This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ICBC Singapore, Fujian Yango Launch $ Bonds; Argentina Gets Near-Unanimous Backing For Deal Restructuring; BUMA’s Credit Quality Under Moody’s Lens

September 1, 2020

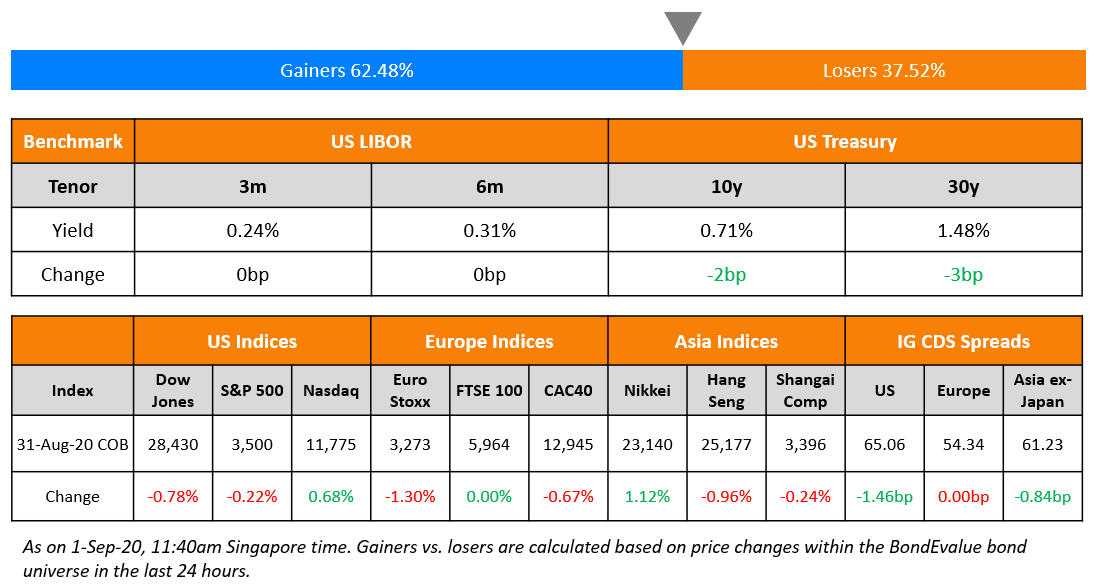

Western markets ended the month on a mixed note with huge rallies in Apple and Tesla that surged 3.4% and 12.6% respectively after their stock splits. This caused the Nasdaq to climb 0.68%, closing it almost 20% above the pre-covid peak. Despite spikes in coronavirus cases in a few US states, technology stocks are outperforming while the DJI and S&P were lower yesterday. European shares were also lower on lower inflation numbers out of Germany and Italy. Long dated US treasuries lost ground following the Fed’s relaxation of the inflation target. US IG CDS spreads narrowed 1.5 bps. India’s Q2 GDP shrank 23.9% compared with the previous year, according to official statistics released on Monday. The slump in the world’s fifth-largest economy was worse than economists expected, and one of the most severe contractions of any nation as a result of the pandemic. Asian credit market is seeing a steady stream of mandates as new issuances are still strong. Asian markets are opening slightly lower this morning.

New Bond Issues

- ICBC Singapore branch $ 3/5yr @ T+130/140bp area

- Fujian Yango $ 2yr @ 12.5% area

Nan Fung raised $500mn via Perpetual non-call 3Y to yield 5%, 40bps inside initial guidance of 5.40% area. The bonds, expected to be rated Baa3, received final orders exceeding $2.1bn, 4.2x issue size. Wholly owned subsidiary Nan Fung Treasury III will issue the bonds with a guarantee from Nan Fung International Holdings. Proceeds of this Perp will be used to refinance Nan Fung’s US$500m 5.5% perpetual bonds callable in November.

ZhongAn Online P&C Insurance, China’s first online-only insurer, raised $300mn via 5.5Y bonds to yield 3.532%, 325bp over Treasuries and 20bps inside initial guidance of T+345bp area. The bonds did not reach the capped amount of $400mn as indicated when marketing began yesterday. The bonds, expected to be rated Baa1, received orders exceeding $900mn when final guidance was announced, 3x issue size.

The Hong Kong-listed property developer Modern Land (China) raised a total of $100mn via a tap on two of its existing green bonds. It raised $50mn via a tap of its 11.50% 2022 green bonds to yield 11.75%, 62.5bp inside initial guidance of 12.375% area. It also raised $50mn via a tap of its 11.95% 2024 green bonds to yield 12.75%, 50bp inside initial guidance of 13.25%. This brings the total outstanding amount for both bonds to $300mn and $200mn respectively. The taps received final orders totaling to over $1.8bn, 18x issue size. Proceeds will be used to fund a concurrent tender offer for the company’s outstanding $235mn 7.950% 2021 bond. The maximum acceptance amount of the tender offer will be equal to the issue size of the reopening and the tender price is $1,005 in cash plus accrued and unpaid interest per $1,000 in principal amount. The tender offer’s expiration date is September 9.

Rating Changes

Moody’s revises Powerlong’s outlook to positive

Moody’s downgrades NORD/LB’s Fuerstenberg preference shares to Ca(hyb) from Caa3(hyb)

Fitch Affirms Guangzhou R&F’s IDR at ‘B+’; Revises Outlook to Negative

Xinjiang Zhongtai ‘BB+’ Rating Withdrawn At The Company’s Request

Moody’s assigns A1 to Huangshan Tourism’s credit enhanced bonds

Moody’s assigns Baa3 to Nan Fung’s guaranteed perpetual securities

Argentina Gets Near-Unanimous Backing For Deal Restructuring

Argentina has clinched a deal with the support of 99% of its creditors to restructure debt to put an end to its ninth sovereign debt default -Martin Guzmán, Argentina’s economy minister, announced on Monday. Almost all of the $65bn of debt will be restructured by extending maturities and lowering interest rate payments from an average 7% to 3%. The debt exchange will enable creditors including BlackRock, Ashmore and Fidelity, VR Capital and Monarch Alternative Capital, to swap old bonds for new ones ending a nine-month long negotiation process.

Argentina was also one of the few issuers of the “Century Bond“ (ToD explained below). Century Bonds – a rarity in markets and almost unseen among issuers whose bonds are rated junk – was openly derided by many investors at the time of its sale, given the South American nation’s poor record of paying off debt, a struggling economy and fractious politics. This restructuring guarantees that foreign creditors will get little more than half of what they were due on $65 billion of debt, including the 100-year bonds the government sold three years ago at the height of a decade long emerging-markets boom.

For the full story, click here

BUMA’s Credit Quality Under Moody’s Lens

According to a Moody’s report, Indonesian mining-services Bukit Makmur Mandiri Utama (BUMA) continues to face pressure of the low coal prices especially as it closes on to a sizable bond maturity in 2022. The mining major currently has sufficient liquidity to meet all its debt obligations till December 2021. A tax refund of $68mn and cost cutting and cost saving measures have helped it to build a cash reserve of $150mn, 3x the size of its historical average of ~$50mn.

Even though the liquidity of the company is strong at present, the rating agency expects the credit quality of the company to deteriorate when the $350mn bonds mature in February 2022 unless BUMA seeks refinancing options. As per Maisam Hasnain, a Associate VP and analyst at Moody’s “the residual cash buffer as of 31 December 2021 will be insufficient to repay BUMA’s $350 million bond maturing in February 2022, and we expect its credit quality will deteriorate if it fails to put together a firm refinancing plan in the coming months,”. BUMA’s leverage is also likely to increase to 3.5x in 2020 from 3.2x in 2019 as one of its three key customers is no longer buying from the company. The two remaining customers will contribute only ~65% of its consolidated revenues in 2021. Even though, the company has secured a bondholders approval to issue USD bonds of up to $750mn, it could face some problems in generating adequate market interest since the approval for the $750 issuance comes with 10% cap on the coupon rate, much lower than ~17% YTM on its existing bonds. Additionally, the market conditions for USD high-yield bond issuance in Indonesia remain weak.

BUMA’s 7.75% bonds due 2022 were largely stable to trade at 90.6 cents on the dollar, up 0.25 points

For the full story, click here

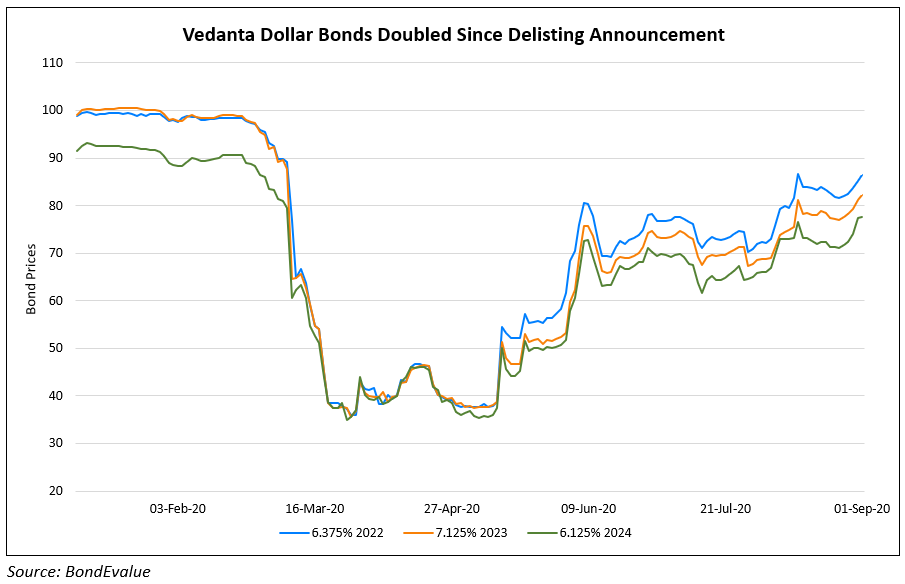

Vedanta Pledges Stake In Hindustan Zinc To Fund Delisting

An exchange filing on Monday showed that Vedanta, the majority owner of Hindustan Zinc with 64.92% stake, has pledged 14.82% of its stake (626 million shares) and created a non-disposal undertaking on the remaining 50.1% stake (2.1 billion shares) in favour of SBICap Trustee Co. Ltd. The covid-19 pandemic and the resulting economic slump that sent stock prices plummeting has brought on a wave of voluntary delisting proposals as promoters try to buy back shares cheap. On 12 May, Vedanta Ltd had announced its holding company’s intention to de-list the Indian business. The holding company, Vedanta Resources Ltd, has proposed to acquire fully paid-up equity shares of the company that are held by public shareholders at an indicative offer price of ₹87.5 per share. Vedanta bonds’ prices have more than double since the announcement on 12 May.

Vedanta’s 6.375% bonds maturing in 2022 traded at 86.5 cents on the dollar, up 1.25 points and the 7.125% bonds maturing in 2023 traded at 82.3 cents on the dollar up 1.07 points.

For the full story, click here

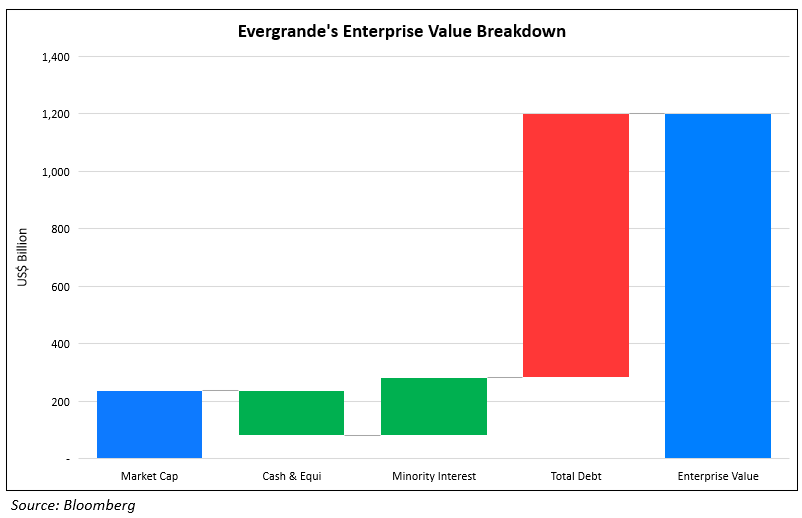

Evergrande Debt On the Rise Amid Low Cash-Flow

China Evergrande Group’s witnessed an increase in its debt load YoY even as the country’s most indebted property developer pledged to recast itself as a leaner company. The earnings report of the company revealed that the company’s total debt increased by 4% to CNY835bn ($122bn) at the end of June, compared to CNY800bn YoY. The net debt also rose to a record CNY631bn on a weaker cash buffer according to Bloomberg. Net gearing ratio, a measure of debt to equity which includes minority shareholders, reached 199% compared to 159% at the end of last year. The measure was 484% in case the minority shareholders were excluded. The company’s balance sheet is as follows.

The Shenzhen-based developer has raised $3bn by selling a part of its service arm and has also resorted to cost cutting measures. It plans to cut borrowing by at least CNY150bn each year from 2020 to 2022. The deleveraging push has been met with some skepticism amid a looming debt maturity wall. In June, Moody’s Investors Service changed its credit outlook to negative from stable, citing its “weak” liquidity.

Evergrande’s bonds were marginally down with the 6.25% bonds maturing in 2021 trading at 98.5 cents on the dollar, down 0.22 points and the 9.5% bonds maturing in 2022 trading at 97 cents on the dollar, down 0.57 points.

For the full story click here

Qantas Reaches Out to Bond Market to Tide Over the Pandemic

Qantas Airways Ltd. has reached out to tap the debt market for A$500mn ($370mn) through a 10Y note at an coupon of 5.25% to tide over the disruptions caused by the pandemic to the travel sector. The Baa2 rated company’s 5.25% September 9 2030s has been priced at 98.936 for a yield of 5.389%, in line with asset swaps plus 450bp area guidance. The national carrier has also bought back A$30m of its A$400m 7.5% June 2021 bond at a yield of 2%, equating to a repurchase price of 105.936. The company expects to receive a good response to the issuance due to its strong market presence in Australia. Further, its operations are likely to be boosted due to the likelihood of increase in its market share in light of the struggles faced by rival Virgin Australia.

The air travel industry has been one of the worst hit by the pandemic. Airlines across the world have struggled with liquidity as the air travel came to a grinding halt. Airlines have been forced to cut costs as well as jobs. Infact, the carriers across the globe have broken the record for annual bond sales, raising ~$51bn through notes as per Bloomberg data. Qantas had received a luke warm response to its equity issuance earlier in the month when it received orders worth ~A$72mn against a plan of A$500mn ($368mn). However, the debt issuance is more likely to be successful as the coupon rate of ~5.25% is much higher compared to 2.95% on a similar Australian dollar bond issued last year.

“Qantas won’t face any difficulty in raising money through the debt market, albeit investors may demand a higher coupon than earlier or there may be some covenants on the issuance,” according to Bloomberg Intelligence analyst James Teo who added “The airline has enough cash to last about two years and investors very well know that.”

For the full story, click here

Companies with Lowest Junk Rating Struggle to Raise Money

Debt issuance has been on a rise during the ongoing pandemic as companies struggle with the top line due to the slowdown. Junk-rated companies have been selling bonds to keep themselves afloat. However, the lowest Junk rated companies have found it hard to raise debt and have consequently been pushed closer to default. The total sale of high-yield bonds by companies rated in the CCC tier was just $1.1bn formed only ~2% of the total high yield issuance for August despite accounting for ~12% of the debt in the Non Investment Grade bonds. A failure to raise debt through securities can potentially lead to bankruptcy. There have been 177 bankruptcies filed in the U.S. alone with ~$50mn in liabilities, according to data compiled by Bloomberg through Aug. 21. That’s the most for any comparable period since 2009, when there were 271 bankruptcies filed. The American Bankruptcy Institute forecasts that bankruptcy filings could reach a record this year.

However, there lies some hope for the CCC rated companies due to the Fed’s action of reducing the interest rates close to zero. Due to the low interest rates, investors are struggling to earn decent returns on their investments which could lead to a increase in demand for CCC bonds according to Oleg Melentyev, head of U.S. high-yield strategy at Bank of America Corp.

For the full story click here

Term of the Day

Century Bonds

Century bonds are bonds with a maturity of 100 years and are a relatively rare market phenomenon although countries including Argentina, Austria and Mexico and companies such as Walt Disney and Coca-Cola have issued these in the past. The general idea is for issuers to take advantage of low yield environments and the demand comes from certain institutional clients who have a need to extend the duration of their portfolios such as pension funds and insurance companies. These bonds like perpetuals will usually come with a call schedule.

Century bonds are often of great interest to the hedge fund community because of the so-called “high convexity” of the securities. “The convexity of a bond is a measure of the curvature, or degree of the curve, in the relationship between bond prices and bond yields. It shows how the duration of a bond changes as interest rates change,” explained Ioannis Rallis of the SSA team in JP Morgan. “With a high convexity bond, the price falls less if yields go up than it increases when yields go down. That asymmetry is very interesting for some investors who can use it as a hedge if interest rates, as some expect, have further to fall.”

Talking Heads

“Countries will have to be more selective as to who they support,” Georgieva said. “Up to now we support everybody.”

“Make sure that governments are put on a digital platform, so that citizens can see where does the tax euro actually go.”

“The same way the virus hits people with preconditions the hardest, the economic crisis hits countries with weak policies, not sufficient oversight the hardest.”

On India’s central bank new measures to maintain market stability

In a statement by RBI

“The RBI remains committed to use all instruments at its command to revive the economy by maintaining congenial financial conditions, mitigate the impact of COVID-19 and restore the economy to a path of sustainable growth while preserving macroeconomic and financial stability,” the central bank said.

Prasanna, chief economist at ICICI Securities Primary Dealership

“It’s a band aid for the market but the steps also show RBI doesn’t have space for outright OMOs (open market operations, see term of the day),” said Prasanna.

Ashhish Vaidya, Head of Trading and Asset Liability Management at DBS Bank India

“This move does not take away the problem of supply overhang, the impact of this move in (keeping bond yields in check) will only be temporary,” said Vaidya. “What the market requires, due to the bond supply overhang, is some sort of decisive move in terms of OMO purchases, like what the central banks in developed markets have demonstrated.”

On the importance of sustainability efforts for Pemex investors

Marie-Sybille Connan, an analyst at asset manager Allianz Global Investors

“It will become increasingly challenging for international institutional investors to invest in their bond issuances if they don’t address their sustainability concerns – whether climate, oil spills due to oil theft and health and safety,” Connan said.

Jaime Gornsztejn, who leads the engagement with Latin American companies for Federated Hermes.

“When we look at what peers are doing, Pemex should do more, show more ambition in terms of commitment to reduce carbon emissions,” said Gornsztejn.

On bond investors’ doubt over Fed’s inflationary potential

Jim Leaviss, CIO of public fixed income at M&G Investments

“It’s all very well them saying this, but they have been trying to get inflation above 2 per cent since the global financial crisis, and it hasn’t been possible on a consistent basis despite strong economic growth, low unemployment, and massive stimulus,” said Leaviss. “There’s quite a lot of scepticism that they can manage it now.”

Nathan Sheets, chief economist at PGIM Fixed Income and former under-secretary for international affairs at the US Treasury

“I do think that in some parts of the market there are worries about inflation, [given the] combination of rapid money growth, a large balance sheet, rapid debt growth, some concerns about globalisation being short-circuited and starting to reverse, and broken supply chains putting upward pressure on prices,” said Sheets. “But the post-global financial crisis period was one of low inflation in the US and globally, and I expect that this next period will be very much the same.”

Karen Ward, a strategist at J.P. Morgan Asset Management

“Ultimately, whether you think this is good or bad for bonds ultimately depends on your view about the potency of monetary policy,” said Ward. “Just because you say you want something, that doesn’t mean it will happen.”

On the lost appeal of US Treasuries in zero-rate world – Ben Inker, head of asset allocation at GMO

“Investors would be well advised to think critically about not only what their fixed-income portfolios can feasibly achieve going forward but also what the implications are for the amount of risk they can afford to take across the rest of their portfolios,” he wrote.

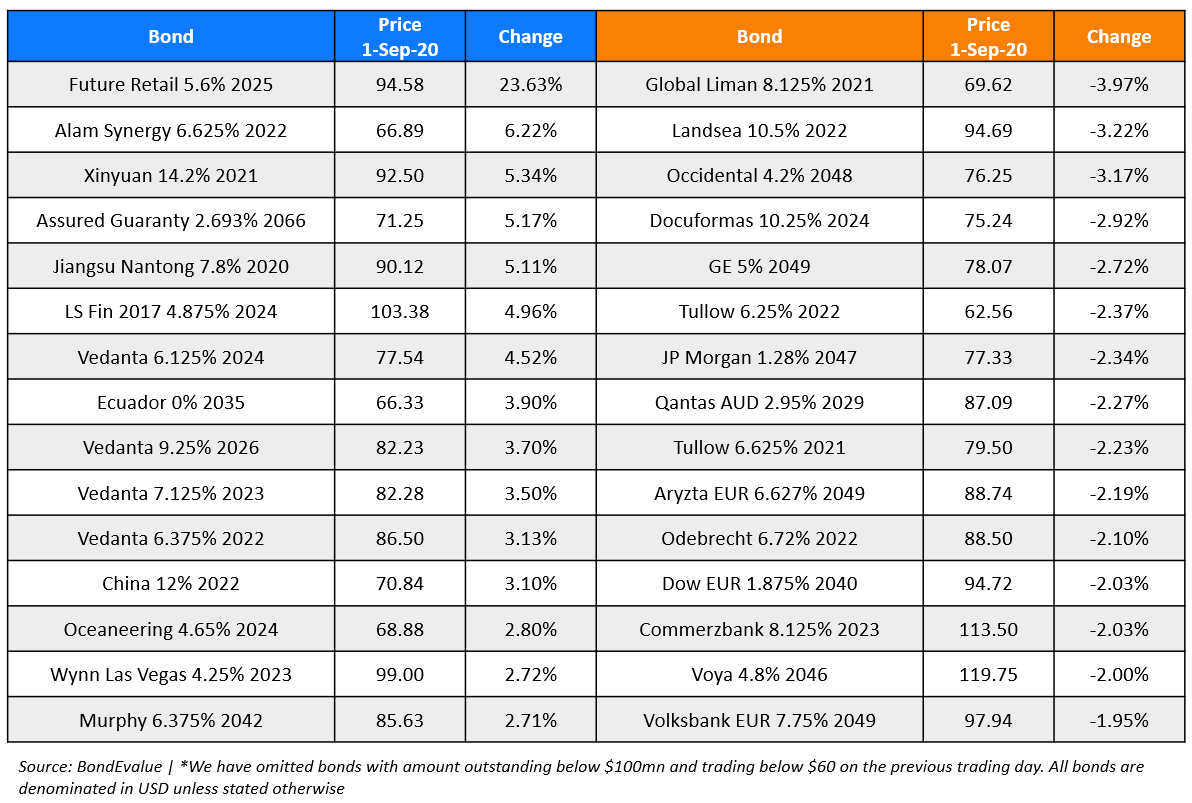

Top Gainers & Losers – 1-Sep-20*

Go back to Latest bond Market News

Related Posts: