This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ICBC, Hysan Launch $ Bonds; Oman Downgraded to BB-; Court Orders Against Virgin Australia Bondholders

August 18, 2020

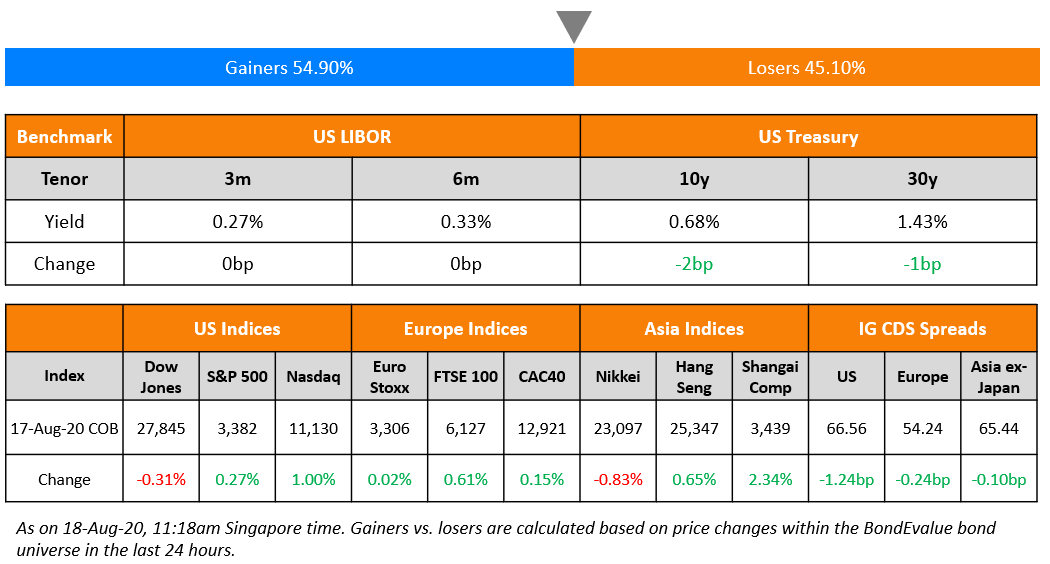

Rallying technology stocks helped the Nasdaq and S&P inch higher and European indices were slightly higher with the exception of FTSE Milan, which underperformed amid concerns of an uptick in coronavirus cases in Italy. US treasuries recovered losses from last week’s record supply and yields were lower by 1-2bp. Europe and US CDS spreads were mostly unchanged and Asian risk assets are set for modest gains in Asia after a handful of deals were completed at the start of the week.

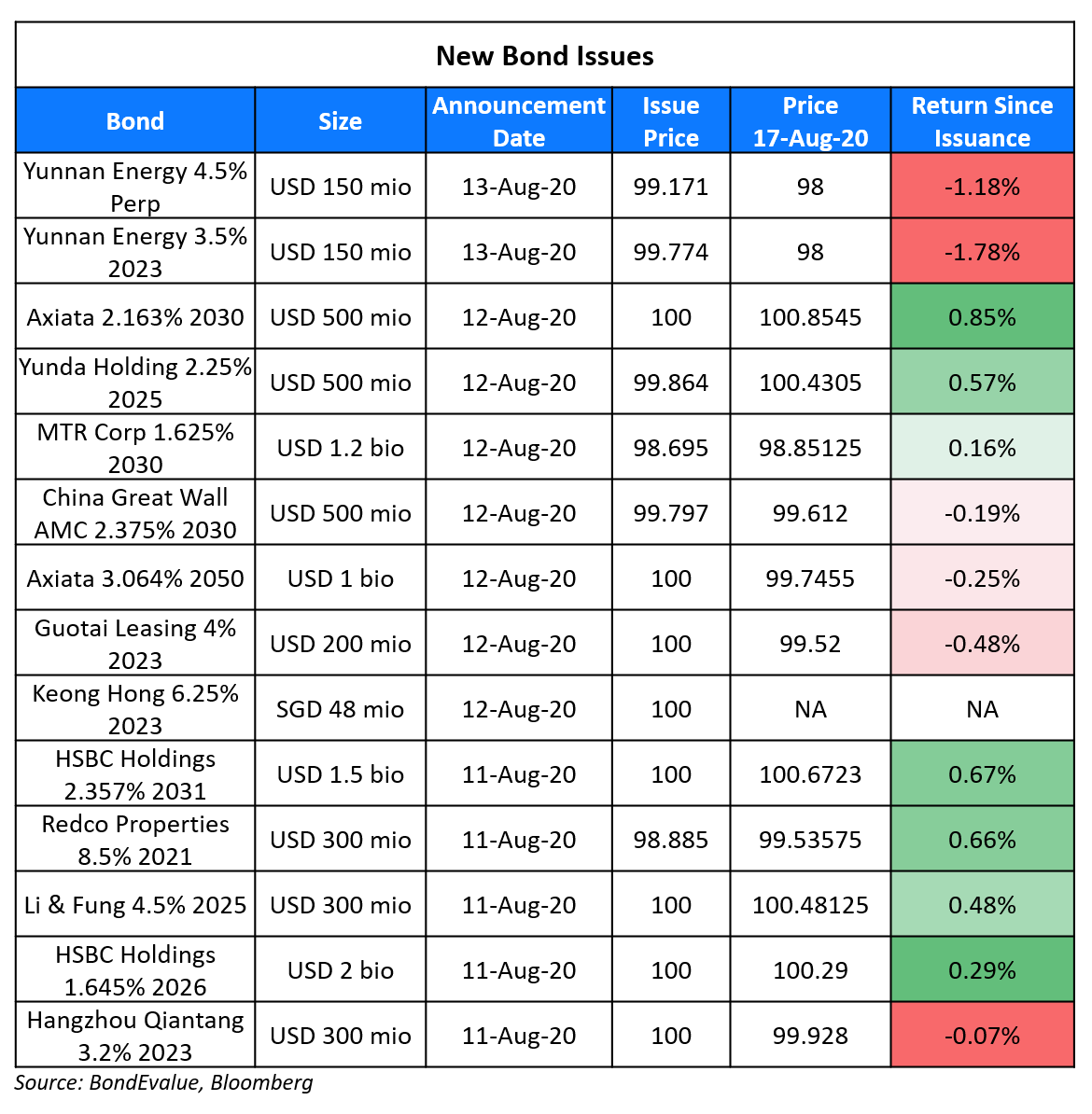

New Bond Issues

- ICBC Financial Leasing $ 5yr @ T+200bp area

- Yibin State-Owned Asset Management $ 3yr @ 4.3% area

- Hysan Development $ 300 mio Perp NC3 @ 5.3% area

- Yangzhou Urban Construction $ 3yr @ 3.7% area

Indian conglomerate Vedanta Resources raised $1.4bn via 3Y amortising bonds to yield 13%, 25bp inside initial price guidance of 13.25% area. The bonds, with expected ratings of B3/B, received final orders exceeding $2.4bn, 1.7x issue size. As per IFR, The secured notes amortise in equal installments at 24, 30 and 36 months for a weighted average life of 30 months. Vedanta Limited is the issuer and Vedanta Resources is the parent guarantor of the notes. Vedanta Holdings Jersey and Vedanta Holdings Mauritius are subsidiary guarantors.

National Australia Bank priced a $1.5bn 2.332% via 10Y tier 2 bonds to yield 2.332%, 165bp over Treasuries and 25-30bp inside initial guidance of T+190bp–195bp. The bonds have expected ratings of Baa1/BBB+/A–.

Property developer Shui On Land raised $500mn 4Y non-call 2Y bonds to yield 6.15%, 35bp inside initial guidance of 6.5% area. The bonds drew final orders of over $1.5bn, 3x issue size.

Agri-business company Olam International raised S$400mn ($293m) via 5.5Y bonds to yield 4.00%, 25bp inside initial guidance of 4.25% area. The bonds received orders over S$900mn when final guidance was announced, 2.25x issue size.

Rating Changes

Fitch Downgrades Oman to ‘BB-‘; Outlook Negative

Moody’s downgrades Laos’s rating to Caa2, outlook changed to negative

Moody’s withdraws LVGEM’s ratings for business reasons

Fitch Upgrades Petropavlovsk to ‘B’; Outlook Stable

Aramark Downgraded To ‘BB-‘ On Coronavirus-Related Demand Drop; Off Watch; Outlook Stable

Carnival’s New Secured Bonds First In Line to Lose Security of Collateral

Carnival Corp tapped the bond markets for the third time since the pandemic broke out last Friday, raising $900mn via 7Y non-call 3.5Y (7NC3.5) 2nd lien bonds at a yield of 9.875%. The new bonds, rated BB+ by S&P, priced 37.5bp inside the upper-bound of initial guidance of 10-10.25%. The 2nd lien bonds, like the earlier issues, are backed by collateral of 80 ships, shares of subsidiary guarantors and other assets such as intellectual property, which has provided confidence to investors. However, as per the FT, the new bonds will be the first to lose the security of its collateral, should the company’s total secured debt exceed 25% of total tangible assets, a covenant on its previous issues. The FT reported that Carnival’s total secured debt now stands at $10.6bn with the new bond issue, just 15% lower than its total tangible assets of ~$12.4bn as of July. A reduction in the value of its tangible assets could lead to a breach of this 25% threshold as the world’s largest travel leisure company continues to impair assets on the back of the pandemic. The risk is further heightened as the company is looking to sell-off assets to shore up cash, having already sold five ships and agreeing to sell five more. Ross Hallock, an analyst at Covenant Review said, “If investors are buying secured paper and it could potentially become unsecured, then that matters. It’s a risk. Everyone who is buying these bonds should be aware that Carnival has this very strange provision in there.” The new bonds have traded up since issuance, currently at 100.6 on the secondary markets.

For the full story, click here

Court Serves a Critical Blow to Virgin Australia Bondholders

In a critical blow to Virgin Australia Bondholders, a federal judged blocked their bid to propose an alternative to Bain Capital’s restructuring plan at the second creditor meeting scheduled on September 4. Singapore-based Broad Peak Investment Advisers and Hong Kong-based Tor Investment Management that collectively hold ~A$300mn ($216mn) of Virgin’s bonds had asked the courts to order Virgin’s administrator Deloitte to put to vote their rescue plan, which included a debt-to-equity swap that would entitle bondholders to recover ~67 cents on the dollar. The latest court order clears the way for Deloitte to proceed with a take-it-or-leave-it vote on Bain’s plan. As per The Sydney Morning Herald, Bain’s proposal includes a haircut of 90% for the bondholders.

For the full story, click here

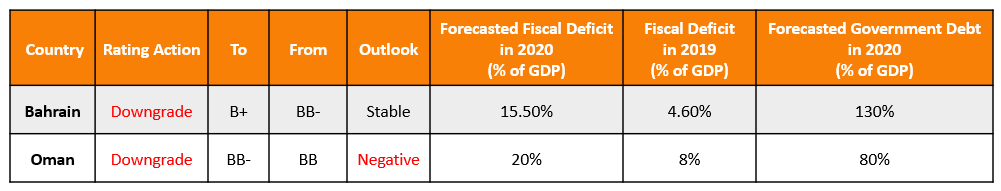

Fitch Downgrades Oman to BB- with a Negative Outlook & Bahrain to B+ with a Stable Outlook

Over the past few days, Fitch has pushed Oman’s and Bahrain’s ratings further into junk. The Sultanate of Oman was downgraded by Fitch to BB- from BB with a negative outlook on August 17, a day after Bahrain was downgraded to B+ from BB- with a stable outlook on August 14. This is the second downgrade this year for Oman, not just by Fitch but also by Moody’s, putting Oman’s rating at par with Turkey. On the other hand, this was Bahrain’s first downgrade in two years by Fitch, placing it at par with Egypt.

Justifying the Bahrain downgrade, Fitch said, “The downgrade (for Bahrain) reflects the combined impact of lower oil prices and the coronavirus pandemic on Bahrain, which is causing marked increases in the budget deficit and government debt, pressure on already low FX reserves and sharp GDP contraction.” However, it added that the following factors augured well for Bahrain:

- High GDP per capita

- High human development indicators

- Strong financial backing from the GCC partners

- A sizable domestic financial sector favor Bahrain in its efforts against the pandemic.

Oman is considered as one of the more vulnerable economies among the six nation Gulf Cooperation Council (GCC). On Oman, Fitch said that, “The downgrade and Negative Outlook reflect the continued erosion of Oman’s fiscal and external balance sheets, which have accelerated amid low oil prices and the coronavirus shock, despite some progress on underlying fiscal consolidation.” According to the rating agency, half of the government’s funding will have to be met with external debt and the government’s debt/GDP is expected to rise to over 80% this year against 60% last year. It added, “The coming three years will be a critical test of the funding flexibility that Oman has displayed in the past, and a steep maturity schedule will keep Oman’s funding needs large beyond that, even as the fiscal deficit is reined in.”. A summary of the rating action of the two sovereigns is given in the table below

For the rating action on Oman, click here and for Bahrain, click here

Reliance-Future Retail Deal Hits a Roadblock on Amazon’s Stake

Speculation about an acquisition of a majority stake in Future Retail by Indian behemoth Reliance has been doing the rounds for weeks now. In the latest update as per the Economic Times, the deal has hit a roadblock on American giant Amazon’s stake in the new combined entity. The ET reported that Reliance is keen on offering a minority stake of 1-2%, but Amazon wants to hold at least 5-6% in the combined entity. Amazon currently owns a 3.58% indirect stake in Future Retail through its $100mn investment in Future Coupons last year for a 49% stake. As per the terms of the investment, Amazon has the legal rights to intervene on any future stake sales by Future Group. The ET quotes a person with knowledge of the matter as saying, “Reliance group doesn’t need capital and there is absolutely nothing that Amazon can offer at this point in time. Also, the concern for Reliance group is that going ahead it would directly compete with Amazon, so how could the company have them as an investor?”. The clock is ticking for Future Retail to secure funding as it had defaulted on a debut coupon payment of $14mn on its $500mn 5.6% bonds due 2025 last month, now in grace period.

For the full story, click here

Greenko Emerges as Frontrunner to Acquire NEC Energy for $400mn

In other M&A news from India, renewable energy company Greenko has emerged as the frontrunner to acquire US-based large-scale battery installer NEC Energy Solutions, as per the ET. The publication reported that the transaction could possibly close at an enterprise valuation of up to $400mn. Greenko, which is backed by Singapore and Abu Dhabi sovereign funds GIC and ADIA respectively, is in the race to acquire NEC along with US-based NextEra Energy and Fluence, which is a JV between Siemens and AES. Tesla was also said to be in the race, before being outbid by the others. Greenko’s dollar bonds are trading largely unchanged on the secondary markets.

For the full story, click here

Floatel Pushes Forbearance Agreement Date to Aug 31

Floatel, an associate company of Keppel Corp, has announced another extension of the Forebearance Agreement to Aug 31. The company had pushed the dates to July 31 and Aug 15 on earlier occasions. The Ad Hoc Committee of Holders (AHC) hold $400mn of senior secured, first lien 9% bonds that constitute ~56% of the Oslo listed bonds’ outstanding amount. Floatel had entered into a forbearance and deferral agreement with the AHC (holders of first lien bonds) and certain holders of second lien bonds on April 14, in relation to payments of:

- Amortisation, interest and commitment fees due under the Bank Vessel Facility and RCFs, and

- Coupon payments due under the bonds

Keppel posted a net loss of S$697mn ($510mn) in Q2 on the back of impairments worth S$919mn ($672mn), which included impairments worth S$227mn ($166mn) of Floatel’s vessels and a fair value loss of S$10mn ($7.3mn) on the investment in Floatel. Floatel International Ltd was established in 2006 and operates five semi-submersible accommodation vessels. As per a July 1 press release by the company, it has the following debt instruments outstanding:

- $400mn 9 % senior secured 1st Lien bonds 2018/2024

- $75mn 12.75 % 2nd Lien bonds 2018/2024

- $150mn term loan facility (the “Bank Vessel Facility”)

- revolving credit facilities for an undrawn total amount of $100mn

Floatel’s 9% and 12.75% bonds due 2024 were largely stable and traded at 10.5 and 3.6 cents on the dollar on the secondary market.

For the full story, click here

Citigroup Sues Revlon’s Lenders Who Refuse to Return the $900mn That Citi Mistakenly Sent

In a rather funny series of events, Citigroup, the administrative agent for distressed borrower Revlon’s loan, accidentally transferred $900mn to Revlon’s lenders. Some of these lenders refused to return the funds to Citi stating that Revlon had defaulted on its loan and thus the transferred amount was due to them, according to Bloomberg. In the latest update, Citi has filed a lawsuit against one of the lenders, Brigade Capital Management LP in a bid to recover the money. Citi was supposed to transfer $1.5mn to Brigade on account of interest on a loan of $174.7mn. It instead transferred over 117x the amount, $176.2mn to Brigade, which is now refusing to return the excess. The payment by Citi was made on August 11, just before Brigade along with other lenders including HPS Investment Partners and Symphony Asset Management filed a lawsuit against Revlon over its debt-restructuring tactics that have pushed the loan in question to trade at less than 30 cents on the dollar, indicating dim prospects of recovery. In its lawsuit, Citi said, “[Brigade] should have known that a surprise repayment of principal could not be made under the governing credit agreement. And it was well aware that virtually no company, let alone a distressed retail and consumer company such as Revlon, would ever make such a substantial repayment while dealing with the significant financial consequences caused by the ongoing pandemic.” Revlon’s 5.75% bonds due February 2021 have fallen from ~90 cents in March to ~22 cents on the dollar currently as the cosmetics giant struggles amid the pandemic.

For the full story, click here

Term of the Day

Catastrophe Bonds

Catastrophe Bonds also referred as Cat Bonds are risk-linked securities that are designed in favor of the issuer as these allow the transfer of risks related to a major catastrophe or a natural disaster to the investors. These are generally high yield debt instruments that payout to issuers in case of specific triggers. These bonds essentially act as insurance policies against natural disasters and are generally purchased by governments, insurance and reinsurance companies. In the event of a trigger event, the proceeds are paid to the borrower and the principal repayment and interest payments are either deferred or cancelled. In case the trigger event does not occur, the borrower continues to pay the interest and the principal as scheduled, similar to a regular bonds. These bonds have gained traction as the frequency of natural disasters is on the rise. For more details, click here

Talking Heads

On the Fed’s upcoming inflation strategy announcement

Mickey Levy, chief economist for the U.S. and Asia at Berenberg Capital Markets

“It will signal clearly to the market that not only will the Fed tolerate inflation temporarily above 2%, but that it favors it, and will try to aim in that direction,” said Levy. “They’ll use language that will convey the notion that the Fed has total, total discretion,” Berenberg’s Levy said.

Bill Merz, senior portfolio strategist and head of fixed-income research at U.S. Bank Wealth Management in Minneapolis

“Rising inflation expectations are, in part, indicative of the market beginning to price in the Fed’s shift,” said Merz.

Ethan Harris, head of global economic research for Bank of America Corp

“The Fed needs to acknowledge there’s a cycle with inflation,” said Harris. “Some overshooting late in the cycle makes sense.”

On PBOC adding liquidity while maintaining interest rate

Liu Peiqian, a China economist at Natwest Group Plc

The net injection indicates “a more accommodative stance on keeping liquidity levels ample” so that commercial banks can continue to support bond issuance and to stabilize credit growth, said Liu. in Singapore. The move is “a signal to ensure policy continuity and stability” rather than a reaction to a slower pace of economic recovery, she said.

Ming Ming, head of fixed-income research at Citic Securities Co. in Beijing

“The MLF injection is larger than expected,” said Ming. “The PBOC’s overall neutral monetary policy has an easing bias in August. I expect the 10-year government yield to drop to around 2.8%.”

“There is no doubt the pandemic triggered a shift in demand for social bonds,” said Fromaget. “Covid-19 bonds — both general purpose and use-of-proceeds, issued under the sustainability/social bond format — are on the right track to outpace green bonds in 2020.”

“Global risk sentiment is still quite supportive, though to a degree the moves are down to the time of the year and lopsided positioning on the part of investors,” said Guntermann.

On Belarus outlook amid political uncertainty – Christian Wietoska, strategist at Deutsche Bank

“The outlook for the current situation in Belarus remains highly volatile, however, we see the risks of contagion for Russian assets in terms of higher risk premium as likely to be limited in the near-term,” Wietoska said.

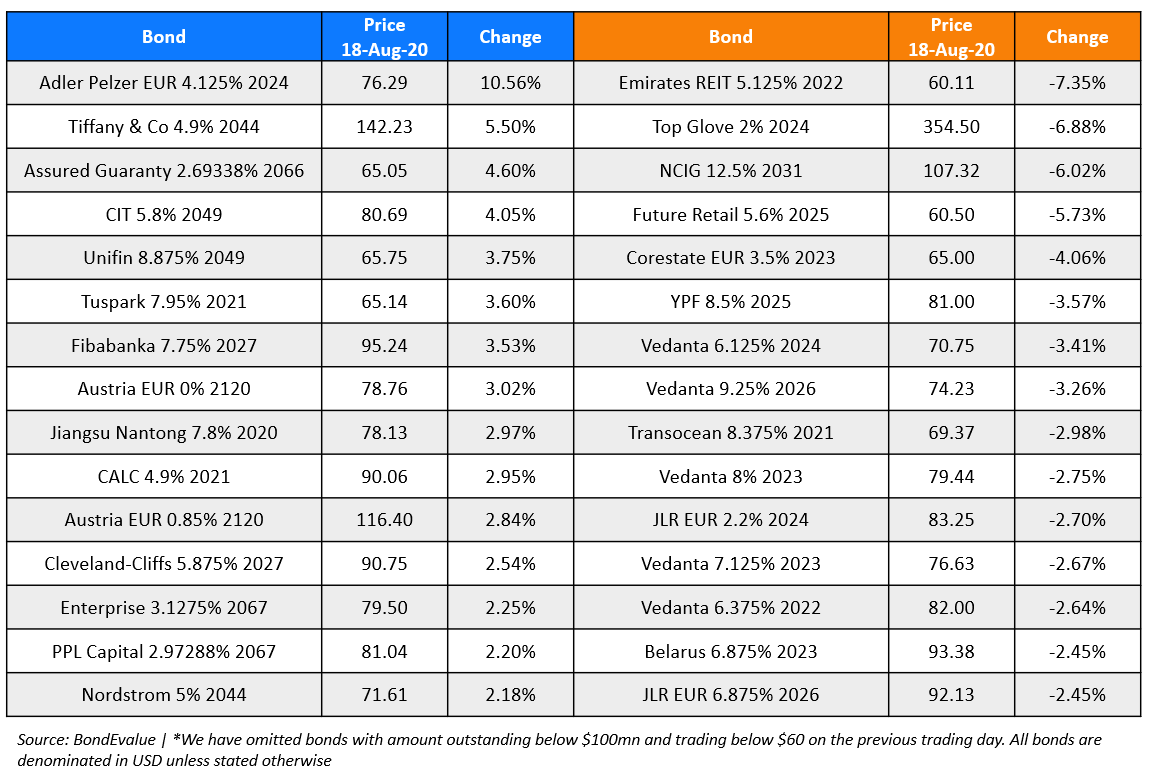

Top Gainers & Losers – 18-Aug-20*

Go back to Latest bond Market News

Related Posts: