This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Huarong’s unit Downgraded by Fitch to CCC from BB

August 12, 2021

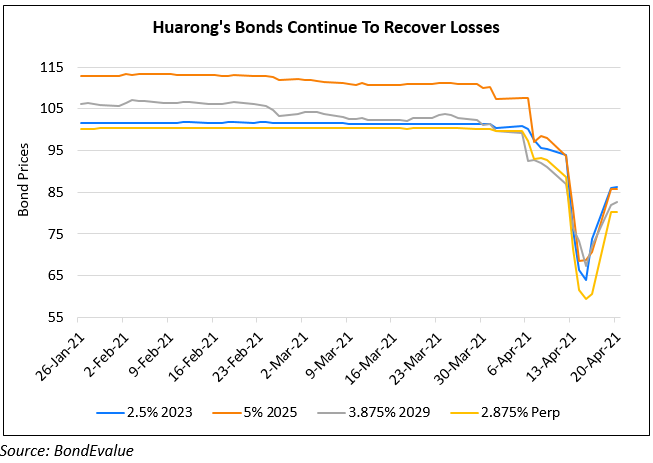

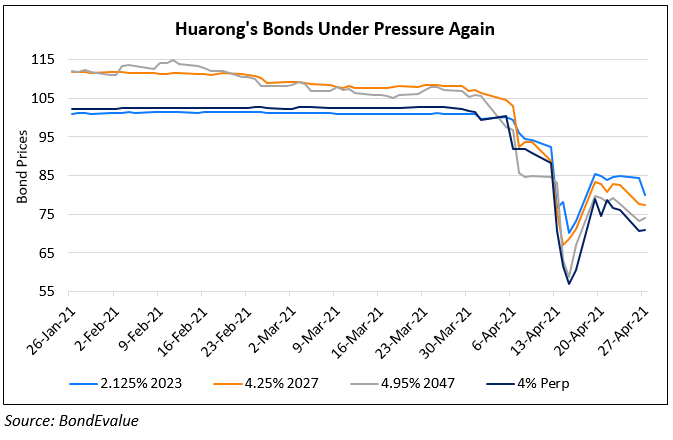

Fitch has downgraded China Huarong’s unit Huarong Industrial Investment & Management Co. to CCC from BB. The downgrade was on account of “an ongoing lack of a refinancing plan for 2022 maturities” and its linkage with China Huarong changing to ‘weak’ from ‘strong’. The firm is no longer on watch for downgrade. Huarong Industrial’s complete reliance on China Huarong for operational and financial health with more than 60% of its total debt consisting shareholder loans from the parent implies a weak credit profile. Fitch also cites the growing uncertainty of the parent to support the unit’s liquidity needs and the inability to confirm it as a core subsidiary only adds to the weakness.

Huarong’s bonds are trading higher with its 5.5% 2047s up 2.4 to 69.98 and its 2.125% 2023s up 1.2 points to 83.34.

For the full story, click here

Go back to Latest bond Market News

Related Posts: