This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

January 2021: 39% of Dollar Bonds Trade Higher with High Yield Outperforming

February 1, 2021

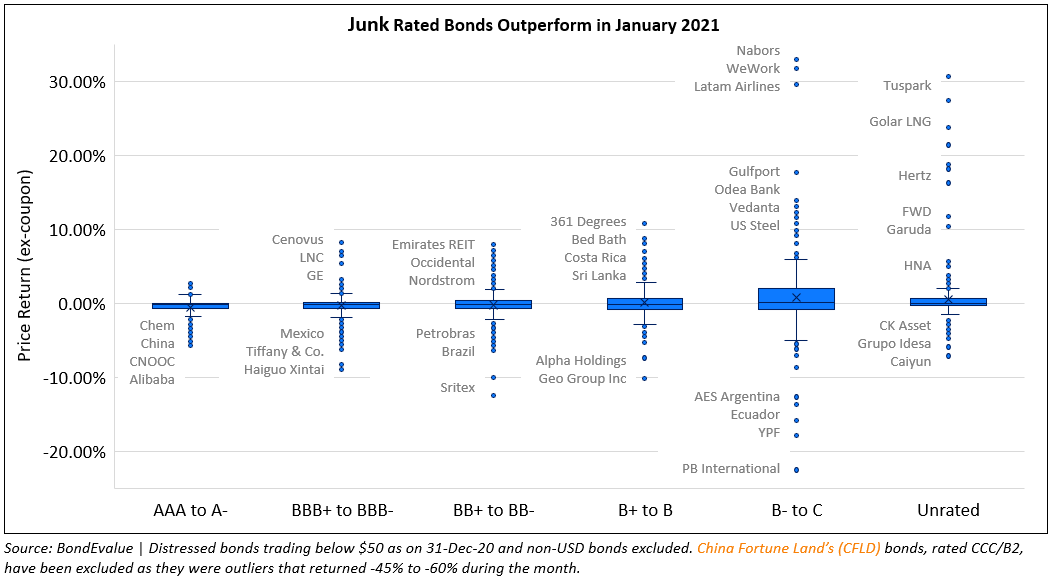

Dollar bonds’ performance in January 2021 was mixed with a negative bias. 39% of dollar bonds in our universe delivered a positive price return ex-coupon with the balance 61% in the red. Investor appetite for riskier debt was apparent with junk rated bonds outperforming investment grade rated bonds during the month. One prominent outlier in the high yield space was China Fortune Land (CFLD), which saw its dollar bonds plummet 45% to 60% through January on growing concerns about its liquidity position and ability to meet upcoming maturities. In the latest update on the Chinese developer, a creditor committee has been set up led by its two largest creditors, Ping An and ICBC. Bloomberg reported that the committee is scheduled to meet today to “to properly deal with the company’s liquidity risk and to protect the rights of financial creditors, with strong support from financial regulators and the local governments of Langfang city and Hebei province.”

Investment grade bonds underperformed the overall dollar bond segment while High Yield (HY) fared better with 43% of the HY bonds in our universe delivering positive price returns in October vs. 32% for investment grade bonds.

Issuance Volume & Largest Deals

Global corporate dollar issuance volume stood at $113bn, 2.35x December 2020’s volumes and up 13% vs. last January’s issuance of $100bn.

Asia ex-Japan G3 currency issuance stood at $55.96bn, 20% higher vs. last January’s issuance of $46.7bn while APAC & Middle East ex-Japan volumes were at $78.69bn , 4.3x December 2020’s and 20% higher than last January. Investment grade bonds dominated with new deals worth $50.5bn. Particularly, issuance volumes in the APAC ex-Japan region were the highest on record for January as the month saw one of the busiest days ever with 16 new deals on a single day; total deals for the first week of the year were at $26.2bn, 15% higher than the same period last year. “80% of the reason for coming this week is that conditions are good now, not that issuers think things could get worse,” said an Asia debt syndicate head. A chunk of the issuances in the month also came from Chinese real estate developers taking advantage of favorable financing conditions.

Below are the largest deals in January sorted by issue size. The largest issuances globally were dominated by banks with Wells Fargo raising $3.51bn via a PerpNC5 while Morgan Stanley and Goldman Sachs raised a combined $13bn. Also 7-Eleven’s combined $10.95bn 8-part issuance was the largest issuance in 2021 yet.

The largest issuances across APAC and Middle East was led by Saudi’s $5bn deal, followed by Oman and Turkey raising $1.75bn each. Saudi’s NCB was a noteworthy issue as it raised $1.25bn via a PerpNC6 sukuk at a yield of 3.5%, the lowest coupon ever for a perpetual issuance from the Gulf region.

Top Gainers & Losers

On the gainers list, Co-working company WeWork saw its 7.875% bonds due 2025 jump 10 points on Thursday on news of the company going public via a merger with a special purpose acquisition company (SPAC). Other prominent name on the list include Latin American carrier Latam Airlines, with its 2024s up 30% and Vedanta, whose 2026s traded higher by 11.8%. Among the losers, YPF made the list as the company is in the midst of a debt restructuring that involves a debt exchange with the revised offer said to have been well received by investors.

Among the gainers from APAC and Middle East, Chinese sportswear maker 361 Degrees made the list on the back of a $138.3mn bond buyback, on which Fitch commented, “which will partly alleviate the risk of 361 Degrees facing regulatory challenges in doing so”.

Chine Fortune Land Development (CFLD) topped the losers list, falling 45%-60%. Next on the list was Indonesia’s PB International (Pan Brothers), whose 2022s lost ~23% on the back of rating downgrades by Fitch and Moody’s to CC and Ca, citing imminent refinancing risks. Most recently, the company has disclosed that it had reached a standstill agreement with lenders on a $138.5mn loan payment that was due on January 27 and has got approval from shareholders and lenders to raise $350mn of 5Y bonds, expected to hit the market soon. This saga spilled over to regional peer Sri Rejeki (Sritex), whose dollar bonds due 2025 also fell over 20% before recovering slightly to currently trade at 90.75.

Go back to Latest bond Market News

Related Posts:

Masala Bonds – Everything You Need to Know

December 17, 2024

Are We Really Out of The Woods?

April 29, 2020