This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

India’s Outlook Revised to Stable from Negative by Moody’s

October 6, 2021

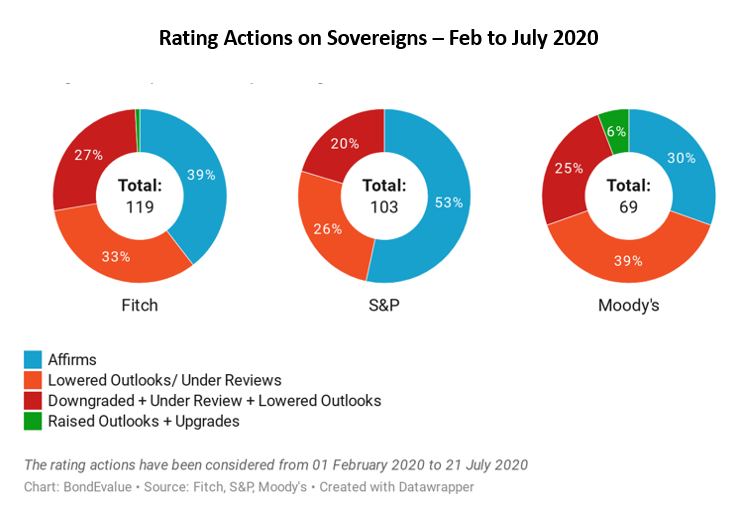

India’s outlook was revised to stable from negative by Moody’s on their view that the downside risks from negative feedback between the real economy and financial system are receding, while the sovereign’s rating remains at Baa3. Banks and non-bank financial institutions pose much lesser risk to the sovereign than Moody’s previously anticipated given their higher capital cushion and greater liquidity. Even as high debt burden and weak debt affordability risks exist, Moody’s expects that the economic environment and a return to trend nominal GDP at 10-11% over the next few years will gradually help reduce the fiscal deficit, preventing further deterioration of India’s credit profile. Moody’s expects India’s real GDP to cross 2019 levels this fiscal year, rebounding to 9.3% in fiscal 2021 and 7.9% in fiscal 2022. Moody’s added that India’s growing working-age population, narrow current account deficits vs. the first half of the last decade and FX reserves at historically high levels, have only “strengthened India’s external position and reduced its vulnerabilities to external shocks”. Moody’s previously downgraded India from Baa2 to Baa3 with a negative outlook since June 2020, after the pandemic struck. Fitch also came out with a negative outlook on India later that month.

For the full story, click here

Go back to Latest bond Market News

Related Posts: