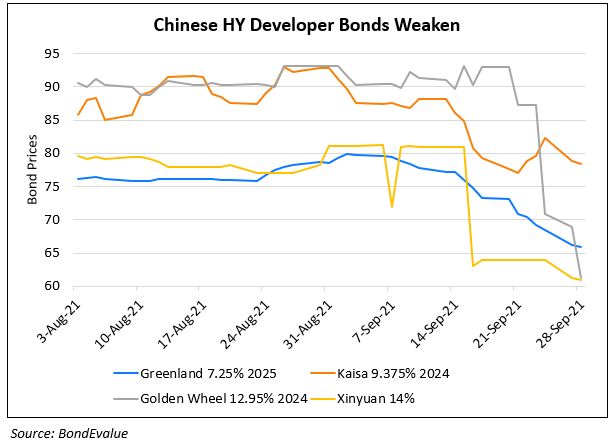

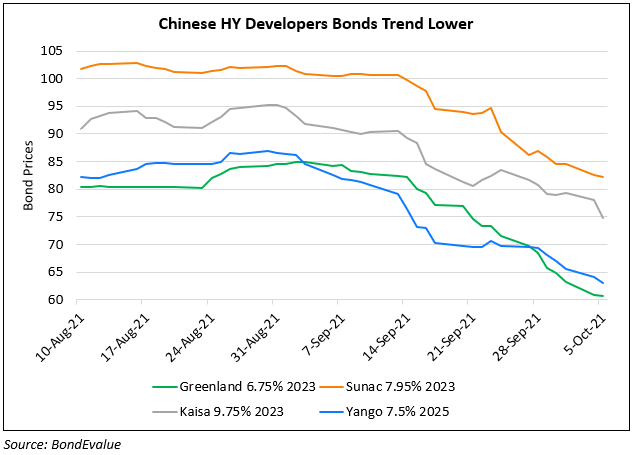

Kaisa Group was downgraded to B2 from B1. The downgrade was on account of weakening liquidity which would increase refinancing risk over the next 6-12 months and a large debt maturity of $3.2bn in offshore bonds by end-2022. Its “modest credit metrics; high geographic concentration; narrow funding channels and substantial exposure to the offshore bond market” weigh on its ratings. Also, its increasing exposure to JVs could increase contingent liabilities and weaken corporate transparency. Despite having unrestricted cash of RMB 38bn ($5.9bn) vs. short-term debt of RMB 25bn ($3.9bn), using it will reduce the funding available for its operations over the next 12-18 months adding to tight market conditions. Its senior unsecured notes were downgraded to B3 from B2 due to structural subordination risks. Kaisa’s dollar bonds were lower with its 8.65% 2022s down 3.3 points at 54.3.

Greenland Holding was downgraded to Ba2 from Ba1. The downgrade was on account of weakening credit metrics and thereby liquidity over the next 6-12 months and sizeable debt maturities. Using internal cash to repay debt, will reduce the funding available for its operations over the next 12-18 months. Moody’s also expects Greenland’s contracted sales to decline over the next 6-12 months, “driven by weaker homebuyer confidence amid tight funding conditions”. This will weaken its credit metrics, operating cash flow and thereby its liquidity. Greenland’s dollar bonds are higher today with its 6.25% 2022s up 2.8 points to 86.44.

R&F Properties was downgraded to B3 from B2. Similar to Kaisa, the downgrade was on account of weakening liquidity which would increase refinancing risk over the next 6-12 months and a large debt maturity. This is despite the company’s focus on accelerating property sales and asset disposals. While the major shareholders’ commitment to provide up to RMB 10.4bn ($1.6bn) can alleviate R&F’s refinancing pressure, it still would have to rely on new financing or asset sales to address its debt maturities over the next 6-12 months. Given the weak market sentiment and tight conditions, the timing of asset disposals are also highly uncertain, they added. R&F’s dollar bonds issued by Easy Tactic were slightly higher with its 11.75% 2023s up 0.8 points to 62.5.

Besides the above three developers, Golden Wheel Tiandi was downgraded to Caa1 from B3 and Yango Group to B2 from B1.

Go back to Latest bond Market News

Related Posts: